For your organization to comply with GASB 87, the new lease accounting standard, you’ll need to consolidate lease data from multiple sources. This process can be time-consuming and is especially difficult as governmental entities tend to be highly decentralized. To prevent duplication of efforts, you need to come up with a plan. Where should you start?

Scoping your leases

Rather than starting by listing all possible leases in an Excel spreadsheet – which may eventually get the job done but can waste valuable time – consider the updated definition of a lease for GASB 87. Fully understanding how a lease is defined under GASB 87 and any other potential scoping exemptions before compiling and finalizing your lease listing can be a more efficient start to the project.

You may be able to exclude certain leased assets for materiality, or some of your leases may be short-term in nature. Consider the following definition of a lease and the exemptions under GASB 87 before spending a lot of time gathering your lease data to avoid unnecessary work.

Definition of a lease

A lease is defined under GASB 87 as a contract that conveys control of the right to use a non-financial asset for a period of time in an exchange (or exchange-like) transaction.

The GASB places significant emphasis on the concept of control within this definition, by further defining two requirements necessary for a lessee to have control:

- The right to obtain the present service capacity from the use of the underlying asset

- The right to determine the nature and manner of the use of the underlying asset

GASB 87 specifies that a lease is a contract that, although not explicitly identified as a lease, meets the above definition of a lease. Therefore, you will need to consider embedded leases as you compile your lease portfolio. Please refer to our full article on embedded leases for further guidance on how to evaluate your contracts for hidden leases.

Exemptions

Short-term leases

GASB 87 does not apply to short-term leases, and both lessees and lessors should not record leases meeting the definition of a short-term lease on the statement of net position.

Per GASB 87, a short-term lease is a lease with a maximum possible noncancellable term of 12 months or less at lease commencement, including all renewal options. The use of “maximum possible term” by the board removes any judgment in determining your certainty to renew from this definition.

A lease is considered short-term if it meets the above criteria, regardless of whether or not you intend to exercise any renewals. Additionally, it’s important to consider the remaining lease terms at transition when determining if leases are short-term, as the standard states leases should be recognized using the facts and circumstances that existed at the beginning of the period of implementation.

For leases already in effect at transition, when considering whether they meet the short-term lease definition, governmental entities should measure the remaining possible term from the date of transition. For example, if a 5 year lease only has 6 months remaining at transition to GASB 87, this lease qualifies as a short-term lease.

While the Board considered a disclosure requirement associated with short-term leases, they determined requiring entities to identify and disclose short-term leases would reduce the relief given by the exemption in the first place. Therefore, no disclosure requirement for short-term leases exists under GASB 87. As mentioned above, a significant amount of time may be saved by excluding leases that meet the definition of a short-term lease from your lease gathering process.

Our full article on GASB 87 disclosures provides more information useful in other disclosure requirements for GASB 87.

Materiality

GASB 87 does not provide an explicit materiality threshold for governmental entities to apply to their lease portfolio. However, you may choose to adopt a reasonable capitalization threshold to avoid inventorying and subsequently recording low-dollar leased assets on your statement of net position.

Your organization’s capitalization threshold for GASB 87 may be similar to its other existing capitalization thresholds, for example, those for your fixed assets. However, do not make the mistake of simply applying the fixed asset capitalization threshold to leases without specific consideration of your lease portfolio. Materiality should be determined independently of any existing threshold, based on the facts and circumstances of the lease portfolio and its impact to the organization.

When considering materiality for governmental organizations, assess whether existing materiality policies are appropriate for the application of GASB 87. Once a decision is made, document the rationale for established thresholds and review any potential materiality policies with your auditors for their endorsement.

Many governmental entities may currently lease a large amount of low-dollar value equipment, like copiers or other IT equipment that might fall under a materiality threshold. The analysis for your materiality threshold should consider whether scoping out an entire asset classification would materially impact your GASB 87 application in the aggregate.

Leases that transfer ownership

GASB 87 does not apply to contracts that transfer ownership of the underlying asset to the lessee at the end of the lease and do not contain termination options or a fiscal funding or cancellation clause that is reasonably certain of being exercised. Rather, those agreements should be accounted for as a financed purchase by the lessee or a sale by the lessor.

When considering this exemption, it is important to distinguish between those leases with an automatic ownership/title transfer as opposed to those with an option to purchase that the lessee is reasonably certain to exercise. While it is often assumed an option to purchase will be exercised, especially if offered at a discount, this is not always the case.

