Determining which dates to capture from a lease agreement

Your organization has more than likely started compiling a lease portfolio in preparation for transitioning to the new lease standard GASB 87. Reviewing the various dates that each lease agreement contains usually brings questions regarding what dates are important.

Each lease will have a commencement date, a possession date, and an end date. Some leases may also include renewal dates at the end of the lease term. It’s imperative to capture these dates as they will impact your lease accounting.

The lease start date, or commencement date, is the date the lease document identifies as the day the lease term begins. From an accounting perspective, the lease commencement date is the date the lessee has the right to use the underlying asset. This date determines when the lessee recognizes the lease asset and lease liability unless the lease transfers ownership of the underlying asset or is a short-term lease per GASB 87.

The possession date is the date the lessee physically obtains the asset or is granted access to use the underlying asset. This date is usually the same as the commencement date. However, in cases where the lessee is granted access to or use of the underlying asset before the “commencement” date specified in the lease contract, the possession date is the date which triggers recognition of the lease asset and lease liability.

The lease end date is the date the lessee no longer has the right to use the underlying asset. The lease end date could be altered based on a renewal of the lease, early termination, or cancellation clauses. An applicable lease accounting software compliant with GASB can offer customizable alerts to track many of the multiple options that could affect your lease term and their related notification requirements so your organization can prepare in advance.

Where are the important dates in a lease contract?

When in the process of extracting important dates from your leases, first identify the commencement date – or the start of the lease term. The commencement date is usually explicitly written at the beginning of the lease contract.

The possession date is usually the same as the commencement date unless the date at which the lessee gains physical possession or access to use the asset is explicitly stated in the lease agreement.

The lease end date may be extracted in several ways depending on how it is stated within the lease agreement. Commonly the specific end date is stated within the term section of the lease agreement or is given as a factor of the lease term and its start date. For example, a contract may specify that the lease ends 36 months or three years from the commencement date rather than provide a specific date.

It’s imperative to review the lease in its entirety and consider all written terms and conditions including renewals, terminations, extensions, penalties, fiscal funding, and cancellation clauses when evaluating the lease term. Next, we will evaluate each part of the lease contract to review to define the lease term.

What is the lease term?

The lease term is the period of the agreement between a lessee and lessor when the lessee has a noncancelable right to use the leased asset owned by the lessor. The noncancelable period is included in the lease term because it is the period for which the lessee and lessor are legally obligated without the possibility of cancellation.

How to determine the lease term

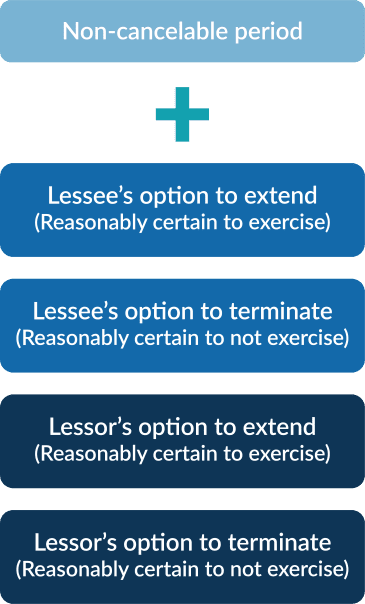

GASB 87 paragraph 12 is the section of the guidance which explains the portions of a lease agreement to include in the lease term. The total lease term is similar to a formula made up of:

All noncancelable lease periods plus any of the following:

- Periods covered by a lessee’s option to extend that the lessee is reasonably certain to exercise

- Periods covered by a lessee’s option to terminate that the lessee is reasonably certain to not exercise

- Periods covered by a lessor’s option to extend that the lessor is reasonably certain to exercise

- Periods covered by a lessor’s option to terminate that the lessor is reasonably certain to not exercise

When determining the lease term, options to review or terminate are included or excluded based on reasonable certainty. The concept is explained in paragraph 22 of the Basis for Conclusions for GASB 87. Reasonably certain is interpreted as a higher threshold than “probable” to exercise or not exercise an option. As you apply professional judgment in your evaluation of being reasonably certain to exercise or not certain options, document or support a probability higher than “more likely than not” or “probable”.

The graphic below offers a visual representation of the portions of the lease agreement making up the lease term:

Short-term lease

A short-term lease has a term of 12 months or less at the commencement of the lease term, including any options to extend or renew the lease, regardless of whether they are exercised. The key criteria for a short-term lease are:

- The lease has a maximum possible term under the lease agreement of 12 months or less

- Any options to extend the lease are included, regardless of the probability of being exercised

Lessees and lessors should recognize short-term lease payments as outflows of resources or inflows of resources based on the payment provisions of the lease contract.

Additional lease term considerations

Month to month / lease considerations

Per GASB 87 paragraph 16, for leases that are cancelable by either the lessee or the lessor, such as a rolling month-to-month lease or a year-to-year lease, the maximum possible term is the noncancelable period, including any required notice periods.

Fiscal funding or cancellation

Your lease portfolio may include a lease with a fiscal funding clause, which allows lessees to cancel the lease if the government does not appropriate funds for the lease payments. Fiscal funding clauses are treated like termination options and should reduce the lease term only if the clause is reasonably certain to be exercised.

Termination options

A termination option is the ability to cancel the lease before the end of the specified lease term, removing the lessee’s right to use the underlying asset. A lease agreement may offer a termination option to either or both the lessor and lessee. Only periods of the lease the lessee is reasonably certain not to terminate are included in the initial lease term.

Financial impact of the lease term

The main goal of GASB 87 is to accurately portray lease obligations and increase the usefulness of governmental financial statements. In order to facilitate that goal and report accurately, the lease term is used to calculate the lease liability and related lease asset appropriately.

The lease term is the timeframe over which the lease liability and lease asset are amortized to zero. The lease liability is calculated as the present value of the remaining lease payments expected to be paid during the lease term. However, the right-of-use asset will be adjusted taking into consideration prepayments, lease incentives, and initial direct costs before being amortized. Lease payments are allocated between a portion that reduces the lease liability and a portion that flows through the statement of activities as interest expense. A corresponding lease asset will also be recorded in the statement of financial position, which will be amortized over the assessed lease term if it is shorter than the useful life of the underlying asset.

Changing the lease term after initial lease entry

Lease agreements are often modified or reassessed by either or both parties after the commencement date. During the lease term, both the lessor and lessee may agree on changes to the noncancelable period, add an extended period, or the likelihood of exercising a renewal or termination option has changed. These events affect the lease end date, resulting in a new lease term. The date new information is known is the date changes to the lease term and/or lease payments should be made.

Summary

It’s important to analyze your lease agreements to extract the appropriate dates and lease terms. You must review all possible options and periods to ensure the accuracy of each amortization schedule. For lease portfolios of more than a few leases, consider a lease accounting solution like LeaseQuery as an efficient way to keep track of dates, notification periods, and changing lease terms.