- ASC 840 – Capital leases and fixed assets on the balance sheet

- ASC 842 – Operating leases now capitalized

- Accounting for finance leases vs operating leases

2. Similarities in accounting policies

3. Lease purchase options: How does a lease become a fixed asset?

4. Example: Accounting for a finance lease with a purchase option under ASC 842

- Step 1: Calculate the lease liability and ROU asset opening balance

- Step 2: Post the initial recognition journal entry

- Step 3: Calculate interest expense and amortization expense

- Step 4: Recognize a fixed asset in the month of purchase

5. Other scenarios where fixed assets and lease accounting overlap

6. Summary

Capitalization of leases and fixed assets

ASC 840 – Capital leases and fixed assets on the balance sheet

A fixed asset is recognized as a long-term asset and depreciated over its useful life. The initial journal entry to record a fixed asset is generally a debit to fixed assets and a credit to payment or liability for payment. Under ASC 840, fixed assets and capital lease assets were reported on the balance sheet.

Finance/capital lease assets under both ASC 840 and ASC 842 are recognized as an asset on the balance sheet. Under ASC 842, finance lease assets are generally amortized over the shorter of the lease term or the useful life of the asset. Some situations require a leased asset to be amortized over the asset’s useful life.

A corresponding finance (capital) lease liability is recorded to represent the obligation to pay for the leased asset over the term of the lease. This liability is calculated as the present value of future expected payments.

ASC 842 – Operating leases now capitalized

Now under ASC 842, operating leases are recognized on the balance sheet with a lease liability and right-of-use (ROU) asset. The operating ROU asset is always amortized over the lease term. The operating lease liability is also equal to the present value of the future lease payments.

Accounting for finance leases vs operating leases

Slight deviations exist in the accounting treatment of finance leases vs operating leases. Operating leases do not require the recognition of interest expense or amortization expense like finance leases, but rather a single lease expense each period. Ultimately, almost all lease transactions are now capitalized with few exceptions. The guidance excludes a few specific types of arrangements from the scope of ASC 842 treatment.

Similarities in accounting policies

Entities will need to implement new policies under ASC 842. Decisions requiring judgment are specific to an organization and must be documented with the reasoning for the policy. Many organizations are leveraging their policies for fixed asset accounting as a starting point for lease accounting policies.

Capitalization thresholds – materiality

Outside of a few specific scope exclusions, the guidance has some subjectivity around what other lease arrangements may be excluded. Organizations have the ability to set a materiality threshold for lease capitalization, as no explicit threshold is stated in the guidance. It is common for organizations to begin with their policy for fixed asset capitalization when determining their lease capitalization threshold. However, entities must determine their lease capitalization threshold using the standalone impact of their leases on operations.

Lease classification

Another assessment companies will make is classifying their leases as either operating or finance. Five tests are used to determine if a lease is classified as finance or operating. While these criteria are specified in the guidance, some of the inputs for these tests, such as the underlying asset’s fair value or useful life, are subjective and will therefore require judgment.

One of the tests compares the useful life of the underlying asset to the lease term to assess if the asset will be leased for essentially all of the asset’s useful life. If this is the case, the lease will require finance lease treatment. If organizations have a policy for fixed assets setting useful life by asset class, they may want to use that policy for determining useful lives of ROU assets as well. Fair values are a little more subjective and change over time, but organizations may apply the cost to purchase the asset to determine the fair value to be used for the finance versus operating test(s).

Lease purchase options: How does a lease become a fixed asset?

Leasing to own

It is common for organizations to lease assets and then purchase them at a later date. In these lease-to-own arrangements, an asset is originally accounted for as a right to use asset, then subsequently treated as a fixed asset. This may be preferable to an organization as opposed to purchasing the asset outright for a number of reasons.

The transaction is similar to a financed purchase in that one large cash outlay is not required, but rather a series of cash payments over time. This arrangement may be structured as a lease with a title transfer at the end of the lease or with a purchase option the organization intends to exercise. This article will go into detail on how to account for purchase options with a full example.

Purchase options are common in equipment leases. An organization may need to use the equipment but does not want to use or have the cash to pay for it all up front. Paying for the asset over time helps with liquidity. Some organizations may have plans to use their cash for other investments in the short-term such as R&D. Aside from the initial payment, when an organization owns an asset they may also be responsible for repairs and maintenance, expenses they may not incur if they lease.

For more information on benefits of leasing vs buying equipment, read our article, “Equipment Lease Accounting under ASC 842 and the Benefits of Leasing Equipment vs. Buying Explained.”

Finance lease treatment

Under ASC 842, leases containing a purchase option are accounted for as finance leases if the lease contains a purchase option the lessee is reasonably certain to exercise. Additionally, a title transfer at the end of a lease, designates the lease as finance. If an organization is not reasonably certain whether or not they plan to exercise a purchase option, the finance lease classification is not triggered.

