LeaseQuery: Cloud-Based Lease Accounting Software

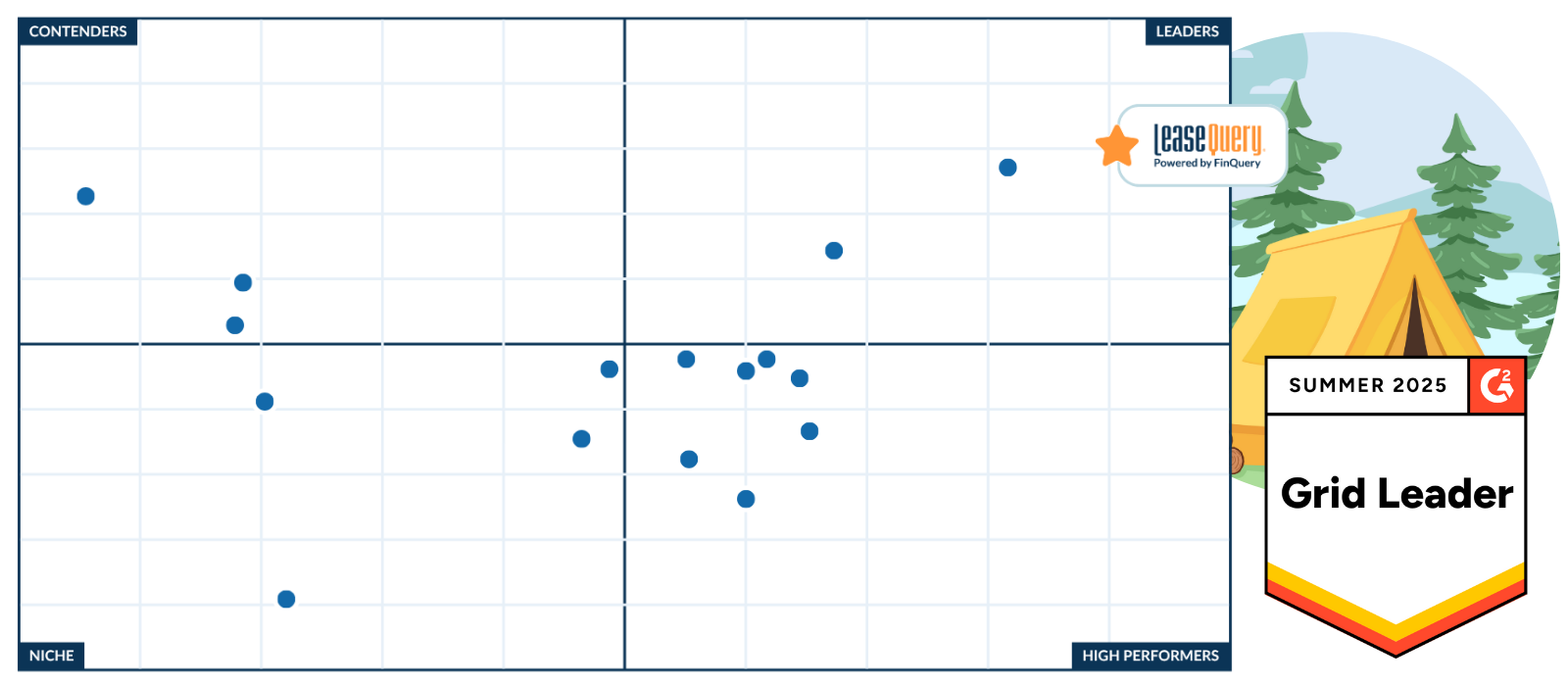

See why LeaseQuery, powered by FinQuery, is the #1 rated lease accounting software by CPAs

