2. Creating operational budgeting goals

3. Largest expenses of the operating budget

4. Determining key performance indicators (KPI’s)

5. Steps to create an operating budget template with examples

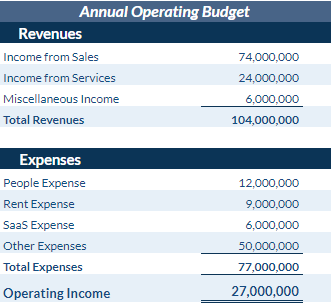

- Step 1: Create an annual budget

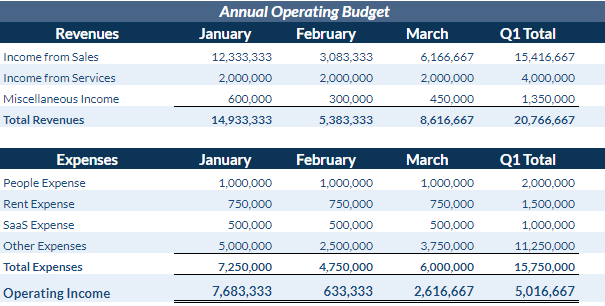

- Step 2: Create a monthly budget from the annual budget figures

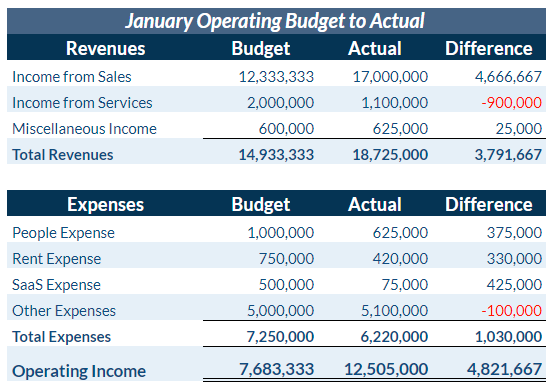

- Step 3: Compare budgeted amounts to actual performance

6. Summary

Operating budget defined

The operating budget, also known as the corporate budget, is a comprehensive plan of an organization’s revenues and expenses for the upcoming fiscal year. The operating budget is created and approved annually and then compared to actual results throughout the year to track progress toward the organization’s financial goals. The budget should include expected revenues along with various types of expenses which may incorporate fixed, variable, and one-time costs.

What is the importance of the operating budget?

The operating budget is critical to help organizations make informed decisions as well as to measure performance and growth. An annual operating budget should reflect the goals of an organization for the upcoming year. Depending on the stage a business is in and the nature of its operations, operating budgets can vary.

Operating budget vs. capital budget

While this article is primarily focused on the operating budget, various types of budgets exist. A capital budget is similar to an operating budget in that it estimates future cash inflows and outflows. However, the key difference between an operating budget and a capital budget is that a capital budget is more focused on the long-term investment of resources and whether or not they’ll be worthwhile. The operating budget is focused on day-to-day operations and the immediate future.

Creating operational budgeting goals

Each organization’s operating budget is unique and should be created with specific goals in mind. Whether your organization is looking to increase revenue or reduce expenses, start with a good record of what happened in the past year and understand some of the organization’s strategic plans for the coming year.

Increasing revenue

Increasing revenue can be the primary objective of an organization for many reasons. If a company, such as a startup, is still in its early stages, increasing revenue is likely a primary objective to stay in business or entice investors. Companies belonging to high-growth industries, such as the SaaS sector, are always innovating and adapting with new strategies and products hoping to increase revenue and, as a result, market share.

When increasing revenue is a key aim of the operating budget, consider all sources of revenue. Many companies have multiple products and/or services, which means multiple streams of income. Additionally, both new customers and existing customers are sources from whom income can be earned. For example, a software company may sell subscriptions to net new customers to generate revenue while also increasing revenue through renewals and negotiating new rates with existing customers.

Some organizations prioritize increasing market share while others are focused on increasing profit margins through pricing changes. While bringing on new customers and grabbing market share is important, it is easier and less costly to keep an existing customer than to sign a new customer, so it is worthwhile to strategically focus efforts on existing customers in many cases.

