Renting space in a commercial building isn’t as simple as it seems. It’s more than signing an agreement and moving in. It requires attention to details within the lease, like negotiating property tax payments, utilities, maintenance, and more. This all depends on the type of commercial lease agreement that the lessor and lessee are entering.

In addition, the new lease accounting standards have made a significant impact on lessees by changing the accounting treatment of operating leases. This article breaks down everything you need to know about commercial lease agreements, lease management, and accounting for them.

Understanding commercial lease agreements

Commercial leases are formal agreements between landlords (lessors) and tenants (lessees) for the rental of commercial property, such as offices, retail spaces, warehouses, and other non-residential facilities. The commercial lease agreement is the contract outlining the terms under which the lessee agrees to rent commercial property from the lessor. The terms of these contracts can include the lease duration, rent amount, payment schedule, and responsibilities for maintenance and repairs.

Unlike residential leases, which are typically structured with uniform terms and conditions, commercial property leases are highly customizable and subject to negotiation on a wide range of terms including lease duration, rent calculations, responsibilities for utilities and maintenance, and options for renewal. The specific terms and structure of a commercial lease greatly depend on the type of property, intended use, and the bargaining power of the parties involved. Understanding the intricacies of commercial leases is crucial for both lessors and lessees to protect their interests and ensure the lease agreement aligns with their business needs and objectives.

Commercial leases of equipment

Commercial leases of equipment differ significantly from real estate leases, focusing on the rental of business-related equipment rather than property. This could include anything from office furniture and computers to heavy machinery and vehicles. Such leases provide businesses with the flexibility to use essential equipment without the hefty upfront costs associated with purchasing. Typically structured with fixed monthly payments, these leases may also offer options to buy the equipment at the lease’s end, return it, or renew the lease. This type of lease is particularly advantageous for businesses that require the latest technology or equipment that depreciates quickly. Understanding the terms, such as the lease duration, payment schedules, maintenance responsibilities, and options at the lease’s end, is crucial for businesses to manage costs effectively and maintain operational efficiency.

Commercial lease management

Commercial lease management encompasses the comprehensive supervision, administration, and operation of leasing agreements between landlords and tenants. Effective management of a commercial lease requires tenants to actively engage in the understanding and negotiation of lease terms, as well as ongoing monitoring and compliance throughout the lease duration. Fundamental aspects include thorough review of the lease contract, clear communication with the lessor regarding any ambiguities, and ensuring all agreed-upon terms are correctly documented and adhered to.

Tenants should pay particular attention to lease provisions related to rent increases, maintenance responsibilities, subleasing options, and termination rights to avoid unexpected liabilities or expenses. Additionally, maintaining a proactive relationship with the landlord can facilitate smoother negotiations for lease renewals or amendments, potentially yielding more favorable terms for the tenant. Understanding and utilizing these strategic approaches can significantly enhance a business’s ability to leverage its commercial lease arrangement to its fullest potential, aligning closely with its financial planning and business growth objectives.

Lease management software

With the increasing complexity and stricter reporting requirements of commercial leases, many businesses are turning to lease management software to effectively track and manage their lease agreements. These solutions provide centralized storage for all lease-related documents and data, automated reminders for upcoming critical dates and deadlines, and real-time visibility into key financial metrics such as rent payments, operating expenses, and occupancy costs. This allows tenants to quickly retrieve necessary information, assess lease performance, and make informed decisions with ease. Additionally, many lease management systems, such as LeaseQuery, also offer functionality for lease accounting under the new standards, providing a comprehensive solution for managing all aspects of commercial leases.

Commercial lease types

Before signing a lease, the lessee needs to be aware of the type of commercial lease to which they are agreeing. There are many different types of commercial lease agreements, each with unique implications for both landlords and tenants. Understanding the various commercial lease types will lead to improved negotiations, help determine monthly expenses, and help ensure that both parties share an understanding of their obligations and rights.

