Lease Accounting Software: Automated FRS 102 Compliance

Simplify lease accounting with a proven solution.

Worried about FRS 102 and IFRS 16 lease accounting?

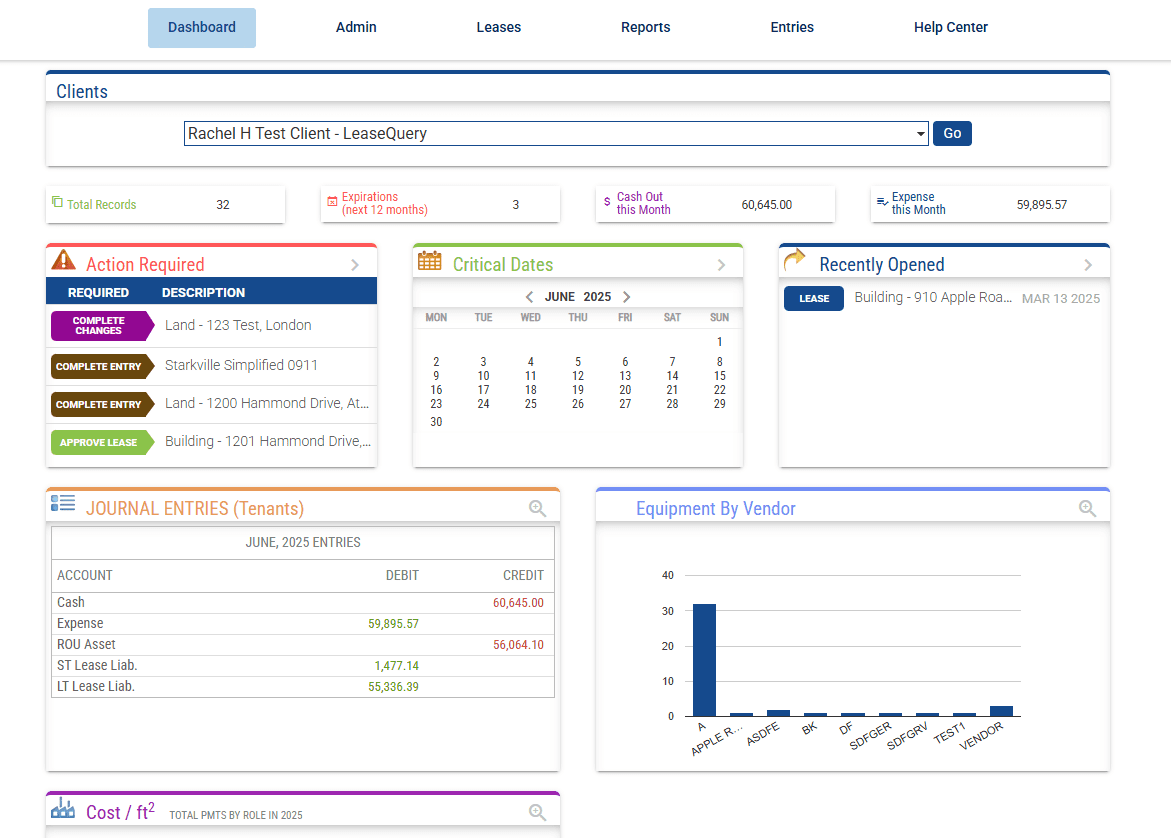

LeaseQuery empowers you to track and account for leases simply, report confidently, and stay ahead of changes.

Globally Trusted: Join 8,000+ global organizations that trust LeaseQuery for simplified lease accounting and lasting compliance.

