1. What is a right-of-use asset?

3. Right-of-use asset under ASC 842

4. Right-of-use asset under IFRS 16

6. Right-of-use asset amortization

7. Lease liability calculation under ASC 842, IFRS 16, & GASB 87

8. Right-of-use assets and lease liabilities on the balance sheet: Placement and impact

9. Summary

What is a right-of-use asset?

In lease accounting, a right-of-use asset, or ROU asset, is an asset that represents a lessee’s privilege to use a leased item over the duration of an agreed-upon lease term. In other words, the lessee is granted the authority to obtain the economic benefit from the usage of an asset owned by another entity. Under GASB 87, this asset is referred to as the “lease asset.”

What is a lease liability?

A lease liability, as appropriately named under three major standards (ASC 842, IFRS 16, and GASB 87), is the financial obligation to make the payments arising from a lease, measured on a discounted basis.

Right-of-use asset under ASC 842

ASC 842 differs from GASB 87 and IFRS 16 as a result of retaining its dual-model approach to presenting lease assets and lease liabilities on the balance sheet and income statement. In other words, ASC 842 continues to distinguish between operating leases and finance leases with each lease classification requiring a capitalized ROU asset.

However, accounting for finance leases, previously referred to as capital leases, under ASC 842 is largely unchanged compared to ASC 840. Under the old standard, lessees were required to record an asset and liability for capital leases. The same is true under ASC 842.

How to calculate the right-of-use asset under ASC 842

Under ASC 842, initial operating and finance lease ROU assets are calculated using the same method. Start with the initial amount of the lease liability, computed by discounting the remaining lease payments, and adjust for any lease payments made to the lessor at or before commencement, less any incentives received, and any initial direct costs incurred by the lessee. Expressed as a formula shown below:

Initial lease liability

+ Outstanding balance of prepaid rent

– Cumulative remaining deferred rent

– Lease incentives paid at or before the commencement of the lease

It is important to note that for basic leases, the ROU asset and lease liability will be equal upon lease commencement. For example, if a company has a lease without initial direct costs, prepaid/deferred rent, or a tenant improvement allowance (or some other lease incentive), then the ROU asset and the lease liability will be equal on the lease commencement date.

Right-of-use asset accounting example

Next, we will walk through a brief example of how to calculate the ROU asset for an operating lease under ASC 842 assuming the facts below.

Entity Information:

Private Company

Fiscal Year End: December 31

Transition Date: January 1, 2022

Borrowing Rate: 5%

Lease Details:

Lease Term: 5 years

Lease Commencement: January 1, 2021

Lease End Date: December 31, 2025

Lease Payments: $2,500 due on the first of each month, starting January 1, 2021

Rent Escalation: Increases of 3% each year starting January 1, 2022.

Initial Direct Cost: $10,000 capitalized on lease commencement

Incentive: $20,000 cash received at lease commencement

First Step: Calculate the lease liability

For this example, take the contractual payments from January 1, 2022, the entity’s transition date, through December 31, 2025, and apply the established borrowing rate of 5% to calculate the lease liability.

Using the free present value calculator from our website returns a present value of approximately $117,218 (rounded to the nearest dollar).

Second Step: Calculate the ROU asset

Since this lease commenced prior to the entity’s transition to ASC 842, to calculate the value of the ROU asset we will first need to determine the incentive, initial direct cost, and any prepaid/deferred rent balances as of December 31, 2021.

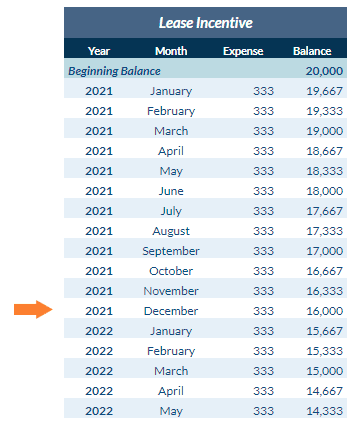

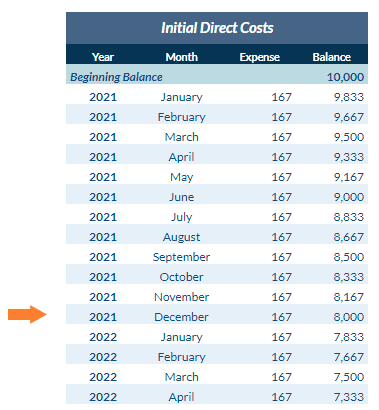

Prior to transitioning to ASC 842 the proper treatment of incentives and initial direct costs was to capitalize them as of lease commencement and then depreciate them on a straight-line basis over the lease term. In this example, we capitalized the initial direct costs and incentive on the first day of the lease (January 1, 2021). Below are portions of the amortization schedules for each of these items before the entity’s effective date of ASC 842.

