1. Scope

2. Recognition and measurement of a SBITA

- Subscription liability

- Subscription asset

- Outlays other than subscription payments

- Disclosure requirements

- Terms

- Additional costs evaluation

- Calculation of subscription liability

- Calculation of subscription asset

- Amortization of subscription asset and liability

- Journal entries

4. Summary

This article provides a straightforward explanation of the key concepts, using a practical example to guide you through the process. We’ll cover everything from recognizing subscription assets and liabilities to accounting for those extra costs that are not directly associated with the subscription payments.

Scope

SBITA defined

The application of GASB 96 begins with the determination of whether or not the contract is a SBITA. Under GASB 96, “a SBITA is a contract that conveys control of the right to use another party’s (a SBITA vendor’s) IT software, alone or in combination with tangible capital assets (the underlying IT assets), as specified in the contract for a period of time in an exchange or exchange-like transaction.”

A key component of this definition is the element of control. Governments must evaluate each contract to determine whether the contract grants them control over the underlying IT assets. Examples of control would indicate the following:

- The ability to use the software right away, whenever they needed.

- The power to decide exactly how the software was used and what it did.

Both of these specifications must be met for the government to have control, and therefore, for the contract to be a subscription-based information technology arrangement. The definition of control under GASB 87 is similar to the above.

Exemptions

GASB 96 explicitly excludes contracts that only provide an organization’s IT support services, but does include contracts providing IT support services in conjunction with the right to use a related IT asset. The following are also exempt from the scope of GASB 96:

- Contracts that meet the definition of a lease under GASB 87.

- The contract includes both a software component and a capital asset component.

- The capital asset’s cost significantly exceeds the software’s cost.

- Governments that provide other entities the right to use their own IT software and associated tangible assets through a SBITA.

- Contracts that meet the scoping criteria for GASB Statement No. 94, Public-Private and Public-Public Partnerships and Availability Payment Arrangements.

- Any licensing arrangements providing the government entity with a perpetual license to use a vendor’s computer software falling under the scope of GASB Statement No. 51, Accounting and Financial Reporting for Intangible Assets.

Short-term SBITAs

GASB 96 introduces a simplified approach for short-term subscription-based IT arrangements (SBITAs). Essentially, if the maximum possible term of the SBITA is 12 months or less (including any renewals or extensions regardless of certainty to exercise), it’s considered short-term.

While both GASB 87 and GASB 96 short-term leases consider all possible term extensions aside from its reasonable certainty, the governmental entity is not required to recognize a subscription asset and liability for any short-term SBITAs. Instead, subscription payments are recognized as outflows of resources when incurred, with an asset recognized if payments are made in advance, or a liability if payments are due as of the end of a reporting period.

Recognition and measurement of a SBITA

If a SBITA is identified, government entities recognize a subscription liability and a subscription asset at the commencement of the SBITA’s subscription term, which occurs when the government obtains control of the right to use the underlying IT asset. The subscription term is the period that the government has the noncancellable right to use the underlying IT assets, plus the following periods, if applicable:

- Periods covered by a government’s extension option if it is reasonably certain that the government will exercise that option

- Periods covered by a government’s termination option if it is reasonably certain that the government will not exercise that option

- Periods covered by a vendor’s extension option if it is reasonably certain that the SBITA vendor will exercise that option

- Periods covered by a vendor’s termination option if it is reasonably certain that the vendor will not exercise that option

Subscription liability

Like the present value calculation for lease liabilities, the initial subscription liability is measured as the present value of the total subscription payments expected to be made to the vendor during the subscription term. The total future payments are discounted using the interest rate the vendor charges the government, which may be the interest rate implicit in the SBITA. If the implicit interest rate is not readily determinable, the government may use an estimated incremental borrowing rate for the present value calculation.

