2. How has accounting for rent payments changed under ASC 842?

3. How is rent expense measured?

4. Differences in timing of cash flows in rent payments

5. How is rent expense presented in the financial statements?

6. Example: straight-line rent expense calculation

- Step 1: Calculate the total payments

- Step 2: Divide the total payments by the lease term

- Step 3: Calculate the operating lease liability

- Step 4: Calculate the right-of-use asset (with journal entry)

7. Summary

This article explores rent expense and the impact of the adoption of ASC 842. It provides insights into the recognition and presentation of rent expense in financial statements, complete with an example at the end of the article to illustrate rent expense measurement.

What is rent expense?

Rent expense represents the cost incurred by an organization for using or occupying an asset it does not own. It is a crucial expense for many businesses, often involving buildings, warehouses, offices, vehicles, or various equipment types.

How has accounting for rent payments changed under ASC 842?

Under ASC 840, accounting for rent in operating leases was straightforward. Lessees would simply record a debit to rent expense and a credit to cash, reflecting the expense for using the leased asset and the payment made within the same period.

However, with the introduction of ASC 842, lease accounting has become more complex, and with it, the recognition of rent expense. Organizations must now recognize both an asset and a liability for their operating leases. Specifically, they record a lease liability equal to the present value of future lease payments and a right-of-use asset that corresponds to this liability, with adjustments for certain amounts.

Lease payments reduce the lease liability over time. The lease expense, which includes the time value discount of the lease liability and the amortization of the right-of-use asset, is recognized in a manner similar to the straight-line rent expense recognized under ASC 840. The combined lease expense is now reported in the operating section of the income statement under ASC 842 in place of rent expense.

How is rent expense measured?

Under current US GAAP, the FASB states that when rent payments are not constant over the lease term, lease expense should be recognized on a straight-line basis throughout the life of the lease rather than as lease payments are made. This method of rent expense recognition is applicable under both ASC 840 and ASC 842 for leases classified as operating leases. The current lease accounting standard addresses the recognition of a single lease expense over the term of the lease for operating leases in ASC 842-20-25-6:

“A single lease cost, calculated so that the remaining cost of the lease is allocated over the remaining lease term on a straight-line basis unless another systematic and rational basis is more representative of the pattern in which benefit is expected to be derived from the right to use the underlying asset.”

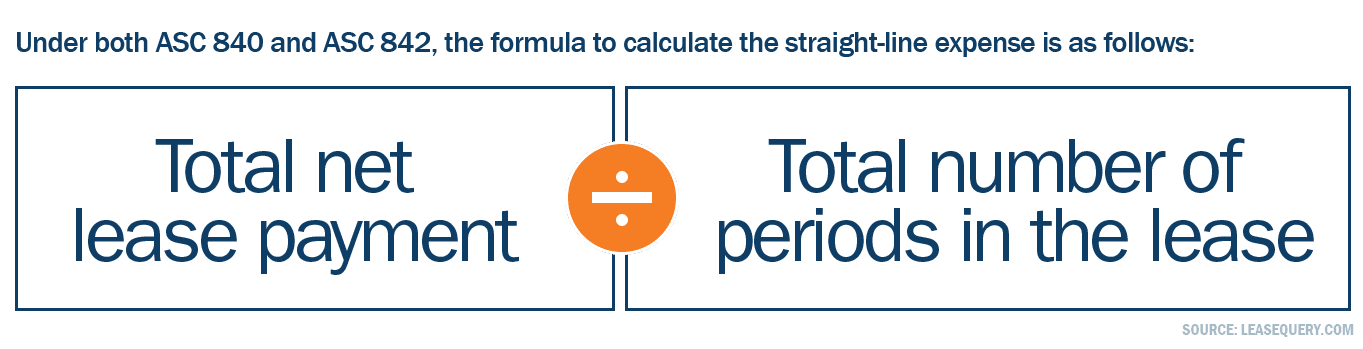

Under both ASC 840 and ASC 842, the formula to calculate straight-line rent expense is total net lease payments divided by the total number of periods in the lease.

For an in-depth discussion of operating lease accounting under ASC 842 and a full example with deferred rent expense and journal entries, read our blog, Operating Lease Accounting under the New Standard, ASC 842: Full Example and Explanation.

Other considerations in the rent expense measurement

Additional items within the lease agreement to be factored into the straight-line lease expense calculation may include the following:

- Lease incentives – An incentive is an instance in which the lessor motivates the lessee to sign the lease by offering beneficial terms. A common example of a lease incentive is a tenant improvement allowance. If the lease incentive has not been paid at the lease commencement date, the anticipated cash inflows from the incentive are netted against the cash outflows for the lease payments and factored into the straight-line rent expense calculation. For a more in-depth explanation of lease incentive accounting please refer to this article, Lease Incentives under ASC 842 Explained with a Full Accounting Example.

