1. Accounting for a sublease under ASC 840

2. A comprehensive example of sublease accounting under ASC 840

- Straight-line amortization schedule for the head lease

- Accounting for an operating sublease under ASC 840

3. Accounting for a sublease under ASC 842

4. A comprehensive example of sublease accounting under ASC 842

5. Summary

A sublease is defined by both ASC 840 and ASC 842 as a transaction in which an underlying asset is re-leased by the original lessee to a third party, and the lease agreement between the two original parties remains in effect. The original lease is referred to as the head lease and the new lease with the third party is the sublease. The original lessee becomes the sublessor and records lease income from the sublessee, in addition to the lease expense recorded for the head lease. If the original lease obligation is assumed by the new lessee, meaning the original lessee is relieved of any obligation associated with the lease, the transaction does not meet the criteria of a sublease.

The accounting treatment of a head lease and sublease are similar to that of a normal lease, but there are complexities related to the classification of the sublease; a sublease transaction may trigger a reassessment of the head lease. This article will explain the correct accounting for subleases under US GAAP – for both ASC 840 and ASC 842 – and provide comprehensive examples under both standards.

Accounting for a sublease under ASC 840

When a lessee ceases using a property or piece of equipment under an operating lease agreement, subleases it to a third party, and continues making payments to the lessor, the correct accounting treatment is determined by the lease classification. If the head lease is an operating lease, the sublease will also be treated as an operating lease. When the anticipated revenue of the sublease does not exceed the costs of the original lease, the full estimated loss must be recognized on the income statement by the sublessor within the period the sublease is executed.

If the head lease is a capital lease under ASC 840, the obligation related to the original capital lease continues to be accounted for as before and the criteria for classifying it as a capital lease dictates the accounting treatment of the subsequent sublease:

- If the original lease is a capital lease due to title transferring or an existing bargain purchase option, the sublease is classified as any new lease, using the criteria outlined in ASC 840-10-25-1.

- If the head lease is a capital lease, due to the lease term or minimum lease payments criteria, the sublease classification determination is made solely on the economic life criteria. *Note: if the circumstances of the original lease imply that the original lessee acted only as an intermediary to the sublease transaction, the sublease can also be analyzed by the minimum lease payments criterion using the original fair value of the underlying asset.

- If the original lease is a capital lease, but the sublease fails to meet any of the criteria of a capital lease, account for it as an operating lease.

- If the sublease qualifies for capital lease treatment, the unamortized capital lease asset under the original agreement becomes the cost of the asset being subleased.

In all cases of accounting for a loss on a sublease transaction, the loss is recognized through the income statement by the sublessor within the period the sublease is executed. However, the calculation of the loss differs for the various lease types:

- The loss for a sublease which is an operating lease is calculated as the amount of the costs of head lease in excess of the estimated revenue of the sublease and recorded in full within the period the sublease is executed.

- The loss for a direct financing sublease is calculated as the excess of the net investment or carrying amount of the investment in sublease over the expected rental payments and estimated residual value to be received by the lessor.

- The loss for a sales-type sublease is recognized at the commencement of the lease when the sublessor records their net investment in the transaction. A loss has occurred for a sales-type sublease if the sublessor’s carrying amount of the original leased asset, less the present value of any unguaranteed residual value, is greater than the present value of the rental payments to be received by the sublessor.

A comprehensive example of sublease accounting under ASC 840

Below are the details of a building lease and the sublease arrangement between Company A, the original lessee and the sublessor, and a third party, the sublessee, to further illustrate the accounting for a sublease under ASC 840.

Terms of the head lease

Lease term: 10 years

Lease payments: $7,500 annually, paid in advance

Fair value of building: $200,000

Escalations: $500 annually

Incremental Borrowing Rate of Lessee at Lease Commencement: 7%

No transfer of ownership

No purchase option

Lease classification: Operating

At the end of Year 5, Company A decides that it no longer needs the space, and decides to sublease the space to a third party for the remaining 5 years of the lease, rather than terminate the lease. Company A is not released from its obligations under the head lease through the sublease arrangement. Company A, now the sublessor, negotiates the following terms for the sublease.

Terms of the sublease

Lease term: 5 years

Lease payments: $10,000 annually, paid in advance

Fair value of building: $200,000

No transfer of ownership

No purchase option

Lease classification: Operating

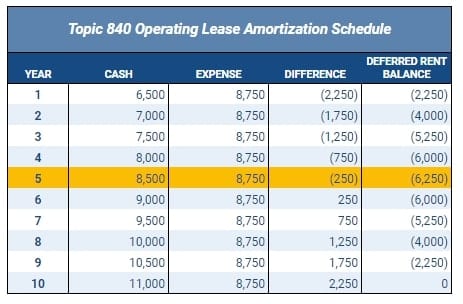

Straight-line amortization schedule for the head lease

At the end of Year 5, the total remaining payments Company A owes under the head lease is $50,000. The sublease agreement outlined above stipulates that Company A will collect $10,000 annually from the sublease over 5 years, or $50,000 (5 years x $10,000). Netting the remaining cost of the head lease against the revenue to be received from the sublease results in $0, neither a gain nor a loss.

