3. Who are the lessor and the lessee in rental agreements?

4. What is lessor’s risk insurance?

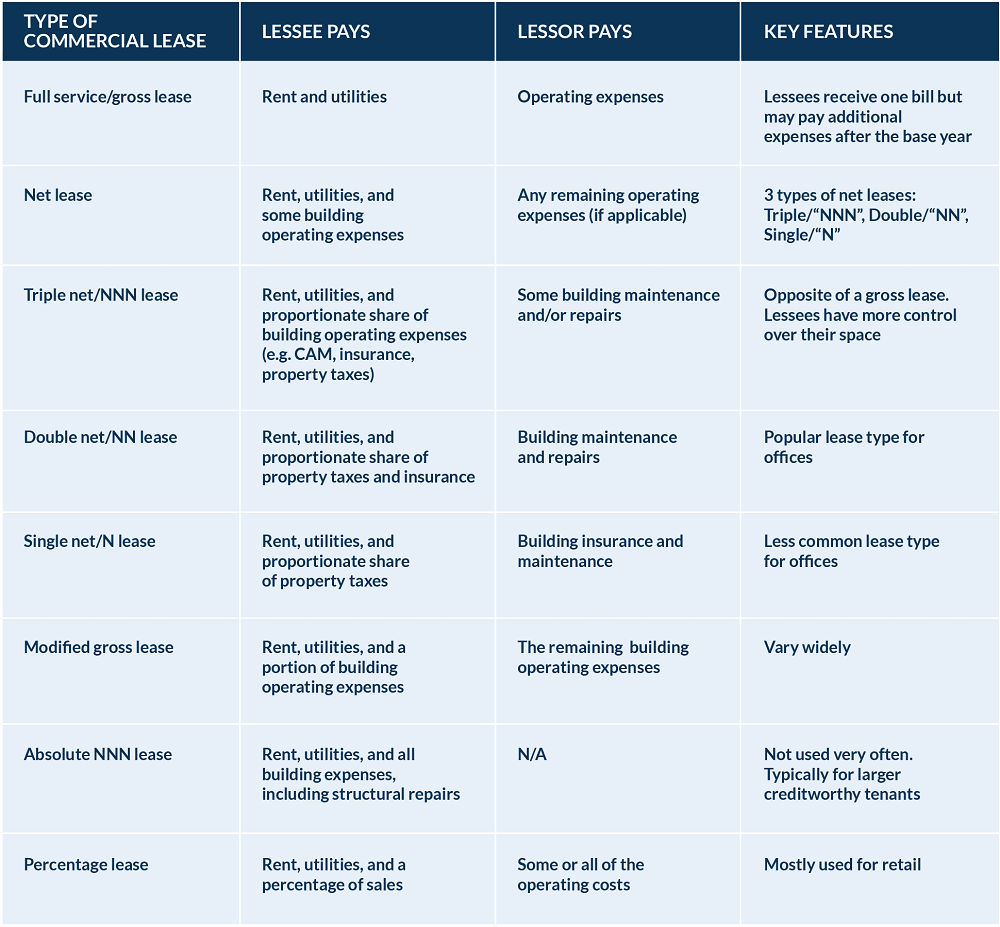

5. Differences in lessor vs. lessee obligations under different types of commercial lease agreements

- Gross leases

- Net leases

- Modified gross lease

- Absolute net lease / absolute NNN lease

- Percentage lease

6. Lessee vs. lessor accounting under the new lease accounting standards

7. Summary

The terms “lessor” and “lessee” are seen all over rental agreements. A lease cannot exist without two parties participating in the agreement: the lessee and the lessor. This article explains who is the lessor and who is the lessee in various types of leasing arrangements as well as what their obligations are under the different types of commercial lease agreements and how to account for them under multiple lease accounting standards.

Lessee meaning

A lessee is an entity that is paying for the right to use an asset that’s owned by another party. The contract allows the lessee use of an asset for an agreed-upon price or amount of consideration. For example, if a car dealership leases a vehicle to someone, the car is the asset. The person renting the car is the lessee and the dealership is the lessor. The lessee pays the dealership, or lessor, for the right to use the vehicle for an agreed-upon amount of time. Under the new lease accounting standards, the lessee is required to recognize an intangible right-of-use asset along with a lease liability when accounting for the lease.