For more information on classifying a lease as finance/capital or operating, check out our article: “Capital/Finance Lease vs. Operating Lease Explained: Differences, Accounting, & More“.

If an organization decides subsequent to initial recognition of the lease they are reasonably certain to exercise a purchase option, they must perform a remeasurement of the lease liability and ROU asset effective as of the date of reassessment.

Lease purchase option accounting

Initial measurement

When a lease has a purchase option that will be exercised, it is accounted for as a finance lease until the underlying asset is purchased. However, the accounting for a finance lease with a purchase option that is reasonably certain to be exercised will be different from the accounting for a finance lease without a purchase option that is reasonably certain to be exercised.

Lease term

The lease term used for the initial lease liability and ROU asset measurement is based on when the purchase option is likely to be exercised. If the purchase option is exercised at the end of the lease, the lessee accounts for an ROU asset through the entirety of the contract. Once the underlying asset is purchased, the lease liability and ROU asset are fully derecognized and a fixed asset is recorded in their place. Subsequent to the purchase, the asset will be accounted for as a fixed asset that is depreciated over its remaining useful life.

Amortization schedule

For the initial recognition of a finance lease: the lease liability is equal to the present value of remaining future payments and a corresponding ROU asset will be recorded. If the lease has a purchase option likely to be exercised, the expected purchase price of the underlying asset should also be included in the lease payments. The liability balance on the date the lessee plans to execute the purchase option will be equal to the agreed upon purchase price of the asset, as the amount still owed at the end of the lease.

Additionally, the ROU asset recognized for a finance lease is usually amortized on a straight-line basis over the term of the lease, with the underlying asset’s ending balance equal to zero at lease expiration. When accounting for a finance lease with a purchase option that is reasonably certain to be exercised, the ROU asset is amortized over the asset’s entire useful life instead of the lease term, similar to how a fixed asset is depreciated over its useful life.

Recording the fixed asset

Once the underlying asset is purchased at the end of the lease term, the remaining ROU asset balance is reclassed and accounted for as a fixed asset. The new fixed asset balance will be equal to the unamortized balance of the ROU asset at the time of purchase, the contract end date.

Example: Accounting for a finance lease with a purchase option under ASC 842

Let’s assume ABC Company would like to purchase a forklift to use in manufacturing their products. The company needs the forklift now but would prefer not to use cash from their reserves for equipment.

Their solution is to enter into an arrangement with XYZ Company allowing them to lease the forklift for 2 years and then purchase it. The agreement contains an option to purchase the forklift for $20,000, and ABC Company has determined they will exercise the option at the end of the lease. Title to the forklift will transfer to ABC Company at the time of the purchase.

Here are the details from the lease agreement:

- Market price of forklift at lease commencement: $25,000

- Lease term: 2 years

- Useful life: 10 years or 120 months

- Salvage value: $2,000

- Monthly lease payments: $500

- Purchase price: $20,000

- Lessee’s incremental borrowing rate: 4.5%

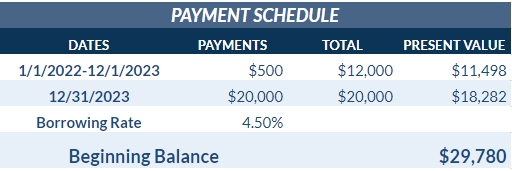

Step 1: Calculate the lease liability and ROU asset opening balance

The opening balance of the lease liability and ROU asset will be calculated as the present value of the $500 monthly lease payments and the $20,000 purchase price to be paid at the end of the lease term. The present value of the 24 monthly payments and the payment to purchase the forklift at a discount rate of 4.5% is $29,780.

This present value was found using LeaseQuery’s Present Value Calculator.

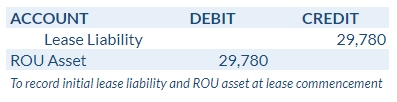

Step 2: Post the initial recognition journal entry

Here is the journal entry for the initial recognition of the lease liability and ROU asset:

