GASB 96

GASB 96 Compliance

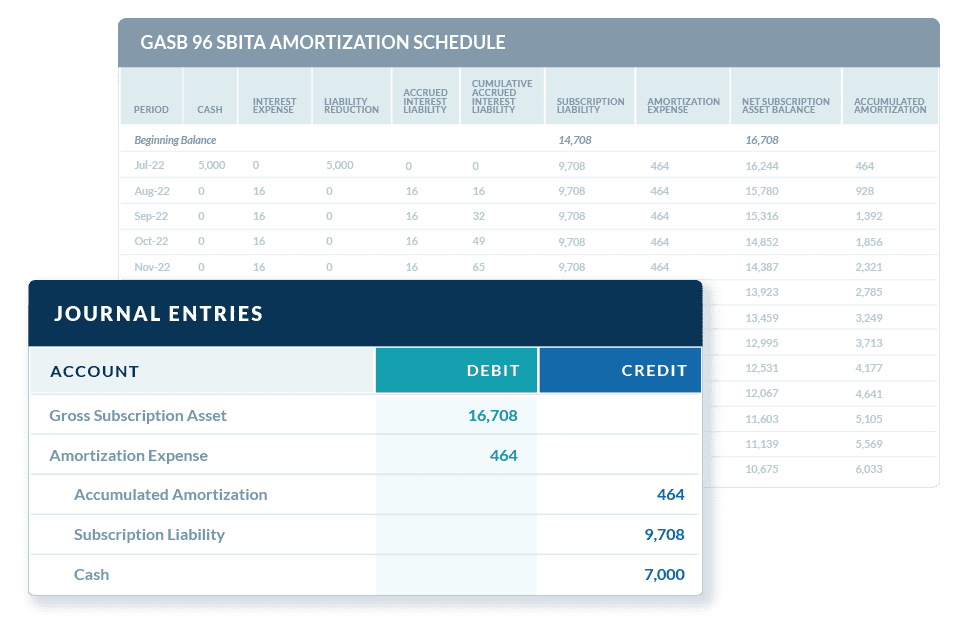

Amortization schedules and journal entries calculated for you. All required reports and disclosures ready out of the box.

Fund Accounting

Get fund-level modified accrual journal entries and government-wide conversion to full accrual journal entries.

Contract Tracking

Keep everything related to your Subscription-based IT Arrangements (SBITA) in a cloud-based central repository.

What is GASB 96?

GASB 96 is the accounting standard that aims to standardize how government entities account for Subscription-Based Information Technology Arrangements (SBITAs). The most common SBITAs are cloud software subscriptions like Office 365, Zoom, DocuSign, or a cloud-based ERP. Entities that report under GASB, like local governments, public colleges and universities, and public hospitals among others, must account for these software subscriptions on their financial statements.

It is estimated that most organizations have 20+ SBITAs, too many to be accounting for in spreadsheets. LeaseQuery for GASB 96 is a proven solution to handle the complex capitalization criteria and subsequent accounting for the GASB 96 guidelines.

“It was the ultimate relief to hear that all this craziness that GASB is putting out, that there really is a way that we’re going to be able to handle it.”

Wendy Keller

Accounting Manager, Utah State University

Determine if you have a SBITA with our free tool

- Decide whether your IT contracts contain subscription arrangements.

- Enable other departments to identify their SBITAs.

- Provide supportable proof of your determination.