1. Off-balance-sheet financing

2. Examples of off-balance-sheet liabilities

3. OBS accounting activities targeted by the Boards

4. Off-balance-sheet leases: How were they recorded?

5. Recording capital leases on the balance sheet under ASC 840

6. Benefits of off-balance-sheet financing

7. Leases that can be excluded from the balance sheet under the new standards

8. Lease liabilities on the balance sheet: Measuring the impact

9. Impact to lease vs. buy decisions

10. Impact to finance vs. operating lease decisions, EBITDA, and debt to equity

Off-balance-sheet financing (OBSF)

Off-balance-sheet financing refers to types of transactions and methods of accounting for transactions in which no liabilities are recorded to an organization’s financial statements. The financial obligations that result from OBSF are known as off-balance-sheet liabilities. In many cases, off-balance-sheet liabilities are simply recorded as operating expenses.

The practice of OBSF can be used to impact various ratios and other metrics that are used in financial analysis, such as the debt-to-equity (D/E) ratio. Under US GAAP, the details of an arrangement must meet certain criteria in order for the associated assets and liabilities to be excluded from recognition on the balance sheet.

Examples of off-balance-sheet liabilities

The payment obligations arising from operating lease agreements are a commonly-referenced example of off-balance-sheet liabilities. Historical guidance on leasing agreements is found in the following standards:

- ASC 840, the legacy FASB lease accounting standard

- IAS 17, the legacy IASB standard

- GASB 62, NCGA Statement No. 5, and GASB 13, the legacy government lease accounting standards

Under the legacy standards, lessees were only required to capitalize, or record, the leased asset and related liability on the balance sheet when it met one or more of the capital lease criteria specified within each standard. Leasing agreements that did not meet the applicable capital lease criteria were considered operating leases; therefore, an asset or liability related to the lease agreement was not required to be recognized on the balance sheet.

In a FASB February 2016 news release, FASB Chair Russell G. Golden was quoted, stating that the “U.S. Securities and Exchange Commission and other stakeholders have identified [operating leases] as one of the largest forms of off-balance sheet accounting.” However, for most companies, operating leases are no longer an available method of off-balance-sheet financing due to the release and adoption of ASC 842 and the other new lease accounting standards, IFRS 16 and GASB 87.

Some other examples of off-balance-sheet assets and liabilities can include those that result from joint ventures and other partnerships that involve pooling resources to accomplish a shared task.

OBS accounting activities targeted by the Accounting Standards Boards

The FASB and IASB released their new lease accounting standards in early 2016. Clearly, the Boards planned to reduce the number of off-balance-sheet transactions with their changes to operating lease accounting. The Q1 2016 issue of FASB Outlook specifically addressed off-balance-sheet transactions in relation to leases:

“…current off-balance sheet leasing activities will be required to be reflected on balance sheets so that investors and other users of financial statements can more readily and accurately understand the rights and obligations associated with these transactions.” – FASB.org

An IASB announcement regarding the release of IFRS 16 also contained a similar message on the problems being caused by OBSF and the difference between the recording of finance leases and operating leases under IAS 17:

“This somewhat arbitrary distinction made it difficult for investors to compare companies. It also meant that investors and others had to estimate the effects of a company’s off balance sheet lease obligations, which in practice often led to overestimating the liabilities arising from those obligations.” – IFRS.org

Off-balance-sheet leases: How were they recorded?

If the terms of a lease did not meet any of the four criteria for capital lease classification under ASC 840, it remained off the balance sheet. Payments for operating leases were simply recorded as operating expenses and future obligations were referenced in the footnotes of an organization’s financial statements.

Recording capital leases on the balance sheet under ASC 840

We cover this topic in full detail and with a comprehensive example on our blog, Capital Lease Accounting and Finance Lease Accounting: A Full Example.

In short, capital leases, which are now classified as finance leases under ASC 842, were treated like financed purchases. They were required to be recorded on the balance sheet with an asset, subject to depreciation, and a lease liability with interest. The liability was calculated as the present value of the minimum lease payments over the lease term and the interest portion of the lease payments was categorized as interest expense.

Benefits of off-balance-sheet financing

Despite OBSF making it difficult for investors and shareholders to compare businesses and their financial statements, off-balance-sheet accounting was standard practice under US GAAP for all operating leases until recently. As a result, any business or organization that had operating leases was accounting for them with this method. There are clear advantages to an organization using this method.

