The Accountant's Journey Towards Adopting the New Lease Standards

CONDUCTED BY LEASEQUERY IN PARTNERSHIP WITH ENCOURSA DOWNLOAD THE PDFAccountants have faced significant challenges on their journey towards adopting the new lease accounting standards.

While the deadline for public companies to comply has come and gone, private companies are likely to be granted an additional year to prepare, given the complexity of the new rules.

For the last two years, we’ve conducted a survey to assess where organizations stand in their transition, and to get deeper insights into the obstacles they’re up against.

News of a deadline extension was likely welcome to private companies and nonprofits, as many are only in the early stages of transition. However, this is a gift that could be squandered by inaction.

Perception vs. Reality

Our survey finds that companies early in their transition have underestimated the depth of the challenge ahead of them. Only 37 percent of companies in the early stages anticipate that their transition will be difficult. But 67 percent of companies in the later stages have experienced difficulty.

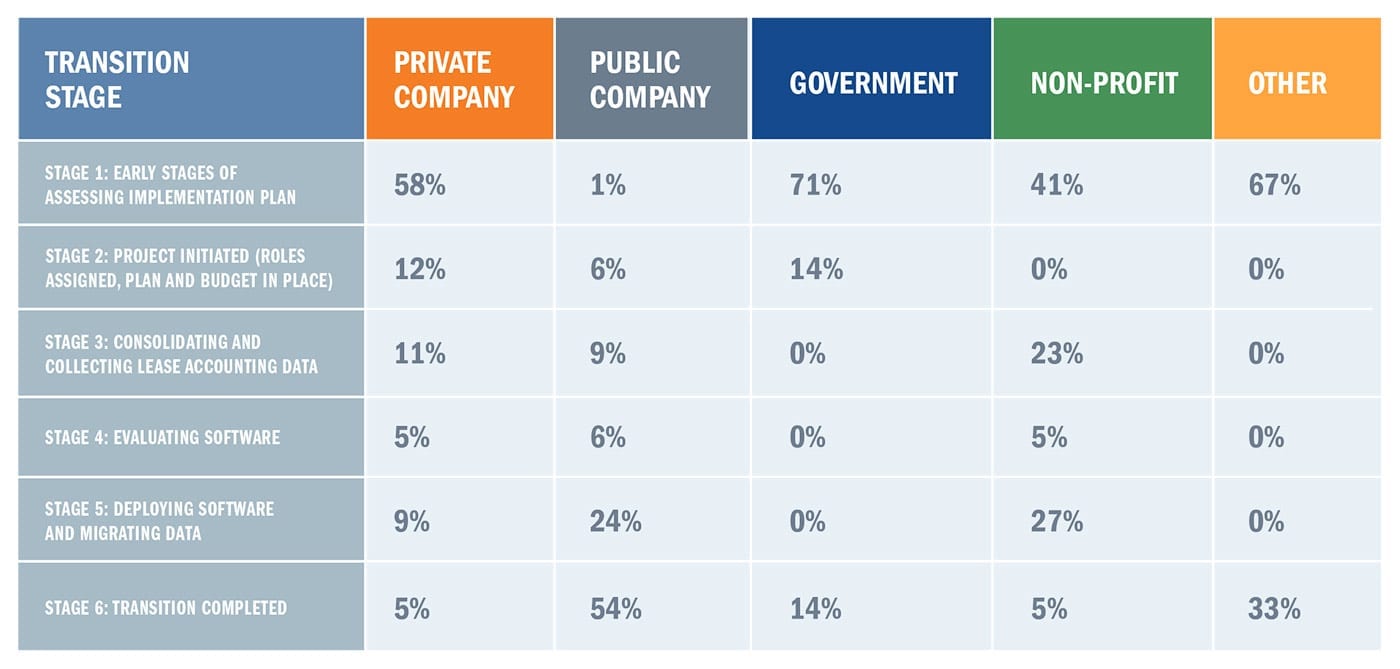

Delay or not, the risk of failing to meet the deadline is high: 58 percent of private companies are in the first stage of the transition, while nearly one-quarter of public companies are still onboarding a lease accounting system seven months after the effective date. With 71 percent of government agencies in the first stage of the transition, this sector faces the highest risk of falling behind.

