Determining which dates to capture from a lease agreement

After compiling your lease portfolio it’s important to understand which dates are pertinent to your leases and how they will affect your lease accounting. Each lease in your portfolio will have a commencement date, a possession date, and an end date. Some of these dates may coincidentally be the same. Additionally, some lease agreements may also have renewal dates at the end of the specified lease term.

The lease start date, or commencement date, is the date agreed upon in the lease documents as the day the lease term begins.

The possession date is the date the lessee physically obtains access to the underlying leased asset or the lessor offers no barrier to obtaining the leased asset. This date determines when the lessee recognizes their ROU asset and lease liability under ASC 842. This date is also used to determine the appropriate incremental borrowing rate, which is utilized to discount the future lease payments recorded on the balance sheet as a lease liability. The possession date is sometimes the same as the commencement date, but can also fall after, or even before.

The lease end date is established when the lessee no longer has control or physical possession of the asset and marks the end of the lease term. Keeping track of the end of lease terms, various renewal notification dates, and time frames can be cumbersome. A good lease accounting solution may offer customizable alerts to track multiple renewal dates and their related notification requirements so your organization can prepare beforehand.

Where are the important dates in a lease contract?

When extracting the lease dates and the related lease term, start by identifying the commencement date – or the start of the lease term. The commencement date is usually explicitly stated near the beginning of the lease contract, but can also be contingent upon a specific action such as the execution of the agreement by both parties.

The lease end date can be defined in several different ways. One of the more common ways the lease end date is stated is as a factor of the start date and/or the lease term. For example, a contract may specify that the lease ends 36 months or three years from the commencement date rather than provide a specific date.

Be sure to review the contract in its entirety and consider all written terms and conditions including penalties, renewals, terminations, and extensions when evaluating the lease term. Depending on how the contract is written, the lease term may be determined from the commencement date or possibly the possession date. Below we identify each part of the lease contract that needs to be considered to arrive at the correct lease term.

What is the lease term?

A lease term is the period of the agreement between a lessee and lessor when the lessee can use the leased asset owned by the lessor. The lease term for accounting purposes starts from the lease possession date and extends until the end of the lease. Determining the correct lease term is imperative during lease entry as it significantly impacts the classification and measurement of the lease.

How to determine the lease term

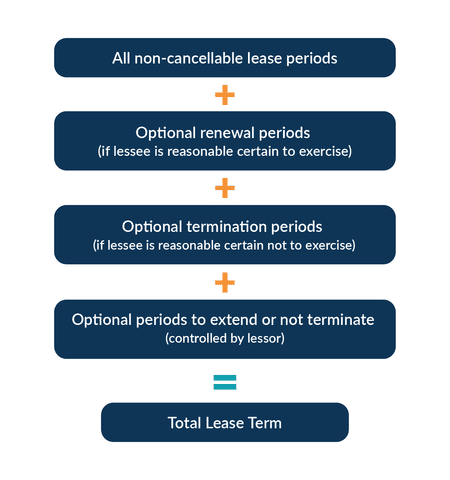

ASC 842-10-30-1 is the section of the guidance which explains the portions of a lease agreement to include in the evaluation of the lease term. The total lease term is similar to a formula made up of:

- All non-cancellable lease periods,

- Any optional renewal periods the lessee is reasonably certain to exercise,

- Any periods covered by a termination option the lessee is reasonably certain not to exercise, and

- Any periods to extend or to not terminate the lease controlled by the lessor.

The graphic below offers a visual representation of the portions of the lease agreement making up the lease term:

A non-cancelable lease period is the minimum possible length of time both the lessee and lessor must abide by the contract and do not have the option to terminate the contract. This is the initial term of the lease before any renewals, extensions, or purchase options are considered.

Add any renewal periods and/or extensions the lessee is reasonably certain to elect to the initial lease term. Conversely, evaluate the end of the lease term based on when the lessee is reasonably certain they will terminate the lease and/or not exercise any optional renewal periods or extensions.

Reasonably certain is interpreted as a high possibility that an event will or will not occur. An entity that is reasonably certain whether they will exercise or not exercise a renewal or termination option at the commencement of the lease has weighed the outcomes and made a decision based on the facts and circumstances of the agreement at the time. The lessee reviews various economic factors to assess if they are reasonably certain to exercise or not to exercise an option. Some of those factors are based on the contract, underlying asset, market, and entity.