Accounting for an operating sublease under ASC 840

At the end of Year 5 (or beginning of Year 6), Company A would not be required to make any entries for either the head lease or to record the sublease because both are classified as operating leases according to the terms of the agreements.

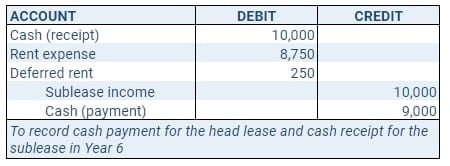

Subsequent entries with a sublease agreement

Assuming a sublease contract was agreed upon with Company B with the terms from above, Company A makes the following entry at the beginning of Year 6 to reflect the payment of cash to their lessor and the receipt of cash from Company B for the sublease:

Accounting for a sublease under ASC 842

Accounting for subleases under the new accounting standard is similar to legacy accounting, except now the head lease has a ROU asset and lease liability. The first step in accounting for a sublease under ASC 842 is to determine whether the transaction qualifies as a sublease. Similar to ASC 840, if the original lessee is relieved of its primary obligations, a new lease contract with a new lessee replaces the original lease and termination of the original lease has occurred; not a sublease.

In contrast, when the lessee transfers or sells the original lease to a third party but retains its obligations, this is a sublease. With a sublease, the lessor of the head lease will continue to account for their lease the same as before. Additionally, the accounting treatment of the sublease by the sublessee will be no different than other leases. The sublessee may or may not be aware that they are the lessee of a sublease, and therefore the sublease status will have no effect on their accounting treatment of the lease.

The accounting treatment for the head lease by the original lessee, now the sublessor, is what may change in a sublease. The remaining portion of this article focuses on the sublessor’s accounting for the sublease. To account for a sublease, the sublessor must follow these three simple steps:

- Establish the discount rate for the sublease.

- Establish whether the sublease is an operating or finance lease.

- Account for the sublease using the established discount rate and according to its lease type.

Under ASC 842-20-35-15, the sublessor will use the rate implicit in the lease to determine the classification of the sublease. However, in cases where the implicit rate is not readily determinable, possibly stemming from difficulties in establishing a fair value for the ROU asset, the sublessor should revert to the discount rate used in accounting for the head lease.

To determine the lease classification of a sublease, the sublessor will perform the standard finance vs. operating lease assessment by referencing the underlying asset of the lease in its analysis, rather than the ROU asset of the head lease. When the lease term of the sublease is longer than the term of the head lease, the classification of the head lease must be reassessed by the sublessor or original lessee. (The term to consider for each is the noncancelable term with any renewals the lessee [or sublessee] is reasonably certain to elect). This can occur when the sublessee is offered and elects renewal options that are the same as those of the head lease, but that the sublessor originally elected to not exercise. The longer-term of the sublease would indicate the sublessor is now reasonably certain to exercise the same renewal options in the head lease, and the change in term would trigger a reassessment of lease classification and a remeasurement of the head lease.

Finally, once the discount rate and the classification of the sublease have been determined, the sublessor accounts for the sublease in accordance with the applicable lease classification. In some cases, this will be the same lease classification as the head lease, but it can also be a different classification. ASC 842 contains specific guidelines for accounting for the head lease and sublease in the various scenarios:

- If the head lease is an operating lease or a finance lease and the sublease is an operating lease, the sublessor continues to account for the original lease as it did prior to the commencement of the sublease and recognizes sublease income. One caveat exists – if the total expected sublease income is less than the head lease’s cost for the term of the sublease, the sublessor has an indication that the ROU asset recorded for the original lease may not be recoverable. Therefore the sublessor must perform the recoverability test specified by ASC 360-10-35-17 to determine whether further asset impairment analysis is required for the head lease.

- If the head lease is a finance lease and the sublease is a sales-type or direct financing lease, the sublessor derecognizes the ROU asset from the head lease and records a net investment in the sublease. The sublessor continues to account for the lease liability of the original lease as it did prior to the commencement of the sublease.

- If the head lease is an operating lease and the sublease is a sales-type or direct financing lease, the sublessor derecognizes the ROU asset from the head lease and records a net investment in the sublease. The sublessor then accounts for the lease liability of the original lease in accordance with the accounting guidance for finance leases.

Generally, in any of these scenarios, separate presentation of the head lease expense and the sublease income on the income statement is required under ASC 842. Net presentation of expense and income may be allowed if the criteria for contract combinations are met or subleasing is not a major part of an organization’s business.

