What is accrued rent?

Accrued rent is a liability that represents the obligation incurred for the use of an asset owned by a third party. Companies can be charged rent for any type of asset they utilize. Typically accrued rent is recorded for the use of a building or property that has not yet been paid for.

Accrued rent vs deferred rent

While accrued rent occurs when the timing of rent expense incurred differs from when payments are due, deferred rent is a result of a difference in the amount of the straight-line expense recognized and cash paid for rent in the reporting period.

Accrued rent is caused by a timing discrepancy between the expense being incurred and recorded. For example, if payments are made quarterly at the end of the quarter, expense will need to be recorded each month, before payment. The act of recognizing the expense when the company is obligated to pay for the use of the asset but before payment is made is called accruing the expense. Whenever the rent is paid, the accrued rent will be reduced by the amount paid.

Deferred rent is the result of rent expense being recorded on a straight-line basis when cash paid for rent escalates or de-escalates over the term of the lease. When a lease term has rent holidays, prepayments, rent escalations, or de-escalations, there will be periods the actual cash being paid (or not paid) is different from the average of total lease payments to be made over the term of the lease.

Since the rent expense is an average, there will be months where cash is more than the straight-line expense and correspondingly months where cash is less than the expense. Deferred rent occurs in periods where the expense incurred is greater than cash paid for rent. The additional rent expense is “delayed” or deferred to be recognized at a later date.

Over the entire lease term, total cash payments will equal the total expense incurred. If there are periods where the straight-line expense is greater than cash paid, deferred rent is recorded and accumulated, to be relieved later in the term. This can be assumed because straight-line rent expense is the average of all required payments. When the cash paid is greater than the straight-line expense, the accumulated deferred rent will be reduced each period by the excess of cash paid over the expense incurred. By the end of the lease term, the deferred rent balance will be reduced to zero, as the total cash paid and expense incurred over the life of the lease is equal.

Accounting for accrued rent with journal entries

Accounting for accrued rent under ASC 840

Under ASC 840, a rent accrual liability was recorded in periods when rent was incurred, because the company used or occupied the leased asset and not yet made a payment. The entity received the economic benefit of the leased asset in the period and has an obligation to pay for the benefit it received.

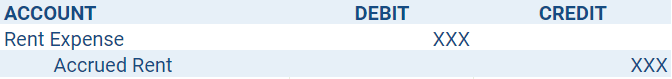

This situation is recorded with a credit to a liability called Accrued Rent, representing the obligation to pay at a later date for the benefit received. The liability increases each period the expense is incurred and no payment is made.

The debit for this journal entry will be to rent expense, increasing expense on the income statement. This represents the benefit received in the period from the occupation or use of the leased asset.

Here is the journal entry showing the accrual of rent expense – rent expense is a debit to record it on the income statement in the period incurred and accrued rent is a credit to record the liability on the balance sheet.

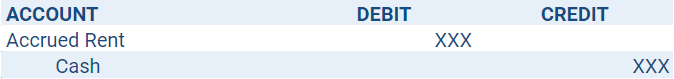

As cash payments are made, accrued rent will be reduced. The entry to relieve accrued rent is a credit to cash for the amount of payment and a debit to accrued rent, shown in the example below:

Accounting for accrued rent and deferred rent under ASC 842

Under ASC 842, accrued rent is no longer recognized as its own line item on the financial statements. Instead, it is reflected in the ROU asset. The ROU asset is calculated as the lease liability, which is derived from the present value of future cash payments, adjusted for some specific reconciling items, including prepaid, accrued, and deferred rent.

At transition, any cumulative balances accrued for unpaid rent obligations will be reclassified to the opening balance of the appropriate lease’s ROU asset. On a net basis, the balance sheet will not be impacted by this journal entry. The accrued rent liability is reduced, but the ROU asset is also reduced by the same amount.

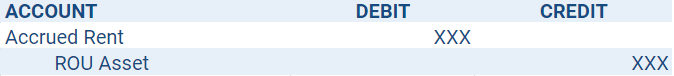

Accrued rent typically has a credit balance, because it is a liability. At transition when accrued rent is derecognized, the accrued rent for a lease agreement is debited and the corresponding ROU asset is credited:

Here is the journal entry at transition – showing the debit to accrued rent to remove the balance from a separate account and credit to the ROU asset to adjust the beginning balance.

A similar adjustment will be made for any deferred rent expense at the transition to ASC 842. If deferred rent has a credit balance, the balance will be cleared with a debit and the offsetting credit will be recorded to the appropriate ROU asset. Conversely, if deferred rent has a debit balance at transition, a credit to deferred rent and an offsetting debit to the ROU asset will be recorded.

Summary

Accrued rent was a liability previously reported under ASC 840 for expense related to the use of an asset incurred in a period but not paid in that same period. Under ASC 842, that liability will be derecognized at transition and no longer be a separate line item. Instead accrued rent will now be reflected in the balance sheet as an adjustment to the newly capitalized ROU asset.