Gross lease / full-service lease

A gross lease, also known as a full-service lease, is the most common type of commercial lease agreement. In this type of lease, the lessee is responsible for paying the base rent and the lessor generally handles any other building expenses, such as utilities, maintenance costs, taxes, and insurance. This type of arrangement typically results in higher rental rates, but the lessee only receives one bill to cover all of the necessary expenses and isn’t involved with the day-to-day expenses.

However, some gross leases require tenants to pay additional expenses beyond their base rent after their first year of renting the space. It’s important to double-check the details of the lease before signing. Generally, gross leases are used for office buildings and other commercial real estate properties.

Net lease

A net lease is a commercial lease agreement specifying that the lessee pays a proportionate share of the operating expenses of the building. That means they have to pay part of things like maintenance costs, property taxes, and insurance. In a net lease agreement, each lessee’s share of expenses is generally allocated based on the percentage of the property the lessee occupies.

There are three different types of net leases:

- Triple net lease (NNN)

- Double net lease (NN)

- Single net lease (N)

Triple net lease or “NNN lease”

A triple net lease is a commercial lease agreement in which the lessee agrees to pay rent, utilities, and all of the property’s operating expenses. The operating expenses on a commercial lease property include maintenance costs such as common area maintenance (CAM), insurance, and property taxes (represented by “NNN”). A triple net lease is essentially the opposite of a gross lease; rather than paying only base rent, the lessee agrees to pay for all of the expenses related to the property.

Typically, these types of leases are longer-term and have a lower base rent because the tenant has agreed to pay for all operating expenses. This is a common commercial lease type.

Double net lease or “NN lease”

A double net lease requires the lessee to pay for rent, utilities, property taxes, and insurance (represented by “NN”). The difference between a triple net lease and a double net lease is the lessor is responsible for paying for the building’s maintenance expenses. This typically results in lower base rent.

Single net lease or “N lease”

A single net lease is one in which the lessee agrees to pay for rent, utilities, and property taxes (represented by “N”). The lessor pays for building insurance and maintenance costs. While this type of lease is similar to a full-service/gross lease, it’s not the same.

Absolute net lease or “absolute NNN lease”

In an absolute net lease agreement, the lessee is responsible for all payments and the lessor is absolved from all financial obligations. In other words, the tenant pays for all building costs, including all repairs and maintenance. It’s as though they own the building without having to purchase it. While it may seem like an absolute net lease is interchangeable for a triple net lease, they are different. The biggest difference is the lessee’s responsibility to pay for major building repairs.

Modified gross lease

A modified gross lease falls between a gross lease and a triple net lease. The lessee pays rent, utilities, and part of the operating costs. Every contract is different depending on the lessor.

For example, some modified gross leases only require lessees to pay a portion of operating costs after their first year renting the space.

Percentage lease

A percentage lease specifies the lessees pay base rent plus a percentage of their gross business sales over a defined threshold. The lessor takes care of property taxes, maintenance, and insurance fees. This type of lease usually involves a retail space.

Typically, lessors ask for around 7% of gross sales in these types of arrangements. Comparatively, a percentage lease contract requiring a gross sales percentage of 10% or higher is uncommon and should be closely examined.

