- The investing company is simply looking for a lucrative investment

- Two or more companies have a similar goal and want to diversify their risk and costs

- The investment entity was previously a wholly-owned subsidiary that the organization now wants to partially sell

- Two or more companies want to fund research and development and form a joint venture to pool financial resources, as well as expertise and experience

Regardless of the drive behind an entity’s investments, ASC 323 Investments – Equity Method and Joint Ventures (ASC 323) provides guidance on the criteria for determining whether you have an investment that qualifies for the equity method of accounting and how to account for the investment under US GAAP.

This article will cover when and how to apply the equity method to account for certain investments. To further demonstrate the equity method of accounting, we will also provide examples of some of the more common accounting transactions that apply to an equity investment.

What is the equity method of accounting?

The term “equity method” describes the applicable accounting treatment when an organization holds an investment in a separate entity in the form of common stock or capital and has the ability to influence the operating or financial decisions of the investee. The initial measurement and periodic subsequent adjustments of the investment are calculated by applying the ownership percentage to the net assets, or equity, of the partially owned entity. Because the investor does not own the entire company, they are only entitled to assets, liabilities, and earnings or losses that represent their portion of ownership. An investment in another company is recorded as an asset on the balance sheet, just like any other investment. An equity method investment is valued as of a specific reporting date with any activity related to the investment recorded through the income statement.

Only investments in the common stock of a corporation or capital investments in a partnership, joint venture, or limited liability company qualify as equity investments and are eligible for the equity method of accounting.

When do you apply the equity method?

The equity method of accounting is only applicable to equity investments. Per ASC 323, equity investments include:

- Common stock

- In-substance common stock

- Capital investment

- Undivided interest

ASC 323 also specifies investments excluded from the scope of the equity method of accounting:

- Derivative instruments

- Investments held by non-business entities

- Controlling financial interests

- (Most) investments held by investment companies

- Investments in limited liability companies accounted for as debt securities under ASC 860 Transfers and Servicing

- Certain qualified affordable housing investments

Once an entity has determined that they hold an equity investment, they must determine whether the investment should be accounted for under ASC 323 or one of the other US GAAP subtopics providing guidance on the accounting treatment of investments.

How do you determine if the equity method is applicable?

The final step for determining if the equity method of accounting applies to an investment is to assess the amount of control the investor has over the investee. If the investing entity has enough control over the investee to consolidate under ASC 810 Consolidation, the investor consolidates the investee as a subsidiary of the investor, and ASC 323 would not apply. Generally, ownership of 50% or more of an entity indicates control, but entities must use significant judgment and additional criteria before making the final ownership determination.

If the investor does not control the investee but has the ability to exercise significant influence over the investee’s operating and financial policies, the equity method is the correct accounting treatment for the investment.

Do you have significant influence?

In accounting terminology, significant influence generally equates to ownership of 20% or more of the voting rights of a corporation and less for a partnership. The 20% threshold assumes significant influence over an investee’s financial and operational policies without the investor demonstrating actual influence. The FASB recognizes the determination of the ability to exercise significant control over another entity’s financial and operating policies will require judgment and will not always be black and white. To assist with the evaluation of significant influence, ASC 323-10-15-6 provides several examples:

- Representation on the board of directors

- Participation in policy-making processes

- Material intra-entity transactions

- Interchange of managerial personnel

- Technological dependency

- Extent of ownership by an investor in relation to the concentration of other shareholdings

However, an investor does not have to own 20% of an entity for the equity method of accounting to apply. If the investor owns less than 20% of an entity, it is assumed they do not have significant influence over the financial and operating policies of the investee, but that does not preclude accounting for the investment using the equity method.

In instances where the investor owns less than 20% of an entity, the guidance requires demonstration of actively influencing the financial and operating policies of the investee to apply the equity method. Demonstrating the ability to have influence is no longer enough. The investor can demonstrate active influence by some of the examples presented above, but the above list is not all-inclusive. In summary, 20% ownership is only an indicator that significant influence over financial and operating policies of another entity may exist.

In instances where the investor owns less than 20% of an entity and is unable to demonstrate influence over the entity, the investor will apply the cost method of accounting to the investment. The cost method specifies recording the investment at the purchase price or historical cost and recording any activity in the income statement. Cost method investments are not adjusted for the earnings or losses of the investee, but may be analyzed for impairment.

We have discussed the 50% ownership threshold for consolidation accounting for an investment and the 20% ownership threshold for accounting as an equity method investment. General practice is to treat investments between 20-50% as eligible for the equity method of accounting, while also using the various other criteria to support the correct accounting method. The guidance recognizes judgement will be necessary for each individual set of circumstances. The assessment of whether one entity has influence over another will not always be a clear “yes” or “no” answer.

