Gear up for GASB

The effective dates for GASB 87 & GASB 96 have passed.

Where are you on the journey towards adoption?

Let’s pack up your GASB gear and we’ll lead the way!

GASB TRANSITION GUIDE

The first step of your compliance journey is knowing which direction to go. Our guide will help you navigate your way through the GASB 87 standard.

LEASE IDENTIFIER

Key concepts for the definition of a lease changed under GASB 87. This tool will help you spot all of your leases.

TWO EXAMPLES OF HOW TO TRANSITION FOR LESSEES

LESSOR ACCOUNTING EXAMPLE WITH JOURNAL ENTRIES

Don’t forget – both lessees and lessors need to comply with the new standard. Use this step-by-step overview of the accounting treatment for lessor leases to keep your transition moving.

DISCLOSURE REQUIREMENTS FOR LESSEES EXPLAINED

It’s important to always have a clear, well-lit view of the path ahead. This article will shed light on disclosure requirements under GASB 87.

Applying Fund Accounting to GASB 87

The fund accounting requirements under GASB 34 add an extra layer of complexity to the lease accounting standard. This article covers some of the basics of fund accounting for leases.

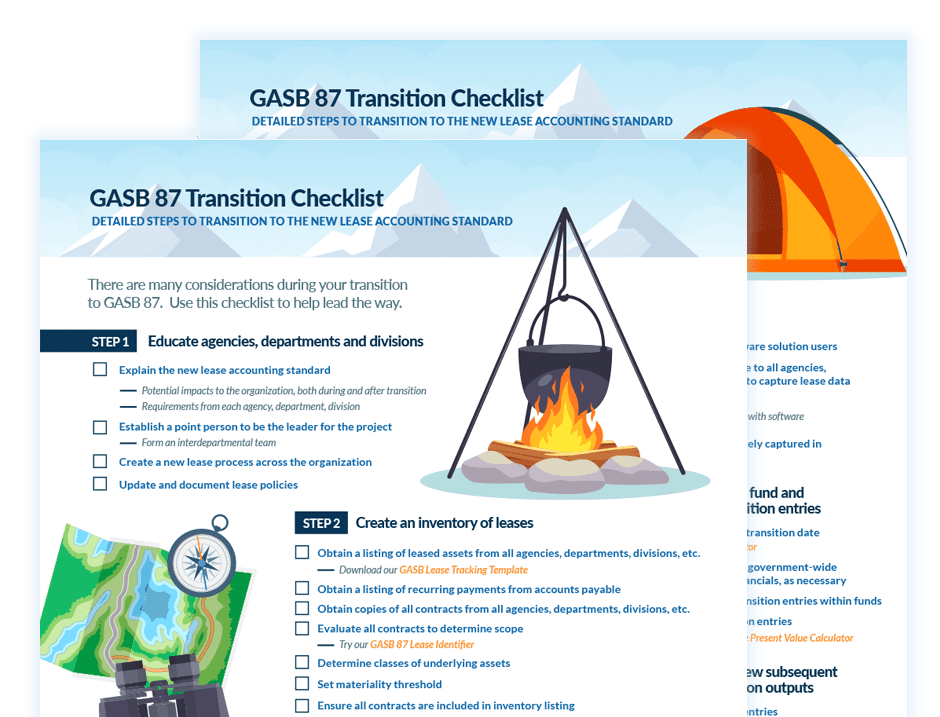

Get our free checklist for transitioning to GASB 87

With the shift to the new standard comes many considerations, so we have assembled this checklist to assist you in your transition journey.

Still working on GASB 96 Compliance?

Document your subscription agreements with our free tool.