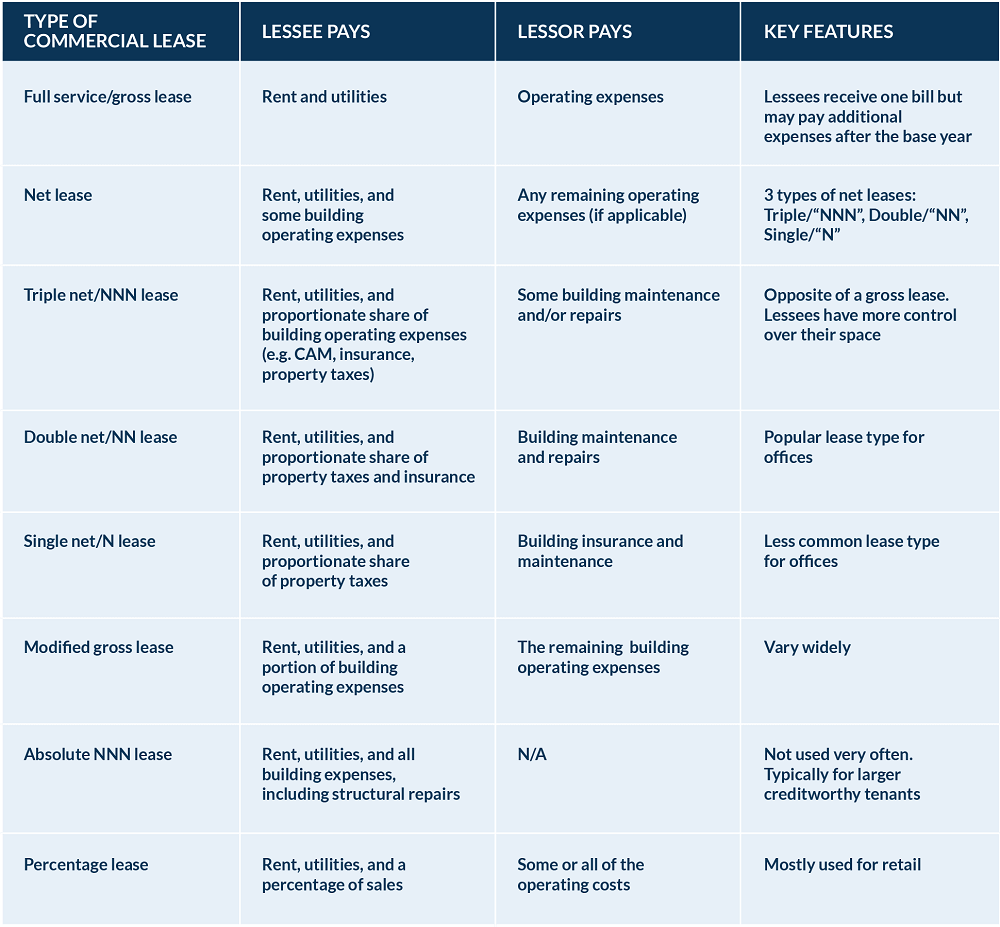

Commercial lease types table

To make things easy for you, below is a full table of all the commercial lease types we discussed above. This resource offers a concise, easy-to-understand overview of each lease type, including gross leases, net leases (triple, double, and single), absolute net leases, modified gross leases, and percentage leases. It highlights the key features and financial responsibilities associated with each lease type, enabling both lessors and lessees to make informed decisions.

Accounting for commercial leases

Regardless of the commercial lease type, the way we account for leases has changed. ASC 842, the new lease accounting standard for organizations reporting under US GAAP, impacts any lessee entering into a lease. The way leases are classified has changed and, at a high level, lessees must now record the majority of their leases on the balance sheet.

A few of the differences between ASC 840 and ASC 842 need to be considered. Under ASC 840, the previous standard, leases were categorized as either capital or operating leases. ASC 842, however, classifies lessee leases as either finance or operating. Under both lease types, a lease asset is recognized as a right-of-use asset and future lease payments are recognized as lease liabilities on the balance sheet.

To assist with accounting for these changes, make sure you are working with an accountant who has a good grasp of the new standards. Understanding how these new standards impact lessees and lessors involved in commercial leases is imperative for your organization to be compliant and avoid potential accounting errors, which can lead to material misstatements or worse.

Summary

In conclusion, navigating the complexities of commercial leasing requires a deep understanding of lease management, knowledge of various commercial lease types, and awareness of the latest lease accounting standards. Effective commercial lease management is critical in ensuring all parties fulfill their obligations and maintain favorable terms throughout the lease duration. Familiarizing oneself with the different commercial lease types – be it gross, net, or percentage leases – enables lessees and lessors to negotiate agreements that best match their financial and operational objectives. Furthermore, with the introduction of new lease accounting standards such as ASC 842, accurately accounting for leases on the balance sheet is now more crucial than ever to provide transparency and reflect the true financial position of a business. Being vigilant in these areas will help avoid legal and financial issues as well as create lease arrangements that benefit everyone involved. To learn more about how you can use LeaseQuery to help with both your lease management and lease accounting, schedule a demo today.