- Rent abatements or rent-free periods – These are instances where the lessee is not required to pay rent for a set period or recurring periods of the lease, as stated within the lease agreement. These periods of free rent or rent abatement are factored into the total net lease payments, as well as the straight-line rent expense calculation.

- Rent escalations – Rent escalations are very common in lease agreements. These are instances where the contract stipulates an increase in base rent payments, typically either a percentage or a dollar amount, over the life of the lease. This will impact the calculation of straight-line rent expense as these increases will need to be factored into the calculation. The example below demonstrates how to calculate the straight-line rent expense for a lease agreement with rent escalations.

Differences in timing of cash flows in rent payments

In practice, lease payments are not typically disbursed at a constant amount, even if they are recognized in that manner. Under ASC 840, the difference in timing of actual cash payments and the recognition of expense on a straight-line basis was typically recognized on the balance sheet in the form of prepaid rent, deferred rent, or accrued rent.

Prepaid rent

When cash payments in a period were greater than the expense recognized, prepaid rent would be capitalized on the balance sheet with a debit balance. This was considered a prepayment, which is an asset, due to more rent being paid for than rent expense incurred. For an extensive explanation of prepaid rent and other rent accounting topics, see our blog, Prepaid Rent and Other Rent Accounting for ASC 842 Explained (Base, Accrued, Contingent, and Deferred).

Deferred rent

The inverse of prepaid rent is deferred rent. When cash payments in a period were less than the expense incurred, deferred rent would be recognized on the balance sheet as a credit balance. This was considered a deferral, which is a liability, as expense for rent was incurred, but some of the amount was still owed. For further explanation of deferred rent, see our blog, Deferred Rent under ASC 842 Explained with Examples and Journal Entries.

Accrued rent

Accrued rent is another liability account under ASC 840 that is derived from a difference in the timing of cash payment and expense recognition. If cash payments are not made at the same time as expense is recognized, the obligation to pay the amounts that have been expensed would be accrued. For a full explanation with journal entries, read our blog, Accrued Rent Accounting under ASC 842 Explained.

Under ASC 842, none of these accounts are presented on the balance sheet. After the effective date of ASC 842, the differences in the timing of cash flows and expense recognition will continue to be reflected in adjustments to the ROU asset balance.

How is rent expense presented in the financial statements?

Rent expense on the income statement

Rent expense appears on the income statement. Not every organization will have an identical presentation, but rent expense is now widely referred to as lease expense on the income statement. As stated previously, the rent payments for operating leases under ASC 840 were expensed and therefore considered off-balance-sheet transactions. This would be beneficial for lessees as organizations did not have to report a liability on the balance sheet for the obligation. However, not reporting the obligation on the balance sheet may make the organization’s overall commitments appear drastically lower, depending on the significance of that entity’s operating lease portfolio.

The total liability balance (short-term and long-term liability balances) is often used by stakeholders to evaluate whether to invest or lend to an organization. Potential investors or lenders use those balances in financial ratios that often greatly contribute to decision-making. As a result of transitioning to ASC 842, organizations saw an increase in overall liability and asset balances, which may significantly impact the balance sheet and financial ratios used by various stakeholders. Organization’s lease activity is more transparent, which was ultimately the goal of the FASB’s issuance of a new lease accounting standard.

Rent expense on the balance sheet

Rent expense is not reported on the balance sheet. It is still only reported on the income statement and calculated on a straight-line basis.

Example: Straight-line rent expense calculation

Consider the following scenario:

A retailer enters into a 10-year warehouse lease with initial rent payments of $120,000 a month and a 2% annual rent escalation. The Landlord agrees to provide a $200,000 tenant improvement allowance to be paid upfront at the commencement of the lease. The lease commences on January 1, 2022, and ends on December 31, 2031.

Let’s assume this is an operating lease, and the retailer transitioned to ASC 842 on January 1, 2022 and utilized a 7% borrowing rate for the present value calculation.

How do you calculate the lease liability, ROU asset, and straight-line rent expense for the scenario above? In order to arrive at the correct answer under US GAAP, we need to sum the total net lease payments and then divide those payments by the total number of periods in the lease term.