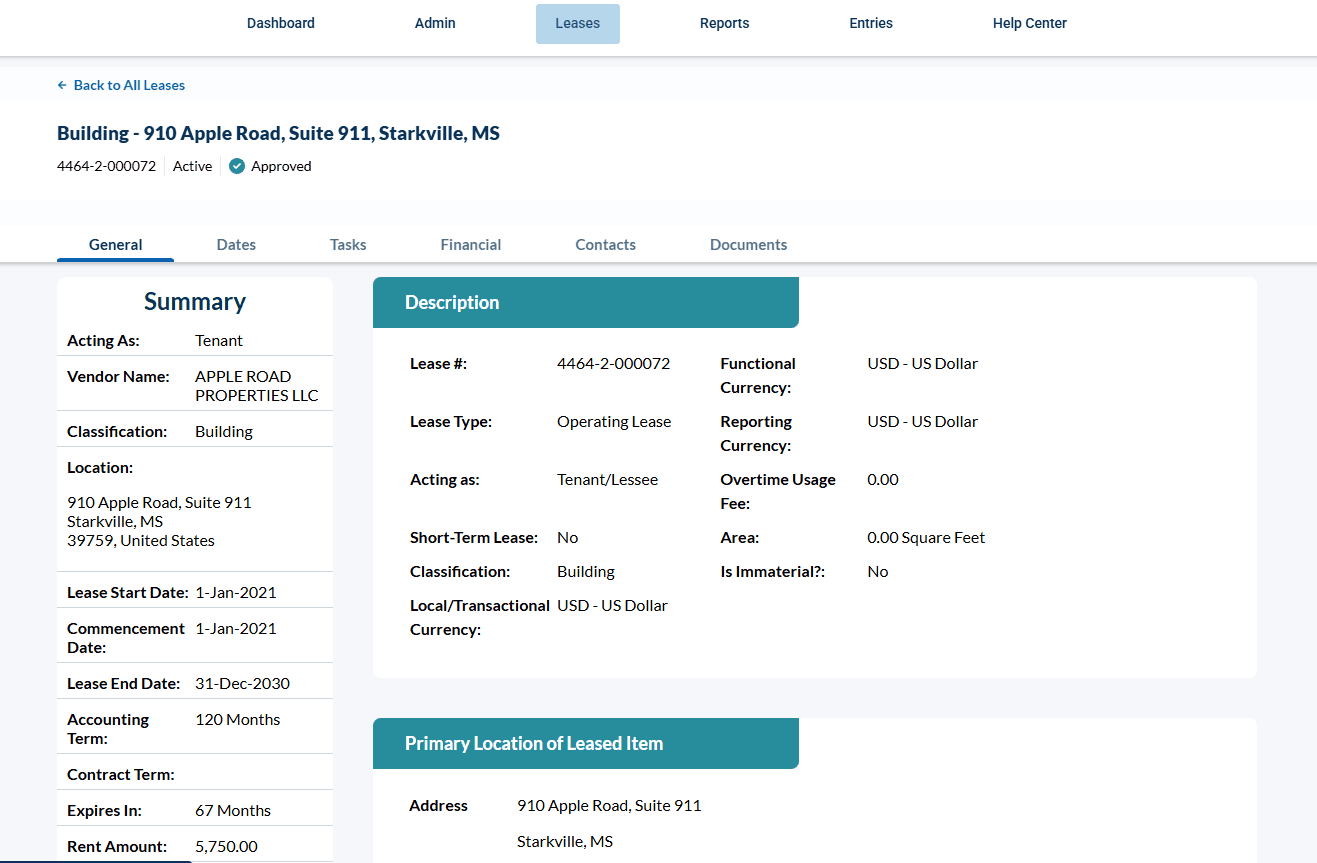

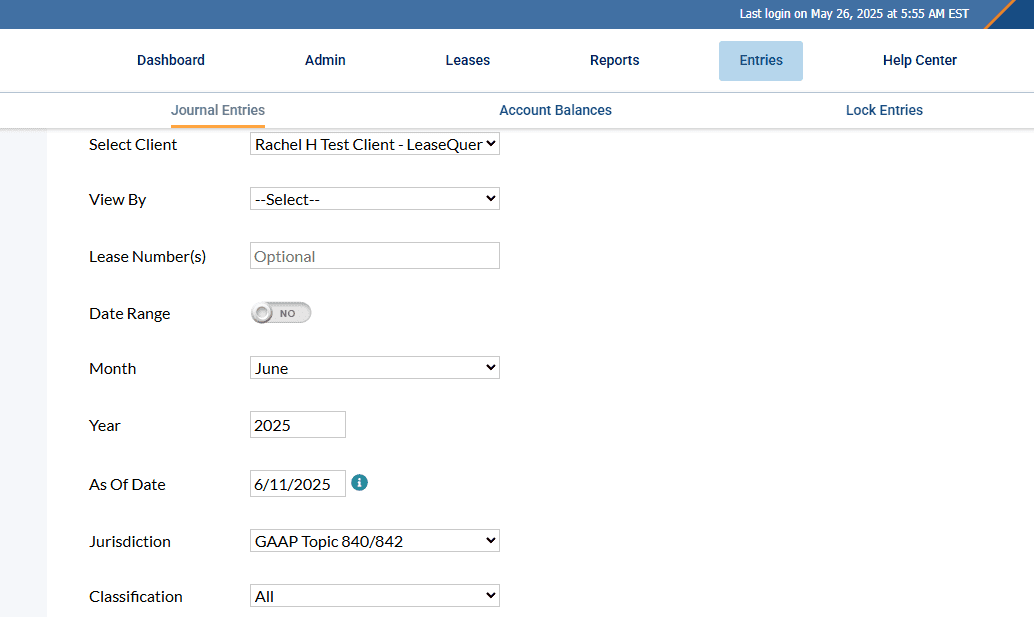

Proven Compliance: FRS 102 leases compliance out of the box including journal entries, amortisation schedules, and required disclosures.

Confident Audits: Efficient audit process enabled by a central lease repository and a single subledger with an audit trail.

How LeaseQuery Makes Your FRS 102 Transition Seamless & Compliant:

Transition Tools & Expertise

Precise & Professional Implementation

Seamless ERP Integration

Support for Your Clarity & Confidence

FAQs

Why should I choose LeaseQuery software?

Is LeaseQuery compliant with UK GAAP/FRS 102 20 for lease accounting?

