This article is part of a series of articles covering equity method accounting in accordance with ASC 323 Investments – Equity Method and Joint Ventures. This series will cover broader, less complex equity method investment transactions and progress to more specific and complicated scenarios. We will introduce the concepts and then provide a realistic example with calculations and journal entries to illustrate.

In this article, the focus will be on how to account for partial disposals of equity method investments, highlighting the proper accounting treatment when the investor loses significant influence. For a refresher on the principles of equity method accounting, please see this article: The Equity Method of Accounting for Investments and Joint Ventures under ASC 323.

Equity method

The equity method of accounting applies when an organization invests in a company and exercises significant influence over, but does not control, the company. Equity investments in a separate entity can be held in the form of common stock of a corporation or a capital investment in a partnership, joint venture, or limited liability company. For the equity method of accounting to apply to the investment, the organization must have the ability to influence the operating and financial decisions of the investee.

Per ASC 323, the equity method of accounting is applicable to the following types of investments:

- Common stock

- In-substance common stock

- Capital investment

- Undivided interest

Equity method of accounting

The investor measures the initial value of an equity method investment at cost, recording the investment as an asset offset by the consideration exchanged. The value of the investment is increased by the investor’s proportionate share of the investee’s current period net income. On the other hand, the investment is decreased by the investor’s portion of the investee’s current period net loss, distributions, and dividends. The investment asset continues to be increased/decreased until the investment is disposed of or the investee’s portion of accumulated losses exceeds the investment balance.

Partial disposal

Generally, an investor’s portion of an equity investment is reduced in one of two ways, either:

- Sale of the investment, or

- Dilution of shares

When an investor disposes a portion of their equity investment, the transaction is treated as a sale. The carrying value of the sold portion of the investment is derecognized, offset by any consideration received. If the consideration received is more or less than the carrying amount disposed of, a gain or loss on the transaction is recorded in net income.

Once the investor has recorded their partial disposal, they must determine how to account for the remaining investment. If the investor retains significant influence over the investee, they will continue to account for the investment under the equity method of accounting. However, in order for the equity method of accounting to apply, the investor must maintain significant influence over the investment.

From time to time an investor may lose significant influence while still owning a portion of the investee, and therefore, the application of equity method accounting must be suspended. After a sale or dilution of shares which decreases an investor’s influence to an insignificant level, the investor transitions to applying ASC 321, Investments – Equity Securities (ASC 321) to account for its remaining investment. Under ASC 321, the investor measures an investment at fair value and recognizes any changes to fair value in net income.

Fair value measurement

When an investor shifts to measuring their remaining equity investment under ASC 321, the investor establishes the initial carrying amount of the investment immediately following the sale and then adjusts the carrying value of the investment to be its fair value with an offsetting entry to net income.

Fair value measurement alternatives

In some instances, the fair value of the investment may be indeterminable. In this case, an alternative method for measuring the investment exists. The alternative is to measure the investment as cost less any impairment, plus or minus any observable price changes in an orderly transaction for a similar investment of the same issuer.

If the investor will be applying the fair value measurement alternative to the investment once they no longer have significant influence, ASU 2020-01 Investments–Equity Securities (Topic 321), Investments–Equity Method and Joint Ventures (Topic 323), and Derivatives and Hedging (Topic 815) (ASU 2020-01) provides updated guidance on the use of fair value measurement alternatives. Previously two views existed on how the investor should establish the initial carrying value amount under ASC 321.

View A: The investor establishes the carrying amount of the investment as the existing carrying amount from when the investor stopped applying the equity method under ASC 323.

View B: The investor adjusts the carrying amount of its remaining investment to fair value if and when it is discontinuing the equity method. This is because the sale represents an orderly transaction for an identical or similar investment of the same issuer, and therefore, the investor is able to use the transaction to determine fair value for the investment they retained.

ASU 2020-01 was effective for public entities with fiscal year ends beginning after December 15, 2020 but will not be effective for private entities until after December 15, 2021. For public entities, ASU 2020-01 clarifies that when an entity transitions to accounting for an investment under ASC 321 and will use the fair value measurement alternative, the investor must consider all observable transactions. This will include the transaction which resulted in the dilution of ownership leading to fair value accounting.

Ultimately, this means companies will shift to only applying view B as they adopt ASC 2020-01 and view A will phase out as an option.

Example: How to account for an equity method disposal resulting in a loss of significant influence

To illustrate the accounting treatment of a partial equity method disposal resulting in a loss of significant influence, let’s walk through an example. Initially, Company A purchases stock in Company Z equating to a 25% ownership in Company Z for a purchase price of $500,000. Company A’s 25% ownership provides them significant influence over the operational and financial decisions of Company Z. Therefore, Company A records their investment in Company Z using the equity method of accounting.

Initial measurement

Company A records the initial value of their equity method investment at cost as a debit to an investment account and a credit for the cash payment. The investment is recorded in the period the transaction is made with the following journal entry:

Subsequent disposal

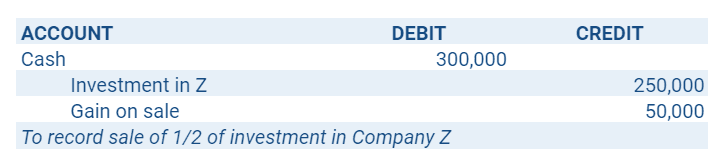

During the first year of ownership Company Z realizes no income or loss. Therefore at the end of year one, Company A’s investment in Company Z remains $500,000. Company A sells one half of its 25% investment to a third party investor for $300,000 cash and recognizes a gain on the sale of $50,000 ($500,000 x .5 – $300,000). The entry to record the sale is as follows:

Due to the reduction of ownership from 25% to 12.5% (25% x .5), Company A no longer has significant influence over Company Z. Company A must now transition to accounting for their investment in Company Z under the fair value method as prescribed by ASC 321. Assuming Company A is a private company for this example, below we present the two different methods of applying the fair value method after the partial sale of the investment.

View A: Company A establishes the carrying amount of their investment in Company Z as $250,000, the carrying amount when the investor ceased having an equity method investment. Furthermore, the balance of Company A’s investment in Company Z is $250,000 after the transaction and no other entries are required.

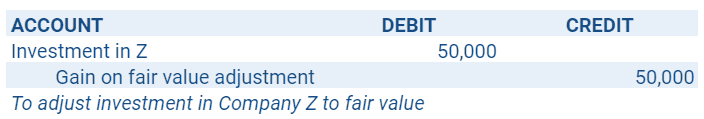

View B: Company A adjusts the carrying amount of its remaining investment to the fair value based on the recent sale because the sale represents an orderly transaction for an identical or similar investment of the same issuer. In this instance the fair value of the remaining 12.5% investment will be adjusted to $300,000, which is the sale price of 12.5% of Company Z to a third party. The entry to record the adjustment to fair value is:

Summary

In this article, we discussed how to account for partial disposals of equity method investments as outlined in ASC 323 Investments – Equity Method and Joint Ventures. In summary, a disposal of a portion of an equity investment, is treated as a sale. The carrying value of the sold portion of the investment is derecognized and any consideration received in excess of or below the carrying amount disposed of is a gain or loss on the transaction recorded in net income.

When the partial disposal of an equity method investment results in the loss of the investor’s significant influence over the investee, the investor must transition to accounting for the investment using the fair value method under ASC 321. If the fair value of the investment is indeterminable, the investor may be able to use a fair value measurement alternative.

This was one part of our equity method series. Stay tuned for additional articles further discussing specific and increasingly complex scenarios and examples under equity method accounting.