1. Benefits of leasing vs. buying

2. Lease vs. buy analysis: Five factors to consider

- 1. How long will you need the item and how much is it worth?

- 2. What is feasible for your budget?

- 3. Does the asset need to be customized?

- 4. Have you factored in depreciation?

- 5. Have you examined your business’s financials?

3. How lease vs. buy decisions are impacted by the new lease accounting standards

5. Summary

When looking for real estate, equipment or vehicles for your organization, your team must make a lease vs buy decision. Whether you decide to lease or buy is dependent on several factors, such as the type of item (real estate, equipment, or vehicle), the fair value of the asset, the company’s expected financial position over time, and the amount of capital your business currently possesses.

A lease vs buy calculator is helpful in making the right choice. This article takes a closer look at the advantages and disadvantages to both leasing and buying.

Benefits of leasing vs. buying and the disadvantages of each

Benefits of leasing

Many reasons exist for companies to lease assets rather than buy them.

- When leasing, a company can benefit from the advantages of ownership without the risks – for example, in the case of real estate, most maintenance is handled by the lessor.

- Companies eliminate the hassle and hefty costs of disposing of outdated equipment.

- Leasing allows organizations to take advantage of renewal options and upgrade the leased equipment after the lease term.

- Leasing also reduces the initial cash outflow required to purchase an asset. For instance, a leased vehicle will require a lower monthly payment and no down payment versus a higher monthly payment and down payment to purchase.

- Finally, leasing can also provide liquidity to organizations that need it.

If you are currently leasing but wish to purchase an asset at a later date, a purchase option can be helpful. At the end of the specified lease term, the landlord can provide the option to purchase the leased asset. This not only provides additional time to meet specific purchase qualifications, but the lessee is able to use their monthly lease payments toward the down payment or purchase price of the item. Despite having to renew the lease or find a replacement asset, it will now be an investment. It’s important to review the purchase terms in detail as every purchase option varies.

Benefits of buying

Buying is often considered a good long-term investment. Given that rent payments are likely to increase each year and payments on an owned building typically have fixed overhead costs, buying may be the best investment for your company. For a stable business with plans to stay in one place for a long time, buying is a sensible alternative to leasing real estate.

Similarly, if the business is in an equipment-based industry, ownership of the asset affords the ability to make modifications at any given time. Constraints of mileage limits or penalties for your vehicles do not exist when an organization owns an asset. Owners will not be subject to any lessor restrictions and can eventually sell the asset. Lastly, the owner of the asset can benefit from deductions to reduce their tax liability under IRS Section 179.

With either property or equipment, a purchase allows for the asset to be recorded to the balance sheet as a fixed asset and depreciated over time rather than make periodic lease payments. The total annual expense for a fixed asset is generally less than the annual expense of a comparable leased asset.

Disadvantage of leasing

When leasing, the space, equipment, or vehicle is not your property and it needs to be returned to the lessor. A lessee will not recognize any equity or benefit from the appreciation of leased property. Also related to real estate, the organization will have no say regarding the space and could experience high rent costs as the market changes over time. Changes or updates to equipment are only allowed if the lessor agrees. Penalties may apply for mileage consumed over a specified threshold listed in the contract agreement. Limits to your control of a leased asset will always exist.

Disadvantage of buying

When evaluating an asset for purchase an organization may face difficulties qualifying for a loan with reasonable rates. The upfront spending includes a down payment of the property’s value, closing costs, and appraisal fees to purchase real estate, which may not be cost-effective for your business. If an organization is planning to purchase equipment, the warranties, customer support, and part replacement costs will need to be budgeted for as these become outdated after a certain period. Vehicles and equipment become less valuable over time from increased wear and tear. Additionally, the business becomes responsible for the maintenance and repairs of the purchased vehicles or equipment.

Lease vs. buy analysis: Five factors to consider

To perform a lease vs buy analysis, an entity must have a thorough understanding of the current state of its operations. Several questions must be asked, with these five being the most important on which to focus:

1. How long will you need the item and how much is it worth?

Flexibility is an important factor in regards to lease terms and costs. Every entity, no matter the industry, needs specific equipment to get the job done. Certain equipment, such as computers, needs to be updated in a semi-regular time frame. A lease allows your team to stay up-to-date. Vehicles and additional equipment such as forklifts, golf carts, and other tools can be expensive. Leasing these assets avoids exorbitant fees.

2. What is feasible for your budget?

Does your organization have the capital to purchase a new property? If not, and you don’t want to apply for a loan, it’s recommended to lease property. Be sure your budget includes additional payments such as common area maintenance (CAM), property tax, or insurance. Even though leasing equipment or a vehicle is often less expensive, you need to know the terms of the lease. Be sure the agreement ends around the same time the equipment is no longer needed or your company is ready to move into a bigger or smaller space, or you could end up overpaying. Additionally, keep in mind that owned equipment can be sold when you no longer need it.