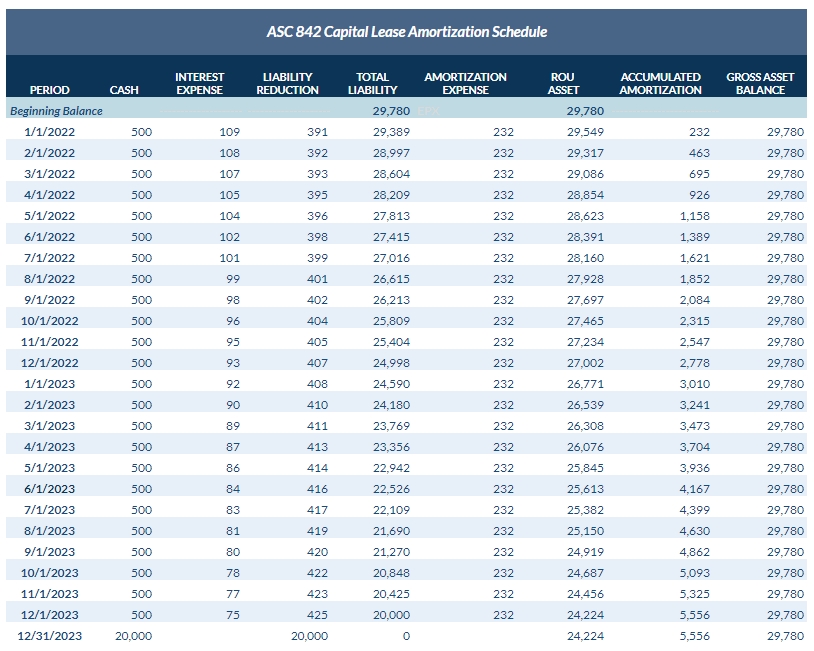

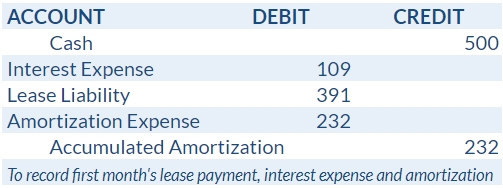

Step 3: Calculate interest expense and amortization expense

Each month, interest expense will be recognized based on the beginning balance of the liability for the month and the discount rate. The liability will be reduced periodically by the difference between the cash paid and the interest expense incurred. The asset will be amortized on a straight-line basis over its useful life and taking into account its salvage value.

Here is the journal entry for the first month’s lease activity, interest and amortization expense:

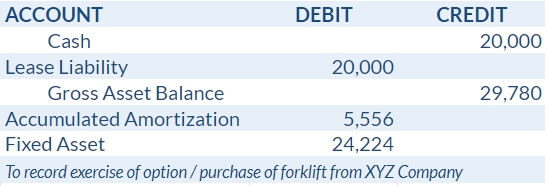

Step 4: Recognize a fixed asset in the month of purchase

At the end of the lease, ABC Company will purchase the forklift and record a fixed asset. They will pay XYZ Company the agreed upon price for the forklift and derecognize the ending lease liability balance, which will be in the amount of the purchase price. Then ABC Company will reclass the ending ROU asset balance to fixed assets to record the transfer of title of the forklift from XYZ Company. The asset will continue to be depreciated at the same rate it was amortized at as the ROU asset throughout the lease term.

Cash will be credited in the amount of the purchase price of $20,000. The ending lease liability balance will also be equal to the $20,000 purchase price and will be debited once XYZ Company is paid, clearing out the lease liability account. The ending ROU asset balance of $24,224 will be reclassed to the fixed asset account. The ROU asset was amortized over the useful life throughout the lease term, so the ending balance is equal to the book value left to be depreciated in the fixed asset account.

Here is the journal entry to recognize the new fixed asset:

Other scenarios where fixed assets and lease accounting overlap

Leasehold improvements

Accounting for leasehold improvements does not change with the adoption of ASC 842. Leasehold improvements owned by the lessee are accounted for as fixed assets and depreciated over the lesser of their useful life or the remaining lease term. However, leasehold improvements should be amortized to the end of their useful life in the following scenarios:

- The lease transfers ownership of the asset to the lessee or

- The lessee is reasonably certain they will exercise an option to purchase the asset.

Lessor accounting

Accounting for lessor leases involves both fixed asset and lease accounting, as well. For operating leases, lessors recognize revenue on a straight-line basis throughout the lease term and maintain the fixed asset on their books. For finance type leases, such as a sales-type or direct financing lease, a lease receivable or the net investment in the lease is recognized and the fixed asset will be derecognized from the lessor’s balance sheet at this time. A sale-leaseback occurs when a company sells an asset to another company and then leases the same asset from the buyer-lessor.

“Lessee vs. Lessor: Differences, Accounting, and More Explained” provides more information on lessor accounting.

Summary

Lease accounting under ASC 842 intersects with fixed asset accounting in several ways. Many organizations have a mix of owned and leased assets to reap the benefits of each asset type. Both leases and fixed assets are recognized on the balance sheet.

It is common for a company to originally lease an asset, but exercise an option to purchase the asset at a later date. In those cases, the ROU asset would originally be accounted for with the lease under ASC 842. Subsequently, the ROU asset would be derecognized and a fixed asset would be recognized. Other ways lease accounting and fixed accounting overlap are when an organization has leasehold improvements or they own an asset and also lease the asset to others as a lessor.