Accounting for an equity method investment

Once the investor determines the type of investment and the applicable accounting treatment, it is time to record the equity investment. Equity method investments are recorded as assets on the balance sheet at their initial cost and adjusted each reporting period by the investor through the income statement and/or other comprehensive income (OCI) in the equity section of the balance sheet.

Initial measurement

The investor should measure the initial value for an equity method investment in the common stock of an investee at cost, according to the guidance in ASC 805 Business Combinations, specifically section 805-50-30. Under ASC 805, the cost of an asset acquisition includes the consideration paid and transaction costs incurred by the investor directly related to the acquisition of the asset or investment, such as legal, accounting, or finder’s fees. Internal costs incurred by the investor, even if nonrecurring or directly related to the asset acquisition, are not included in the initial cost and are expensed as incurred.

When the equity investment results from a deconsolidation, ASC 810-10-40 applies, and the investor values the investment at its fair value. Additionally, when an investor acquires an equity investment through a noncash transaction, such as an exchange of asset(s) or the issuance of equity, the investment’s value equals either the fair value of the asset(s) exchanged or the fair value of the acquired investment, whichever is more evident. If the carrying value of the assets given as consideration differs from their fair value at the acquisition date, this will result in the recognition of a gain/loss.

The investor records their investment after either the common stock or capital investment is acquired and when they have the ability to significantly influence the financial and operating policies of the investee.

Subsequent measurement

After initial measurement, the investee must recognize their share of net income/losses within current earnings with a corresponding adjustment to the recorded equity investment. Additionally, the entity adjusts their investment for received dividends, distributions, and other-than-temporary impairments. These subsequent measurements to the investment value adjust the balance of the equity investment on the investor’s balance sheet but do not affect the investor’s proportionate share of the investee.

The investor calculates their share of net income based on their proportionate share of common stock or capital. Adjustments to the equity investment from the investee’s net income or loss are recorded on the investor’s income statement in a single account and are made when the financial statements are available from the investee. Income adjustments increase the balance of the equity investment and loss adjustments decrease the balance of the equity investment.

The investor’s share of the investee’s OCI is calculated and recorded similarly. The investor calculates their share of the investee’s OCI activity based on their proportionate share of common stock or capital. The investor records OCI activity directly to their equity method investment account, with the offset recorded to their OCI account.

From time to time, the investee may issue cash dividends or distributions to its owners. Dividends or distributions received from the investee decrease the value of the equity investment as a portion of the asset the investor owns is no longer outstanding.

Conversely, the investee may make a capital call. A capital call is when an investee requires its investors to make additional capital contributions. In some types of agreements, each investor has an obligation to the investee for a total amount of capital over a specific period of time. In these types of arrangements, the investor would be required to make the initial minimal contribution and is then obligated to make any additional contributions required in a capital call up to the total amount obligated within the specified timeframe. Subsequent contributions or capital calls increase the carrying value of the investment.

Equity investments are also decreased due to other-than-temporary impairments. If the investee experiences a series of losses, it may be indicative of an impairment loss. Equity investments are evaluated for impairment anytime impairment factors are identified that might indicate that the fair value of the asset is not recoverable.

In the case of an equity method investment, the investor’s investment asset is analyzed for impairment, not the underlying assets of the investee. The investment asset’s recoverability, or the amount of cash or earnings it will generate over its remaining life, is compared against the investor’s carrying value. If the equity investment is not deemed to be recoverable, the carrying value of the investment asset is then compared to its fair value. The impairment loss is the amount of the carrying value over the fair value and is recorded as a reduction to the investment asset offset by an impairment loss.

Disposal

The disposal of an equity investment is treated as a sale. Whether the investor is disposing of a portion of their investment or the entire asset, the treatment is the same. The carrying value of the equity investment is reduced in total or by the amount sold (or disposed). Per ASC 323-10-35-35, the investee reduces the equity investment by the portion disposed and compares that against the consideration received. The difference between the carrying value of the asset or portion of the asset disposed of and value of the consideration received is recognized by the investee as gain or loss on sale of equity investment in the income statement in the period of disposal.

If the investor has made adjustments to OCI for the equity investment, the accumulated balance, or accumulated OCI (AOCI), the investment must also be reduced for the disposed portion of the investment. If only a portion of the investment is being disposed of, the AOCI related to the equity investment is reduced by the same percentage.

Under ASC 323, when an investor reduces an equity investment to the extent that it no longer qualifies for the equity method of accounting, the final carrying amount of the investment under the equity method, including any adjustments for reduction in ownership, becomes the carrying amount for the investment asset going forward. The investor’s proportionate share of the investee’s AOCI is written off against the remaining carrying value, also contributing to the calculation of the carrying amount of the “new” asset. If the investor’s amount of adjustment to AOCI exceeds the equity investment value, the excess will be recorded to the income statement as a current period gain.

