In 2020, many companies saw an increase in lease liabilities after adopting the new lease accounting standard, ASC 842. As private companies prepare for their final steps of ASC 842 adoption, it’s critical to understand how it could impact the balance sheet for your industry.

Our Lease Liabilities Index Report is an expanded analysis of more than 950 companies’ balance sheets pre- and post-transition which indicates average liabilities are continuing to increase under the new standard. The lease accounting transition was difficult for everyone but will be especially challenging for private companies adopting after the tumultuous year caused by the effects of the COVID-19 pandemic.

Lease liabilities increase after adopting new standards

Public companies just completed filing their second annual report using the new lease accounting standards. While these companies are now familiarized with the new standards, the transition came with some challenges. Our previous Lease Liabilities Index Report showed that public companies saw an average lease liability increase of 1,475%.

As a result of the pandemic, some private companies pumped the brakes as the transition deadline was moved, but are slowly pushing the gas again as they begin to prepare for ASC 842 adoption. As these companies are still facing the fallout from the global pandemic, they’re unfortunately left facing implementation challenges on top of changes in consumer behavior, investor sentiment, and an economic decline. Because public companies have already completed the transition, they’ve left valuable insight into the implementation process for private companies.

Private companies need to prepare for challenges ahead

The SEC provided comments on lease accounting disclosures stemming from the filings of public companies in various industries. After analyzing these comments in the Lease Accounting SECrets report, LeaseQuery believes companies must centralize their lease data, fully comprehend their lease portfolios, and secure the technology and resources to identify and solve any barriers to compliance.

