3. What is a lease under ASC 842?

5. ASC 842 lease accounting for lessees

- Operating lease accounting under ASC 842 and examples

- Finance lease accounting under ASC 842 and examples

6. ASC 842 lease accounting for lessors

7. Sale-leaseback accounting under ASC 842

8. Leveraged lease accounting under ASC 842

9. ASC 842 practical expedients

10. ASC 842 disclosure requirements

What is ASC 842?

ASC 842, also known as Topic 842, is the new FASB lease accounting standard and dictates how organizations reporting under US GAAP should record the financial impact of their leases. Among other changes, the new standard requires organizations to record the majority of their leases on the balance sheet. ASC 842 replaced the prior lease accounting standard, ASC 840, and was instituted by FASB to enhance transparency into lease liabilities for financial investors and reduce off-balance sheet financing.

ASC 842 effective dates

The effective date of ASC 842 was different for public and private companies. Publicly-traded companies were required to transition to the new standard for reporting periods beginning after December 15, 2018. This meant calendar year-end companies adopted the standard on January 1, 2019.

The original effective date for private companies and non-profit organizations was set for reporting periods beginning after December 15, 2019. However, in the summer of 2019, as a result of feedback from public companies on the complexities of implementation, FASB delayed it in order to give these organizations more time to prepare for the transition. In 2020, the board then delayed the effective date a second time in response to the impact of the COVID-19 pandemic.

Following these two delays, the effective date for private companies and non-profit organizations was set for reporting periods beginning after December 15, 2021 and most private companies and non-profit organizations transitioned to ASC 842 for the 2022 fiscal year.

What is a lease under ASC 842?

ASC 842 defines a lease as a contract or a portion of a contract that grants “control” of an identifiable asset for a period of time in exchange for payment. In order to demonstrate “control” of an asset under this definition, the business entity must be able to obtain “substantially all” of the economic benefit from the asset’s use and direct its use throughout the period of the contract.

ASC 842 lease classifications and subtopics

ASC 842 recognizes two types of leases for lessees, which are covered in ASC 842-20:

For lessors, the standard recognizes three types of leases, which are covered in ASC 842-30:

- Operating leases

- Sales-type leases

- Direct financing leases

In addition to these lease classifications, the standard contains two more subtopics with guidance covering the following types of transactions:

- Sale-leaseback transactions, covered in ASC 842-40

- Leveraged lease agreements, covered in ASC 842-50

Scope of ASC 842

ASC 842 applies to the majority of leases and subleases, but some exceptions exist. A few specific lease types are out of the scope of Topic 842 and the guidance should not be applied to these transactions. Here are the out-of-scope lease types, as detailed in Subtopic 842-10-15-1:

- Leases of intangible assets, such as software subscriptions. The guidance for these agreements is in ASC 350, Intangibles – Goodwill and Other.

- Leases for the exploration or use of non-regenerative natural resources such as oil, natural gas, and minerals are covered under ASC 930, Extractive Activities – Mining, and ASC 932, Extractive Activities – Oil and Gas.

- Leases of biological assets such as plants, animals, and timber. These are covered in ASC 905, Agriculture.

- Inventory leases, which are addressed in ASC 330, Inventory.

- Leases of assets under construction. These are covered in ASC 360, Property, Plant, and Equipment.

ASC 842 lease accounting for lessees

For lessees, ASC 842 classifies every lease as either an operating lease or a finance lease. This applies to all categories of leased assets, including both real estate and equipment leases. Because nearly all leases are capitalized under the new standard, the term, “finance lease,” was adopted to replace the term, “capital lease,” used under ASC 840.

ASC 842 requires lessees to recognize both an asset and a liability for each lease. The lease liability is represented as the present value of lease payments. The lease asset is measured as the lease liability adjusted for certain items like prepaid rent, initial direct costs, and lease incentives.

Among the many changes to lease accounting under this standard, the most significant is the recognition of operating leases on the balance sheet as lease assets and lease liabilities. The lease asset is referred to as the right-of-use asset, or ROU asset, and represents the lessee’s right to use the underlying asset. The lease liability represents the lessee’s financial obligation over the lease term. When measuring the assets and liabilities, both the lessee and the lessor should also include any lease renewals beyond the current lease term and lease purchase options which they are “reasonably certain” to exercise.

For leases with terms of 12 months or less, lessees can elect not to recognize lease assets and liabilities. They should instead recognize lease expense on a straight-line basis, generally, over the term of the lease, similar to the accounting treatment under ASC 840.

Existing capital leases are not impacted by the change in lease standards apart from being referred to as finance leases.