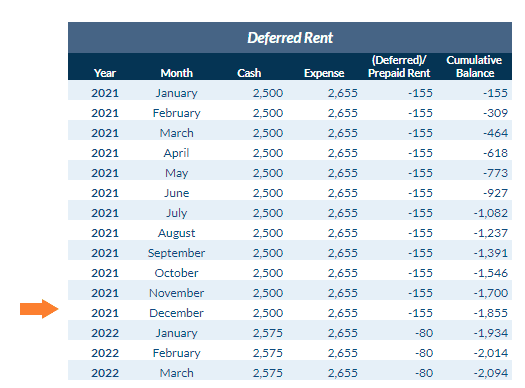

Under ASC 840, operating leases were accounted for by straight-lining the rent expense over the lease term, creating deferred or prepaid rent. Deferred rent was a result of rent payments increasing over time while rent expense stayed constant due to the straight-line approach.

Below is a portion of the deferred rent schedule for the lease in this example.

With the appropriate incentive, initial direct cost, and deferred rent balances we are able to calculate the initial ROU asset on January 1, 2022.

| Initial Liability Balance | $ 117,218 |

| Less: Deferred Rent | (1,855) |

| Plus: Initial Direct Cost | 8,000 |

| Less: Incentive | (16,000) |

| ROU Asset | $ 107,363 |

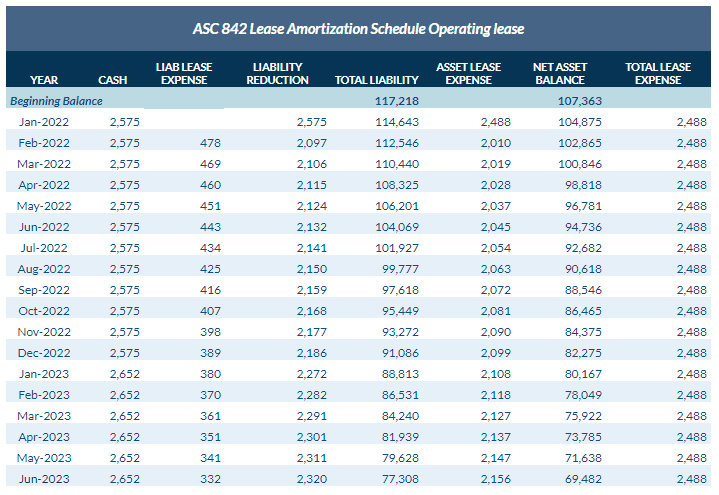

Third Step: Create the amortization schedule

Once the lease liability and ROU asset have been calculated, calculate the rent expense and create the amortization schedule to be used to create the periodic journal entries.

The total lease expense for an operating lease under ASC 842 is the sum of the remaining payments as of the transition date adjusted for any deferred/prepaid, incentive, or initial direct cost balances, divided by the remaining term of the lease.

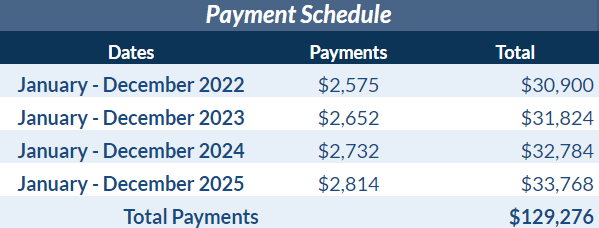

In this example, the total remaining cash payments equal $129,276, as shown in the payment schedule below.

The total remaining cash payments are then adjusted for the remaining balances of deferred rent, incentives, and initial direct costs as of December 31, 2021, included in the ROU asset calculation, as shown below.

| Total cash payments | $ 129,276 |

| Less: deferred rent | (1,855) |

| Plus: initial direct cost | 8,000 |

| Less: incentive | (16,000) |

| Net payments | $ 119,421 |

The total net payment amount of $119,421 is divided by the remaining lease term of 48 months (January 1, 2022 – December 31, 2025) to calculate a lease expense of $2,488. The initial lease liability and ROU asset as of January 1, 2022, and the calculated lease expense are used to create the amortization table, a portion of which is shown below.

Download the Ultimate Lease Accounting Guide for more examples

Our Ultimate Lease Accounting Guide includes 44 pages of examples, journal entries, disclosures, and more step-by-step guidance on operating leases and finance leases under ASC 842.

Right-of-use asset under IFRS 16

A classification distinction between operating and finance leases does not exist under IFRS 16. Rather, a single model approach is applied whereby all lessee leases post-adoption are reported as finance leases. These leases are capitalized and presented on the balance sheet as both assets and liabilities, unless subject to any of the exemptions prescribed by the standard. IFRS 16 also refers to the lease asset as an ROU asset.

How to calculate the right-of-use asset under IFRS 16

IFRS 16 directs lessees to calculate the ROU asset as the following:

The initial amount of the lease liability

+ Payments made at or before the commencement of the lease

– Lease incentives

+ Initial direct costs

+ Estimated costs for restoration or removal/disposal per IAS 37 Provisions, Contingent Liabilities, and Contingent Assets

Lease asset under GASB 87

Similar to IFRS 16, GASB 87 uses a single-model approach and classifies all leases as finance leases. GASB 87 also requires the lessee to recognize an intangible right-to-use lease asset, referred to as a lease asset, in conjunction with a lease liability. However, in order to do so, the reporting entity must have the right to control and obtain economic benefit from the present service capacity of the underlying asset.

