Summer is winding down, and it’s time for students to head back to school. While your children are in the classroom this fall, you can brush up on your lease accounting and post-transition audit knowledge. This blog combines recent survey data and LeaseQuery tools to ensure you can tackle your ASC 842 audit like a pro.

Post-transition audit takes extra effort

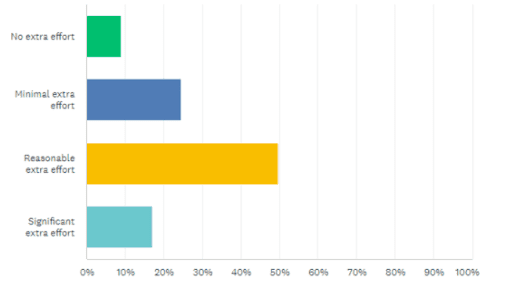

Recently, LeaseQuery surveyed accountants who have completed their first post-transition audit. Most respondents from private companies revealed that while they expected the new standards to impact the ASC 842 audit, they didn’t realize how much time and effort would go into the process. Nearly 98% reported the audit took extra effort due to the lease accounting transition.

How much total time was devoted to your audit due to the lease accounting transition?

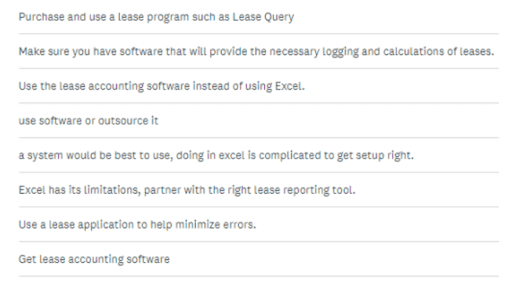

Toward the end of the survey, LeaseQuery asked participants for advice for organizations that have yet to complete their audits. Some of the commonly mentioned tips are outlined below.

Use lease accounting software

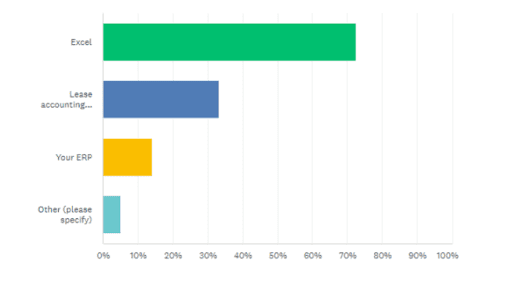

While most survey participants said they have completed their first audit under ASC 842, the majority of them used Excel to prepare for it. Although 72% of respondents reported using Excel, the 33% who used a lease accounting software expressed how advantageous the solution was during their transition process.

Did your company leverage software to prepare for the post-transition audit? Check all that apply.

Excel lacks the automation and efficiency of accounting software. When asked what advice participants would give to others completing their first post-transition audit, one of the most frequent replies was to use a lease accounting software to streamline the process, as highlighted below.

What advice would you give other companies or organizations heading into an audit?

Excel can make compliance with the new standards more challenging. Using lease accounting software helps minimize errors, organize lease data, and create reports the auditors will request much more efficiently than manual spreadsheets. With features such as role-based access for auditors and quick reporting, an automated solution will save accounting and finance teams a lot of time and stress.

Get the right departments involved ahead of time

The second most-common tip from respondents was to plan for the audit ahead of time, including determining which departments will handle which tasks. Participants found the ASC 842 audit process takes much longer than expected, and the sooner data, procedures, and reports are organized, the better. Companies will experience a smoother post-transition audit if they brush up on the practices and procedures required for a successful audit.

Before the audit, it’s essential to have proper policies and internal controls in place.

- Who is in charge of managing lease data?

- How do you differentiate duties?

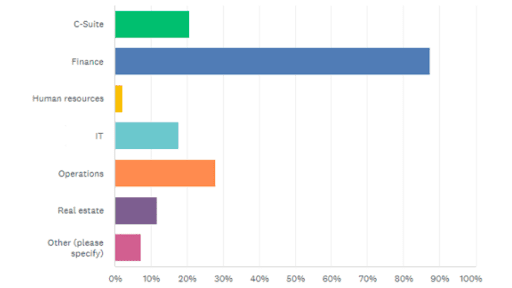

Your audit team needs to have a thorough understanding of the procedures in place surrounding the new lease accounting standards. Figure out what teams will be involved ahead of time. According to our survey, the top three teams typically involved include finance, operations, and C-Suite executives.

Which teams were involved? Check all that apply.

While planning for an audit feels overwhelming, resources are available to help. Use this guide from LeaseQuery to prepare for your first post-transition audit.

Document everything

As touched on in the section above, proper documentation is key to a successful audit under ASC 842. Participants in the audit survey expressed preparation is key many times. With lease accounting software, this documentation process is much simpler.

What advice would you give other companies or organizations heading into an audit?

Auditors will request documentation of internal controls and policies. Document everything thoroughly, including the rationale for any decisions related to your lease population. Assume the auditors will ask for clarity on any of the supporting documentation you provide, and be prepared to explain all of it.

Tips for proper documentation procedures

When documenting your ASC 842 policies, ask yourself if you have clearly compiled the answers to these three essential questions to ensure all your key lease accounting judgments and processes are recorded correctly.

- Have you captured all leases?

- Is the data abstracted from contracts accurate and complete?

- Are the calculations correct?

The auditor will want to see proof of the above questions. The more comprehensive and clear your records are, the smoother the process will be.

This podcast episode gives more tips for preparing for your first audit after the transition.

Summary

As revealed by the survey participants, preparing for your first audit under ASC 842 can be overwhelming. In order to ace your audit, use a lease accounting software to organize data, prepare the involved departments ahead of time, stay in contact with your auditors, and document everything thoroughly.

For more information, check out this webinar from LeaseQuery.