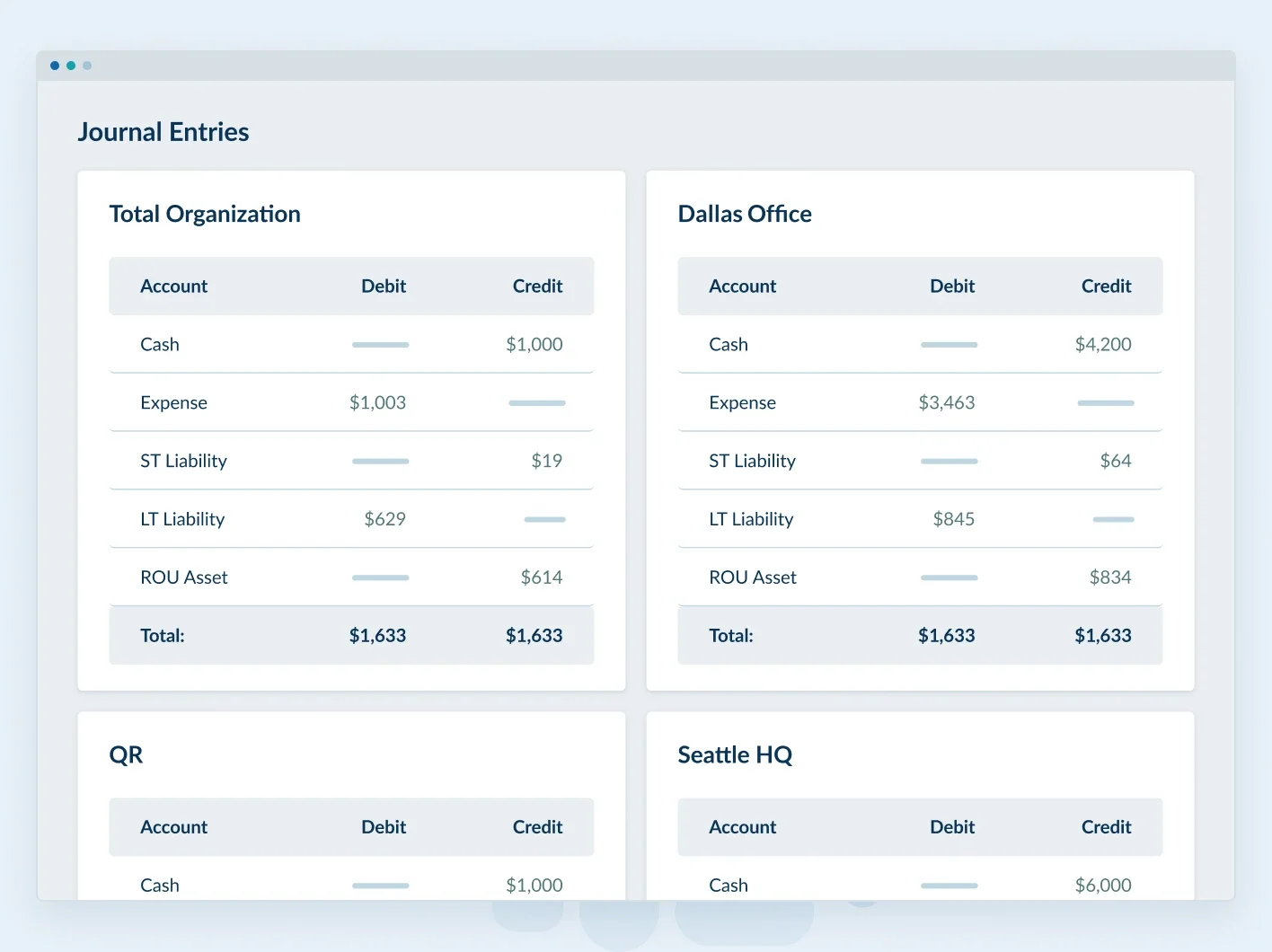

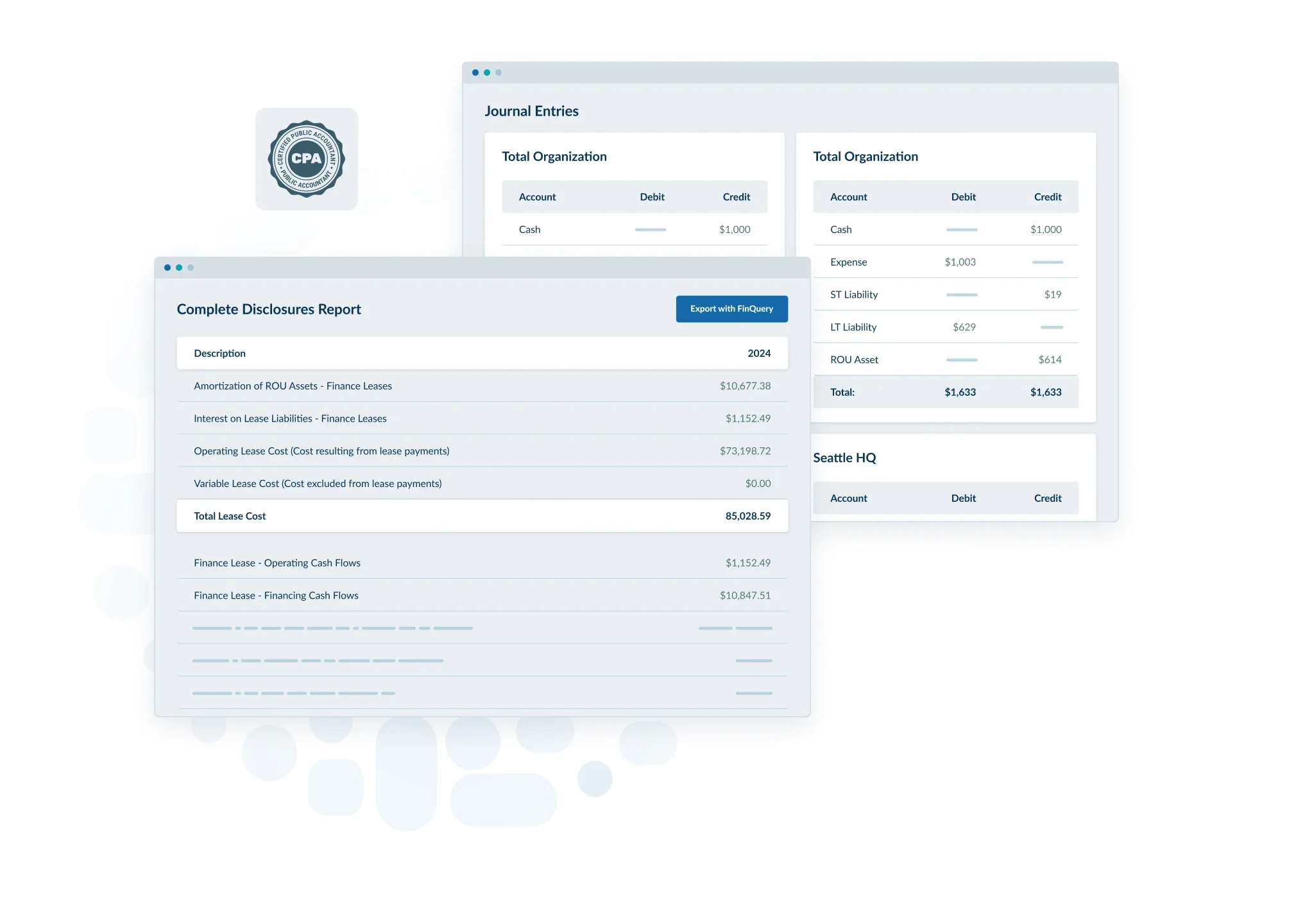