GASB 96 outlines that the payments included in the present value calculation of the subscription liability should include the following:

- Fixed payments

- Variable payments based on an index or a rate, measured using the index or rate as of the commencement of the subscription term

- Variable payments that are fixed in substance

- Termination penalties, if the subscription term reflects the government exercising either an option to terminate the agreement or a fiscal funding or cancellation clause

- Incentives receivable from the vendor

- Other payments the government is reasonably certain will be required to be made to the vendor

In subsequent periods, the government will accrue interest on the remaining subscription liability at the applicable discount rate. The subscription payments will be allocated first to the accrued interest, and then to reduce the outstanding subscription liability.

Subscription asset

In addition to the subscription liability, the government recognizes a subscription asset. The subscription asset is measured as the initial value of the subscription liability plus

- payments made to the vendor at the commencement of the subscription term

- capitalizable initial implementation costs

- minus any vendor incentives received at the commencement of the subscription term

Subsequently, the government will amortize the subscription asset in a systematic and rational manner over the shorter of the subscription term or the useful life of the underlying IT asset. Amortization of the subscription asset begins at the commencement of the subscription term, and is reported as an outflow of resources by the governmental entity.

Outlays other than subscription payments

In addition to subscription payments, there may be cash outlays for other activities associated with SBITAs. The type and timing of the activity dictate the accounting treatment of these cash outlays. Other activities associated with SBITAs are grouped into three stages:

1. Preliminary project stage

The preliminary project stage includes activities associated with the government’s decision to procure the technology provided by the SBITA. During this stage, governments evaluate vendors, applicable pricing, and other various options related to the SBITA and their organization. Any cash outlays made by the government while in this stage are expensed in the period incurred.

2. Initial implementation stage

During the initial implementation stage, the government would spend money and resources implementing the selected system through system customizations, testing, data migration, installation, etc. Any charges incurred while placing the subscription asset into service would be included in this stage. After the subscription asset is placed into service, this stage of the project is complete. Cash outlays during this initial implementation stage are generally capitalized as part of the subscription asset.

3. Operation and additional implementation stage

Throughout the subscription term, governments would experience operational challenges that require technical support, maintenance, troubleshooting, or other measures to assist the entity in maintaining ongoing access to the underlying IT assets. The government’s cash outlays during the operation and additional implementation stage are expensed in the period incurred unless the activity is related to increasing the efficiency of or adding to the functionality of the subscription asset in a way that didn’t exist before. For these types of activities, the costs are capitalized as an addition to the subscription asset.

Disclosure requirements

The long-term portion of the subscription liability is reported as a long-term liability, separate from debt, and the short-term portion of the subscription liability is recorded as a current liability on the statement of net position. In contrast, the total subscription asset is reported as a noncurrent intangible asset, on a separate line item from other capital assets.

The amortization of the subscription asset is reported as an outflow of resources, whereas subscription payments are allocated between a reduction of the subscription liability and any accrued interest. In addition, information related to a government entity’s SBITAs is also required to be included in the notes to the financial statements.

The disclosure requirements under GASB 96 are not arduous or extremely lengthy. However, since specific disclosures were not required for IT agreements previously, below is a full list to prepare for the transition. Short-term SBITAs are excluded from the disclosure requirements.

- A general description of the government’s SBITAs, including the basis, terms, and conditions of any variable payments not included in the measurement of the subscription liability

- The total amount of subscription assets and related accumulated amortization is reported on a separate line item from other capital assets.

- The amount of outflows of resources recognized in the current period for

- variable payments not included in the measurement of the subscription liability and

- any other payments (for example, penalties) not included in the measurement of the subscription liability

- The maturity of the subscription liability is separated into principal and interest, for each of the five years subsequent to the reporting period and in five-year increments for the remaining term of the SBITA

- Any SBITA commitments not yet reported as a subscription liability on the statement of net position (i.e prior to the commencement of the subscription term)

- Any impairment loss and the applicable adjustment to the subscription asset

SBITA accounting example

We will use a hypothetical subscription to LeaseQuery to demonstrate the appropriate SBITA accounting for a governmental entity. In our example, the City of Springfield uses LeaseQuery to account for its lease portfolio. Springfield recognizes its contract with LeaseQuery as a SBITA due to the following facts:

- The agreement does not meet the definition of a lease under GASB 87 or the scoping criteria for GASB Statement No. 94, Public-Private and Public-Public Partnerships and Availability Payment Arrangements.

