Under GASB Statement No. 87, Leases, the majority of leases will be recorded on the statement of net position of the lessee/lessor by establishing either a lease liability or lease receivable, and a corresponding lease asset or deferred inflow of resources. To determine these amounts, both lessees and lessors must calculate the present value of remaining lease payments. Per the new governmental lease accounting standard, the rate at which the lease payments will be discounted should be the rate the lessor charges the lessee, also known as the rate implicit in the lease. If that rate is not readily determinable, then the incremental borrowing rate can be used. This article defines and explains the implicit interest rate, specifically from the lessor’s perspective.

What is the implicit rate under GASB 87?

While the implicit rate is not explicitly defined under GASB 87, the standard does reference Statement 62 for an explanation of the rate. It can be described as the internal rate of return on all payments or receipts related to the lease. Paragraph 40 of the Basis for Conclusions for GASB 87 (B40) indicates that a lessor should apply the interest rate it charges the lessee, which could be the implicit rate.

Lessees may have a difficult time determining this rate as it uses inputs that the lessee may not be privy to. It is also unlikely for a lessor to provide the necessary internal metrics as it would allow the lessee to understand exactly what the lessor’s rate of return or profit is on the transaction. As a result, GASB 87 allows lessees to apply an estimated incremental borrowing rate to calculate the present value of lease payments (i.e. the lease liability recorded on the statement of net position).

As described in the glossary of Statement 62 and shown in the graphic below, the lessor’s implicit rate equally balances the lease payments and the fair value of the asset at the inception date.

To determine the implicit rate in the lease, lessors should consider the term of the lease and assess the residual value of the underlying asset. The residual value is the amount the lessor expects the asset to be worth at the end of the lease term. Sometimes this is provided in contracts with purchase options.

In addition to evaluating the residual value, the lessor must consider the market value of the asset. The market value of certain assets may be easier to determine, such as equipment, copiers, vehicles, etc. However, specialized assets (i.e. port/airport terminals, real estate) may require a professional consultant to determine the market value.

It is also important to consider that the market value of the asset will not always be equivalent to the market value of the right to use the asset. Differences can often be a result of the lease term being shorter than the useful life of the asset, and/or the service capacity of the asset. As described in the Implementation Guide No. 2019-3 for GASB 87, if the market values are different, then professional judgment should be used to estimate the market value.

Additionally, any retained and expected investment tax credits that the lessor will realize must be considered when measuring the fair value of the asset. Such tax credits would be subtracted from the fair value of the asset.

Lastly, the lessor should evaluate any initial direct costs incurred to place the lease in service. This includes all costs relating to:

- Assessing and recording guarantees

- External legal fees

- Various other external administrative costs which would not have been incurred without the lease

Implicit rate: Understanding GASB 87 vs ASC 842

Some government entities may have reporting requirements that extend beyond the leasing standard set forth by GASB. For example, universities could have foundations that also require them to adhere to accounting standards issued by the FASB. As such, it is important to understand both the similarities and differences with how GASB 87 and ASC 842 define the implicit rate in the lease.

ASC 842 describes the implicit rate as the following:

“The rate of interest that, at a given date, causes the aggregate present value of

(a) the lease payments and

(b) the amount that a lessor expects to derive from the underlying asset following the end of the lease term

to equal the sum of

(1) the fair value of the underlying asset minus any related investment tax credit retained and expected to be realized by the lessor and

(2) any deferred initial direct costs of the lessor.”

As mentioned previously, GASB 87 does not specifically address the definition of the implicit rate. However, it is important to note the evaluation of initial direct costs when comparing the calculation of the implicit rate under GASB 87 and ASC 842.

ASC 842 outlines specific guidelines for the treatment of initial direct costs based on the type of lease (operating, sales-type or direct financing). GASB 87, on the other hand, does not provide specific requirements as there is no longer a lease classification distinction under the new standard. It simply states that a lessor’s initial direct costs are to be recognized as outflows of resources when incurred. Therefore, it’s important to note that under ASC 842 only deferred initial direct costs of the lessor factor into the implicit rate calculation but under GASB 87, since initial direct costs are not deferred, all initial direct costs are included in the calculation.

Example of calculating the rate implicit in the lease

To further illustrate the implicit interest rate, let’s walk through an example of how to calculate the rate for a lessor following GASB 87. Assume a city leases equipment to a school system for 5 years starting at the beginning of July 2019. The city will collect $3,500 annually for the rental of the equipment, payable on the anniversary of commencement. In order to execute the lease, the lessor paid $200 in administrative fees to a third party. Please see below for a listing of the described facts.

Lease Commencement Date: 7/1/2019

Lease End Date: 6/30/2024

Base Rent: $3,500 annually

Lessor Initial Direct Costs: $200

Lessor Lease Classification Prior to Transition: Operating

The city has a June 30 fiscal year-end and will adopt the new lease accounting standard as of July 2021. Therefore, the lease will only have three years remaining at the date of transition. Also, the equipment has a fair value of $10,000 as of July 1, 2021.

Transition Date: 7/1/2021

Fair Value of the Asset: $10,000

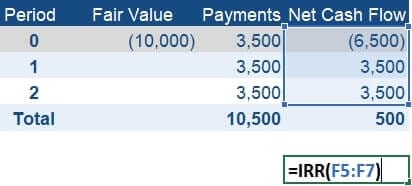

To calculate the implicit rate in the lease, we will use the internal rate of return function (IRR) within Excel. The table below displays the details of the lease necessary for the calculation. The number of periods starts at 0 as the payments are made at the beginning of the fiscal year. As of July 1, 2021, the city will recognize an initial net cash flow of $6,500 which is the difference between the $10,000 fair value of the asset and the $3,500 rent payment for the year.

The IRR for the net cash flow over the three remaining periods of the lease is 5.09%.

When calculating the implicit rate at the beginning of the lease term, the lessor’s initial direct costs should be recognized as an outflow in the initial net cash flow. Based on the details of this example, however, the lessor would have already incurred these costs.

Validating the rate implicit in the lease

Validating the interest rate is helpful to both the lessee and lessor. The lessee can verify that an appropriate rate is being charged by the lessor or the implicit rate they estimated is appropriate. The lessor can confirm the terms within the lease agreement and what will be charged to the lessee.

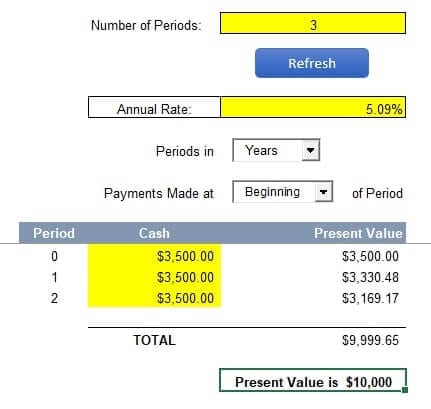

To validate the implicit rate calculated in the example, we will use LeaseQuery’s Present Value Calculator. The number of payment periods remaining in the lease term as of the city’s transition date is three. Using the rate we previously calculated, 5.09%, we determine that the present value of the $3,500 annual payments is $10,000, the fair value of the asset.

Summary

Determining the appropriate interest rate is critical for compliance under the new lease accounting standard for both the lessee and lessor. More specifically, the implicit interest rate under GASB 87 provides the internal rate of return necessary for establishing the lease liability and lease receivable for lessee and lessor, respectively. Due to lessee limitations, the implicit rate may not be readily available. However, the lessor should have the necessary details to calculate the implicit rate. To calculate the rate, lessees and lessors alike need to understand the lease payments, unguaranteed residual value, fair value, and initial direct costs.