CPA-Approved accounting for leases, prepaids, and accrued expenses.

Simplified Accounting Compliance

CPA-approved calculations, amortization schedules, and journal entries for your leases and prepaid and accrued expenses.

Critical Alerts

No more surprise renewals or missed opt-out dates. Get automated renewal and critical date alerts for all the leases and contracts in your portfolio.

Efficiency & Time Saving

Alleviate any burdens with AI-assisted document entry and reduce repetitive manual work entering leases, contracts and invoices.

Contract & Spend Intelligence platform for complete visibility and confident compliance.

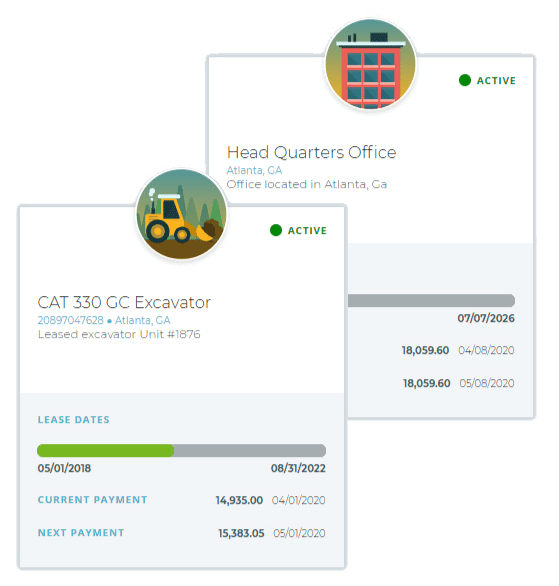

Lease Accounting and Management

Market-leading, AI-enabled lease accounting software simplifies lease accounting and lease management providing timely insights about your leased assets for confident compliance and maximum value.

Contract Management with Prepaid and Accrual Accounting

An AI-enabled, central repository to track recurring vendor contracts. Get timely renewal reminders, generate cash flow forecasts, and automate prepaid and accrual accounting.

Lease Accounting Software Solutions

Master ASC 842 & Lease Accounting: Navigate updates, calculations, and classifications with our ultimate guide.

This guide simplifies the transition from ASC 840 to 842, covering key calculations and lease classifications you need to know for compliance. Start mastering ASC 842 now.

Download for insights on how to handle:

Lease Classifications

Finance Lease Accounting

Operating Lease Accounting

ASC 842 Transition Examples