FRS 102 20 broadly mirrors IFRS 16, with which LeaseQuery complies. The minor ways in which FRS 102 20 for lease accounting differs from IFRS 16 (rates available to use, low-value thresholds, etc.) are all items that are inputs to be determined prior to software use. As with all GAAP, there may be some UK- and Republic of Ireland-specific items that may need to be accounted for outside of the software, as we may not support the nuances of all local GAAP. Sign up for a demo to learn more.

Can LeaseQuery integrate with my existing technology?

LeaseQuery can integrate with any ERP so you can automate journal entries, consolidate data, and maximize your return on investment.

Does LeaseQuery's software support the specific disclosure requirements for FRS 102?

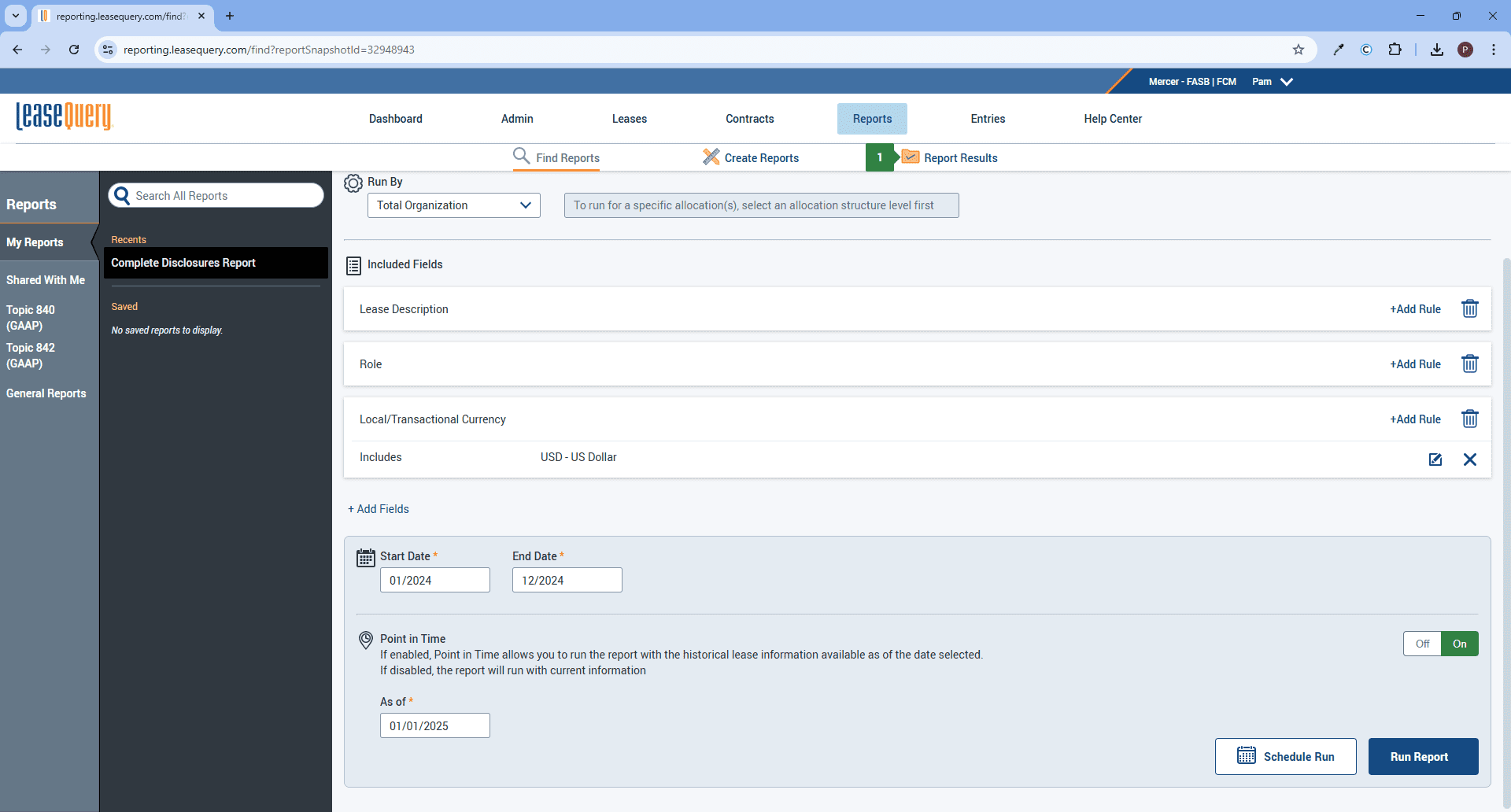

Yes, LeaseQuery provides pre-built disclosure reports specifically tailored to meet FRS 102 requirements. This includes quantitative information about ROU assets (by asset class), interest expense on lease liabilities, and other necessary details, saving your team significant time in report preparation.

How does LeaseQuery ensure its software stays current with any future changes to FRS 102?

Our team of accounting experts actively monitors pronouncements from the Financial Reporting Council (FRC) and other relevant bodies. We are committed to updating our software in a timely manner to reflect any changes to FRS 102, ensuring our customers maintain ongoing compliance.

key features