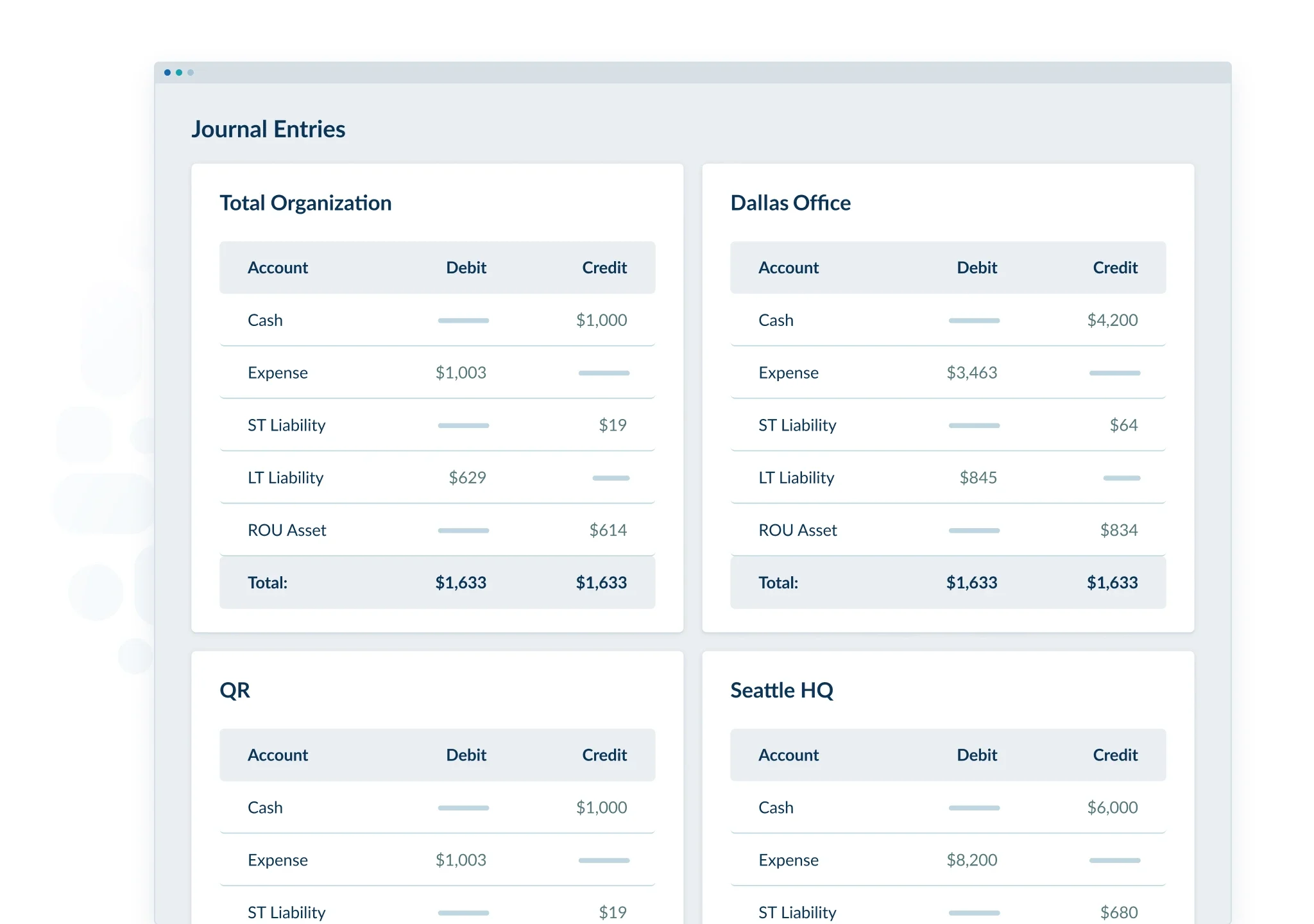