%

of companies in early stages anticipate a difficult transition

%

of companies in later stages have experienced difficulty

About the Survey

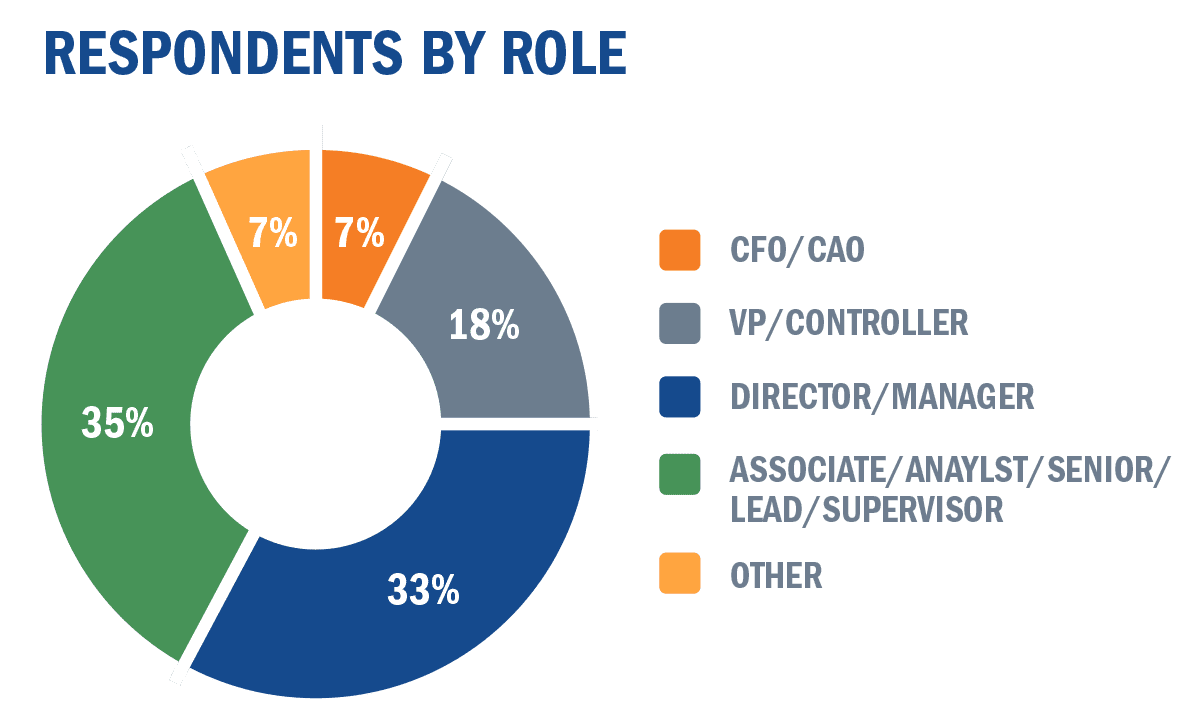

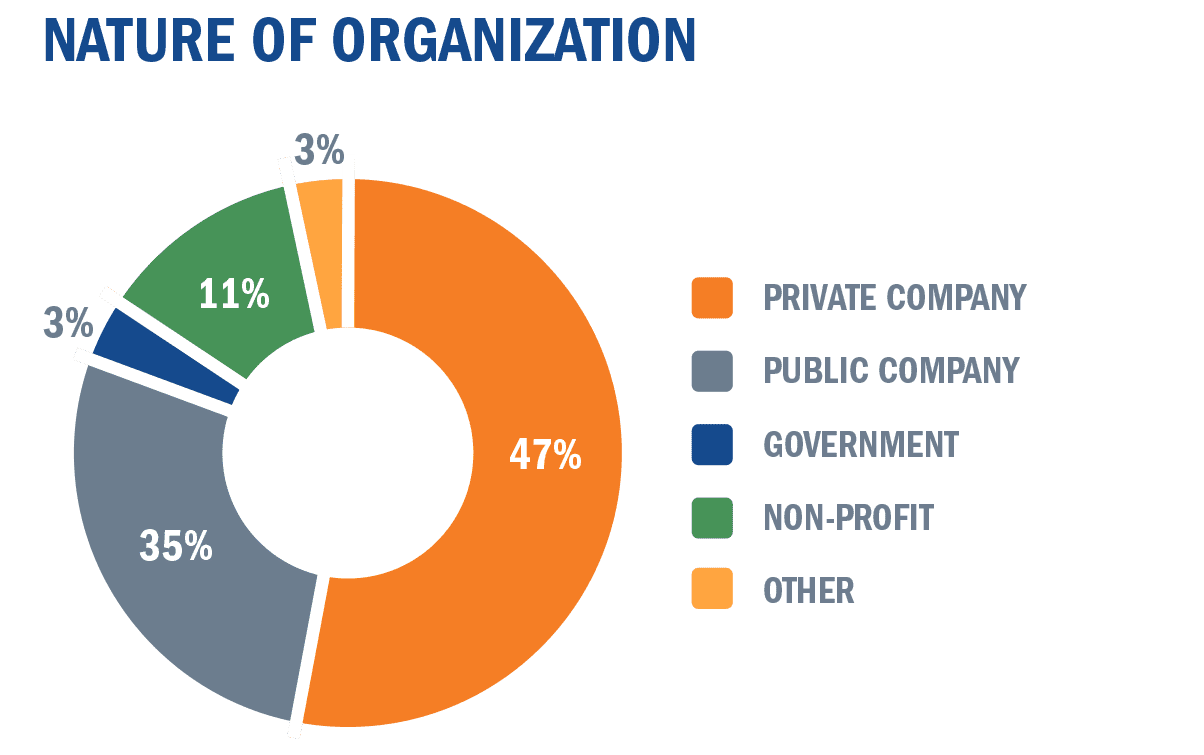

LeaseQuery conducted this survey in partnership with Encoursa. Respondents consisted of accountants who have expressed interest in continuing education on the topic of lease accounting. The results in this report are