Choosing and correctly applying the right accounting method is a crucial step for any business. There are several different accounting methods, but the two primary ones are cash basis and accrual basis. While both track a business’s revenue and expenses, the biggest difference between the two is the timing of the revenue and expense recognition in relation to the period of use.

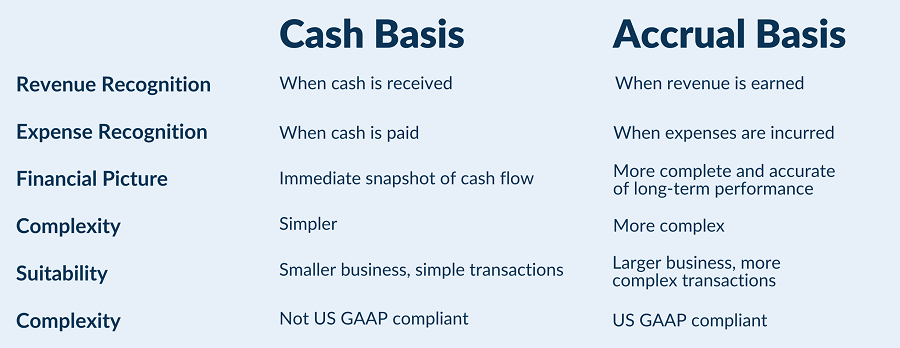

Let’s break down the key differences:

Cash basis accounting

Imagine a small business owner, perhaps a freelance artist or a local bakery. They’re focused on delivering products or services at a small scale, and their accounting needs to be straightforward and manageable. This is where cash basis accounting makes sense.

Cash basis operates on a simple principle: recognize revenue when cash is received and expenses when cash is paid. With this method, there is no attempt to match the cost of a good or service with its usage period. This method is similar to how you may manage your personal finances – the business records transactions when money actually enters or leaves their hands.

Advantages of the cash basis:

- Easy to Manage: No need for complex accounting software or in-depth knowledge of accounting principles. A simple spreadsheet or basic accounting software can suffice.

- Clear Cash Flow Visibility: Provides a real-time snapshot of your cash position, making it easy to track incoming and outgoing funds. This is particularly helpful for managing day-to-day operations and short-term liquidity.

- Simplified Tax Preparation: Often results in simpler tax calculations, especially for businesses with minimal inventory or credit transactions.

May be best for:

Small businesses or those with straightforward or simple transactions

Accrual basis accounting

In contrast to the companies listed above, envision a growing company with inventory, credit sales, and a desire to secure funding for expansion. They need an accounting method that provides a comprehensive and accurate view of their financial performance, which is where accrual accounting comes in.

This method recognizes revenue when it’s earned, regardless of when payment is received. Similarly, expenses are recognized when they’re incurred, not necessarily when they’re paid. This approach is called the Matching Principle, which is one of the basic concepts within accrual accounting, and is named as such because this concept matches revenue and expenses in the coverage period. For example, an entity making a payment for a good/service would recognize expense over time, and a prepaid asset or accrued liability depending on the timing of the cash payment vs the expense or usage period. On the other side of the transaction, the company providing the goods or services would recognize deferred revenue, and recognize revenue over the period of time it is earned and provided, rather than at the time the payment is received.

Advantages of the accrual basis:

- Accurate Profitability Measurement: Provides a more accurate picture of a company’s profitability by matching revenues and expenses to the relevant period. This allows for better assessment of long-term financial health.

- Enhanced Decision Making: Offers valuable insights into performance trends, enabling informed decisions regarding pricing, inventory management, and resource allocation.

- Meeting Compliance Requirements: Required method for US GAAP compliance and essential for securing loans or attracting investors.

May be best for:

- Larger businesses with inventory or more complex transactions: Where tracking the cost of goods sold and matching it to revenue is essential.

- Businesses with credit transactions: Where sales and purchases are often made on credit, creating a time lag between transaction and payment.

- Companies seeking financing: Lenders and investors rely on accrual accounting for a comprehensive understanding of a company’s financial position.