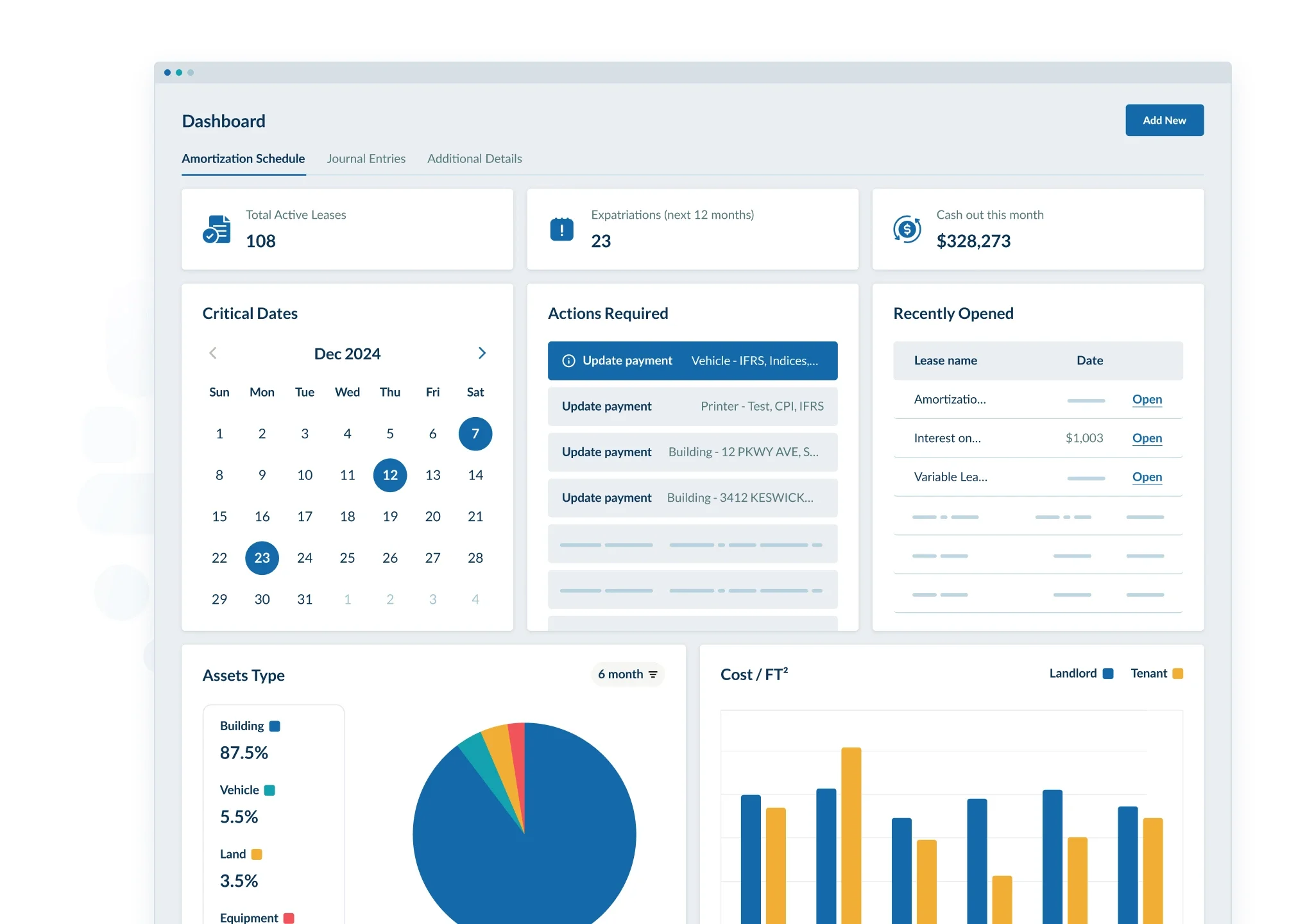

- Lease Accounting. Auto-generate error-free amortization schedules, journal entries, and disclosure reports.

