What is government fund accounting?

Fund accounting is a system of accounting used primarily by nonprofit and governmental entities. It differs profoundly from the accounting system used by for-profit commercial organizations. The objective of for-profit organizations is to maximize revenue and profit whereas nonprofit and government organizations have the goal of providing specified services with a fixed amount of revenues allocated.

Fund accounting is the mechanism by which governments and nonprofits demonstrate their responsible use of the cash and other financial resources they receive. Being that governmental organizations often derive their income from taxes or answer to public authorities, and nonprofit entities are largely dependent upon donations from the public, governments or private institutions, fund accounting provides transparency around an entity’s use of its funding and resources.

The term “fund” refers to the different silos or checkbooks maintained in fund accounting to track and report on income allocated for specific expenses. While federal government and nonprofit organizations also use fund accounting, this article will focus on the fund accounting present within governmental entities falling under the jurisdiction of the Governmental Accounting Standards Board (GASB), including:

- State & local universities

- Public universities & school districts

- Airports & port authorities

- Water & sewage authorities

- Public universities

- Employee retirement systems

Different types of funds

A fund is a standalone accounting entity with a set of self-balancing accounts for tracking cash and other financial resources earmarked for the purpose of carrying out specific functions or activities. Governments use fund accounting to demonstrate fiscal responsibility to their resource providers.

With the use of funds, a governing body is able to establish and monitor how resources are allocated and spent, set and manage spending limits and achieve other fiscal accountability objectives.

GASB 34 is the standard which outlines the principles of fund accounting and introduces three overarching fund categories. Each of these main fund categories has their own fund types. They are as follows:

- Governmental Funds

- General Funds

- Capital Projects Fund

- Debt Services Fund

- Permanent Fund

- Special Revenue Fund

- Proprietary Fund

- Enterprise Fund

- Internal Services Fund

- Fiduciary Fund

- Pensions (& Other Employee Benefits) Trust Funds

- Investment Trust Funds

- Private Purpose Trust Funds

- Agency Funds

The purpose of each fund category, how they should be presented in governmental financial statements, as well as the basis of accounting to be used, are all clearly defined within GASB statement 34. Below, is a summarized view of each fund group.

1. Governmental Funds

This category is for the funds that track the basic activities of a government and serves as the catch-all for any fund type or function not recorded within the fiduciary or proprietary funds. Types of funds or activities within this category can be a general fund – sometimes referred to as a primary operating fund, special revenue, debt service, and capital project. Governmental funds use a modified accrual basis of accounting with the underlying premise being to report mostly readily available assets and liabilities expected to be used and paid back within a year. As a result, modified accrual financial statements of governmental funds don’t report long-term assets/liabilities like capital assets and debt.

As an example, if a local government institutes a penny tax to be used specifically to build a new bridge on a major intersection, the tax revenue collected is tracked in a special revenue fund and the construction of the bridge may be tracked in a capital projects fund, if it does not fall into an infrastructure or transportation department fund.

2. Proprietary Funds:

Proprietary funds are used to track and report the internal and external business-like activities within a government. Most resemble the accounting system of for-profit entities with revenue recognized when earned and expenses recognized when incurred, also known as the full accrual basis of accounting. An example of an external proprietary fund is an enterprise fund established by a state for revenues generated from the sale of lottery tickets. Departments which provide services to other departments within a government on a cost reimbursement basis are accounted for by internal services funds.

3. Fiduciary Fund:

The fiduciary fund category consists of funds where the government is serving as a trustee or custodian of resources for citizens, organizations, or other governmental entities. The government is restricted from using the funds, but holds them for a specific group, entity or activity. Common examples of fiduciary funds are pensions or other types of employee benefit funds. Fiduciary funds are reported under the full accrual basis of accounting.

As can be observed above, the various fund types not only differ in their practical use but also in terms of the basis of accounting applied to recognize revenue and expenditures. The governmental funds use a modified accrual basis which can be understood as a hybrid of cash and full accrual accounting. When it comes to revenues under modified accrual for governmental funds, they are recognized when reasonably available, measurable, and collectible in the current period or soon after that; more akin to cash basis accounting. Whereas expenditures are recognized when a liability is incurred which follows along the line of full accrual accounting with certain exceptions. On the other hand, fiduciary and proprietary funds both use the full accrual basis similar to commercial entities.

