What are initial direct costs?

With the transition to ASC 842 now active for all companies, it is important to understand the various changes adoption causes, aside from adding operating leases to the balance sheet. This article will focus on the change of accounting treatment for initial direct costs (IDC). The key update with respect to IDC is what can and cannot be capitalized when it comes to costs incurred to obtain a lease. Before diving into the changes to IDC, let’s first understand the definition of initial direct costs.

Definition of initial direct costs

Initial direct costs (IDC) are expenses related to the negotiation and execution of a lease agreement. This is a general definition, due to the fact the definition changes depending on whether we are applying ASC 840 or 842. Typically, these will be the expenses organizations incur during the process of obtaining a lease, and many factors potentially go into obtaining a lease. Below we will walk through several different expenses and compare and contrast their treatment under ASC 840 and ASC 842.

ASC 840 treatment of initial direct costs

Under ASC 840, a lessee capitalized initial direct costs for both operating and capital leases on the balance sheet and amortized these costs over the lease term. The stipulations for these costs were less restrictive, and organizations could have incurred IDC before the lease was even executed. Costs categorized as IDC under ASC 840 include both internal costs, such as salaries, and external costs, such as legal fees.

Previously, the determination of whether a cost qualified as IDC did not depend on whether the lease was obtained. As long as the cost was incurred in the process of obtaining the lease, it met the criteria.

What could be classified as initial direct cost?

When organizations go through the process of obtaining a lease, multiple types of costs are incurred. Below are a few examples of some costs that could be incurred:

- Employees’ salaries for time spent preparing lease agreements (fixed salaries and commissions)

- Costs associated with negotiating and executing the lease agreement

- Preparation of lease documents

- Incentives paid to current tenants to terminate their existing lease early

- Commissions paid to selling agencies

Under ASC 840, all of the above costs could have been capitalized on the balance sheet. Under ASC 842, this list will look different.

Initial direct costs under ASC 842

ASC 842 brought many changes to lease accounting and IDC was not exempt. The first change was to the definition of initial direct costs, which was mainly around the scope of expenses considered IDC.

What changed?

Initial direct costs are now defined as incremental expenses that would not have been incurred if the lease had not been executed. Costs that would have happened whether the lease was executed or not are now just expensed as incurred. We saw above that ASC 840 allowed companies to capitalize a portion of internal expenses, such as a portion of the salaries for internal real estate departments or legal staff, and amortize these costs over time as IDC. Under ASC 842, internal expenses are no longer considered IDC. Internal costs are now considered standard expenses and not capitalizable, regardless of whether or not a lease is obtained.

Additionally, organizations will change how they record IDC. A lessee will not record a separate asset to capitalize IDC under ASC 842. Instead, IDC will be included in the initial calculation of the ROU asset. While the amount of capitalizable costs has decreased, they continue to be recorded on the balance sheet and amortized over the lease term.

Accounting treatment under ASC 842

Understanding the changes to the accounting treatment of IDC is important for many organizations who have previously capitalized costs under ASC 840. Internal costs cannot be capitalized. Only external incremental costs, incurred after execution of the lease meet the new criteria for IDC. Below are a few examples of costs incurred after the execution of a lease which can be capitalized under ASC 842:

- Commissions paid to the selling agent once the lease is executed

- Legal fees incurred from the execution of a lease agreement

- Payments made to current tenants to terminate their existing lease early

In addition to the requirement that the costs be external, they must also be incurred after the lease is executed and as a result of the lease agreement being executed.

Example: Initial direct costs under ASC 842

To illustrate the accounting treatment of IDC under ASC 842, take a look at the example below. We will assume the lease commencement date is after the entity adopts ASC 842. Below are the facts:

- Lease Term: 10 years

- Incremental Borrowing Rate: 3%

- Payments: Monthly installments of $15,000, with annual escalations of 3.5%

- Commissions to selling agent, due after lease commencement: $25,000

- Legal fees for processing executed lease: $15,000

- Fees to locate a suitable property to lease: $5,000

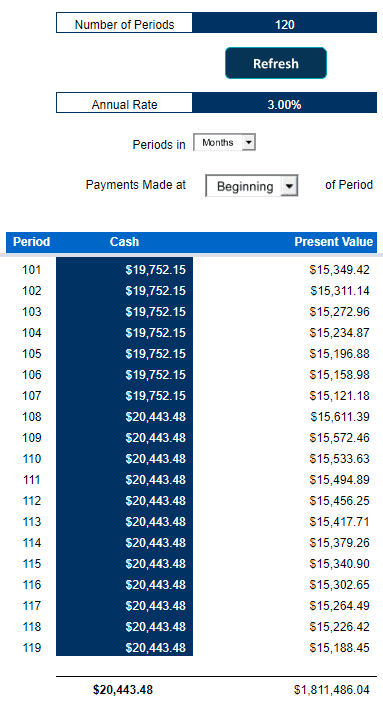

First, we calculate the lease liability as $1,811,486. This total is arrived at by taking the present value of the rent payments using the 3% IBR given: PV is the calculation of what a future sum of money or stream of cash flows is worth today given a specified rate of return over a specified period. The simplest way to calculate this is using a present value formula within Excel.

To better understand how this balance was calculated, refer to our article on lease liability amortization schedules.

Now that we know the initial lease liability, we use that amount to calculate the ROU asset for this lease agreement. The ROU asset will include the lease liability plus the $25,000 and $15,000 paid for commissions and legal fees, respectively, but not the $5,000 for locating the lease. In total the ROU asset is $1,851,486 ($1,811,486 + $25,000 + $15,000).

In this example, the $25,000 and $15,000 meet the criteria for capitalization because they are incremental costs incurred solely for the execution of the lease agreement. In contrast, the $5,000 paid to identify a property to lease is not dependent on whether or not the lease was executed. Therefore this cost has been excluded from the IDC and will instead be recognized as an expense in the month it was incurred.

Summary

Initial direct costs are expenses associated with creating a lease agreement. While a variety of costs were allowed to be capitalized under ASC 840, ASC 842 creates a shift in how IDC are handled, both in terms of scope and accounting treatment. Some expenses previously capitalized, such as internal costs, are now expensed as incurred. Additionally, only expenses that are a direct result of a lease execution are capitalized and captured in the ROU asset.

Companies should ensure they are aware of these changes since they can have financial impacts on the balance sheet and the current identification of these costs has changed dramatically. Since IDC are no longer recognized in their own line item on the balance sheet, use a lease accounting solution like LeaseQuery to track any IDC capitalized with your ROU assets going forward.

Related articles