Organizations often enter into either sale-leaseback or lease-leaseback arrangements for strategic purposes. Under the guidance of GASB 87, these transactions require unique financial statement presentation. This article will provide clarity on the qualifications of both types of arrangements, as well as each arrangement’s inherent value. Additionally, the article will give an example of how to appropriately account for each type of transaction, including necessary footnote disclosures.

Sale-leasebacks

A sale-leaseback occurs when an organization sells an underlying asset and subsequently leases back the right to use the same underlying asset. From a value perspective, organizations may prefer to relinquish the burdens of asset ownership while retaining the economic benefits of the asset. Additionally, the sale provides the original owner of the asset immediate liquidity to utilize at its discretion, while creating the annuity-like payment structure to rent back the same underlying asset. Governmental organizations often look at high-priced assets, such as municipal buildings or larger construction equipment, to facilitate sale-leasebacks for an immediate cash infusion. However, organizations can look to facilitate a sale-leaseback with any type of asset.

GASB 87 requirements

An arrangement must initially qualify for a sale under the guidance of GASB Statement No. 62, Codification of Accounting and Financial Reporting Guidance Contained in Pre-November 30, 1989 FASB and AICPA Pronouncements (GASB 62) to receive the sale-leaseback designation. Once the seller confirms a qualified sale and transacts the leaseback of the underlying asset, the seller/lessee will account for this arrangement as two separate transactions:

- The qualifying sale

- The leaseback

For the sale component, a gain or loss may exist based on the difference between the carrying value of the asset at the time of sale and the net proceeds from the sale itself. To simplify the accounting for the gain/loss calculation, GASB 87 removes the previous GASB 62 requirement of evaluating the amount of leaseback usage when determining how and when to recognize the gain/loss. In most instances, GASB 87 requires the lessee to defer the gain/loss and recognize this amount over the lease term (as a separate deferred inflow/outflow of resources) in a systematic and rational manner.

When the leaseback portion of the transaction qualifies as a short-term lease, however, the seller/lessee recognizes the full gain/loss from the sale immediately. The seller/lessee accounts for the leaseback component of this arrangement akin to a normal in-scope lease arrangement, following the guidance under GASB 87.

Quantitative example

This example will cover the deferral of the gain/loss on the qualified sale portion of a sale-leaseback transaction. For an example of lessee accounting under GASB 87, see LeaseQuery’s article on GASB 87 lessee accounting.

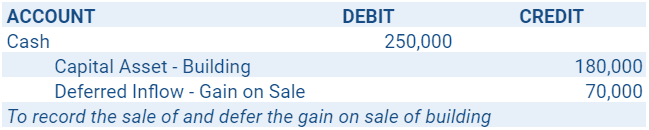

Consider a scenario in which a government sells a town hall office building for $250,000. At the time of sale, the building has a net book value of $180,000. Thus the seller recognizes a $70,000 ($250,000 – $180,000) deferred gain on the sale. To record the initial deferral, the seller records the following journal entry:

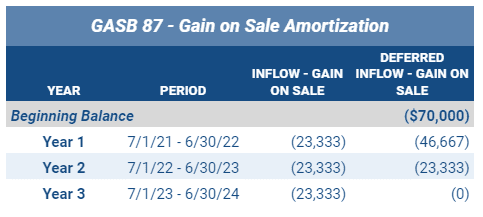

Subsequent to the sale, the government leases back the property from the buyer for a three-year period commencing on July 1, 2021 and ending on June 30, 2024. The schedule below represents the systematic and rational recognition of the deferred gain by the seller/lessee throughout the lease term.

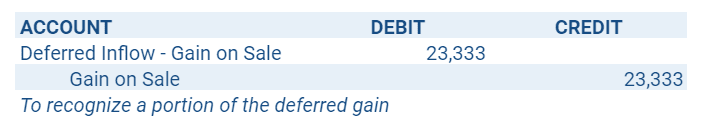

During the first year, the seller/lessee books the following journal entry to recognize a portion of the deferred gain:

The seller/lessee records the same journal entry each year during the term of the lease agreement until the deferred gain is fully realized.

Disclosure requirements

Outside of the traditional GASB 87 lessee disclosure requirements, seller/lessees only need to include a qualitative analysis regarding the terms and conditions of sale-leaseback transactions to provide further useful detail for financial statement users. No separate disclosure requirement exists for the deferred gains/losses from the sale portion of the transactions, as the GASB felt no need to differentiate these specific gains/losses from other capital asset disposals.

Additionally, the buyer/lessor would simply disclose the standard requirements for a lessor under GASB 87.

Lease-leasebacks

Lease-leasebacks commonly surface in construction arrangements. For example, an organization may lease government land to a company for development purposes. Once construction concludes, the constructed asset and land is leased back to the initial lessor by the developer. This allows the company to direct the use of the leased land during construction without having to purchase the land outright.

Other common examples include organizations that own high occupancy real estate but do not have the ability to fill the entire space. The organization may lease out the entire building, while subsequently leasing back a smaller portion of the building for internal use. To qualify as a lease-leaseback, the transactions must occur between the same counterparties.