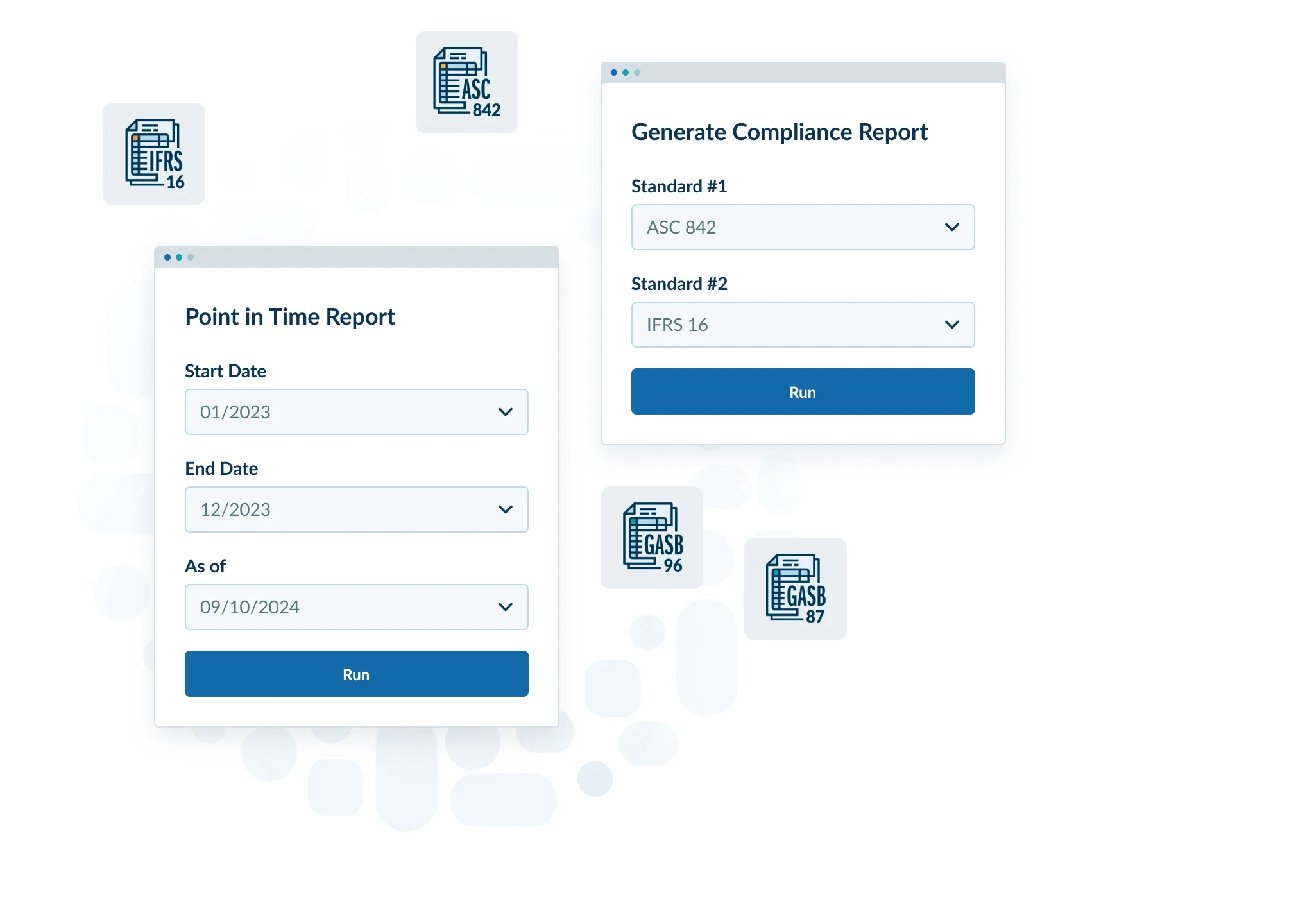

- Compliance. Create compliance documents including ASC 842, GASB 87 and 96, IFRS 16, SFFAS 54 and FRS 102.