Here are two benefits that off-balance-sheet leases would have presented to businesses:

1. More streamlined accounting

Under ASC 840, accounting for an operating lease was not as complicated as it was for a capital lease. Organizations with operating leases may have recorded rental payments as rent or lease expense and stopped there. No liability or asset was recognized in the financial statements and thus, a record of lease terms and implicit interest rates was generally not maintained. Further, leases that were embedded within service contracts were often not identified, especially given the expense impact of accounting for a service arrangement and an operating lease were the same.

2. Lower debt and total liabilities

Since an operating lease payment was simply an operating expense under the old lease accounting standards, the lease obligation was not included in total liabilities. As a result, metrics used in financial statement analysis that took debt and total liabilities into account were typically better when choosing operating lease agreements as opposed to capital leases.

Leases that can be excluded from the balance sheet under the new standards

While the new accounting standards do require more comprehensive recognition of all types of leasing agreements, some lease assets/obligations will still be excluded from recognition on the balance sheet.

Here are two examples of leases that would not require capitalization under the new lease accounting standards. These two exceptions apply to both finance and operating leases:

1. Short-term leases

ASC 842, IFRS 16, and GASB 87 allow for the practical exception of leases that are considered short term. This results in a population of leases under each standard continuing to be recorded consistent with the legacy standards, or continuing to utilize an OBS approach. Generally, this is a lease that has a lease term of 12 months or less. However, the definition of a short term lease varies based on each standard, so companies will need to ensure any short term leases identified for OBSF are appropriate.

2. Low-value assets (under certain circumstances)

Depending on the size of an organization and other factors, low-value assets may be exempted from capitalization. IFRS 16 designates a materiality threshold of $5,000 or less to scope out assets from capitalization, whereas FASB and GASB have not designated a similar threshold. However, in accordance with the respective accounting standards, assets/liabilities that are not material can be excluded, so a company may choose to identify capitalization thresholds for its lease arrangements.

Lease liabilities on the balance sheet: Measuring the impact

Moving operating leases onto the balance sheet caused substantial changes in lease liabilities for many organizations, so it’s no surprise that the Boards were specifically looking at these leases as a way to reduce off-balance-sheet transactions. For example, our recent study, the Lease Liabilities Index Report, demonstrates how common these transactions were. Among a sample of over 400 businesses that transitioned to the new lease accounting standards, the recognition of previously-excluded leases to balance sheets led to an average increase of 1,479% in lease lease liabilities. The study includes an analysis of these businesses’ balance sheets, both pre- and post-transition, to highlight the impact of transitioning to the new rules.

The impact to lease vs. buy decisions

Previously, the benefits of off-balance-sheet operating leases were a large part of any business’s lease vs. buy decisions. Now that operating leases will be reflected on the balance sheet, those benefits no longer factor into lease vs. buy analysis.

To help perform a detailed lease vs. buy analysis, we have created the LeaseQuery Lease vs. Buy Calculator. This robust calculator will help your organization make an informed decision, based on updated considerations from the new accounting standards, on whether to lease or purchase its next asset.

To learn more about what factors to consider when making the lease vs. buy decision, read our blog, Lease vs Buy Analysis in Corporate Finance – How to Determine When to Lease or Buy an Asset.

Finance vs. operating lease decisions: Impact of the changes on EBITDA and debt to equity

Similarly to lease vs. buy, the decision on whether to enter into a contract for a finance lease vs. an operating lease will be impacted as well by the removal of the OBS accounting option. Going forward, one major factor in this decision will be how lease classification impacts various metrics used in financial statement analysis. Previously, off-balance-sheet operating leases could be used to affect these types of metrics. This has changed in several ways and, furthermore, there are significant differences between the FASB and IFRS standards.

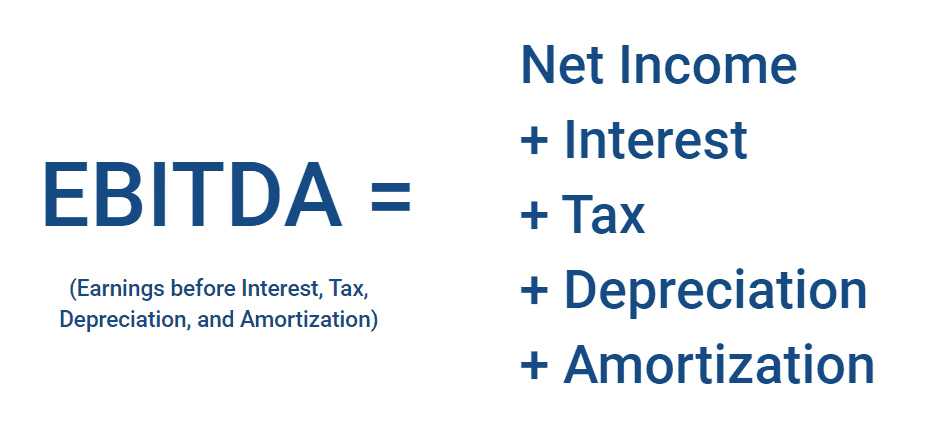

Below, we will identify the impact on two metrics that many companies use for their internal management purposes: the debt-to-equity ratio and EBITDA.

