Working from home began as a two week “temporary” experiment in March 2020 at the start of the COVID 19 pandemic. Over four years later, remote work has evolved into the new normal as companies and employees realize they can operate as efficiently, if not more efficiently, from anywhere.

According to the Wall Street Journal, despite some companies implementing return-to-office policies, office-utilization rates have failed to pick up and are still 30% to 40% below pre-pandemic 2019 levels.

Robin, a workspace management platform, surveyed over 500 business owners and facilities managers to see how offices were being used, and found 40% of the companies surveyed are only using half or less than half of their available office space; and only 28% were using 100% of their office. That is a lot of wasted rent expense, and does not bode well for the value of office commercial real estate. In fact, Moody’s Analytics believes the value of office commercial real estate will likely plunge 26% by the end of 2025.

So, if you are paying for office space you aren’t using, what are your options?

Subleasing

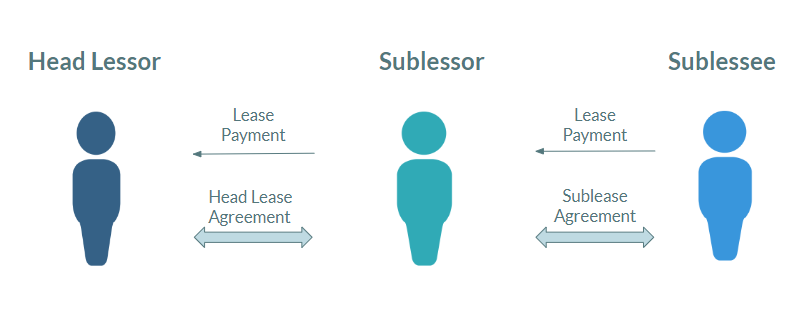

A sublease is a lease agreement where the asset, or part of the asset, is re-leased by the original tenant to a third party, and the original lease agreement between the two original parties remains in effect. The original lease is referred to as the head lease and the new lease with the third party is the sublease. The original lessee becomes the sublessor for the sublease and records lease income from the sublessee, while continuing to pay rent and recognizing lease expense on the original lease.

A sublease provides an organization with more flexibility for future use of a space than terminating the lease would, as subleases are often shorter-term arrangements. Some other reasons an organization may choose to sublease are:

A sublease provides an organization with more flexibility for future use of a space than terminating the lease would, as subleases are often shorter-term arrangements. Some other reasons an organization may choose to sublease are:

- They have a large remote workforce

- They are downsizing

- They want to avoid paying fees for breaking a lease early (early termination fees)

- They plan to grow in the future (e.g. they may have purchased a large space they aren’t using fully but plan to at a future date)

Before jumping into a sublease, take these steps to determine if it makes sense for your organization:

1) Review your current lease

You don’t want to get ahead of yourself: Before wasting time and resources finding a subtenant and executing a sublease, review your current lease agreement to ensure subleasing is even permitted. If permitted, we recommend having your attorney review your lease to determine what specific terms and conditions of subleasing are allowed. Discuss this with your landlord so no surprises occur down the road.

2) Assess your current space

When considering how much space you have available to sublease, be sure to account for both your current headcount and planned headcount. The last thing you want is to sign an agreement and end up needing the subleased space sooner than anticipated! Evaluate your space and determine which sections are being underutilized. Then specifically identify what could be easily partitioned off as a separate area, taking into account access to exits, utilities, common areas, and other necessities.

3) Determine your lease price

Once you’ve determined your available space, research the rental market for your area. Consider factors such as size/sq footage, location, condition, and the price of comparable space. Also consider the potential construction/build-out costs for the subleased space and factor those into your lease price so you don’t end up with a loss. Talk to other tenants and consider consulting with an agent to help determine the right price for your space.

4) Advertise to potential tenants and screen interested parties

Talk to your neighbors and advertise to companies you feel would make responsible and reliable tenants. Screen applicants and perform research on interested companies to ensure their values align with your company’s. Validate whether potential tenants are in a financial position to meet their lease obligation to you.

5) Draft your sublease

Involve your legal counsel in drafting and negotiating the sublease agreement. Once you draft your sublease and both parties sign it, you need to account for it correctly. For a full example and explanation of how to account for a sublease, follow this guide.

Lease termination

If you aren’t able to sublease your unused space, another potential option is a lease termination, either partial or full. A partial termination involves a reduction of the leased asset with the lessee maintaining control of a portion of the original asset. For example, if you are leasing 10,000 square feet of office space, and determine you are only using 6,000 square feet, you could negotiate with your landlord to reduce the amount of leased space in your agreement. The amended lease would result in a partial termination of the existing lease to account for the 4,000 square feet returned to your landlord.

Of course, a full lease termination is also an option. A full lease termination results in the lessee relinquishing the right to the entire leased asset. This option may make sense if your space is way too large for your headcount, or if you have entirely different needs than you did when you signed the lease. For both a partial and a full lease termination, you must negotiate with your landlord to come to an agreement upon terms.

Accounting for a termination includes derecognizing the portion of the right of use (ROU) asset and lease liability balances returned to your landlord. For a full termination the ROU asset and lease liability are both reduced to zero as of the effective date of the termination. For both full and partial terminations, any difference between the reduction of the asset and liability balances will result in a gain or loss.

Part of the reason a lease termination is a less ideal option than subleasing is it provides less flexibility to regain control of the leased space at a future date, and can often result in a greater loss. This is because the original lease agreement often stipulates the lessee must pay the lessor a penalty upon early termination of the lease. If a lease termination penalty is applicable and not previously included in the calculation of lease payments, the lessee will factor such penalty into the gain or loss calculation.

Lease abandonment

If you cannot sublease your unused space, and are unable to renegotiate your lease to either fully or partially terminate it, your final option is a lease abandonment. Abandonment occurs when a lessee permanently stops using the leased asset and does not have the intent or ability to sublease it. For an asset to be abandoned, the lessee must not receive any benefit from the space, including using the space for something other than its original purpose. For example, an abandoned asset may not be used as storage, which is common for servers or some other types of equipment.

Under ASC 842, ROU assets recognized for leases are subject to the impairment and abandonment model outlined in ASC 360-10-35. As stated in this guidance, the lessee first must determine whether a triggering event has occurred. If so, the lessee then applies the abandonment model and accelerates recognition of the remaining expense when they commit to cease use of the asset. The remaining expense is to be recognized evenly between the commitment date of the abandonment and the date they will cease use of the asset (the “cease-use date”).

Summary

In an ideal world, your office utilization would be at 100%. In reality, however, that is not the case for most organizations, as office space, and ultimately company cash, is being wasted due to low utilization rates. Subleasing is ideal to allow greater flexibility for future use, and offset rental expenses with income recognition. And as we outlined above, several steps need to be taken before you sublease your available space.

If your agreement doesn’t allow for subleasing, negotiating a partial or full lease termination may be a viable option to cut costs on unused office space. However, you can end up with a large loss on your income statement due to hefty termination fees. Lastly, if you cannot sublease the space and are planning to cease use of it entirely, abandoning the lease is your last resort.

If you find yourself in charge of your real estate lease accounting and need to account for a lease change due to downsizing your real estate lease portfolio, contact FinQuery for a demo to see how we can help.