Fund accounting in brief

Government or public-sector organizations receive taxes, grants, and donations which must be spent on certain things, and sometimes are spent to provide public goods or services which don’t generate revenue. Government entities do not function like private-sector businesses, which sell goods and services for a profit and spend money for the purpose of generating more revenue.

Because of this, government accounting is different from for-profit accrual accounting. For day-to-day accounting and financial reporting, governments tend to focus on accounting in terms of funds, which behave like their own unique accounting entity and serve a specific purpose.

Three types of funds exist:

- Governmental funds are for activities supported by taxes, grants, or other types of regulatory income and use a modified accrual basis of accounting.

- Proprietary funds capture the business-like activities of a government that create their own income, such as lottery ticket sales.

- Fiduciary funds capture all monies the government serves as a custodian of, such as employee benefit plans.

Proprietary and fiduciary funds use the full accrual basis of accounting, like the private sector.

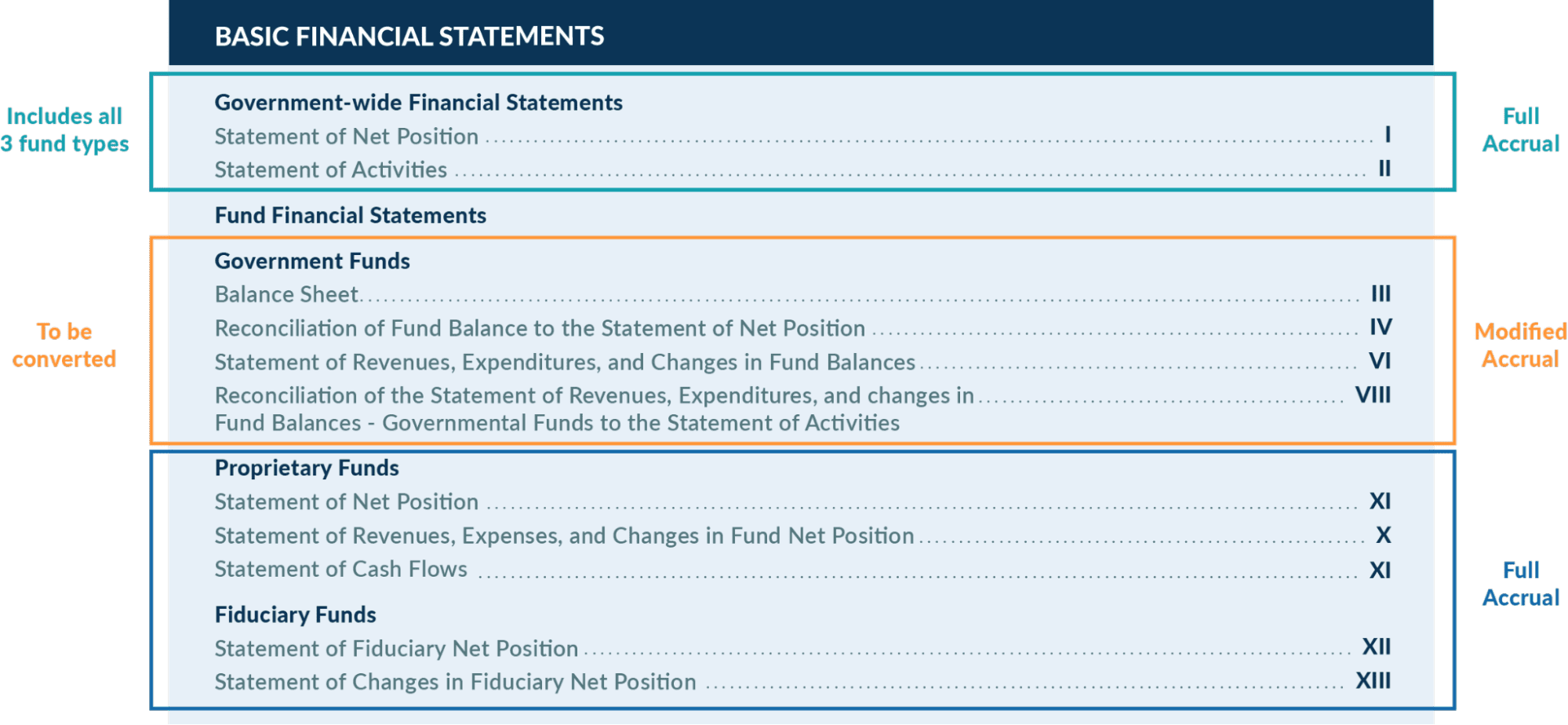

At the end of the fiscal year when government entities prepare their financial results, they first present the information at the fund level with a financial statement for each of the three fund types. The governmental fund type, which is kept on a modified-accrual basis, must then be converted from the modified-accrual basis to full accrual accounting and to be presented in tandem with the proprietary and fiduciary funds in the government-wide statement of net position and statement of activities.

Below is an example of the table of contents from an Annual Comprehensive Financial Report (ACFR) highlighting the organization of these different financial statements.

To learn more about fund accounting and how it ties into GASB 87 Leases, check out our article “Government Fund Accounting: Types of Funds and Leases under GASB 87 with Journal Entries”.

The focus of this article is the accounting considerations for leases under GASB 87 and how they become part of the statement of net position and statement of activities under GASB 34.