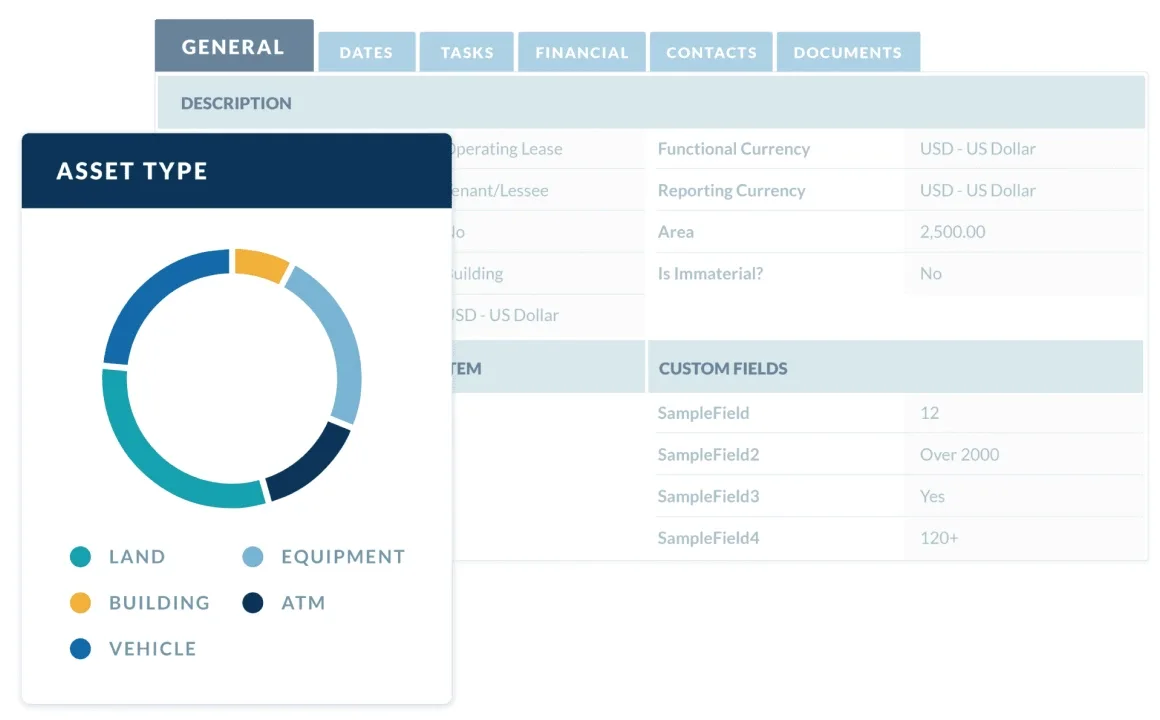

- Dashboard. Monitor your portfolio from one dashboard. Track payments. Alerts for expiring leases and due dates.

Select Your Standard

ASC 842

IFRS 16

GASB 87

GASB 96

SFFAS 54

FRS 102

We passed our audit with flying colors. Our auditors even said the system was the easiest they had worked with.

Join 8,000+ using FinQuery to save time with confidence

Lease Accounting & Management Software Solutions

Features

CPA-Approved Lease Accounting

CPA-approved journal entries, amortization schedules and disclosures for ASC 842, IFRS 16, and GASB 87.

Compliance for Complex Scenarios

Easily handles complex scenarios including dual standard reporting, custom calendar, variable payments, point-in-time reporting, catch-up adjustments and more.

Seamless Transfer

Transferring your leases is easy with bulk upload capabilities, AI-assisted lease entry, and our superior support team working with you to convert, transfer, and reconcile your data.

General Ledger Integrations

Integrate with ANY general ledger including NetSuite, Infor, Acumatica, Sage, Microsoft, SAP, QuickBooks, and Workday. Or use our ledger agnostic journal entries to comply without an integration.

User Friendly

Built by accountants, for accountants to simplify your work life. Features like a frequently updated help center, on-demand training, and daily office hours make learning the tool a breeze. AI-assisted lease entry, read-only auditor access, and push button reporting make day to day use a breeze.

What is lease accounting software?

Lease accounting software provides the calculations and reports necessary to comply with the new accounting standards for leases, including ASC 842 as well as GASB 87, IFRS 16, SFFAS 54, FRS 102, and various others.

LeaseQuery software provides everything needed for organizations reporting under FASB, FRC, GASB, IFRS, and FASAB to be in compliance: amortization schedules for the lease liability and ROU asset, journal entries, reports, disclosures, and a knowledgeable support staff.

LeaseQuery provides compliant and accurate accounting for both finance leases and operating leases under ASC 842, FRS 102, IFRS 16, GASB 87 and SFFAS 54.

For GASB 96 accounting compliance, see our GASB 96 software.

Find the Best Lease Accounting Software for your Business

LeaseQuery Integrations

LeaseQuery seamlessly integrates with any ERP to automate journal entries, reduce errors, and consolidate data from multiple sources. This streamlines your lease accounting process, saving time, unlocking valuable financial insights, and maximizing your return on investment.

Evaluate More Than Just Cost

Occasionally, procurement teams and senior leaders push for the low-cost option, but the cheapest solution may not be best. Understand the software’s features to ensure it has everything needed for long-term compliance and what added value it might bring. Consider features like ad-hoc reporting, storage and management for non-lease contracts, and AI-enabled document extraction.