Due to the potential rigorous procurement requirements , even if it is advantageous for the lessee to exercise this option, the hoops required to execute such an option may prevent the purchase altogether – even for a bargain purchase option or dollar buy-out. Therefore, this exemption only applies to those contracts with automatic ownership transfers at the end of the term.

Similar to the previous scoping exemptions, if you are able to exclude leases with automatic ownership transfers in the beginning of your lease search, you may save yourself some time with the compilation of your lease data.

Other GASB 87 exemptions

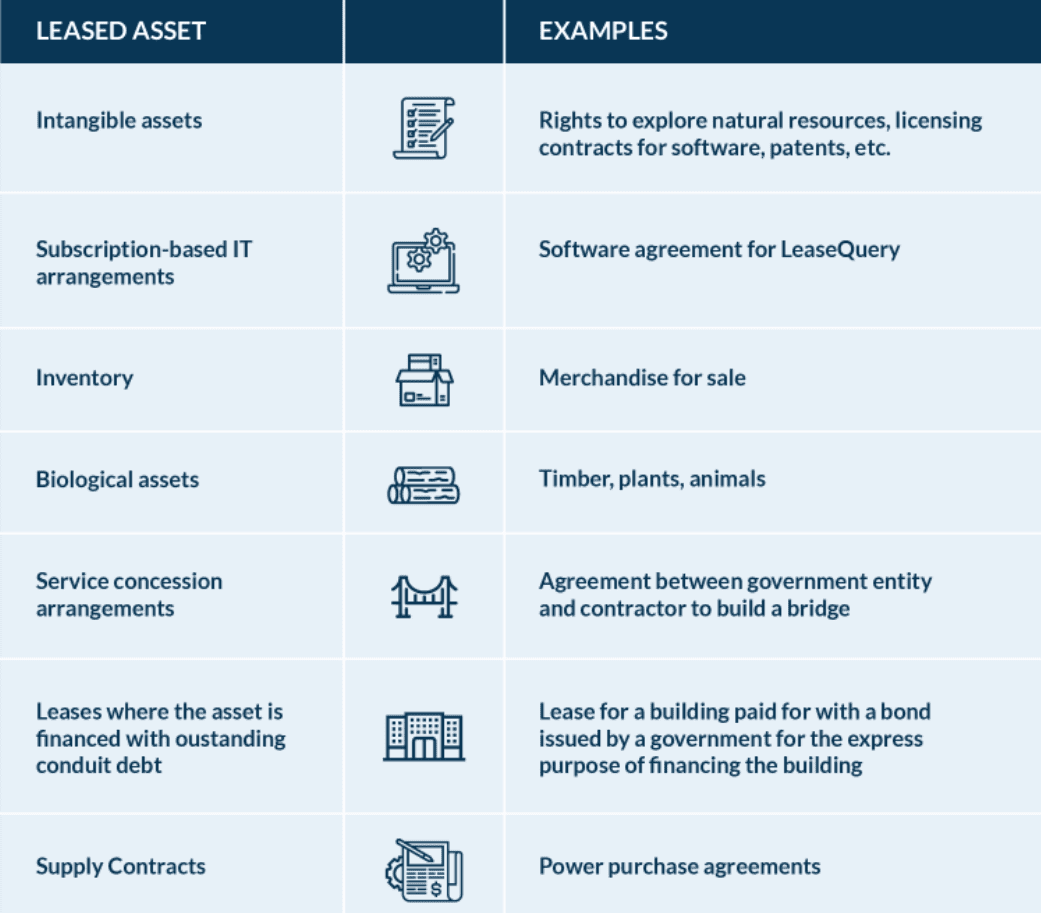

GASB 87 specifically applies to leases of nonfinancial assets, including property, plant, and equipment. When inventorying your leases, you’ll also want to exclude the items in the chart below.

GASB 87 explicitly excludes the following types of agreements:

Finding your leases

Look at your requisition process

When conducting your lease inventory, the first step is to understand your organization’s requisition process and identify the departments involved. You may have a procurement or purchasing department that initiates requisitions, or it may fall on individual department heads.

Governmental organizations are often decentralized and your processes may be siloed. Understand who has their hands in the lease requisition process so you can identify the correct personnel to engage.