Short-term lease vs long-term lease

A short-term lease is a lease with a term of 12 months or less at commencement, in contrast to a long-term lease which has a lease term exceeding 12 months. Key facts to remember about a short-term lease classification are:

- The lease must have a term of 12 months or less at commencement, not at transition or another time

- A lease can not qualify as a short-term lease if it has options that extend the lease beyond 12 months that the lessee is reasonably certain to exercise

- A short-term lease may have a purchase option, if the lessee is reasonably certain not to exercise

Under one of the practical expedients offered by ASC 842, the lessee can elect by class of underlying asset to not recognize their short-term leases on the balance sheet. However, the income statement impact of short-term leases not recorded on the balance sheet is required to be disclosed, so tracking short-term leases by another mechanism is recommended.

If a lessee elects to use the short-term lease expedient, the leases are treated as if ASC 842 had never been applied and the lessee will recognize lease payments as straight-line expenses for the duration of the lease contract.

Additional lease term considerations

You may find in assessing the lease terms within your portfolio that some of your lease agreements do not have an easily identifiable lease term, such as leases that offer shorter-term renewals or perpetual leases. As with all other leases, the lessee establishes the lease term by considering whether they are reasonably certain to exercise the options offered by the contract.

For lease agreements offering month-to-month, week-to-week, or even day-to-day renewals, the lessee reviews all of the circumstances related to the contract to make a determination regarding how long they expect to continue renewing the lease. For example, if a piece of equipment leased to support a construction project is being leased weekly or monthly, the lessee may establish the lease end date as the date they expect the project to be completed.

Perpetual leases, sometimes called evergreen leases, generally renew automatically for some period far into the future until the lessee terminates the lease. As with a normal lease, the lessee still reviews the contributing factors to make a reasonably certain judgment as to when they expect to exit the agreement.

One point to consider for a perpetual lease is the renewal timeframe. If a lease renews automatically for the next 40 – 50 years – or somewhere far into the future, it is highly unlikely the lessee can be reasonably certain they will renew so many years away. However, the lessee could make a case of being reasonably certain to renew for the next five to ten years, in which case they would document their determination of the term length and establish the related lease liability based on that judgment.

Termination options

A termination option is the ability to cancel the lease before the end of the specified lease term, so the lessee no longer has the right to use the underlying asset. A lease agreement may offer a termination option to either or both the lessor and lessee. Only periods of the lease the lessee is reasonably certain not to terminate are included in the initial lease term.

Purchase options

A purchase option is defined as an option to purchase the underlying asset of a lease at the end of the lease term. The presence of a purchase option is one of the five conditions that may distinguish a finance lease from an operating lease. Like other lease options, factoring the purchase option into the lease term is dependent on whether the option may be reasonably certain to be exercised by the lessee. If this option is reasonably certain to be exercised then the agreed upon date that ownership of the underlying asset transfers from the lessor to the lessee is the end of the lease term. When it is reasonably certain a purchase option will be exercised this also results in classifying the lease as a finance type lease.

Financial impact of the lease term

The lease term is generally the timeframe the lease liability and ROU asset are amortized to zero. These timeframes are the same unless the lessee has opted to exercise a purchase option and will own the underlying asset at the end of the lease. If the ownership of the underlying asset transfers to the lessee at the end of the lease term, the leased asset is amortized over its useful life, not the lease term.

The periodic lease cost for an operating lease and the periodic amortization of the ROU asset for a finance lease are both calculated as a factor of the lease term (or the lease term and the additional useful life of the underlying asset in the case of a purchase option). As a result, the length of the lease term inversely affects the periodic expense. When there is a purchase option the lease liability is reassessed and increases.

Changing the lease term after initial lease entry

Lease agreements are regularly reassessed or modified by both parties after the commencement date. The lessor and lessee may agree on changes to the non-cancellable period, updates to circumstances of the lessee may change the likelihood of exercising a renewal or termination option or the lessor may offer an extension to the original term.

In cases where the lessee has new information which causes a reassessment of original decisions to exercise or not exercise any renewal, extension, or termination options, the lease term is also updated to reflect these new conclusions. The date new information is known triggers an update to the lease term and/or lease payments and is also the date the lease term should be recalculated.

Changes to market-based factors outside of the lessee’s control, such as market-rate increases or decreases do not alone trigger a reassessment of the lease term.

Summary

Completely analyzing your lease agreement and identifying important dates are imperative in determining your lease term. You must consider all lease options and relative periods to ensure the accuracy of the amortization schedule. By keeping track of the different dates affecting your lease portfolio and defining the various lease terms, you can classify and measure your leases correctly, and comply with ASC 842.

This article was co-written by Shaniece White and Mario Quach.