3. Does the asset need to be customized?

If your business needs tailor-made equipment, leasing may not be the best route. It is easier to purchase equipment and have it modified than negotiate the customizations with your lessor. When it comes to real estate, your ability to update the space you’re moving into may be included in your contract.

Sometimes, your landlord may include a tenant improvement allowance, or TIA, to your contract as an incentive to sign. However, there are likely strict guidelines you must stick to when making updates to a leased space. For example, you may be required by the lessor to remove any modifications or improvements made to the asset at the expiration or earlier termination of your lease, resulting in additional costs.

4. Have you factored in depreciation?

Equipment and real estate depreciate over time. When you lease, you don’t have to worry as much about the decline in property or equipment value. However, purchasing equipment can mean tax breaks in the immediate or long-term future. Under IRS Section 179, a business can deduct 100 percent of a qualified item if they use it within the first year. With bonus depreciation, entities can recover expenses over time.

5. Have you examined your business’s financials?

Having a lease means less worry about tying up capital, especially if your entity is newer. Before putting money on the line, however, determine whether or not your organization can support the cost of the lease or loan being considered. Remember a lease payment is likely to increase over time; but also keep in mind the added costs that come with owning equipment or real estate.

How lease vs. buy decisions are impacted by the new lease accounting standards

The new standards require nearly all leases to be recorded on the balance sheet, whether you follow US GAAP or IFRS. FASB continues to retain two classifications of leases under ASC 842 – operating and finance (formerly capital leases under ASC 840). While both GASB 87 and IFRS 16 account for only one type of lease: finance leases. Deciding whether to lease or buy is no longer a decision based on the ability to avoid a specific lease classification.

The decision should be made using a cost-benefit analysis. What are the costs of the asset and will the cost change over time? The new standards empower companies to take a more transparent look at their lease portfolios.

Lease vs. buy calculator

LeaseQuery provides a Lease vs. Buy Calculator to help teams make informed choices when comparing the risks of leasing and purchasing. Let’s analyze a commercial property to determine if it’s best to lease or buy and its potential impact on the income statement and balance sheet.

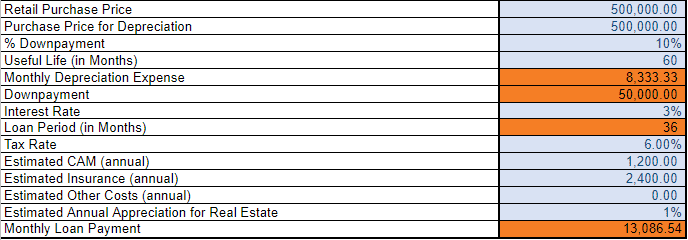

Purchase Price: $500,000

Down payment: 10%

Useful Life: 60 months

Incremental Borrowing Rate: 3%

Tax Rate: 6%

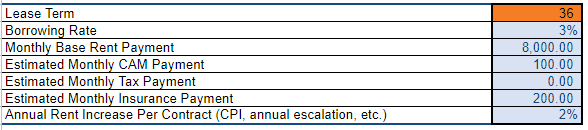

Lease Term: 36 months

Base Rent: $8,000/ per month

Annual Rent Increase: 2%

CAM (annual expense): $1,200

Insurance (annual expense): $2,400

Annual Appreciation: 1%

Download the tool and populate both the “Lease” and “Buy” tabs with the data provided, to compare the lease vs buy results over 3 years, the lease term. The screenshots below depict the data entered into the tool per each tab.

Buy tab:

Lease tab:

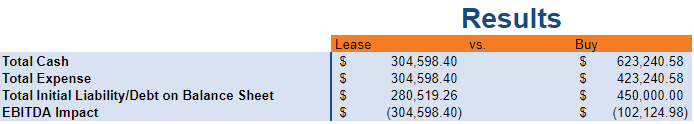

Results:

Based on the results generated by the Lease vs Buy Calculator tool, approximately 50% less cash and 25% less expense will be expended with a lease. The total initial liability is also less when deciding to lease compared to purchasing. However, leasing has an impact to EBITDA of $305K of expense while the expense impact related to a purchase with a loan is only $102K.

Summary

No determinant answer to the lease versus buy debate exists in this example. For some companies, purchasing the office space is more feasible for the addition of an asset and less overall expense. For others, a lease makes more sense to leave more cash for business growth and the added flexibility due to the ease of renegotiating a lease.

Deciding when to lease or buy is never an easy feat, but the information above can help you and your team make informed choices. Whether you’re thinking of leasing or buying equipment or real estate, having the right knowledge and tools will help.