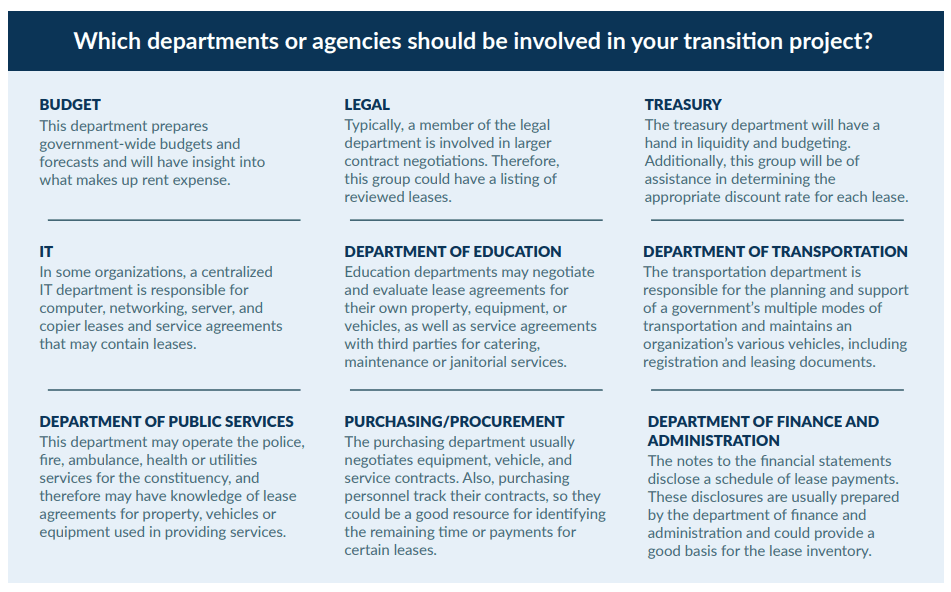

Engage the right departments

While real estate leases are generally material and certainly need to be considered, do not limit your lease search to the real estate department alone. GASB 87 is also applicable to other asset types, including office equipment, IT equipment, vehicles, land, towers, etc. It also applies to both lessee and lessor agreements, so don’t forget to consider owned assets you may be leasing out to various tenants.

To ensure your entity’s transition to GASB 87 is a success, pull together an interdepartmental team and assign a point person in each department. As part of the project, you may need to educate the various departments on the importance of the standard to get their full attention. Consider our GASB 87 Adoption Kit for assistance with this.

The legal department is likely involved with the approval of large contracts, and the purchasing department will be able to provide a list of vendors with contracts in place. IT may currently manage your technology vendors, and the accounts payable department handles lease payments, so they should all have a list of vendors as well.

Below are some of the departments to consider including in your lease inventorying process:

Consolidate your leases in one place

As you endeavor to create one uniform lease listing, use a lease inventory template to promote accuracy and consistency within the data. We have an example you can use here.

Provide each department with the same template, and schedule a meeting to review what is expected for each data point in the template to prevent confusion or inconsistent information.

Cross-check your template for accuracy and completeness

Once each department has provided its completed template, compile them into one master listing which you can cross-check for duplicates. In addition to checking for duplicates, there are a few other ways you should cross-check your listing to ensure you didn’t overlook any important contracts.

First, contact each physical location to obtain a listing of their leases. For larger or decentralized governmental entities with many locations, contact the finance manager at each location to obtain this. For smaller entities, you may need to speak to a few office managers to obtain this listing. Compile the list of leased assets from all of the locations independent of the list created from the departments’ data. Compare this new listing to the departments’ master lease listing and add any leases that may have been missed.

Next, obtain a listing of recurring payments from your accounts payable departments, as recurring payments may be indicative of a lease agreement. Review the recurring payment information to:

- determine what the payments relate to,

- identify any payments representing leases not on your lease listing, and

- add them to your list.

Finally, reconcile your completed lease listing with your ACFR disclosures for leases, specifically your future lease obligations schedule, to ensure you’ve included all of those leases within your lease inventory.

Summary

Inventorying your lease data for GASB 87 requires the cooperation of many colleagues and departments, as there is rarely one centralized place where lease data is housed. To minimize duplication of efforts, ensure the organization understands the scope of GASB 87 and any policy elections it wants to utilize before finalizing your organization’s lease listing. Make sure you involve the right departments and provide a template to promote gathering consistent and relevant lease data. Adoption may be a time-consuming process, but by breaking the project into more manageable tasks, compliance with GASB 87 is within reach.