Below is a summary of the differences between Cash and Accrual Basis:

Cash vs. accrual accounting example:

Company ABC would like to use a new software for tracking its customer data. They contract with Software LLC, a software company, for a 2-year subscription for access to this new software. The software cost is $12,000 annually, or $24,000 total, and is paid in advance, in full, at the start of the contract term, which is January 1st.

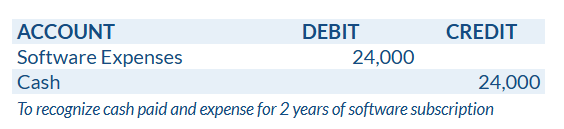

Under cash basis, Company ABC immediately recognizes the expense in full on January 1st, along with the cash payment.

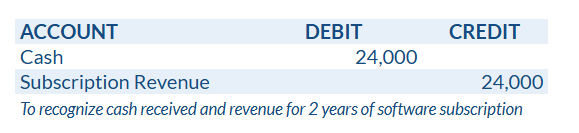

Software LLC, under cash basis, would recognize the following entry to recognize revenue in full:

Software LLC, under cash basis, would recognize the following entry to recognize revenue in full:

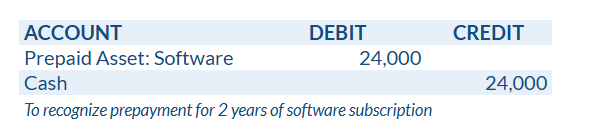

Under the accrual basis of accounting, using the same facts as above, Company ABC would record the following at January 1st:

Under the accrual basis of accounting, using the same facts as above, Company ABC would record the following at January 1st:

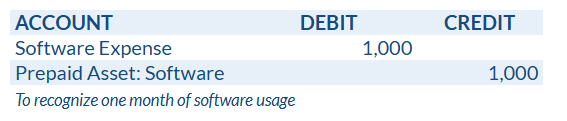

At the end of each month throughout the following 2 years, the entry below is recognized to match the expense to the usage period and reduce the prepaid. The calculation is $24,000 / 24 month usage period = $1,000 per month. As expense is recognized, the prepaid asset is reduced, until it is $0 at the end of the contract term.

At the end of each month throughout the following 2 years, the entry below is recognized to match the expense to the usage period and reduce the prepaid. The calculation is $24,000 / 24 month usage period = $1,000 per month. As expense is recognized, the prepaid asset is reduced, until it is $0 at the end of the contract term.

Under the accrual basis of accounting, using the same facts as above, Software LLC would record the following at January 1st:

Under the accrual basis of accounting, using the same facts as above, Software LLC would record the following at January 1st:

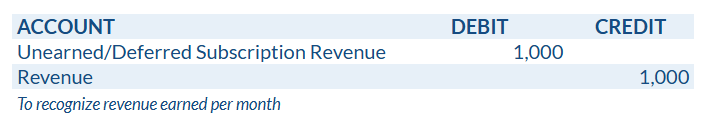

At the end of each month throughout the following 2 years, the entry below is recognized to match the revenue earned to the correct period and convert the unearned deferred revenue into earned revenue. The calculation is $24,000 / 24 month contract period = $1,000 per month. As revenue is recognized, the unearned revenue is reduced, until it is $0 at the end of the contract term.

At the end of each month throughout the following 2 years, the entry below is recognized to match the revenue earned to the correct period and convert the unearned deferred revenue into earned revenue. The calculation is $24,000 / 24 month contract period = $1,000 per month. As revenue is recognized, the unearned revenue is reduced, until it is $0 at the end of the contract term.

As you can see, at the end of the term, both methods result in the same amount of cash, revenue, and expense recognized, however, the accrual basis of accounting provides a more accurate representation of the revenue and expense over the period of time in which the software was used.

As you can see, at the end of the term, both methods result in the same amount of cash, revenue, and expense recognized, however, the accrual basis of accounting provides a more accurate representation of the revenue and expense over the period of time in which the software was used.

Summary:

While the above provides a general overview, the best accounting method ultimately depends on your unique business needs. Considering factors like business size and complexity, financing needs, compliance requirements, and potential for future growth should be evaluated when making your decision. It’s always advisable to consult with an accountant or tax professional to determine the most appropriate accounting method for your specific business needs.