Lessor meaning

A lessor is an entity that is allowing another party to use an asset in exchange for something, such as a cash payment. For example, an entity owning a building may allow a company the right to use its building for office space. The owners of the building are the lessor and the company is the lessee.

Lessor vs. lienholder

A lessor shares similarities with a lienholder, but they aren’t the same. Leases have lessors, and liens have lienholders, also known as lenders or creditors. A lien is the legal right of a creditor to take possession of an asset to fulfill a debt or contractual obligation. A lienholder has a legal interest in an asset for which they provided the funding until the loan is paid in full. A lessor may or may not own the asset which they are leasing to the lessee. If a lease is in default, the lessee loses its right to access the asset.

For example, when a person obtains a car from a dealership, they have the option to buy the car, sometimes by taking out a loan, or to lease the car. In either scenario the entity offering the financing – either the loan or the lease, will likely place a lien on the vehicle being financed. The lienholder then has the right to seize the car if the agreed-upon payments are not made.

Who are the lessor and the lessee in rental agreements?

The terms, “lessee” and “lessor,” apply to leases of real estate, equipment, and various other types of assets. In property/real estate rentals, the lessor is the individual or entity that is allowing someone to rent their property. The lessee is the tenant or party who has the right to use the property.

Commercial real estate

In commercial lease agreements, the lessor is the person granting a lease for use of commercial space. The lessee and lessor come to an agreement establishing the lessor’s rights and obligations for the duration of the lease, as well as the periodic payments the lessee will provide to the lessor.

Lessor and lessee in subleases

In a subleasing agreement, the roles of lessor and lessee become a bit more complex due to the involvement of an additional party. The original lessee, who is leasing the asset from the primary lessor, becomes the sublessor when they decide to lease the asset, or part of it, to another party. This new party is known as the sublessee. Essentially, the sublessor is both a lessee in relation to the primary lessor and a lessor in relation to the sublessee. The sublessee, in turn, interacts exclusively with the sublessor and has no direct contractual relationship with the original lessor. This layered structure means that the sublessor is responsible for fulfilling the obligations of the lease agreement with both the original lessor and the sublessee.

For more information about subleases, read our blog, “Sublease Accounting under ASC 840 and ASC 842.”

Sale-leaseback transactions

In a sale-leaseback agreement, the roles of lessor and lessee are established through a unique financial arrangement. Initially, the owner of an asset, typically a piece of real estate or equipment, sells the asset to another party. The original owner then leases the asset back from the buyer. In this scenario, the original owner becomes the lessee and the buyer becomes the lessor. The purpose of such transactions is often to free up capital while still retaining the use of the asset. By entering into a sale-leaseback agreement, the original owner can convert an illiquid asset into liquid capital without disrupting their operations, while the new owner, now the lessor, gains a steady income stream from the lease payments.

To learn more about sale-leaseback transactions, read our blog, “Sale-Leaseback Transactions and Accounting under ASC 842 Explained.”

What is lessor’s risk insurance?

Lessor’s risk only, or LRO, insurance protects commercial landlords against lawsuits. This applies to property damage or any bodily injuries a tenant sustains on the commercial property. Also known as landlord insurance, it covers commercial property such as apartment complexes or office spaces.

Differences in lessor vs. lessee obligations under different types of commercial lease agreements

The responsibilities and obligations of the lessor and lessee differ depending on what type of lease agreement the two parties enter into. Below, we’ve laid out the various types of commercial lease agreements as well as what the lessor and lessee are responsible for under each type.

Gross leases

Gross leases are also referred to as full-service leases. In a gross lease agreement, the lessee is typically only responsible for base rent payments. The lessor in these agreements is responsible for all other building expenses. These include maintenance costs, such as CAM, as well as utilities, insurance, and property taxes. There are some gross leases, however, that require the lessee to pay additional expenses following the first year of the lease, so it is important to check the details of any lease contract before signing.

