Similar to the FASB and IASB, the Governmental Accounting Standards Board released guidance updating the accounting for lease agreements. GASB No. 87, Leases, is effective for applicable governmental entities for reporting periods that begin subsequent to December 15, 2019.

Click here to read our blog about how best to prepare for the GASB 87 effective date.

Understanding the current guidance

The new requirements should enhance transparency and comparability regarding the reporting for lease financing arrangements. Similar to the new FASB and IASB guidance, the new GASB guidance will require lessees to record leased assets and the associated liabilities on the Statement of Financial Position. This article will provide an illustrative, detailed example of the accounting for a lease transaction under the accounting methods available under the currently applicable guidance of GASB 13. We thought it would be helpful to address existing GASB guidance, and in a subsequent post, we will address an example transaction in accordance with GASB 87.

The scope of GASB 13

GASB 13, “Accounting for Operating Leases with Scheduled Rent Increases,” provides accounting guidance for agreements that contain fixed increases (i.e. increases are contractual and are not driven by future contingent events). This guidance indicates that the accounting for the contract should agree with the contractual terms of the contract when the “pattern of payment requirements, including the increases, is systematic and rational.” For example, rent increases that are based on increases in the usage of the leased asset or correspond to future economic factors associated with the property, such as inflation or estimated property value appreciation, would follow this pattern of payment. Such contracts should be accounted for under the Lease Contract method and accounted for consistent with the contract terms (i.e. cash-basis approach). In contrast, if the rent increases in the contract correspond to a financing arrangement between the two parties (i.e. a free rent period), the contract should be accounted for using one of the other two approaches outlined in the guidance. The straight-line method is consistent with the approach used in ASC 840. Under the fair value option, the lessee would measure the transaction at the estimated fair value of the leased asset. This option would include an interest expense component each period, such that a constant rate of interest over the lease term is recognized.

GASB 13 lease example walkthrough

In practice, most governmental entities account for lease transactions using either (A) the lease contract method or (B) straight-line method options, simply due to the sheer complexity of the fair value option. We will walk through accounting for a lease transaction under both of these methods using the full accrual accounting basis.

If capturing the activity within the governmental fund, a conversion entry will be necessary at year-end to convert from the modified accrual accounting basis to the required full accrual basis for the government-wide financials.

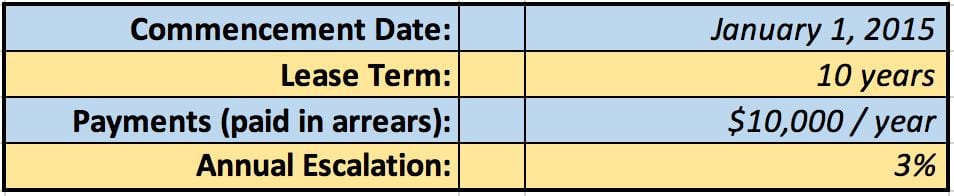

Lease example details:

In this example, the lessee is leasing a building with the following contract terms:

Option A: Lease contract method

In this option, the lease contract contains a 3% annual escalation clause. In contract negotiations, the parties agreed that this annual escalation represents expected increases in the property fair value/inflation amounts over the term of the contract. The GASB notes two main criteria in determining whether a contractual payment schedule is systematic and rational: Whether the change in rent payments overtime mirrors economic factors related to the lease asset (i.e. value appreciation in a real estate lease) The payment schedule mirrors the time pattern in which the lessee has availability to the asset’s intended use In accordance with GASB 13, the escalation represents a pattern of payments specified within the contract that portrays a “systematic and rational” manner. As such, the organization has determined that it will account for this agreement using the lease contract method.

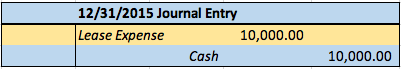

How to create a journal entry under the lease contract method

The lease contract method could effectively be deemed the cash basis of accounting, as the accounting for lease payments mirrors the actual schedule of payments, rather than calculating a straight-line expense for the full term. Under this method, the cash payment each period would match the expense booked by the lessee. Utilizing the payment schedule above, this would provide the following journal entry at the end of each period:

This process of expensing the annual cash payment would continue through the ten-year lease under GASB 13.

Option B: straight-line method

The straight-line method under GASB 13 mirrors the accounting guidance for operating leases under ASC 840 and IAS 17. For the purposes of this example, let’s assume that the annual escalation does not correspond to a future economic value of the property, and is instead intended to represent a form of financing (i.e. reduction in annual rental payments in the early years of the contract) to the lessee. As a result, the organization reviews GASB 13 and determines that it will account for the arrangement using the straight-line method.

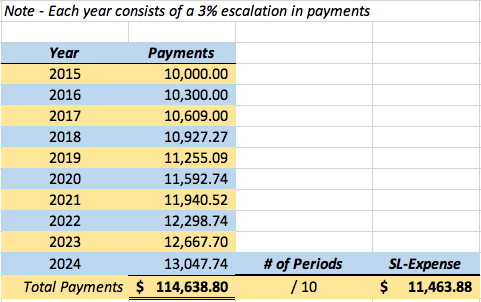

Step 1: Calculate straight-line expense

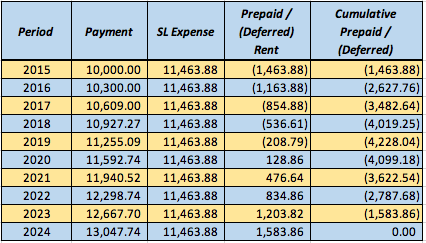

The lessee would simply sum the gross value of lease payments and divide by the number of total periods within the lease agreement to determine the straight-line expense.

The straight-line expense for each period is calculated as $11,463.88 per year.

Step 2: Book periodic journal entries

The lessee would book periodic journal entries, determining a cumulative deferred/prepaid rent balance, based on the difference between the cash payment and the straight-line expense.

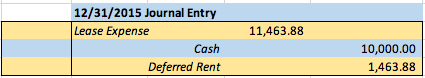

See below for the journal entry at the end of the initial year of the lease term. Each period’s journal entry would similarly populate based on the data within the amortization schedule above.

As a reminder, for operating leases under GASB 13, no actual asset or liability is recorded on the balance sheet—instead only recognition of cash payment and expense is recognized each period.

Looking ahead to GASB 87

A future article will provide a detailed example on how the same agreement would be accounted for under the new governmental lease accounting standard, GASB 87, which provides more transparency to users of the financials regarding lease agreements and financing arrangements.