Operating lease accounting under ASC 842 and examples

Under ASC 842, an operating lease is defined as any lease that does not meet any of the five criteria for a finance lease. When accounting for an operating lease, the lessee must:

- Recognize a single lease cost allocated over the lease term, generally on a straight-line basis

- Classify all cash payments within operating activities on the statement of cash flows

For a full example of an operating lease beginning pre-transition and the accounting treatment at transition, read our article, “Operating Lease Accounting under ASC 842 Explained with a Full Example.”

Below is an example of the accounting for an operating lease. For the example, let’s assume the following facts:

- Payment terms: $20,000 annually

- Start Date: 1/1/2023

- End Date: 12/31/2026

- Incremental Borrowing Rate (IBR): 3%

- The lessee determines this is an operating lease

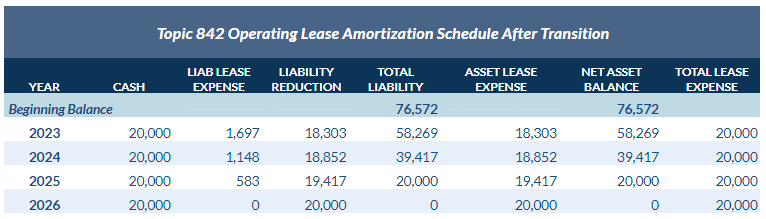

Based on these circumstances, the present value of 4 annual payments of $20,000, made in advance, with a 3% IBR is $76,572. The annual operating lease expense is $20,000, or the straight-line treatment of 4 annual payments with no escalations, rent holidays, etc. The amortization schedule for this lease is below.

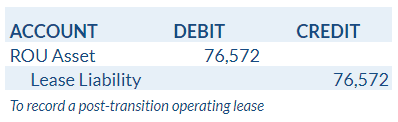

The entry to record the lease upon its commencement is a debit to ROU asset and a credit to lease liability:

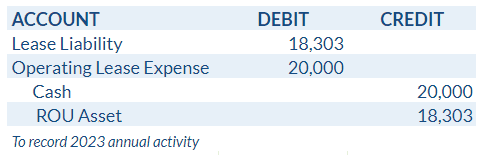

Subsequent entries follow the amounts set forth in the amortization table. The entry for the annual activity of 2023 is below.

Finance lease accounting under ASC 842 and examples

Finance lease criteria

Under ASC 842 , a lease is considered a finance lease if any of the following five criteria are met:

- Ownership Transfer: The lease includes an option to transfer ownership of the underlying asset to the lessee by the end of the lease term.

- Purchase Option: The lease grants the lessee an option to purchase the underlying asset and the lessee is reasonably certain to exercise this option.

- Lease Term: The lease term represents a major part of the remaining economic life of the underlying asset. This generally means the lease term covers 75% or more of the remaining economic life of the asset.

- Present Value: The present value of the sum of the lease payments and any residual value guaranteed by the lessee equals or exceeds substantially all (generally 90% or more) of the fair value of the underlying asset.

- Specialized Asset: The underlying asset is of such a specialized nature it is expected to have no alternative use to the lessor at the end of the lease term.

If none of these criteria are met, the lease is classified as an operating lease.

Finance lease accounting

When accounting for finance leases, lessees must:

- Recognize interest on the lease liability and amortization of the ROU asset in separate line items of the income statement

- Classify payments of the principal portion of the lease liability within financing activities and payments of interest on the lease liability within operating activities on the statement of cash flows

The accounting treatment of a finance lease under ASC 842 is the same as the accounting that was required under ASC 840 and no transition accounting adjustments are necessary. Therefore, existing capital leases under ASC 840 do not require adjustment or remeasurement upon transition to ASC 842, provided they were accounted for correctly under ASC 840.

However, one exception is if any deferred or prepaid rents associated with the capital/finance lease existed at transition. Any outstanding balances of deferred or prepaid rents at transition are adjustments to the related ROU asset.

We’ve detailed a full example of a finance lease beginning post-transition in another article, “Capital Lease Accounting and Finance Lease Accounting: A Full Example.”

Download the Ultimate ASC 842 Guide for more examples

Our Ultimate Lease Accounting Guide for ASC 842 contains 44 pages of examples, journal entries, disclosures, and more step-by-step guidance on operating leases and finance leases under the new standard.

ASC 842 lease accounting for lessors

Lessor accounting is largely the same under ASC 842 as it was under ASC 840. Lessors can classify leases as operating, sales-type, or direct financing leases, but ASC 842 eliminated leveraged leases. Lessor accounting is covered in full detail in ASC 842-30. No significant changes were made to the requirements for balance sheet recognition.