based on the responses of 201 accountants who are in the process of transitioning their organization to the new standards.

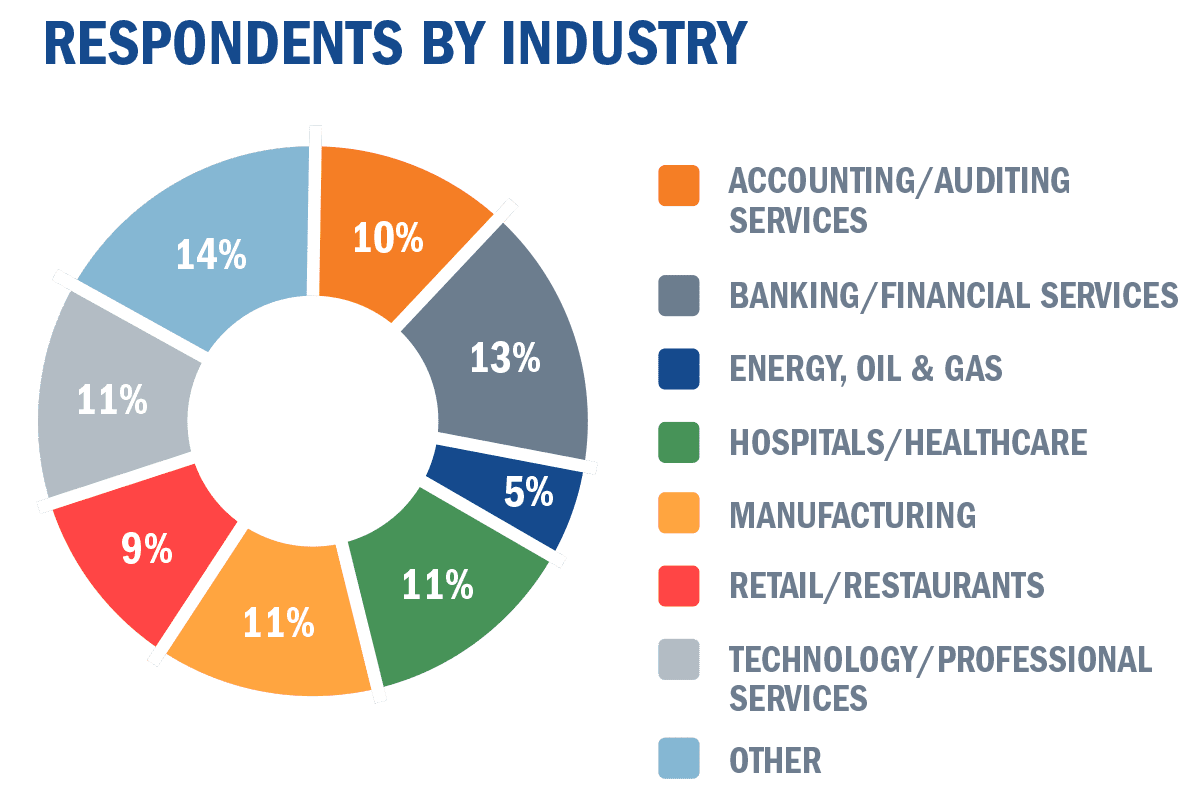

The following industries represented less than 20 percent of respondents:

Automotive, Defense & Aerospace, Federal Government, Higher Education, Local & State Government, Logistics/Transportation, Pharmaceuticals/Medical Devices, Telecom/Communication Services, Travel/Tourism