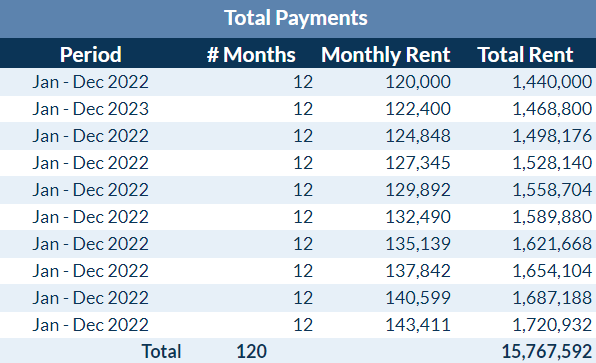

Step 1: Calculate the total payments

The aggregate payments required under the lease total is $15,767,592.

Step 2: Calculate the rent expense by dividing the total payments by the lease term

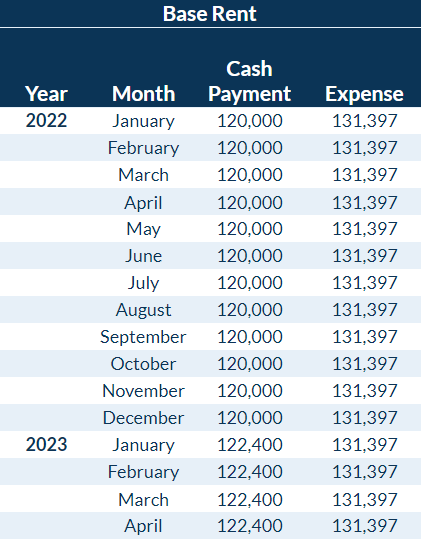

The lease term is 120 months (from step 1) and total rent is $15,767,592 (from step 1). Straight-line monthly rent expense calculated from base rent is therefore $131,397 ($15,767,592 divided by 120 months).

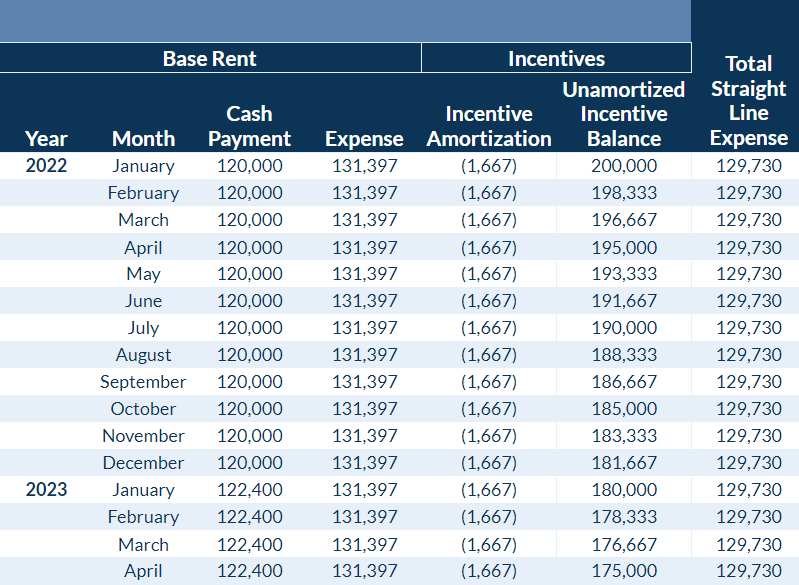

The tenant must also account for the total lease incentive of $200,000. If the lease incentive were to be amortized over the lease term on a straight-line basis as well, the monthly credit to rent expense would be $1,667 ($200,000 / 120 months). As a result of the incentive adjustment, periodic rent expense on the income statement is $129,730 ($131,397 – $1,667).

