What is SFFAS 54?

SFFAS 54 is the new lease accounting standard issued by the Federal Accounting Standards Advisory Board (FASAB or “the Board”) which changes the financial reporting standards for federal lease accounting. The standard changes lease accounting significantly: it now requires lessees to recognize leases on their balance sheet through a lease liability and corresponding lease asset, while lessors recognize a lease receivable and unearned revenue.

The benefits of the new lease accounting standard are that it will provide:

- relevant and meaningful financial information needed by financial statement

users, and - comprehensive lease standards that address the various leasing activities of federal entities

This article will walk through the key changes under SFFAS 54 and provide an example of the initial recognition required by lessees under the new standard.

Effective date

In September 2016, the FASAB released an initial Exposure Draft of SFFAS 54 – Leases. However, the final requirements of SFFAS 54 were issued by the Board on April 17, 2018, and are effective for reporting periods beginning after September 30, 2023. Entities should use a prospective implementation method, as of the adoption date.

Early adoption is not permitted.

Lease definition

What is a lease?

The standard defines a lease as a contract where one entity conveys the right to control the use of an underlying asset to another entity for a specified period of time in exchange for consideration.

There are two factors to evaluate to decide whether a contract conveys the right to control the use of the asset to the lessee. To obtain control, the lessee needs to have both of the following:

- The right to obtain economic benefits or services from using the underlying asset and

- The right to control access to the economic benefits or services of the underlying asset

Embedded leases

In addition to clearly defined lease agreements, some contracts may not be explicitly labeled as leases, but still meet the definition of a lease per the standard. While typically leases contain assets identified as explicitly leased in a contract or agreement, an asset also can be implicitly identified in the agreement, or “embedded”. An asset is implicitly identified when the only way the obligations of a contract can be satisfied is through the use of a specific asset. For examples of embedded leases, read our full article here.

Scope

SFFAS 54 does not apply to accounting for leases of assets prior to the commencement of the lease term, such as during construction periods, or leases/licenses of internal-use software.

Additionally, the capitalization treatment in SFFAS 54 does not apply in the same manner to intragovernmental leases, which are defined as leases within a consolidation entity or between two or more consolidation entities. While intragovernmental leases are out of scope for SFFAS 54, there are still specific disclosure requirements for intragovernmental leases for both lessees and lessors.

Finally, any lease that contains an automatic title transfer/transfer of ownership of the underlying asset to the lessee by the end of the lease and doesn’t contain an option to terminate should be reported as a financed purchase or sale, using the guidance in SFFAS 6, Accounting for Property, Plant, and Equipment.

Short-term lease exemption

SFFAS 54 also exempts leases meeting the requirements of a short-term lease, which is a non-intragovernmental lease with a lease term of 24 months or less.

Rather than capitalizing short-term leases, lessees should recognize short-term lease payments as an expense and lessors should recognize short-term lease receipts as revenue, but there are no disclosure requirements for short-term leases under SFFAS 54.

Lessee recognition

SFFAS 54 requires that lessees recognize a lease liability, measured at the present value of the lease payments expected to be made throughout the lease term. After initial recognition, the lessee should calculate interest on the lease liability based on their discount rate and recognize interest expense in each subsequent period.

The following payments should be included in the present value calculation:

- Fixed payments

- Variable payments that depend on an index or a rate (ie CPI), initially measured using the rate as of lease commencement

- Variable payments that are fixed in-substance

- Any residual value guarantee amount that is probable of being owed by the lessee

- Any purchase option amount if it is probable that the lessee will exercise the option

- Termination penalties, if the lease term reflects the lessee exercising a termination option or an availability of funds/cancellation clause

- Any lease incentives receivable from the lessor

- Any other payments that are probable of being required

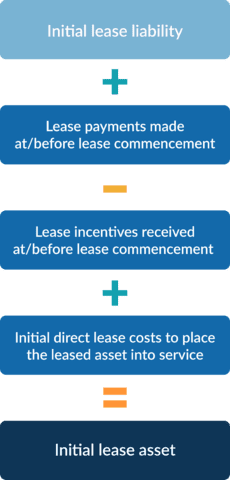

Additionally, the lessee is required to recognize a lease asset, based on the following formula:

After initial recognition, in subsequent periods the asset should be amortized systematically and rationally, over the shorter of the lease term or the useful life of the underlying asset.

Lessor recognition

In a similar fashion to the lessee, the lessor should recognize a lease receivable and an unearned revenue liability. After initial recognition, the lessor should calculate interest on the lease receivable based on their discount rate and recognize it as interest revenue in each subsequent period.

The lease receivable is measured at the present value of the lease payments expected to be received but reduced by any provision for uncollectible amounts if applicable.

The following receipts should be included in the present value calculation:

- Fixed payments

- Variable payments that depend on an index or a rate (ie CPI), initially measured using the rate as of lease commencement

- Variable payments that are fixed in-substance

- Residual value guarantees that are fixed in substance

- Any lease incentives payable to the lessee

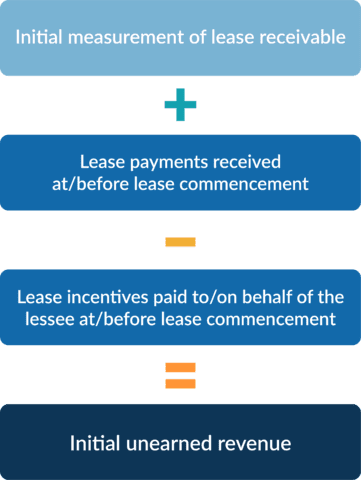

The unearned revenue recognition amount is based on the value of the initial lease receivable, using the formula below:

After initial recognition, in subsequent periods the unearned revenue should be amortized systematically and rationally over the term of the lease and recognized as earned revenue.