- The agreement provides the City of Springfield the use and control of an instance of LeaseQuery’s software in an exchange-like transaction.

- The agreement has a defined, finite, non-cancelable subscription term of three years.

Terms

Below are the additional details of the SBITA:

- Subscription Start Date: July 1st

- Subscription Term: 4 years

- First Payment Date: July 1st

- Payments: $5,000 annually, paid in advance (on July 1st)

- Discount Rate: 2%

In addition to the annual subscription payments of $5,000, Springfield also incurs additional costs during the following stages:

Preliminary project stage costs

The City of Springfield hired an outside consultant to assist with the selection and evaluation of lease accounting software. They incurred fees of $1,000, paid to the consultant during the evaluation process.

Initial implementation stage costs

During the initial implementation stage, the city needed to migrate data from its existing lease accounting system into LeaseQuery. The data migration cost the government $2,000 and was paid directly to LeaseQuery.

Operation and additional implementation stage costs

After placing LeaseQuery in service, Springfield experienced operational challenges, which required additional support services and cost an additional $300. These services did not add to the functionality of LeaseQuery.

Additional costs evaluation

Let’s walk through these different costs to determine whether they are capitalized as part of the subscription asset, or expensed as incurred.

Preliminary project stage

Activities in the preliminary project stage are generally associated with an entity’s decision to procure the technology provided by the SBITA. Per GASB 96, any cash outlays made by the government while in this stage are expensed in the period incurred. Therefore, the $1,000 cost for the outside consultant will be expensed as incurred and not capitalized as part of the subscription asset.

Initial implementation stage

During the initial implementation stage, the government may spend money implementing the software through system customizations, testing, data migration, installation, etc. GASB 96 allows for cash outlays during this stage to generally be capitalized as part of the subscription asset. Therefore, the $2,000 of data migration costs will be capitalized as an addition to the subscription asset.

Operation and additional implementation stage

Governments may experience operational challenges throughout the subscription term which require technical support, maintenance, troubleshooting, or other assistance with the SBITA. Per GASB 96, cash outlays during the operation and additional implementation stage are expensed in the period incurred unless the activity is related to increasing the efficiency of or adding to the functionality of the subscription asset in a way that didn’t exist before.

Because the additional support services did not add to the functionality or efficiency of the software, the $300 cost will be expensed as incurred and not capitalized as part of the subscription asset.

After walking through the additional costs to the City of Springfield (outside of the subscription fees) and determining what to include in the calculation of the subscription asset, let’s calculate the initial subscription liability.

Calculation of subscription liability

The initial subscription liability is measured as the present value of the subscription payments expected to be made to the vendor during the subscription term. By utilizing our present value calculator and populating the terms noted above:

- $5,000 annual subscription payments, paid in advance,

- 3 year (36 months) subscription term,

- 2% borrowing rate,

we calculate a present value of $14,708. This is the value of the initial subscription liability.

Calculation of subscription asset

To calculate the initial subscription asset, take the subscription liability of $14,708 and add the capitalizable initial implementation costs for data migration of $2,000. Therefore, the starting subscription asset value is $16,708 ($14,708 + $2,000).