Net leases

In a net lease agreement, the lessee is responsible for paying a certain share of the building’s operating expenses, which can include maintenance costs, taxes, and insurance, based on what percentage of the property the lessee is occupying. The lessor is responsible for paying all remaining operating expenses. There are three types of net leases: triple net leases, double net leases, and single net leases.

Triple net lease / NNN lease

Triple net lease agreements require the lessee to pay base rent and utilities as well as all of the building’s operating expenses. The “triple net” or “NNN” in the term refers to the three types of operating expenses for which the lessee is responsible: maintenance costs, insurance, and property taxes. The lessor is typically only responsible for some building maintenance or major repairs, depending on the details in the lease contract.

Double net lease / NN lease

In a double net lease, the lessee agrees to pay for base rent, utilities, property taxes, and insurance while the lessor is responsible for all maintenance expenses and repairs.

Single net lease / N lease

In a single net lease, the lessee is responsible for paying base rent as well as utilities and property taxes. The lessor agrees to pay for maintenance expenses and insurance.

Modified gross lease

Typical modified gross leases require the lessee to pay for rent, utilities, and part of the building’s operating expenses. The lessor is responsible for the remaining portion of the building’s operating expenses. Modified gross leases are similar to gross leases, but they differ from contract to contract.

Absolute net lease / absolute NNN lease

An absolute net lease is also referred to as an “absolute NNN lease.” In these lease agreements, the lessee is responsible for all costs, including rent, utilities, all operating expenses, and even major repair costs. The lessor takes on no financial obligations.

Percentage lease

Percentage leases are typically used for retail businesses. This lease type requires the lessee to pay base rent plus a percentage of their gross sales. The lessor is responsible for maintenance expenses, property taxes, and insurance.

Lessee vs. lessor accounting under the new lease accounting standards

The new lease accounting standards (ASC 842, IFRS 16, and GASB 87) have changed the way we account for leases. While the definitions for lessee and lessor have remained unchanged, the financial reporting for both lessees and lessors isn’t the same as it was under the previous standards.

ASC 842

ASC 842 requires most leases to be recorded on the balance sheet. Under the new FASB standard, lessees must classify all leases as either finance leases or operating leases and calculate the present value of future lease payments to establish the ROU asset and lease liability.

Lessors must classify their leases either as a operating, sales-type, or direct financing leases. For operating leases, the lessor recognizes the leased asset as a fixed asset and the income is recognized on the income statement as rental income. For sales-type leases and direct financing leases, the lessor must derecognize the underlying leased asset and record a net investment in the lease on their balance sheet. A portion of the income from sales-type leases and direct financing leases is applied as a reduction to the net investment in these leases and another portion is recognized as interest income.

Download our Ultimate Lease Accounting Guide for multiple full examples of lease accounting under ASC 842:

IFRS 16

Lessee accounting for lessees has changed under IFRS 16. Instead of distinguishing between operating and finance leases, a single-model approach is in place. Post-adoption, all material lessee leases must be reported as finance leases. The leases must be capitalized and recorded on the balance sheet as ROU assets and lease liabilities.

Lessors continue to use operating and finance lease classification. They must determine if a lease is classified as an operating or finance lease and follow the appropriate accounting methods.

For a full example of lessee accounting under IFRS 16, read “IFRS 16 Leases: Summary, Example, Journal Entries, and Disclosures.”

GASB 87

Accounting has changed to a single-model approach for government entity lessees and lessors under GASB 87. Lessees must recognize a lease liability and related lease asset at the lease commencement date, or the transition date to GASB 87. Lessors must record a lease receivable and corresponding deferred inflow of resources at the commencement of the lease term.

For a full example of lessee accounting under GASB 87, read “GASB 87 Explained with a Full Example of the New Governmental Lease Accounting Standards.” For lessor accounting under GASB 87, read “GASB 87 Lessor Accounting Example with Journal Entries.”

Summary

The lessee and the lessor are the two main parties in a lease agreement. Whether an equipment lease or a commercial lease, it’s important to comprehend the particular responsibilities between the two because the accounting differs for each.

The new lease accounting standards impact the financial reporting for both lessees and lessors. LeaseQuery simplifies the transition to the new standards. Schedule a demo to learn the benefits of using lease accounting software for adoption.