GASB 87 requirements

Both parties involved in a lease-leaseback transaction must account for the arrangement as a net transaction, which differs from the requirements for a traditional sublease. Depending on which side of the transaction has a larger present value, a party effectively recognizes either:

- Net lease receivable, or

- Net lease liability

Quantitative example

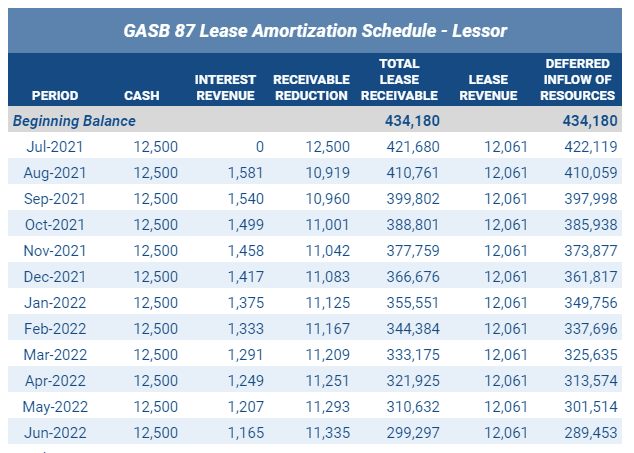

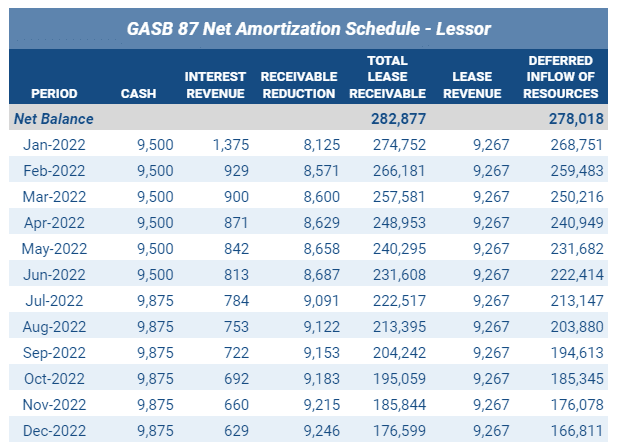

In this example, the originating owner leases an office building to a company on July 1, 2021 for three years. The owner charges the lessee $12,500 per month, due in advance, at an implicit interest rate of 4.5%. Payments will escalate by 3% annually. Using the facts described, the present value of the lease payments in the initial lease agreement calculates to be $434,180. The amortization schedule below provides a detail of the first year from the lessor’s perspective.

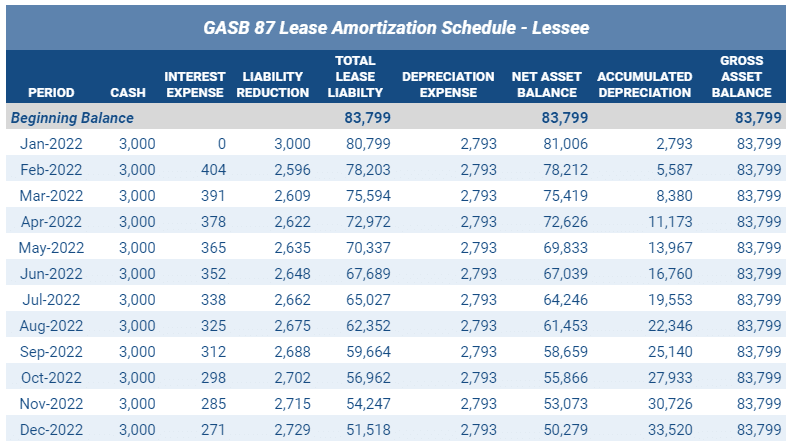

Six months later, the lessee leases one floor of the building back to the originating owner for two-and-a-half years, meeting the criteria for a lease-leaseback arrangement. The originating lessee charges the owner $3,000 per month for the use of the one floor, due in advance. As of the new lease commencement date, the originating owner estimates an incremental borrowing rate of 6%. Using this rate, the present value of the lease payments in the leaseback agreement calculates to be $83,799. The below is reflective of the amortization of the facility leaseback in its first year from the lessee’s perspective.

Starting January 2022, both parties must net these balances to comply with GASB 87 requirements. From the originating owner’s perspective, the following balances exist as of January 2022:

Lease Liability: $83,799

Lease Receivable: $366,676 (as shown as the total lease receivable as of December 2021 from the above lessor’s amortization schedule)

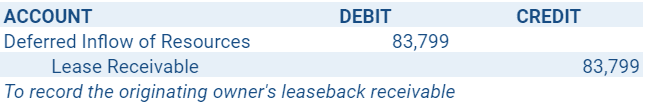

On commencement of the leaseback, the originating owner has a net lease receivable balance of $282,877, calculated as the difference between the two account balances noted above ($366,676 – $83,799). The following journal entry records the originating owner’s lease liability for the leaseback as a reduction to the outstanding lease receivable:

Finally, the below schedule represents the amortization schedule subsequent to the originating owner’s netting of the lease receivable and the lease liability from January 1, 2022 – December 31, 2022:

In the case of the original lessee, the net presentation would be the inverse – a net lease liability.

Disclosure requirements

For purposes of explaining the economics of each individual transaction, GASB 87 does require each transacting party to disclose the lease and leaseback components separately as gross values in the notes to the financial statements. Thus, both parties should maintain separate amortization schedules for each underlying transaction to appropriately disclose the gross amounts under each side of the transaction. As noted above, however, net presentation within the actual financial statements is required.

Summary

GASB 87 can provide a challenge for state and local governments, given some of the changes required in the accounting for existing operating leases. The arrangements discussed within this article highlight further complexities and areas of judgment for organizations to consider when dealing with leases, and specifically leaseback transactions on a go-forward basis.

If capturing the activity within the governmental fund, a conversion entry will be necessary at year-end to convert from the modified accrual accounting basis to the required full accrual basis for the government-wide financials.

A software solution purpose built for lease accounting with government accounting in mind can help prepare the transition journal entries necessary for compliance and the conversion entries for annual governmental reporting in accordance with the requirements under both GASB 34 and GASB 87.