In addition, the following types of leases are exempt from recognizing a right-to-use asset and lease liability under GASB 87:

- Leases not meeting the definition of an exchange-like transaction

- Leases containing a provision for a title transfer

- Leases with a lease term of 12 months or less, including renewal options regardless of intention to exercise

When capturing the activity within the governmental fund, a conversion entry will be necessary at year-end to convert from the modified accrual accounting basis to the full accrual basis required for government-wide financials.

How to calculate the lease asset under GASB 87

In order to compute the initial leased asset amount a lessee should take the total of:

The initial lease liability

+ Outstanding prepaid rent amounts

– Any cumulative remaining deferred rent

– Unamortized incentive balances received at or before the commencement of the lease

+ Initial direct costs incurred to place the asset into service

Right-of-use asset amortization

ASC 842 requires the right-of-use asset for operating leases to be amortized differently than for finance leases. The right-of-use asset for an operating lease is amortized in a systematic and rational basis by subtracting the liability lease expense from the total lease expense. Finance lease assets are amortized on a straight-line basis.

ASC 842 also requires operating lease ROU assets to be amortized from the lease commencement date (the date the lessee obtains possession of the underlying asset) to the end of the lease’s term. In some cases, it may be from the commencement date to the end of the useful life of the asset. The same holds true for finance leases under ASC 842, IFRS 16, and GASB 87.

Lease liability calculation under ASC 842, IFRS 16, & GASB 87

A lease liability is the financial obligation for the payments required by a lease, discounted to present value. Under ASC 842, IFRS 16, and GASB 87, the finance lease liability is calculated as the present value of the lease payments remaining over the lease term. The preferred discount rate to use is the discount rate implicit in the lease under each of the three major lease standards. However, each standard also allows for the use of an incremental borrowing rate defined by the standard in specific circumstances when the implicit interest rate can not be determined.

IFRS 16 also requires lessees to remeasure lease liabilities when future payments change, potentially affecting balances when the lease payments are tied to an index. This is not the case, however, under GASB 87 and ASC 842. For more detail on this, read our blog, “IFRS 16 vs. ASC 842 (US GAAP) Lease Accounting: What Are the Differences?“

Under ASC 842, initial operating lease liabilities and finance lease liabilities are calculated using the exact same method.

Private company practical expedient offered under ASC 842

ASC 842 offers an additional interest rate option to private companies and nonprofits. Non-public entities have the option to elect a risk-free rate as the discount rate for lease liability calculations. As a result of the FASB’s post-implementation review process, private entities can apply the risk-free rate by class of underlying asset rather than having to apply it to the entire lease portfolio.

Right-of-use assets and lease liabilities on the balance sheet: Placement and impact

An operating lease is a contract providing a lessee the right to use an asset without the benefits of ownership. Despite companies’ obligations to make the lease payments associated with their operating leases, ASC 840 and IAS 17 did not require a lease asset or a lease liability to be recorded on the balance sheet, nor did GASB require recording an asset or liability on the statement of the net position under GASB 13 or GASB 62.

ASC 842, IFRS 16, GASB 87, however, now require the capitalization of almost all leases – a major shift in the way lessees account for their operating leases. Aside from the ability to take advantage of a policy election allowing a lessee to account for leases with terms shorter than 12 months similar to an operating lease under the legacy standards, and a few other exemptions seen under GASB 87, all leases must be recognized on the balance sheet with a lease liability and ROU asset, calculated at initial recognition as discussed at the beginning of the article.

Operating lease classification has also changed under all three standards, but in different ways. Under IFRS 16 and GASB 87, all leases are classified as finance leases, eliminating the “operating lease” classification. This isn’t the case for ASC 842, though, which makes the following changes to the lease classification criteria:

- A bargain purchase option criteria no longer exists. If the lease contains an option to purchase the underlying asset the lessee is reasonably certain to exercise, the lease qualifies as a finance lease.

- The “75% of lease term” and “90% of FMV” rules are no longer definitive. However, the FASB has suggested companies should continue to use these thresholds in their analyses, unless a more appropriate threshold exists, based on the company’s facts and circumstances. Entities need to develop an overall policy with regard to these thresholds to use consistently.

- A new fifth test has been added – entities must now consider whether or not the asset is specialized in nature and has any future value to the lessor.

This is primarily a result of the FASB moving away from “rules” based accounting to “principle” based accounting.

Summary

Regardless of which lease accounting standard is adopted, each standard will result in the recognition of a right-to-use asset and lease liability on the balance sheet upon transition. Reporting entities must have a firm grasp of the financial statement presentation and the methods of computing the ROU asset and corresponding lease liabilities, as each guidance has its own nuanced definition of what is deemed a reportable lease and what variables factor into the calculations.

This comprehensive guide on understanding the ROU asset as it relates to both finance and operating leases should help in future calculations. If it’s unclear what type of lease the organization has, LeaseQuery offers a number of free lease accounting tools to help. To learn more, schedule a LeaseQuery demo today.