Lessor operating lease accounting

For operating leases, the leased asset is still recognized as a fixed asset on the lessor’s books. Lease income is recognized on a straight-line basis over the lease term, and the lessor continues to depreciate the leased asset over its useful life.

To classify a lease as an operating lease under ASC 842, a lessor must ensure that none of the following criteria are met, as these would instead classify the lease as a sales-type or direct financing lease:

- Transfer of Ownership: The lease transfers ownership of the underlying asset to the lessee by the end of the lease term.

- Purchase Option: The lease grants the lessee an option to purchase the underlying asset, which the lessee is reasonably certain to exercise.

- Lease Term: The lease term is for the major part of the remaining economic life of the underlying asset.

- Present Value: The present value of the lease payments and any residual value guaranteed by the lessee equals or exceeds substantially all of the fair value of the underlying asset.

- Specialized Nature: The underlying asset is of such a specialized nature that it is expected to have no alternative use to the lessor at the end of the lease term.

If none of these criteria are satisfied, the lease is classified as an operating lease.

Sales-type lease accounting

Sales-type lease accounting occurs when the lease arrangement effectively transfers control of the underlying asset from the lessor to the lessee, which is considered akin to a sale. Under ASC 842, a lease is classified as a sales-type lease if it meets any of the above criteria.

In a sales-type lease, if collectibility is probable, the lessor derecognizes the underlying asset from its balance sheet and recognizes a net investment in the lease. This net investment includes the unguaranteed residual asset plus the present value of both the lease payments and any guaranteed residual value. Additionally, the lessor recognizes selling profit or loss and initial direct costs (if applicable) at the commencement date. Revenue from the lease is recognized based on the interest income from the net investment over the lease term.

If collectibility of the lease payments is not probably at commencement, do not derecognize the underlying asset and record any payments received as a deposit liability.

Direct finance lease accounting

Direct finance lease accounting is similar to sales-type lease accounting. In a direct finance lease agreement, the lessor transfers substantially all of the risks and rewards of ownership of the asset to the lessee. A lease is classified as a direct finance lease if it meets any one of the criteria for a sales-type lease plus both of the following additional criteria:

- The present value of the lease payments and any residual value guarantee equals or exceeds substantially the fair value of the underlying asset, AND

- It is probably the lessor will collect the lease payments plus amounts necessary to satisfy a residual value guarantee.

In a direct finance lease, the lessor derecognizes the leased asset and recognizes a net investment in the lease, which consists of the unguaranteed residual asset plus the present value of future lease payments and any residual value guaranteed by the lessee. Any initial direct costs incurred by the lessor are included in the net investment in the lease and amortized over the lease term, rather than being recognized immediately.

Revenue recognition for direct finance leases occurs over the lease term as interest income using the effective interest method. The interest income is calculated on the net investment in the lease, reflecting the lessor’s rate of return on the lease agreement. This ensures the revenue is matched with the periods benefiting from the lease, providing a more accurate financial picture of the lessor’s leasing activities.

Read more about accounting for lessors in our article, “Lessee vs. Lessor: Differences, Accounting, & More Explained”.

Sale-leaseback accounting under ASC 842

In a sale-leaseback transaction, the lessee sells the asset to the buyer/lessor and enters into an agreement to lease the asset back from the buyer/lessor. This type of transaction consists of both a sale and a lease. The determination of whether or not the transaction is a sale is performed in accordance with ASC 606, Revenue from Contracts with Customers.

To account for a sale-leaseback transaction, the seller/lessee should recognize the sale and any resulting profit or loss when the buyer/lessor gains control of the asset. At the same time, the seller/lessee should derecognize the asset and account for the leaseback portion according to ASC 842 by recognizing a lease liability and a corresponding right-of-use asset.

As a result of the changes under both ASC 606 and ASC 842, some transactions that did not qualify for sale-leaseback accounting under ASC 840 now qualify under ASC 842. The opposite is also true: some sale-leaseback transactions under ASC 840 now no longer qualify for this accounting under ASC 842.

For a full example of a sale-leaseback transaction, read our article, “Sale-leaseback Accounting under ASC 606 and ASC 842 Explained.”

Leveraged lease accounting

Under Topic 840, a leveraged lease is defined as an agreement in which the lessor borrows funds from a lender to help pay for the purchase of an asset that is then leased to a lessee. The lender holds the title of the asset and the lease payments made by the lessee may be collected by the lessor, but are sent to the lender.

As we mentioned above, ASC 842 eliminated the leveraged lease classification. Lessors can only classify a lease arrangement as a leveraged lease if the commencement date is prior to the effective date of the new lease accounting standard. The accounting is detailed in ASC 842-50.

Ultimately, this means no new leveraged leases will be created under ASC 842. Leases with a commencement date falling after an entity’s effective date for ASC 842 should be accounted for in accordance with the rules for lessor accounting contained in ASC 842-30.