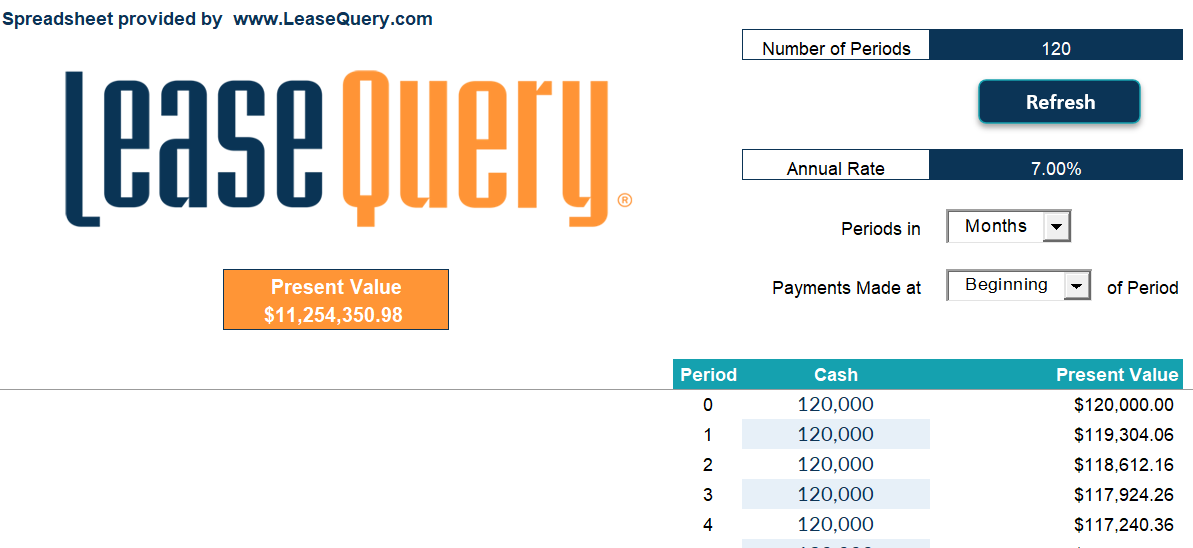

Step 3: Calculate the operating lease liability

In this example, the tenant uses their January 2022 incremental borrowing rate of 7%, and payments are made at the beginning of the month. Using these facts and LeaseQuery’s free NPV calculator, the present value of the remaining lease payments is $11,254,351. This is the lease liability as of January 1, 2022.

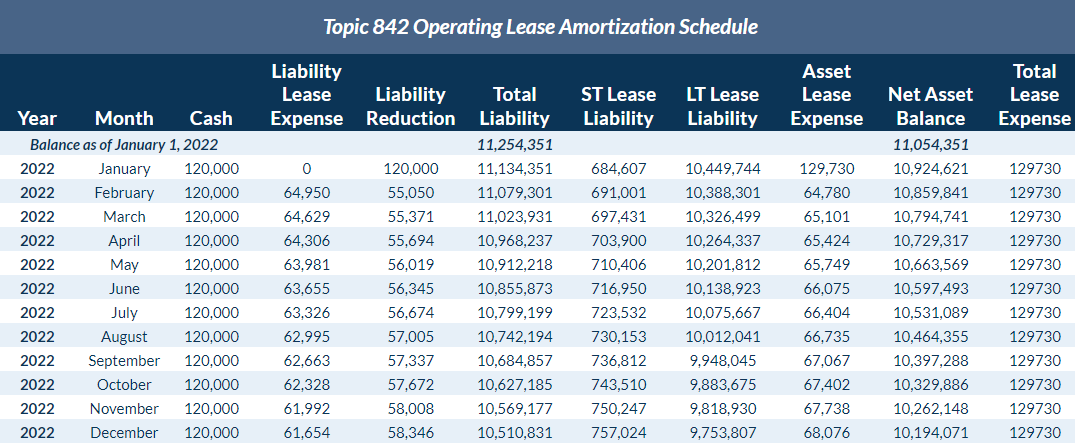

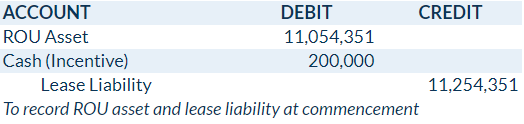

Step 4: Calculate the right-of-use asset (with journal entry)

Per ASC 842, the ROU asset is equal to the lease liability calculated in step 3 above, adjusted by deferred or prepaid rent and lease incentives. In this example, it is the liability of $11,254,351 minus the incentive balance of $200,000. This gives us a total ROU asset of $11,254,351.

The tenant would prepare an amortization table under ASC 842 to assist with the calculation of the periodic entries moving forward. Below is a portion of the amortization schedule for the lease in the example for illustrative purposes.

The journal entry to record the lease liability and ROU asset at commencement and the receipt of the lease incentive would look like this:

Summary

ASC 842 will have little to no impact on the income statement for rent expense. It is calculated and presented in significantly the same way, but may now be called lease expense. Rent expense is calculated on a straight-line basis. Lease agreements may include rent abatements, and/or escalations. However, the general theory of calculating the straight-line rent expense for a particular contract will remain constant: sum the total net lease payments and divide by the total number of periods in the lease.

Future payments for rent-related to operating leases were previously off-balance sheet transactions. This was beneficial to lessees in that the obligation for those payments did not drive up the liability balance. However, ASC 842 aims to increase transparency for stakeholders by including a lease liability and corresponding ROU asset on the balance sheet for operating leases. Rent expense will still not be on the balance sheet.

Under ASC 840, differences in rent payments and expense recognition, stemming from lease agreement complexities like rent holidays, prepayments, or escalations, would be recognized on the balance sheet in the form of prepaid rent, deferred rent, and/or accrued rent. Under ASC 842, those balances are no longer on the balance sheet but are reflected as adjustments to the ROU asset balance.