Amortization of subscription asset and liability

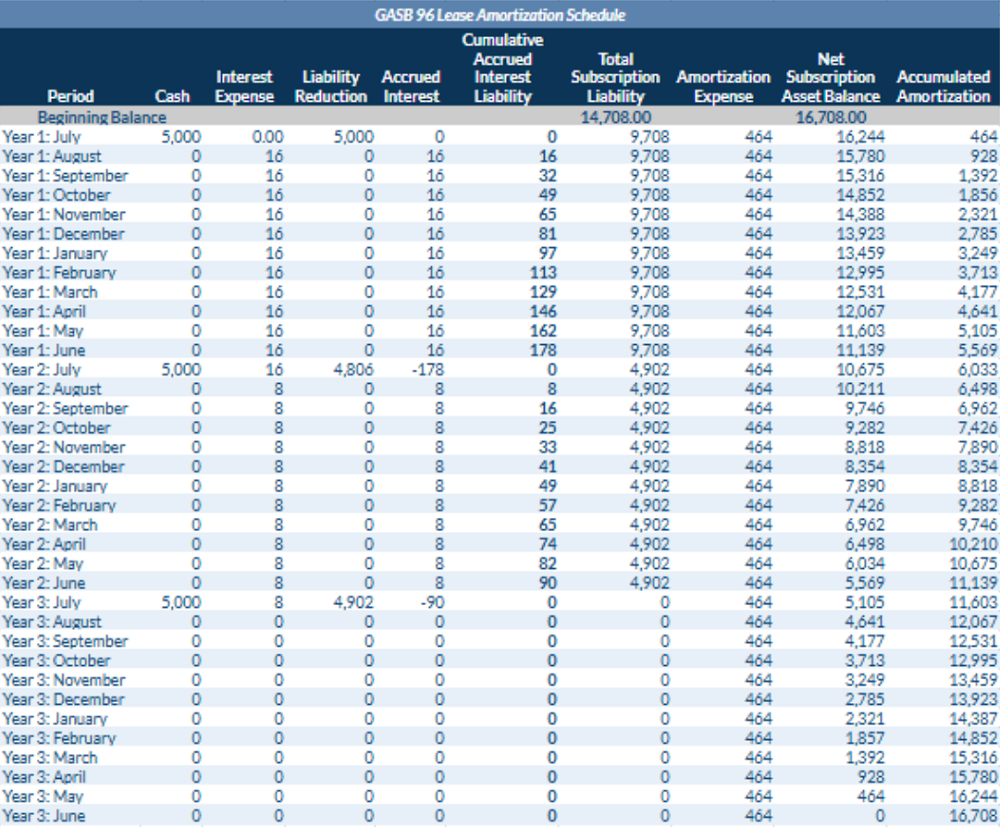

Below is the amortization schedule for both the subscription liability and subscription asset recognized for this SBITA:

The interest expense in each month is calculated by multiplying the outstanding liability balance at the end of the prior month by the 2% borrowing rate divided by 12 months. In a period when no payment is made, the government accrues interest expense in a separate liability account called “accrued interest liability” and does not increase the balance of the outstanding subscription liability. Any subscription payments that the government makes should be allocated first to the cumulative accrued interest liability balance and then to the outstanding subscription liability.

The opening subscription asset of $16,708 is amortized on a straight-line basis over the subscription term. To calculate the $464 monthly amortization of the subscription asset, divide the gross subscription asset of $16,708 by the subscription term of 36 months ($16,708 / 36 = $464).

On the date of the last payment, the subscription liability is reduced to $0 because all payments have been made and the government has no further obligation to the vendor. The subscription asset, however, is amortized over the entire subscription period because the entity has the right to use the SBITA until the last day of the subscription term.

Journal entries

Based on the calculations and the amortization schedule above, the following are the journal entries for both the initial recognition of the subscription asset and liability and the subsequent recognition of payments and expenses.

On July 1, Year 1, the journal entry is made to record the subscription asset and liability:

Also in July, this entry is made to recognize the activity throughout the month:

The above entries can be netted for July reporting, resulting in the combined entry below:

In the next month, August, the following entry is recorded, despite the government not making a cash payment:

In each of the subsequent months, a similar entry will be made to amortize the asset and liability throughout the subscription term. In addition, any costs not capitalized as part of the subscription asset, such as the consulting expenses and the additional support fees, are expensed in the period incurred.

If capturing the activity within a governmental fund, a conversion entry will be necessary at year-end to convert from the modified accrual accounting basis to the required full accrual basis for the government-wide financials.

Summary

Accounting for SBITAs is a new concept, but much of the new accounting treatment mirrors the methodology first presented in GASB 87 several years ago. As you finalize your adoption of GASB 87 and begin researching GASB 96, look for a solution like LeaseQuery that enables you to leverage your lease accounting transition efforts.