Common questions about lease abandonment from a lessee perspective

The main question people have when it comes to abandonment is: Has a leased asset been abandoned if a lessee has ceased using the asset but intends to sublease it to a third party?

The answer here is: No, a leased asset is not deemed to be abandoned if the lessee intends to (and practically can) sublease the asset.

There are also a few misconceptions revolving around dates of abandonment. Here are two common questions:

- What date triggers impairment/abandonment of a leased asset?

- Is it the date the lessee makes the decision to abandon or sublease the asset, or the date the lessee actually does abandon or sublease the asset?

The answer here is that if a leased asset is to be totally abandoned, the amortization of the ROU asset needs to be adjusted as of the date the lessee makes the decision to abandon or sublease the asset, so that as of the cease use date, the carrying amount of the ROU asset is zero.

Lease abandonment example

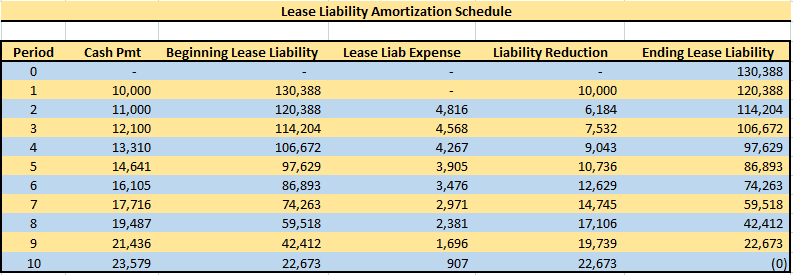

Assume a lessee enters into a 10-year lease. Payments for the lease are $1,000 per year, increasing by 10% each year. Assume payments are made at the beginning of each year. Also assume the rate implicit in the lease cannot be readily determined, but the lessee’s inherent borrowing rate is 4%. The liability amortization schedule for this lease is as follows:

While the ROU asset amortization schedule is as follows:

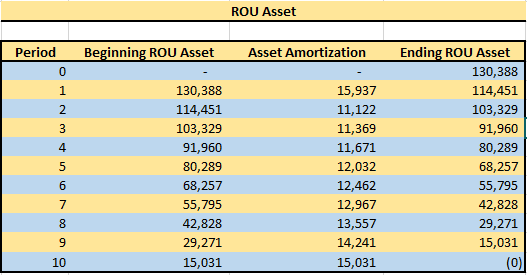

Now, let’s assume that at the beginning of year 5, the lessee decides that it is going to stop utilizing the asset after the end of year 7, and it cannot practically sublease the asset. This means, effectively, the asset will be abandoned after year 7 (the cease use date). Let’s also assume that from year 5 (the decision date) through year 7, the lessee is going to continue utilizing the asset as it did prior to the decision date. Finally, let’s assume that the lessee determined that there was no impairment to the asset group for the ROU asset. Assuming there are no changes to the lease payments, the liability amortization schedule will not change. However, the amortization of the ROU asset will change to ensure the following:

1) That the carrying amount of the ROU asset at the cease-use date (end of year 7) is zero.

2) The ROU asset amortization is equal each year from the decision date through the cease-use date (Years 5 through 7). That is, the ROU asset will be straight-lined starting from Year 5.

Based on the predicates above, the amortization schedule will change as follows:

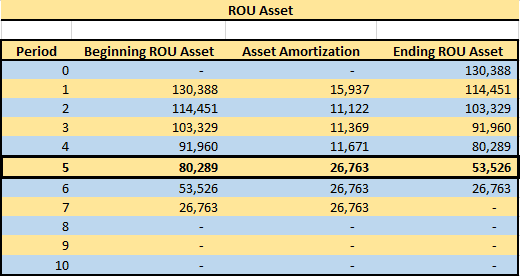

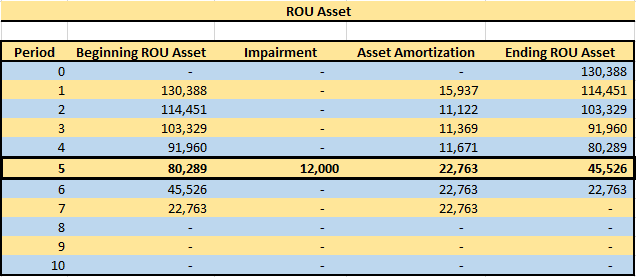

Please note that in this example, there was no impairment to the ROU asset. If there was impairment allocated to the ROU asset, then the ROU asset would first be reduced by the amount of the impairment, then the amortization schedule will be adjusted as determined above. For instance, if the lessee determines that the ROU asset is impaired by 12,000 as of the decision date, then the lessee would make the following Journal Entry to record the impairment loss:

| Account | Amount | |

|---|---|---|

| DR | Loss on Impairment | 12,000 |

| CR | ROU Asset | 12,000 |

To record impairment loss of 12,000

The remaining ROU asset would then be straight-lined, making the amortization schedule look as follows:

Finding a replacement renter to sublet a property is an ideal solution to avoid abandoning a lease and your rental agreement altogether. Knowing how to calculate under these terms and record appropriately will ensure lease abandonment is a seamless transition for lessees. For more expert advice on common lease accounting scenarios, please review LeaseQuery’s examples or contact our Technical Account Managers for more a in-depth explanation.