10 key industries affected by lease accounting compliance and economic change

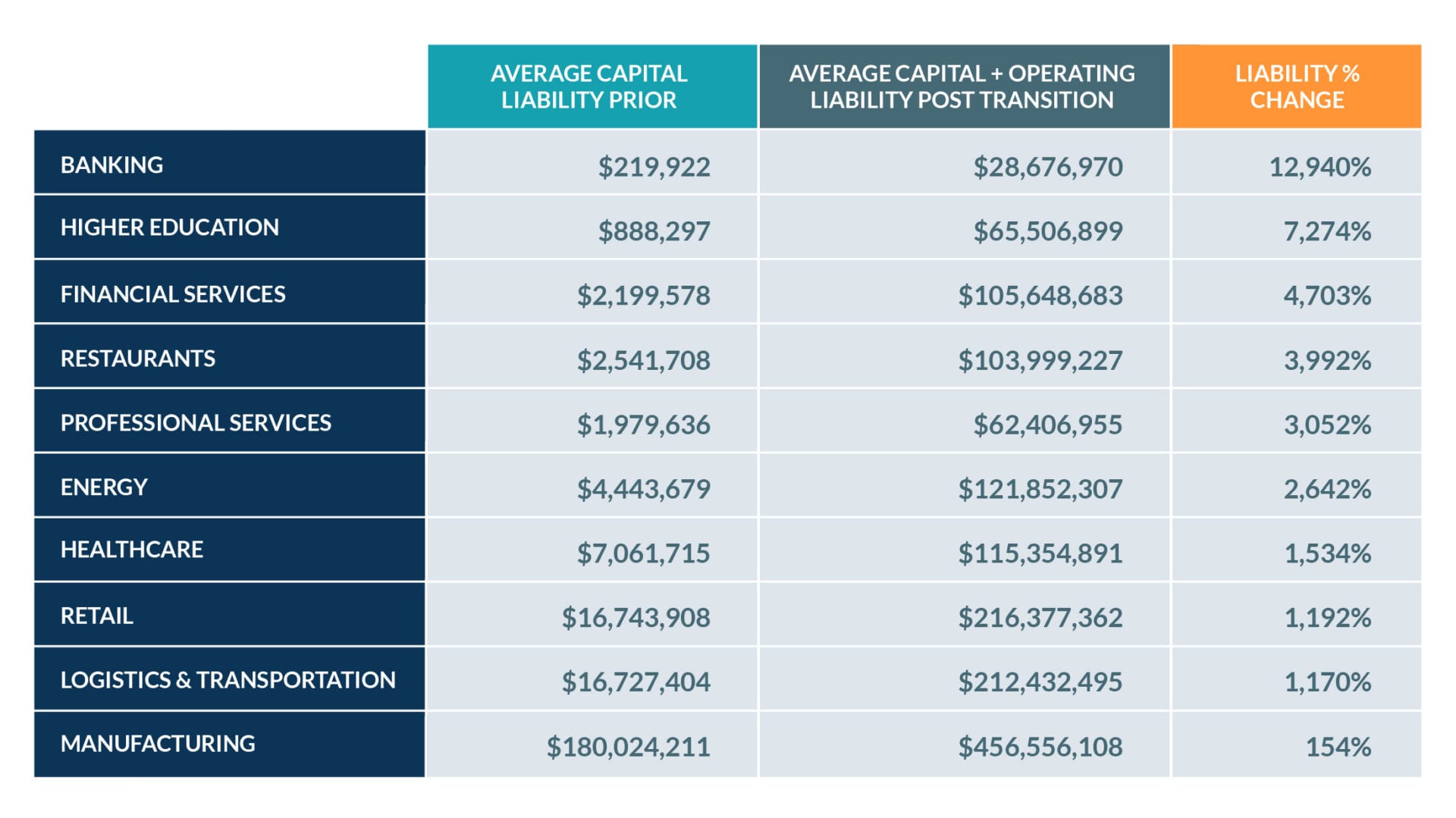

Companies finishing implementation this year have the added undertaking of managing the lingering effects of the global pandemic as they also manage changes in lease accounting. The top 10 industries analyzed in our Lease Liabilities Index update and most affected by these challenges are as follows:

Banking: A higher demand for online banking was caused last year when companies were seeking extra cash in a virtual environment. As in-person interaction was limited, the need for leasing equipment such as ATMs increased.

Higher education: Education underwent a major shift to virtual learning as a result of the pandemic. These institutions are evolving to new regulations, including a lack of physical classroom space. This creates new challenges as they shift to the new accounting standards.

Financial services: The new standards won’t necessarily change how financial services like hedge funds, retirement companies, and others make loan or leasing choices. However, they will affect how those decisions look on the balance sheet.

Restaurants: The pandemic hit the restaurant industry hard. Many closed down, and those that didn’t had to find innovative ways to operate as in-person dining was limited. Equipment leasing trends and re-structured kitchen spaces are becoming more common, making balance sheet accuracy extremely important.

Professional services: Throughout COVID, businesses have realized many professional services can be conducted from home. As the industry continues to move forward, types of leases may change as a result. Centralization and visibility will become even more important.

Energy: The oil and gas industry saw the price of oil decrease drastically at the beginning of the pandemic because fewer people were commuting. As people slowly return to travel, there is a resurgence of demand. This, combined with the push towards renewable energy, will create possible new challenges on the industry’s balance sheets.

Healthcare: Healthcare has remained front and center throughout the past year. While the healthcare industry was busy fighting the global pandemic, lease accounting wasn’t in the spotlight. As the focus goes back to day-to-day healthcare operations, everyone is learning to adapt to new patient care protocols and preferences. Things like telehealth and remote care could impact leased office space and equipment.

Retail: The retail industry has to adapt to the new lease accounting rules as well as major consumer changes. Many retailers are requesting rent concessions as a result of the pandemic and its impact on the economy. Consumers have shifted how they shop, so the retail industry will continue to evolve to their demands as well as the new rules.

Logistics & transportation: COVID-19 drastically changed the way we view transportation and logistics. Demand shifted and highlighted the importance of physically getting items to consumers. Complex lease terms and balance sheet impacts are common in this industry, particularly in times of peak demand.

Manufacturing: The liabilities increase in the manufacturing industry was significant. The new goal of manufacturers is to de-risk the supply chain. There could be a shift in space leases as well as equipment leases.

Summary

As private companies prepare for the final push to implement ASC 842, it’s important to understand how it will impact the balance sheet for your particular industry. Large companies who have already finished filing their second annual report under the new standards continued to see an increase in average liabilities. Those facing the transition now need to prepare for the implementation challenges as they also wrestle with the aftereffects of the global pandemic. LeaseQuery can help companies avoid major complications as they adopt the new standard. Download our Lease Liabilities Index Report to learn more about transitioning to ASC 842.