When it comes to providing government-wide financial statements at year-end for the Annual Comprehensive Financial Report (ACFR), governments utilize the full accrual basis of accounting. As a result, the annual reporting process requires the preparation of conversion entries to convert the governmental funds from the modified accrual basis they employ to the full accrual accounting basis necessary to consolidate all funds into one government-wide financial statement.

Fund accounting & GASB 87

With the advent of GASB 87, governmental reporting entities are now required to capitalize all leases falling under the guidance as finance leases and recognize both a lease liability and a right-to-use lease asset.

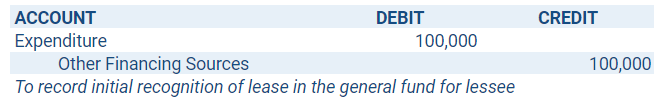

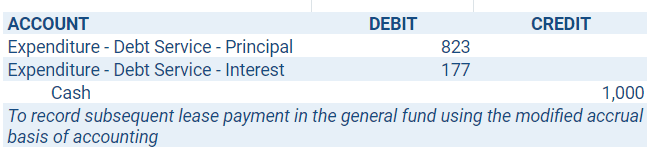

GASB 87 paragraph 34 notes that from a lessee’s perspective, leases financed from general government resources are reported under the governmental fund with an entry to record both an expenditure (equivalent to the lease asset) and other financing resources (equal to the lease liability) in the period the lease is recognized. Subsequent payments on the lease are handled similarly to debt service payments on long-term debt. Examples of the initial entry and a subsequent entry in a government fund are below:

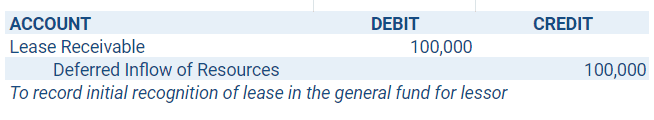

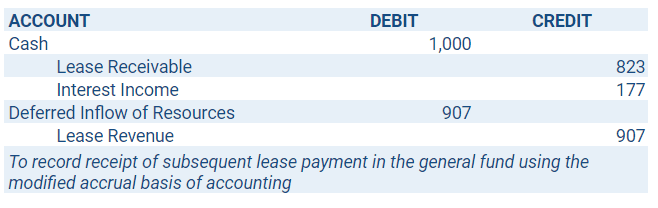

From the lessor’s standpoint, the guidance outlines the receivable recorded in the initial recognition of the lease should be treated no differently than any receivables reported under the general fund. As such, a lessor would recognize a lease receivable and deferred inflow of resources at the inception of the lease and gradually amortize both as payments are received over the lease term. Examples of the initial entry and a subsequent entry for a lessor in a government fund are below:

If facts and circumstances for the lease cause it to be appropriately accounted for under a specific department with a proprietary fund, the lease is initially recorded under the full accrual basis of accounting and year-end conversion entries are only necessary for preparation of the annual government-wide financial statements. This article GASB 87 Accrued Interest Example: Calculating the Liability Amortization provides more examples of lease accounting entries under GASB 87 and within the various funds.

Summary

This article serves as an introduction to fund accounting for entities reporting under the Governmental Accounting Standards Board (GASB). Government reporting entities whose portfolio consists of leases that fall in scope for GASB 87 reporting will be required to recognize a lease asset and liability if they are the lessee, or a receivable and corresponding deferred inflow of resources as a lessor. If capturing the activity within the governmental fund, a conversion entry will be necessary at year-end to convert from the modified accrual accounting to the required full accrual for the government-wide financials.

If your organization is in the process of becoming compliant with GASB 87, a software solution purpose built for lease accounting with government accounting in mind, much like LeaseQuery, can help manage these calculations and journal entries in accordance with the financial reporting requirements under both GASB 34 and GASB 87.