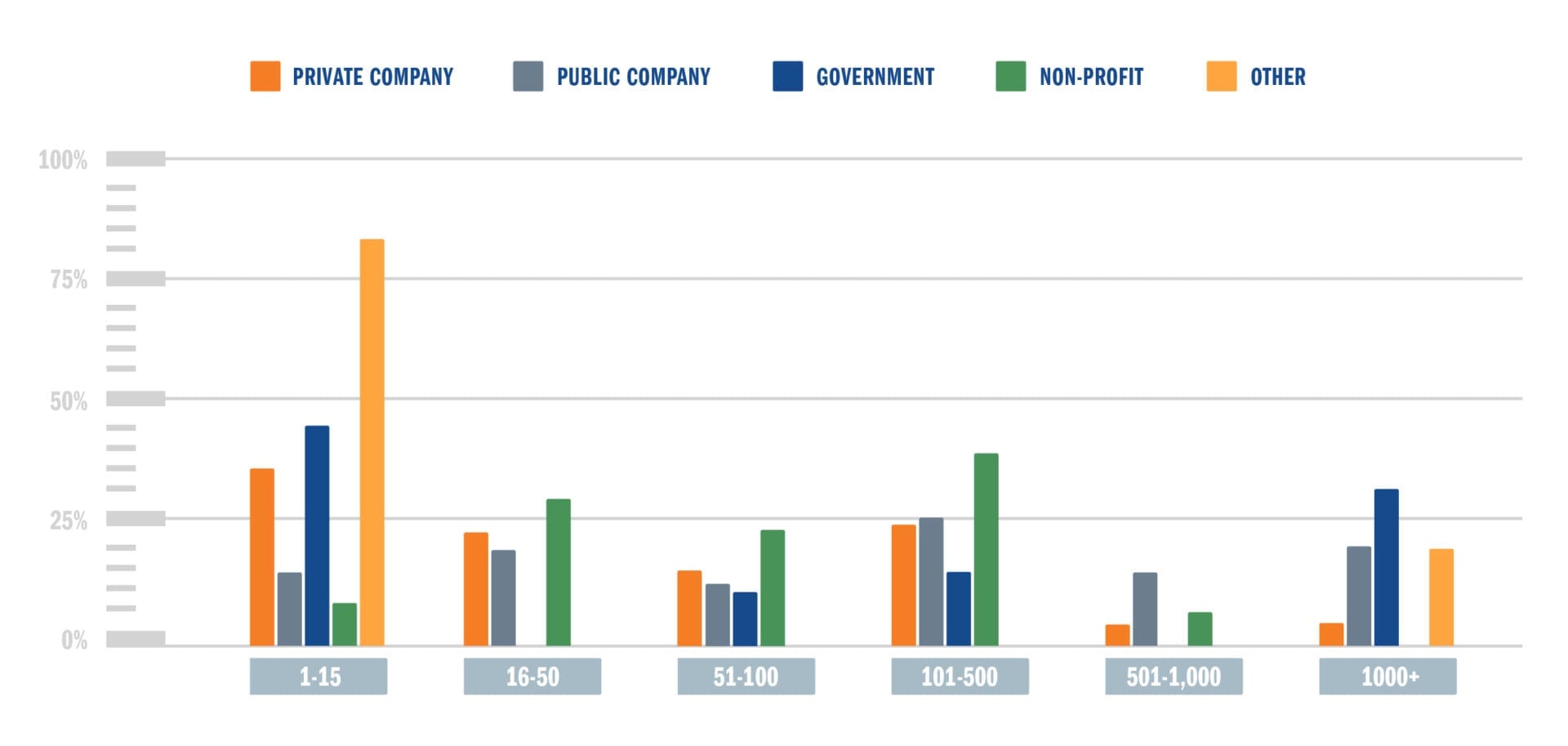

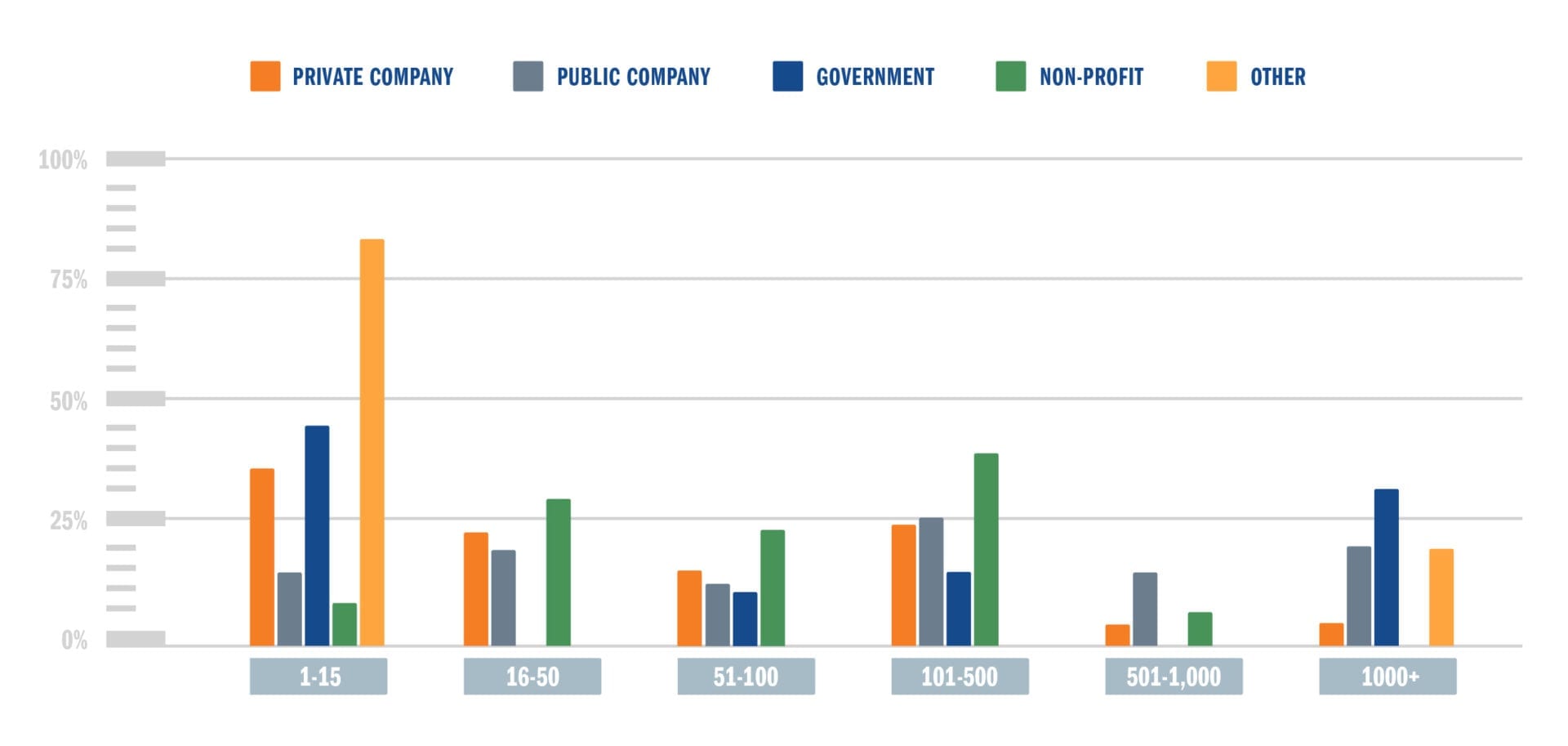

Number of Leases in Portfolio

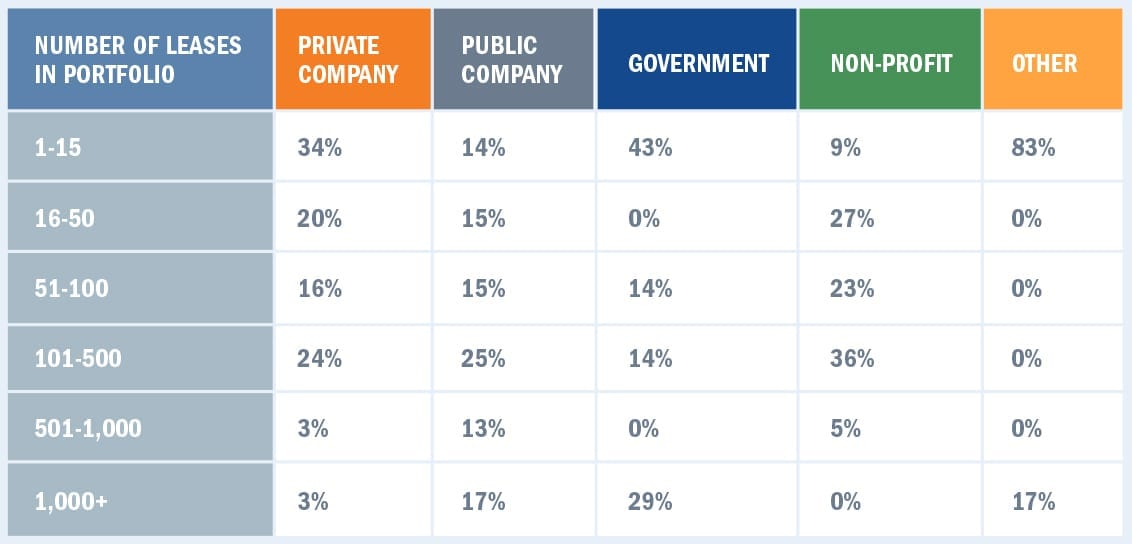

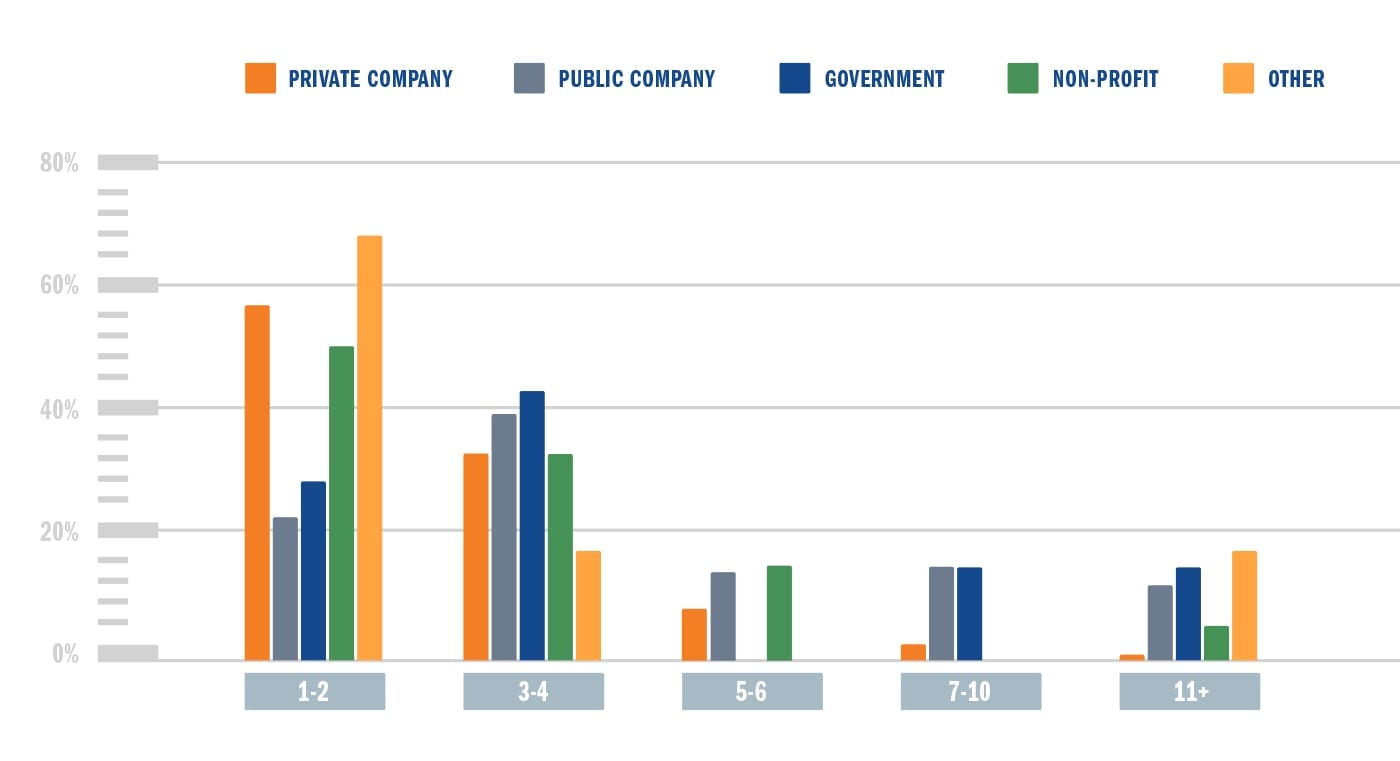

The majority of organizations have fewer than 100 leases. However, across each sector there are a significant number of organizations that have 101-501 leases.

The percentage of government agencies with more than 1,000 leases is noteworthy, considering that GASB 87, the government standard for leases goes into effect later this year.