The debt-to-equity ratio: Impact of ASC 842

The debt-to-equity ratio (D/E) is a common finance and accounting metric used to determine the health of an organization or what portion of the organization’s assets are financed through debt or equity. For many companies, this is a metric that is included within the debt covenants, and this can also be a metric that companies define for internal management purposes. We have seen the most impact of the new lease standard on the calculation for debt covenant purposes, since the addition of the operating lease liabilities to the balance sheet could trigger violation of the debt covenants for some companies. The D/E ratio is calculated as debt (as defined by an organization’s debt covenant with their lender) divided by Shareholder’s Equity, which is the difference between total assets and total liabilities. An illustration of the formula is below:

Because the treatment of finance leases under the new standards is substantially similar to that of a capital lease under the old standards, there is no significant change on the impact to the D/E ratio for finance leases.

For operating leases, transitioning them onto the balance sheet under ASC 842 could impact their D/E ratio. This depends on how the lessee’s debt covenants define the “debt” portion. Under the new standard, there will be an asset and liability recorded for every operating lease, but the liability is not considered debt. However, the lessee’s debt covenants could define the “debt” portion of the D/E ratio to include capitalized lease obligations or even total liabilities.

While the recognition of the operating lease liability will be material for companies, the majority of companies will not have a significant impact on Shareholder’s Equity as a result of the adoption of the new lease guidance, because there will typically be a materially consistent addition to total liabilities. Lessees should carefully review their debt covenants prior to transition to avoid any potential defaults resulting from an increase in lease liabilities at transition.

Impact of ASC 842 on EBITDA

EBITDA, or Earnings Before Interest, Tax, Depreciation, and Amortization, is a common finance and accounting metric. Typically an organization will add interest, tax, depreciation and amortization back to their net income to derive at EBITDA, as illustrated below:

Finance leases

The accounting treatment for a finance lease under ASC 842 will be the same as under ASC 840, so the adoption of ASC 842 will not affect EBITDA unless an organization’s population of finance leases changes due to further analysis. When accounting for a finance lease, whether under ASC 840 or ASC 842, interest on the lease payments is expensed on the organization’s income statement, but the non-interest portion of the lease payments is not expensed. The non-interest portion of the lease payment reduces the lease liability over the term of the lease. Additionally, depreciation of the finance lease asset and interest expense will both continue to be included in the calculations of net income and added back when calculating EBITDA.

Operating leases

Under ASC 842, there is a single, straight-line lease expense for operating leases recorded in operating income, similar to the rent or operating expense previously recorded. This means there is no significant change to the income statement when compared to ASC 840.

The amortization of the right-of-use asset for operating leases and the interest expense portion of the lease payments, are combined as one lease expense. As a result, interest, depreciation, or amortization amounts related to the new operating lease assets and liabilities are not added back into net income when calculating EBITDA.

Going forward, companies that are incentivized on EBITDA may begin to choose finance leases over operating leases as a way to benefit from this change.

Impact of IFRS 16 and GASB 87 on EBITDA and debt to equity

Conversely, operating leases moving onto the balance sheet under IFRS 16 will impact both EBITDA and the D/E ratio.

IFRS 16 and GASB 87 both classify all leases as finance leases, also called a “single-model” approach. Because any existing operating leases will now be classified as finance leases, the interest portion of the lease payments as well as the amortization of the asset will be included in the calculation of net income, most likely resulting in lower net income, but higher EBITDA. This is because the combined interest and depreciation expenses will presumably be higher than the previous rent expense, but they are added back to net income as part of the EBITDA calculation.

There will also be an impact to the D/E ratio because IFRS 16 and GASB 87 categorize lease liabilities as long-term debt. The numerator (debt) will increase while Shareholder’s Equity will not be significantly impacted (as addressed above).

Related articles

To learn more about why the lease accounting standards were changed, the new challenges in accounting for leases, as well as the financial and balance-sheet impact of these changes, check out the following articles.