ASC 842 practical expedients

Topic 842 offers elections meant to ease the transition process, referred to as practical expedients. Some of the practical expedients under ASC 842 include grandfathering of lease classification, combining lease and non-lease components, and not restating the prior year’s financials.

A more thorough explanation of the various practical expedients available can be found in our article “Practical Expedient in Accounting Explained: Adopting ASC 842 and IFRS 16 with Ease.”

ASC 842 disclosure requirements

ASC 842 requires both qualitative and quantitative disclosures. A few of the specific disclosures required are:

- Discussions covering the lease arrangements

- Descriptions of significant judgments made

- Details about the lease costs reported on the income statement

- Weighted-average analysis of discount rates and remaining lease terms

We provide a full overview of the disclosure requirements of ASC 842 with examples in our article, “ASC 842 Disclosure Requirements: Example and Explanation.”

ASC 842 vs. IFRS 16: What are the differences?

Despite the Boards’ efforts to streamline lease accounting with the convergence of these new standards, some major differences between the two standards emerged. For example, ASC 842 continued to distinguish between finance and operating leases and both are now recognized on the balance sheet. Alternatively, IFRS 16 removed the operating lease classification and requires that all lessee leases be treated as finance leases.

Here are a few more examples of how the two differ:

- Under IFRS 16, the lease liability is remeasured each time the reference index or a rate that variable lease payments are tied to resets, whereas ASC 842 does not require the lease liability to be remeasured when indices or rates are reset.

- Though ASC 842 does not explicitly exclude immaterial leases or low-value assets, these are exempt from balance sheet recognition under IFRS 16. The Basis for Conclusions paragraph 100 to IFRS 16 addresses how companies can define “low value” assets and offers a threshold of $5,000 for consideration.

- ASC 842 permits private companies to use a risk-free rate to calculate the lease liability, but IFRS 16 does not provide guidance specific to private entities.

- While ASC 842 generally requires interest payments to be included within operating activities on the statement of cash flows, IFRS 16 allows interest to be reported within operating, investing, or financing activities.

For more examples of differences covered in full detail, read our article, “IFRS 16 vs. US GAAP Lease Accounting: What Are the Differences?”

ASC 842 software: What are the benefits beyond compliance?

There are numerous benefits to implementing lease accounting software for ASC 842, such as LeaseQuery. Here are just a few:

1. More opportunities for lease management

One invaluable feature is getting alerts for critical dates related to your leases, such as reminders about renewals, payment changes, terminations, etc. These alerts can help you manage and track those critical dates better. Having the ability to build customized reporting for lease management purposes, such as tracking cost per square footage or annual payment information, is also an important feature when evaluating software.

2. Improvements to accounting accuracy and reduction of errors

Many companies are still using Excel for lease accounting instead of an accounting-focused software solution. Excel requires significantly more manual work, takes more of the accounting team’s time, increases the effort needed to complete audits, and often leaves companies with doubts about the accuracy of their calculations.

Some companies even have horror stories about using Excel for leases. Finding software that assures controls and calculations can provide additional trust in the accuracy of your financials. An accounting software vendor needs to provide this assurance through a SOC report.

3. Modifications, renewals, and other day two accounting made easy

Even after the transition process, lease accounting challenges still exist. These can include new leases, modifications, impairment, renewals, and even standard changes. This can also include organizational changes like mergers and acquisitions, new balance sheet and income statement accounts, training new staff, etc.

Having a software to maintain compliance and keep up with day two lease accounting can help your team be more efficient and have a smoother close process. For more details on day two lease accounting, see our article, “Dive Into Day Two Lease Accounting.”

4. Improved budgeting and forecasting

The right software can provide the ability to budget or forecast the income statement, balance sheet, and cash flow impacts from lease accounting. Budgeting and forecasting functionality allow you to identify how much cash you’ll spend in a given period as well as how much will be spent by a particular region, department, or business division.

Your solution’s out-of-the-box forecasting reports should be able to help determine the impact your lease portfolio has on important reporting metrics, such as earnings per share and EBITDA.

Finding a lease accounting solution that has custom reporting features is also important so you can create a report specifically for your organization’s needs. That way, you’ll be an expert when colleagues request information about leases and their financial impact on the company.

5. Improved financial footnote disclosures

Without support from software, gathering the information for the quantitative lease disclosures can be a time-consuming task. After this data is gathered, the accuracy has to be validated for the auditors and internal control requirements. Having software that can provide the full set of quantitative disclosures out-of-box can allow your company to quickly aggregate the data to complete your financial footnote disclosures as detailed above.