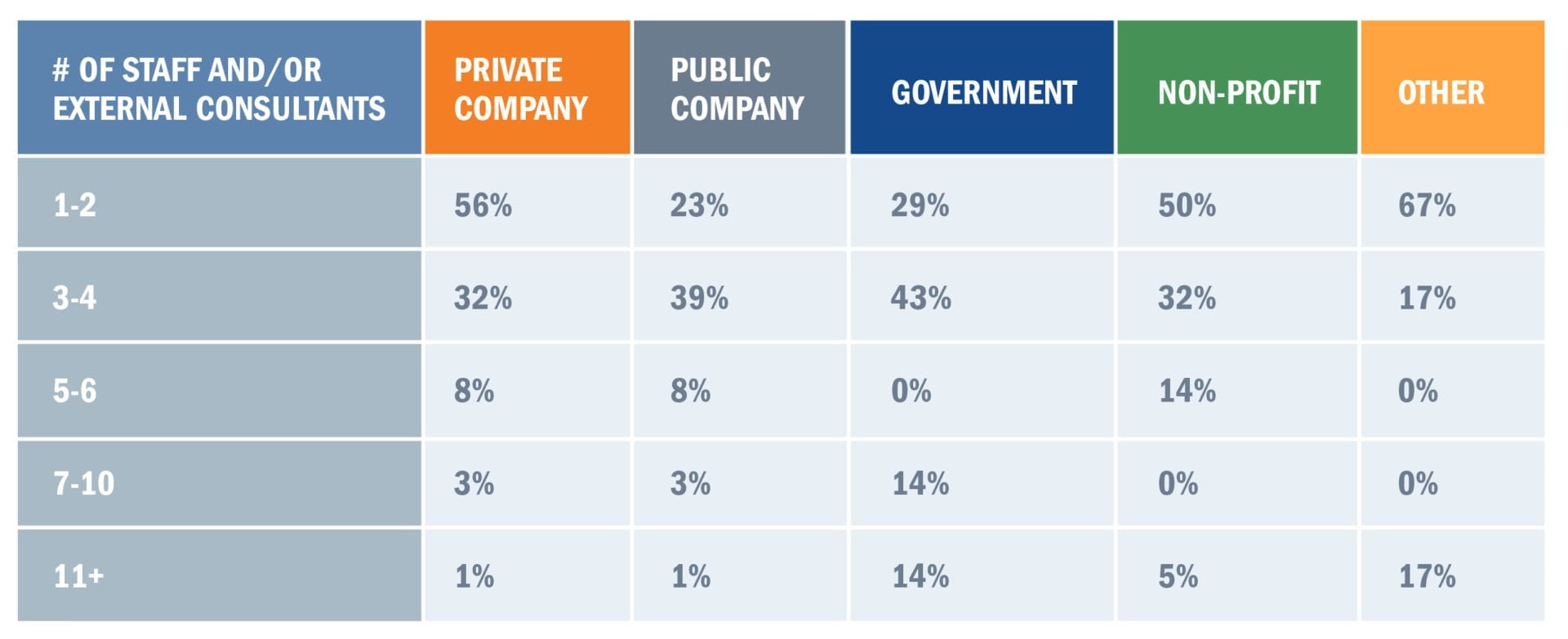

Number of Staff and/or External Consultants

Small teams are the norm. Private companies in particular are tackling the lease transition with limited resources. 56 percent only have one or two staff members or external consultants on their transition team.

Too Many Organizations

are Falling Behind

Private companies and government agencies are at risk of lagging behind in their transition, with 58 percent and 71 percent in stage one, respectively. In our 2018 survey, 80 percent of private companies were in stages one or two; too few have made significant progress since then.

While the majority of public companies have completed their transition, nearly one-quarter are still addressing data migration and software deployment. One-fifth of public companies still haven’t deployed a system to aid in their transition.