Discount rate

For measurement of the initial lease liability/lease receivable, the present value of future lease payments should be discounted using the interest rate the lessor charges the lessee. If the interest rate is not stated in the lease, the estimated incremental borrowing rate (the rate that would be charged for borrowing the lease payment amounts for the lease term) should be used.

In general, a federal entity’s incremental borrowing rate would be the Department of the Treasury borrowing rate for securities that have a similar maturity to the lease term unless the entity has its own borrowing authority.

Example

To illustrate the accounting treatment, look at the simple example below. We will assume the transition date for the entity is 10/1/2023 and that the federal entity is acting as the lessee in the transaction. Below are the other relevant facts:

- Lease Term: 30 years

- Borrowing Rate: 3%

- Lease Commencement Date: 10/1/2023

- Payments: Monthly installments of $1,000, paid in advance

- Initial direct costs of $2,000 to place the leased asset into service

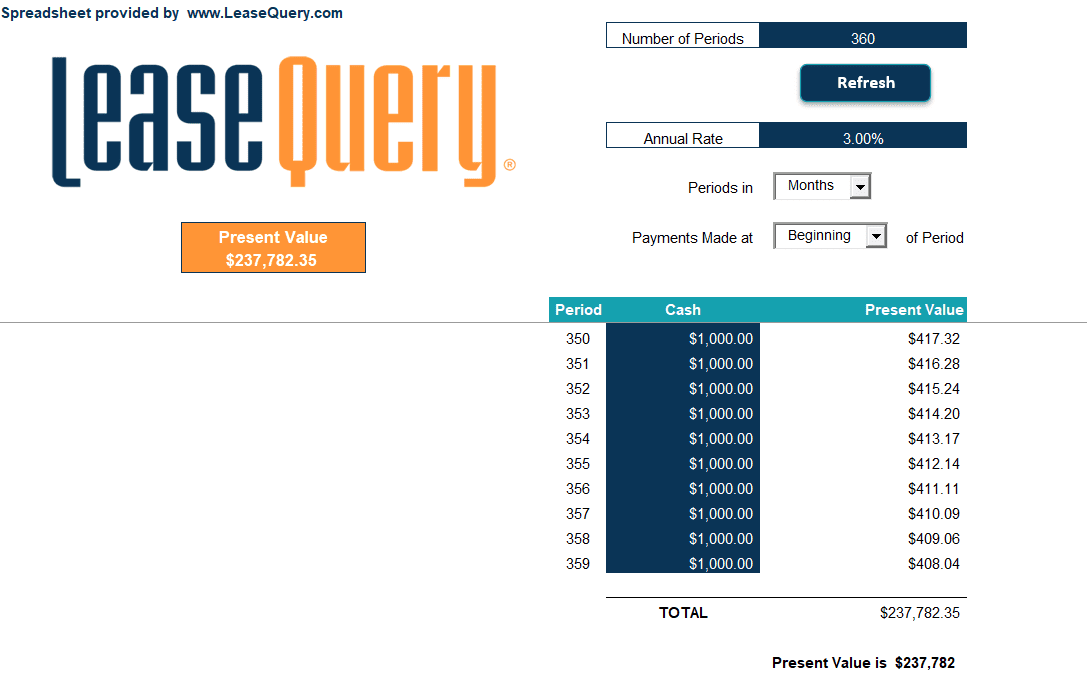

First, the lessee calculates the lease liability. This is done by taking the present value of the fixed monthly payments of $1,000 over 30 years, using the 3% discount rate. The present value represents what the future payments are worth today, and while there are a few methods to arrive at this valuation, the easiest way to calculate this is using our free present value calculator tool.

As shown below, the present value of the lease payments is $237,782.

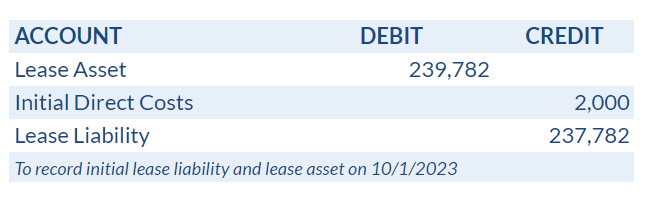

This represents the lessee’s lease liability. Now that the liability has been calculated, the lease asset can be measured. Using the formula in the previous section above, we know that we need to add any initial direct costs to the initial measurement of the lease liability to get to our lease asset value. Therefore, we add the lessee’s initial direct costs of $2,000 to get the leased asset into service to the liability amount of $237,782, and in total, the lease asset is $239,782.

Once we have both the lease liability and the lease asset balance, we can record the journal entry on 10/1/2023 for transition and initial recognition, shown below:

Summary

SFFAS 54 changes the financial reporting standards for federal lease accounting, and provides additional transparency in financial reporting by requiring lessees and lessors to recognize leases on their balance sheet as both asset and liability. Federal entities must identify a full lease population, including any potential embedded leases, to achieve and maintain compliance.

Using a lease accounting software can assist you in these present value calculations and other requirements to comply with SFFAS 54. Schedule a demo with LeaseQuery today to see how a lease accounting software can help your organization with its lease accounting needs!