Required disclosures

An equity method investment is recorded as a single amount in the asset section of the balance sheet of the investor. The investor also records its portion of the earnings/losses of the investee in a single amount on the income statement. The investor’s portion of the investee’s OCI will be recorded within their OCI accounts but can be aggregated with the investor’s OCI. Items recorded through OCI may include foreign currency translation adjustments, pension adjustments, or gains/losses on available-for-sale securities.

In the statement of cash flows, the initial investment is recognized as investing cash outflows. Earnings from equity investments are added back to net income as a reconciling item to arrive at cash flows from operating activities. Dividends received are presented as operating or investment cash inflows, dependent upon the type of the dividend, either a return on, or a return of investment .

Per ASC 323-10-50-3, investors are also required to make the following disclosures in the notes accompanying their financial statements for each of their equity method investments:

- The name and percentage ownership of common stock or capital of each investee

- The investor’s accounting policies for investments in common stock or capital

- Any difference between the carrying value of the equity investment and the value of the underlying net assets and the accounting treatment of that difference

- If available, the value of each investment based on the quoted market price

- Contingent issuances (like convertible securities, issuances, or warrants) of the investee that may have a significant impact on the investor’s share of reported earnings or losses

An example of accounting for an investment using the equity method

To illustrate the accounting treatment of an equity investment, we’ll walk through an example below with actual calculations and journal entries. For our example, we’ll use a joint venture, one of the common types of equity investments.

Applying the equity method of accounting to a joint venture

A joint venture is a business arrangement between two or more companies to combine resources to accomplish an agreed upon goal.

A common example of such an arrangement is several companies forming a joint venture to research and develop a specific product or treatment. Under a joint venture, the entities can pool their knowledge and expertise, while also sharing the risks and rewards of the venture. Each of the participating members have an equal or near equal share of the entity, so no one company has control over the entity at the formation of the joint venture. However each is able to significantly influence the financial and operational policies of the entity. In this scenario, the partners will account for their investment in the joint venture as an equity method investment.

The following is a hypothetical set of facts related to the formation of a joint venture and the subsequent activity and transactions related to that venture. We will use this example to demonstrate the equity method of accounting for an investment that is a joint venture.

Initial measurement

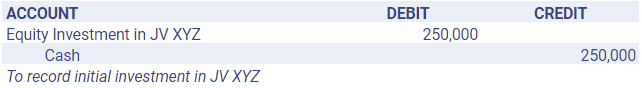

On January 1, 2020, several manufacturing companies, Company A, Company B, Company C and Company D form a joint venture to research applications of their scrap and byproducts. Each agrees to contribute $250,000 of capital to the formation of the joint venture, Joint venture XYZ (JV XYZ), for 250 shares of stock, or 25% of the voting rights. JV XYZ issues no preferred stock. Each company determines they will account for their investment using the equity method of accounting. For the purposes of this example, we will assume that cash is contributed, and there are not any basis differences at initial investment. Additionally, this investee has no OCI activities, therefore no OCI adjustments will be recorded.

Given the ownership is equal, the entry for each of the companies to record the initial investment will be identical. For the purposes of our example, we will assume that we are Company A. This is the entry that Company A would record at initial investment:

Subsequent measurement

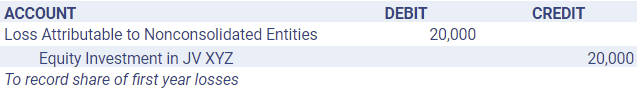

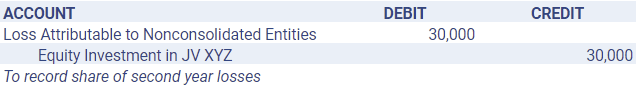

During the first year and second years, JV XYZ has net losses of $80,000 and $120,000, respectively. The companies each apply their ownership interest, 25%, to JV XYZ’s first year and second year losses to determine their proportionate share of losses to record in current period earnings. Each company’s share of the losses is $20,000 ($80,000 x 25%) for the first year and $30,000 ($120,000 x 25%) for the second year.

Below are the entries that Company A would record:

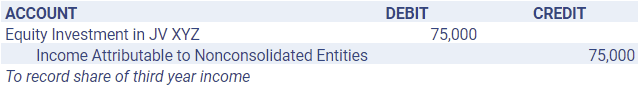

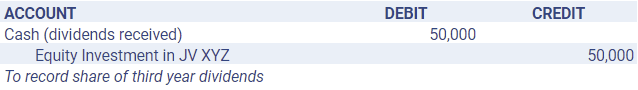

During the third year JV XYZ has net income of $300,000 and pays dividends totaling $200,000.