GASB 87 lease accounting during the year

GASB 87 is the new accounting standard for leases which requires public-sector entities under the jurisdiction of the Governmental Accounting Standards Board to represent all lessee leases as finance leases and recognize both a lease liability and a right-to-use asset. We know leases are one entity paying another for the right to control a certain tangible asset over a specified period.

Therefore public-sector entities logically could have leases recorded to either the governmental or proprietary fund type, depending on what department or function they relate. For example, a building lease might be recorded to a governmental fund because the property serves the whole government, while vehicles or certain equipment may be specific to a public service such as their police force. As such, leases can either be accounted for using the full accrual method in a governmental fund, or the modified accrual method in a proprietary fund.

Governmental fund and modified accrual leases

Recall from above the governmental fund is the accounting mechanism for government activities supported by taxes, grants, or other legislative funds, and is accounted for under the modified accrual basis of accounting.

Modified accrual is a hybrid approach between cash basis accounting and full accrual accounting. With modified accrual, revenues are recognized like the cash basis and accounted for when measurable and available. Expenditures are inherently accounted for under the full accrual basis because they are always measurable when incurred. To learn more about how GASB 87 leases are initially recognized within a governmental fund, check out our article “Government Fund Accounting: Types of Funds and Leases under GASB 87 w/ Journal Entries”.

Proprietary fund and full accrual leases

Secondly, recall from above the proprietary fund is the fund which handles all the business-like activities in which a government engages. Accounting for proprietary fund leases will recognize expenses when incurred, which is the full accrual basis of accounting. To learn more about how GASB 87 leases are initially recognized within proprietary funds, check out our article “GASB 87: Summary and Example of Accounting for a New Lease Arrangement for Lessees”.

GASB 87 lease accounting at year-end and GASB 34 consolidation

GASB Statement No. 34 is one of the most significant public-sector accounting rule changes ever put in place. Going back to 1999, it requires entities under the GASB jurisdiction to convert their governmental funds to full accrual accounting to report all fund-level activity together.

Governmental fund and modified accrual leases

Because governmental fund statements use modified accrual accounting, they need to be converted to full accrual to be consolidated into the government-wide statements of net position and activities.

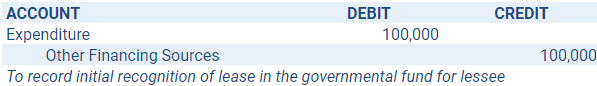

The first entry a lessee makes to account for a governmental fund lease is a debit to expenditure to establish what is essentially the lease asset, and a matching credit to other financing sources to establish what is essentially the liability, as illustrated in the example below:

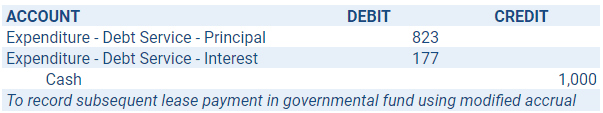

Ongoing payments are made to the lessor as defined by the lease agreement. The payments are recorded as a credit cash for the amount paid and debit a combination of debt service expenditure principal and debt service expenditure interest, as illustrated in the example below:

At the end of the year to convert to full accrual accounting, the total expenditures recognized for the lease are credited to reduce the balance to zero with a corresponding debit recorded to establish the GASB 87 lease asset. Conversely, the total amount of other financing sources are debited to also reduce that balance to zero and a corresponding credit will establish the GASB 87 lease liability. For a full description of these conversion entries for modified accrual leases, check out our article “GASB 87 Accrued Interest Example: Calculating the Liability Amortization”.

Financial statement presentation

So, what is different about governmental fund leases as presented in the fund-level statements versus the government-wide statements? Since governmental funds are accounted for during the year with the modified accrual basis of accounting, they have to be converted to full accrual accounting at the end of the year to be consolidated with the government’s other funds to create government-wide statements. Under GASB 34 government organizations must present three things:

- Their fund type financials before conversion

- Their consolidated government-wide financial statements

- A reconciliation of the conversion of the modified accrual basis financials to the full accrual basis.

The reconciliation for the statement of net position shows the conversion of certain modified accrual accounts such as capital outlays or deferred inflows/outflows of resources to the appropriate full accrual accounts such as capital fixed assets or long-term debt. There is a second reconciliation that shows the conversion of the statement of changes from modified accrual to full accrual accounting. For example, the total amount of capital outlays are reported as expenditures when incurred in the modified accrual basis of accounting, but in the full accrual basis of accounting the cost of those assets is capitalized and then allocated over an asset’s estimated useful life as depreciation expense.

Proprietary fund / full accrual leases

Because proprietary funds already use full accrual accounting, their lease account balances simply need to be combined with the lease account balances of any other proprietary funds when presented in the government-wide statements of net position and activities.

Summary

Government entities with leases falling in the scope of GASB 87 will either account for those leases with full accrual accounting methodology in the proprietary funds, or the modified accrual accounting methodology within governmental funds. If capturing the activity within governmental funds, conversion entries will be necessary at year-end to convert from the modified accrual basis of accounting to the full accrual basis of accounting required for government-wide financials. To be transparent with financial statement users about how this conversion was performed, a reconciliation is also presented within the government-wide financials.

If your organization is in the process of complying with GASB 87, a software solution purpose-built for lease accounting, such as LeaseQuery, can help manage these calculations under the financial reporting requirements under GASB 87 and GASB 34. LeaseQuery can provide you with both full accrual and modified accrual journal entries during the year as needed and can provide you with the conversion entries necessary to adjust from modified accrual to full accrual basis at the end of the year.

Related articles