Lease Accounting Software Reviews

The best way to assess any technology is to hear from those who have used it. Over 66% of B2B buyers say reviews are “very important” in the buying process.

Most of LeaseQuery’s customer reviews are from the accountants who perform their company’s lease accounting. Several competitors have received good reviews, but from people in real estate, legal, and lease administration, rather than accountants.

When checking out a solution’s reviews, look for how many of those reviews were made by people who understand lease accounting specifically.

Seek Feedback From Your Peers

Go beyond online reviews and reach out to your peers to find out which solutions they’re using. A one-on-one conversation allows you to ask questions you may not see addressed in a review.

The demanding landscape of lease accounting, with its complex standards, compliance requirements, and staffing challenges, may have resulted in some companies adopting solutions that lack the necessary features and support for sustained compliance. Learning from the experience of your peers and having a keen eye for detail will help you make the right choice.

Small Portfolio Lease Accounting

LeaseGuru lease accounting software makes it simple and secure to account for small lease portfolios, producing the amortization schedules, journal entries, and disclosures required for ASC 842 or IFRS 16 compliance. Create an account and enter your first 2 leases for free.

Check Out Lease Accounting Software Reviews On These Comparison Sites

What to Look for When Comparing Lease Accounting Solutions

Knowledgeable Support Staff

No matter how simple a solution seems, it’s always good to confirm reliable help is available.

- Is the provider’s support staff competent with the system?

- Do they know how to apply the lease accounting guidance correctly?

- Are you able to get support in a timely manner?

These things will be crucial for a smooth implementation and ongoing compliance.

Automation And Efficiency

The software you choose should provide accurate lease accounting and compliance right out of the box. When comparing solutions, be sure to ask:

1. Are report exports built to comply with the standard’s disclosure requirements?

2. Are missed lease adjustments seamlessly made with an easy-to-follow audit trail?

3. Does the software use AI to automate repetitive or tedious tasks such as lease abstraction and data entry?

SOC Reports

System and Organization Controls (SOC) reports – issued by a third-party CPA firm – examine a software company’s internal controls over various functions, including financial reporting, IT security, and data processing integrity. A SOC 1 Type 2 is the most relevant report for lease accounting software. Your vendor should be able to provide one, issued within the previous 12 months, to give assurance their controls are operating effectively.

Data Security And Support For Your Internal Controls

Don’t sacrifice security or controls. Providers should be able to show you how their lease accounting system’s built-in functionalities keep your data secure and reinforce your internal controls. Security features like unique user logins and data encryption are a must. Controls like data validation, appropriate approval processes, and lease change reporting will support Sarbanes-Oxley (SOX) compliance and a smooth audit process.

Lease Software Comparison Guide

Comparing lease accounting software solutions? Supplement the reviews and pricing info with considerations from our comparison guide:

- Evaluation of ASC 842, GASB 87 & 96, or IFRS 16 software.

- Must-ask questions to check vendor expertise.

- List of the top functionalities required for compliance.

More Than a Lease Accounting Tool

Lease Database Software

Our cloud-based software houses your leases and financial contracts in a centralized and secure database available anywhere with an internet connection and provides data integrity not possible with Excel.

Give departments and team members the appropriate level of access for their roles and they can create alerts for upcoming dates, set workflow notifications, or use the search function to quickly pull up contracts. You can even give auditors read-only access for a simpler audit process.

Financial Decision Support Tool

LeaseQuery reporting gives you insight into all the financial details of your leases. This new visibility enables better and easier forecasting, budgeting, and capital allocation.

In addition, LeaseQuery reporting, along with critical date alerts, help you identify and address issues with your leases before they become problems.

Lease Management and Lease Tracking Software

Tracking leases is possible with Excel or a Google Sheet, but it’s not ideal. Failure to meet accounting compliance isn’t the only risk.

Relying on a spreadsheet and human accuracy can also lead to missed renewals, failure to escalate (or de-escalate!) payments, and miscommunication across departments.

Lease management software aids lease tracking and management to improve processes and catch errors before they can become bigger issues.