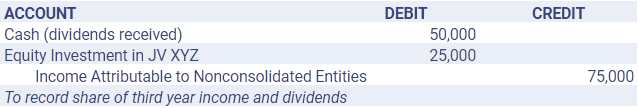

Again, each company applies their ownership percentage to the earnings and dividends to calculate their share of earnings to be $75,000 ($300,000 x 25%) and dividends to be $50,000 ($200,000 x 25%). A dividend is considered a return on the capital contribution and is accounted for as a reduction of the investment. Company A records the following entries for their share of income and dividends:

If Company A chooses to record a combined entry for their share of both the dividends and the third year income, the entry would be as follows:

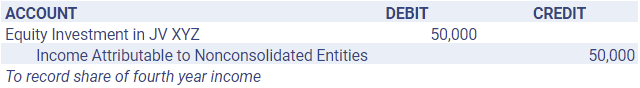

During the fourth year JV XYZ makes a profit of $200,000. Each company’s share of the net income of JV XYZ is $50,000 ($200,000 x 25%). Company A records the following entry:

Sale of equity method investment

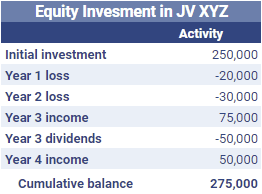

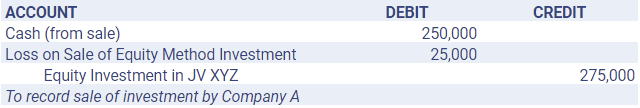

Also at the end of the fourth year, Company A decides to sell its investment in JV XYZ to Company Q. Company A and Company Q agree on a sale price of $250,000 for 100% of Company A’s interest in JV XYZ. Before the ownership transfer, Company A’s cumulative balance of it’s equity investment is $275,000:

To record the sale of their investment, Company A will recognize a loss from the sale of the investment of $25,000 as the difference between the payment received from Company Q and the value of their investment at the time of the sale. The entry would be as follows:

Dissolution

Since Company A has sold their investment, for the remainder of this example, we will now follow the investment of Company B in JV XYZ.

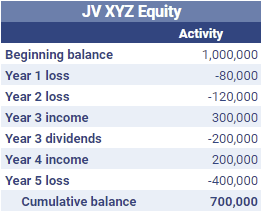

In the fifth year, JV XYZ experiences a loss of $400,000 and the companies mutually decide to dissolve the joint venture. The remaining capital is distributed to the companies based on their proportionate share of the company. At the end of the fifth year the equity of JV XYZ is as follows:

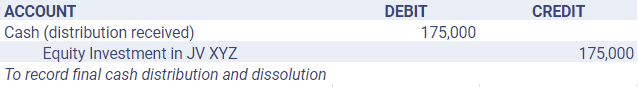

Each company’s share of the net loss of JV XYZ is $100,000 ($400,000 x 25%) and each of the four investors receives an equal distribution of the remaining capital of $175,000 ($700,000 x 25%). Company B’s cumulative investment balance is $175,000, after recording their proportionate share of the fifth year loss. The final entry made by Company B at the dissolution of JV XYZ is:

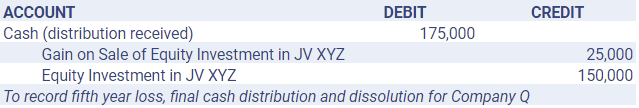

Company Q’s final entry is a bit different because Company Q entered the joint venture after the other companies. Their initial equity investment is $250,000, equal to the amount they paid for Company A’s shares. After recording their share of the current year loss ($100,000 = $400,000 x 25%) from the fifth year, Company Q’s investment is valued at $150,000 ($250,000 – $100,000). Therefore, when JV XYZ dissolves and makes its final distribution, Company Q recognizes a gain of $25,000 ($175,000 – $150,000), the difference between the final distribution and the final value of their investment.

Summary

Companies invest in other companies or ventures for a number of reasons, but the equity method of accounting is only applicable to these investments if the investor is able to demonstrate the ability to significantly influence the financial and operational policies of the investee. Once an equity method investment is recorded, its value is adjusted by the earnings and losses of the investee, along with dividends/distributions from the investee. An investor can sell all or a portion of their equity method investment and will recognize a gain or loss at sale or dissolution equal to the difference between their cumulative investment balance and the consideration received for the sale or dissolution. Accounting for equity method investments can be quite complicated, but this article summarizes the basic accounting treatment to give you a high level understanding.