Projecting revenue requires a balance – set a challenging or optimistic goal to be motivational, but at the same time it must be reasonably achievable. Some factors to consider when estimating revenue can be historical trends and past year-over-year growth. Many industries experience seasonal peaks and dips, so each month or quarter in the budget may look different. Prices of products or services will be another factor in this estimation – is your business strategy to keep prices competitive and predictable or are you planning any increases in the near future? Demand and competition are of course important in answering these questions. To be more precise in estimating revenue, many organizations utilize calculations and models ranging from simple to complex to assist with projections.

Examples of revenue estimation models include:

- Historical perspective – a simple but proven method

- Length of sales cycle approach – predicting how long it will take for a customer to purchase from you

- Test market analysis – determining if a market for a new product or service exists by testing it on a small scale first

- Multivariable analysis – a more complex model factoring supply and demand, kinds of promotions and marketing campaigns, seasonality and macroeconomic factors amongst other relevant considerations

Organizations may use one of these approaches, or more likely, a combination of approaches. Predicting revenue isn’t effortless, however with time, creating the annual revenue budget may come more efficiently.

Cutting expenses

Many organizations focus more on cutting expenses. Managing expenses can be overwhelming, as it is hard to track costs in an organized manner. To create the annual expense budget, it is essential to have a good system with accurate records of current costs. Consider any long-term goals of the organization in the event new expenses are to be expected. Leverage the capital budget to predict large purchases whether those be for machinery, equipment, or an acquisition.

First, ensure the list of the current year’s expenses is complete and accurate. Establish good interdepartmental communication so you are aware of costs being incurred throughout the business. An organized record keeping system is key, as well, whether it is managed in spreadsheets or a software program. New expenses may have been incurred since the last operating budget was created, so the finance team needs to have access to a full detail of all departments’ spending.

Additionally, sort expenses into different categories – fixed, variable and one-time. Fixed payments are generally more predictable. However, consider if there are any new fixed costs to expect. Variable expenses need to be estimated, but can be somewhat consistent, too. These are often based on factors like usage, so consider if usage is expected to stay the same, increase or decrease in the coming year. One-time expenses are usually situational. Understanding the company’s strategic plans is the best way to predict these expenses.

Once current expenses are deemed complete, accurate and categorized, look for areas for improvement. Some approaches to cutting costs may include:

- Reduce usage, production costs or overhead where possible

- Identify potential waste such as spending money on underutilized equipment or services or unused software licenses, or “zombie accounts“

- Explore cost efficiencies with alternative products or vendors for products or services used in everyday operations

- Automate processes or go paperless

- Consider whether leasing or buying assets used in day-to-day operations is more cost efficient

- Consider current economic climate, such as inflation and interest rates and plan accordingly whether those are advantageous or not

Largest expenses of the operating budget

Regardless of the goals of your organization, monitoring and accurately estimating expenses is important when creating the operating budget. Certain expenses are almost always the largest areas of a company’s spend.

People expense

People expense, or the costs a business incurs to compensate and retain employees, contractors, and temporary hires, is typically the largest expense of any organization. These expenses do not only include actual salaries and wages but also the various taxes and benefits employers are obligated to cover. When creating the operating budget, factor in potential new hires, employee retention rates, and raises, as well as overtime and bonuses. Also consider if you have a busy season or a significant event in the upcoming year like an acquisition.

Rent expense

Rent expense is the second largest expense for many organizations. The real estate market is very sensitive to macroeconomic factors, so monitoring those sorts of aspects is important for this particular expense estimate. Additionally, you may have leases for years into the future, so those contractual terms can be included in the operating budget. Therefore, it is important to have a central repository for lease agreements. Determine if any renewals are coming up and whether to expect any corresponding rent escalations.

Many leases have both fixed and variable components to be aware of, as well. Outside of base rent, common area maintenance (CAM) charges, property taxes, and insurance are common costs related to leases. Many companies have only just recently adopted ASC 842 which resulted in the obligations for operating leases being presented on the balance sheet. This resulted in finance teams paying more attention to leases than they did in the past and many looking for automated solutions for both tracking and accounting for their leases.