A comprehensive example of sublease accounting under ASC 842

As simple as those three steps may seem, accounting for a sublease by the sublessor requires analysis of multiple details. Using the head lease and sublease terms specified above in our comprehensive ASC 840 example, we will walk through an example of sublease accounting under ASC 842.

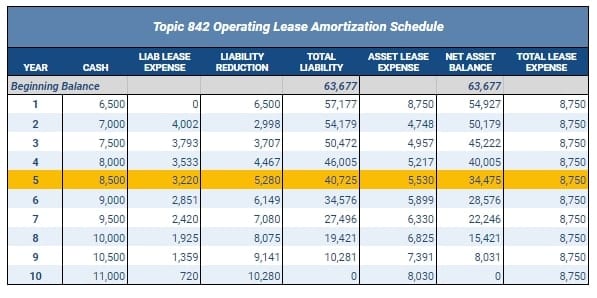

Like our ASC 840 example, let’s assume the original lease is an operating lease. Our first step is to calculate the lease liability and ROU asset and create the amortization schedule for the original lease. Using the LeaseQuery Present Value Calculator we calculate the lease liability and the ROU asset of the head lease to be $63,677.

Operating lease amortization schedule for the initial lease:

The amortization schedule for the original lease under ASC 842 is below:

At the end of Year 5, Company A determines that it no longer needs the space, and decides to sublease the space to a third party for the remaining 5 years of the lease. At the end of Year 5, the present value of the remaining payments Company A owes under the head lease is $40,725 and the book value of the ROU asset is $34,475. As with our previous example, the company determines it will receive $10,000 annually from a sublease over the remaining 5 years.

Following the steps to account for a sublease under ASC 842, first Company A must determine the discount rate of the sublease. The implicit rate of the sublease is not readily determinable from the facts available, so the sublessor will revert to the discount rate used to measure the head lease, which is 7%. Using the LeaseQuery Present Value Calculator we calculate the lease liability and the ROU asset of the sublease to be $43,872.

Next, Company A determines whether the sublease is a finance or operating lease. Based on the analysis below, the sublessor classifies the sublease as an operating lease:

- The sublease does not transfer ownership or provide for an option to purchase the underlying asset.

- The building which is the underlying asset of the head lease has a remaining economic life of 15 years at the commencement of the sublease. The sublease term of 5 years is for a less than significant portion of the remaining economic life of the building. *Note: this analysis is performed with the remaining economic life of the underlying asset of the lease and not the ROU asset of the head lease.

- The present value of the sublease payments, $43,872 does not equate to substantially all of the fair value of the building at the commencement of the sublease.

- The building is not customized to the original lessee or the sublessee, such that at the end of the lease it has no value to the lessor.

Once the discount rate and lease classification of the sublease have been determined, the sublessor is able to proceed with accounting for the sublease. In this example since Company A, the sublessor has concluded the sublease is classified as an operating lease, it accounts for the sublease exactly as it would account for any operating type lease as a lessor, which is to say Company A does not record any journal entries at the commencement of the sublease as the sublessor.

Subsequent entries with a sublease agreement

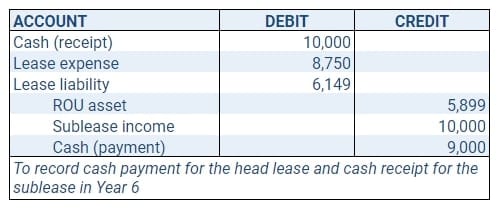

Following the commencement of the sublease, Company A makes the following entry at the beginning of Year 6 to reflect the payment of cash to their lessor and the receipt of cash from Company B for the sublease. The head lease is amortized according to the original amortization table above but since the sublease is also an operating lease only the income from the sublease is recorded by the sublessor:

For the remaining term of the head lease, Company A will continue to record annual lease expense of $8,750 on the income statement. Company A will also record annual lease revenue of $10,000 for the 5 years of the sublease. The gain to the sublessor is recognized over the term of the sublease as the excess of sublease revenue over the lease cost.

Summary

Sublease accounting primarily applies to the sublessor – the party which is the lessee of the original, or head lease, and the lessor of the same asset in a secondary lease to a third party. The accounting by the lessor in the original lease and the sublessee in the sublease are rarely impacted by a sublease.

Under ASC 840 a sublease agreement may result in updated accounting treatment for the original lease for the lessee. This is also true for ASC 842, but with some added complexities. Because an ROU asset and lease liability are recorded for an operating lease under ASC 842, sublease accounting for the sublessor is impacted by both the lease classification of the original lease and the lease classification of the sublease. In this article, we have summarized the accounting guidance under ASC 840 and ASC 842 for a sublessor and walked through examples of each to further illustrate their similarities and differences.