ATLANTA, August 7, 2019 – Accountants are underestimating the challenges of complying with new lease accounting standards. A new LeaseQuery survey of more than 200 accountants, conducted by Encoursa, finds that only 37% of companies in the early stages of implementation anticipate that their transition will be difficult. However, 67% of companies in the latter stages have experienced difficulty.

The new lease accounting rules, also known as ASC 842, went into effect January 1, 2019 for public companies, while private companies and nonprofits will have until 2020 to implement. Given the complexity of the new rules, the Financial Accounting Standards Board (FASB) voted in July 2019 to recommend a further delay for private companies.

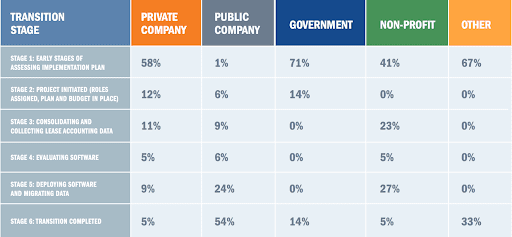

Delay or no delay, organizations would be wise to heed the advice of early and public company adopters. Just over half of public companies (54%) have completed their transition, meaning that many have further work ahead even seven months after the deadline. Just 5% of private companies have completed the transition, with 58% in the early stages of assessing their implementation plan.

“While organizations await the FASB decision, one thing is clear: a delay is just a false sense of security,” says George Azih, CEO of LeaseQuery. “Transitioning to the new standard is a complex, time-consuming process, even when you have the best team and tools on your side. Private companies, nonprofits and government organizations should continue to move transition plans forward, and with haste.”

Lease Accounting Transition Progress

For more, read the full report: The Accountant’s Journey Towards Adopting the New Lease Standards.

About the Survey

In June, LeaseQuery commissioned Encoursa to conduct a survey of 201 accountants who expressed an interest in learning about lease accounting. Respondents are in the process of transitioning their organization to the FASB’s Accounting Standards Update No. 2016- 02, Leases (Topic 842).

About LeaseQuery

LeaseQuery helps accountants and other finance professionals eliminate lease accounting errors through its CPA-approved lease accounting software. By providing specialized consulting services in addition to its software solution, LeaseQuery enables companies across all sectors to ensure compliance with the most comprehensive regulatory reform in 40 years. It is the first lease accounting software built by accountants for accountants. For more information about LeaseQuery, click here or call 1-800-880-7270.

Additional Resources:

- Learn more about LeaseQuery

- Follow LeaseQuery on LinkedIn, Facebook and Twitter

- Read LeaseQuery’s blog articles