Saas spend

Saas spend is a fast-growing expense, rapidly expanding to earn a spot in the top operating expenses. As it continues to grow for companies across the globe, more scrutiny is being applied to the SaaS spend budget. While it is relatively new, these costs are climbing at an exponential rate for many organizations. As businesses are looking at ways to reduce costs and increase efficiency through automation, different departments are entering into various software subscriptions.

Many organizations have no current method of tracking their SaaS products outside of a spreadsheet manually maintained by IT. As different departments may use various software programs, communication between teams is critical to tracking these specific costs. The terms of these contracts are not usually long periods of time, so it is important to monitor upcoming renewals and potential related price increases. We recommend documenting more data than just a list of software program names. Track the number of licenses associated with each application and how often programs are actually being used to identify areas where SaaS spend can be reduced.

Determining key performance indicators (KPIs)

Once the annual budget is approved, you can refer to it throughout the year, updating it with actual revenues and expenses and then analyzing your budget to actual results.

What are KPIs?

Key performance indicators, or KPIs, are quantifiable metrics used to assess the performance of your operations. Many different types of KPIs exist, so determine which are most relevant to the nature of your business. Financial KPIs are always relevant in creating the operating budget, but consider other KPIs such as those related to logistics, manufacturing, sales, and marketing, depending on the goals and focus of the organization.

Examples of operational KPIs

Some common examples of financial KPIs used to create and monitor the operating budget include:

- Gross Profit Margin – dividing gross profit by revenue in order to assess profitability

- Accounts Receivable Turnover – dividing net credit sales by average accounts receivable in order to assess efficiency

- Accounts Payable Turnover – dividing total purchases by average accounts payable balance in order to assess liquidity

- Working Capital – subtracting current liabilities from current assets to assess liquidity

- Operating Cash Flow – subtracting operating expenses from revenue/sales to focus strictly on cash flow/liquidity and ignore accrual basis items/non-cash expenses, such as depreciation or amortization

Outside of strictly financial KPIs, other metrics can be important to consider for operating budget estimates. Examples of these could include:

- Customer Retention and Satisfaction Rates – typically expressed as a percentage and found through CRM data analysis and reviews from online sources

- On-time Delivery – number of items delivered on time divided by the total number of items delivered times 100 to be expressed as a percentage

- Order Accuracy – number of accurately filled orders divided by the total number of orders x 100 to be expressed as a percentage

- Marketing ROI’s – monitoring website traffic and conversion rates from marketing lead sources

- Employee Turnover and Satisfaction Rates – measure turnover by dividing the number of employees who left by the average number of employees times 100 to be expressed as a percentage coupled with HR surveys and skip level meetings to assess satisfaction

Steps to create an operating budget template with examples

Step 1: Create an annual budget

Start by creating an annual operating budget template that can be rolled forward with updated revenue and expense estimates each year. You may find an operating budget sample online, but be sure to include revenue streams and expense types relevant to your organization. If you are using the prior year’s operating budget as a starting point, update it annually to include new sources of revenue or costs. For example, any new products or services, acquisitions, or new types of expenses, such as SaaS spend.

Step 2: Create a monthly budget from the annual budget figures

Create a budget for each month or quarter of the year by distributing the annual budget amounts across the year. It may make sense to allocate total annual revenues and expenses evenly to each month and/or quarter. However, if your business is cyclical, experiences busier periods, or expects any significant events at certain points during the year, factor those items into your allocations.

Step 3: Compare budgeted amounts to actual performance

On a periodic basis, compare the actual amounts earned and incurred to those included in the annual budget. This will help to measure performance and build a more accurate operating budget in the next fiscal year. Analyze the results using the KPIs pertinent to your organization.

Summary

Setting the operating budget for the year is an important process. The operating budget is focused on the day-to-day operations of the upcoming year and is based on the strategic goals of the company. Once these goals are initially created, the budget can be periodically compared to actual results and relevant KPIs can be used to track progress toward those goals and help the company measure success.