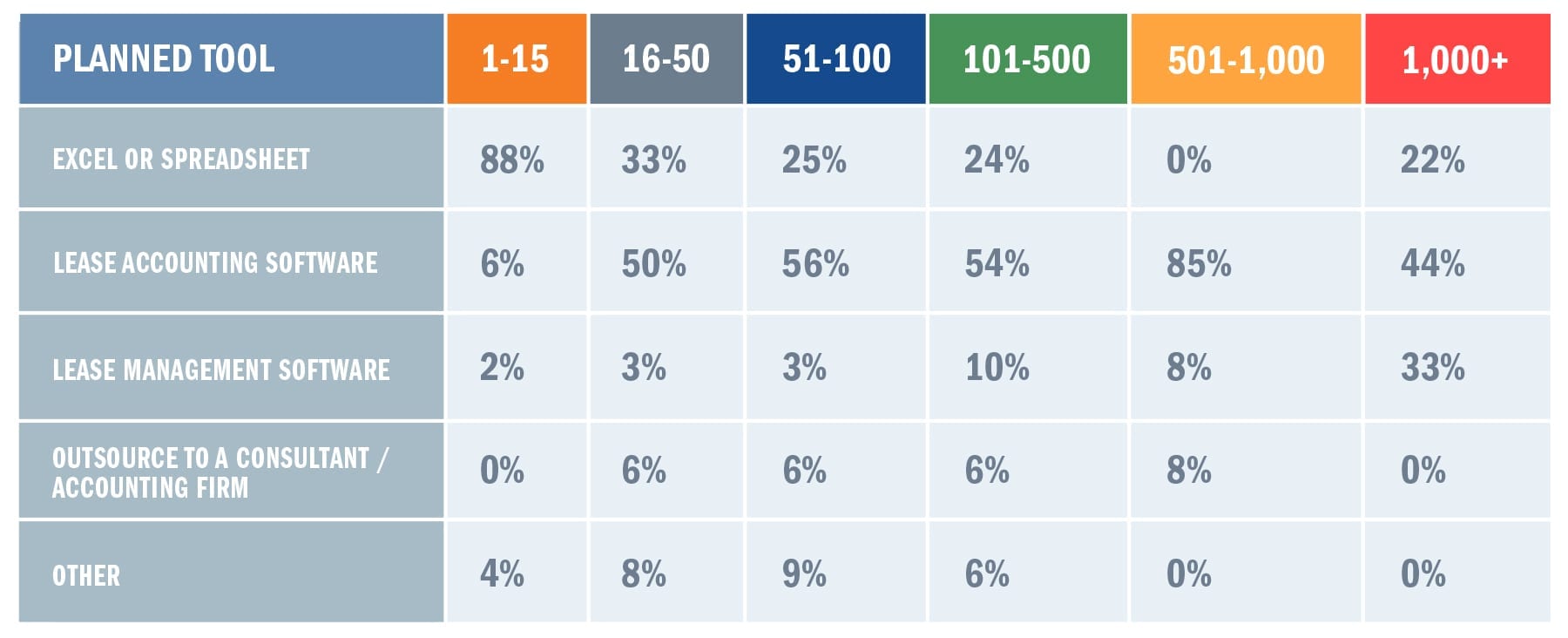

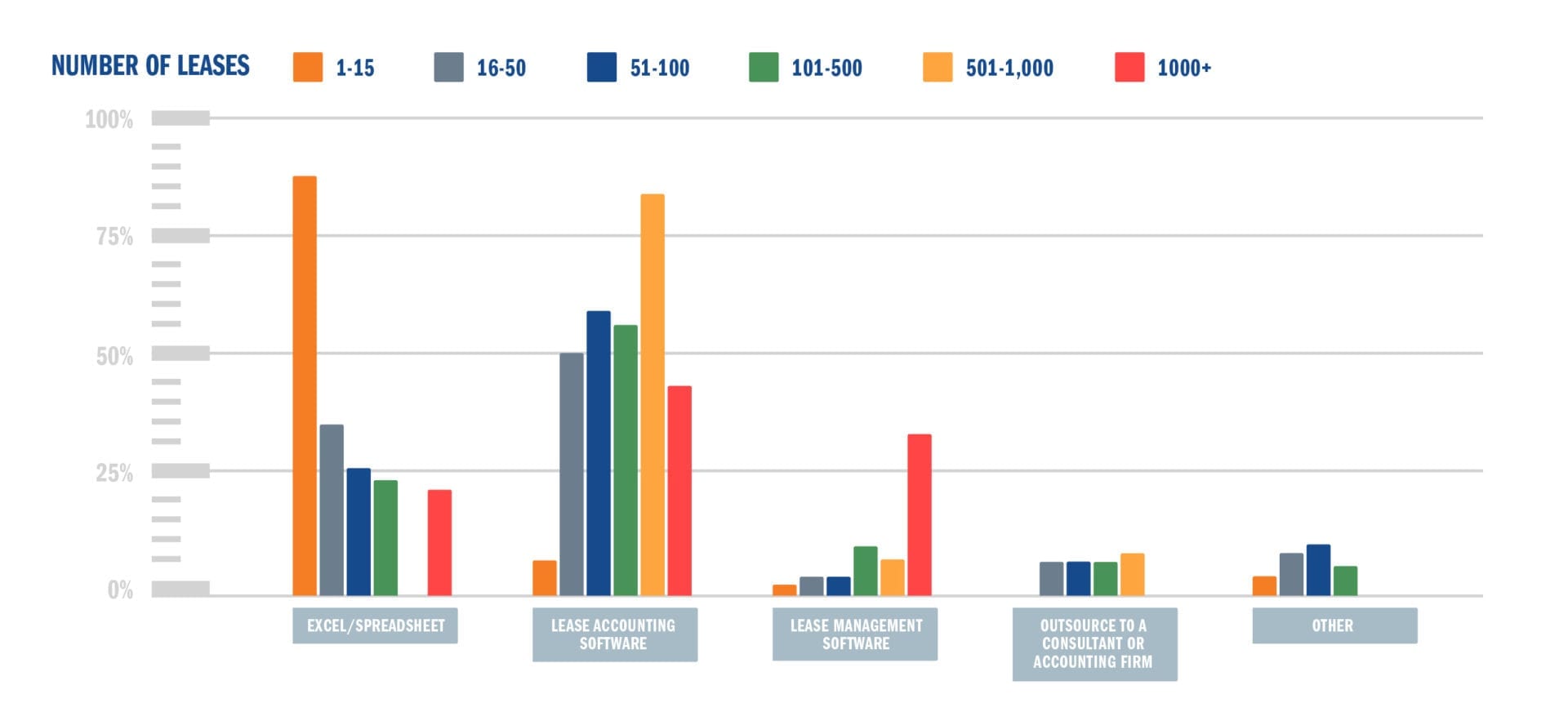

Planned Tool for Compliance

It’s not surprising to see that the overwhelming majority of organizations with less than 15 leases are planning to use Excel. For some in this category, Excel will be an appropriate tool for compliance, especially if their lease agreements lack complexity.

Tthe number of organizations with a higher number of leases that plan to use Excel is cause for alarm. Using Excel will greatly increase the time involved in transitioning, and accountants need to consider whether its features meet standards for accuracy and internal controls.

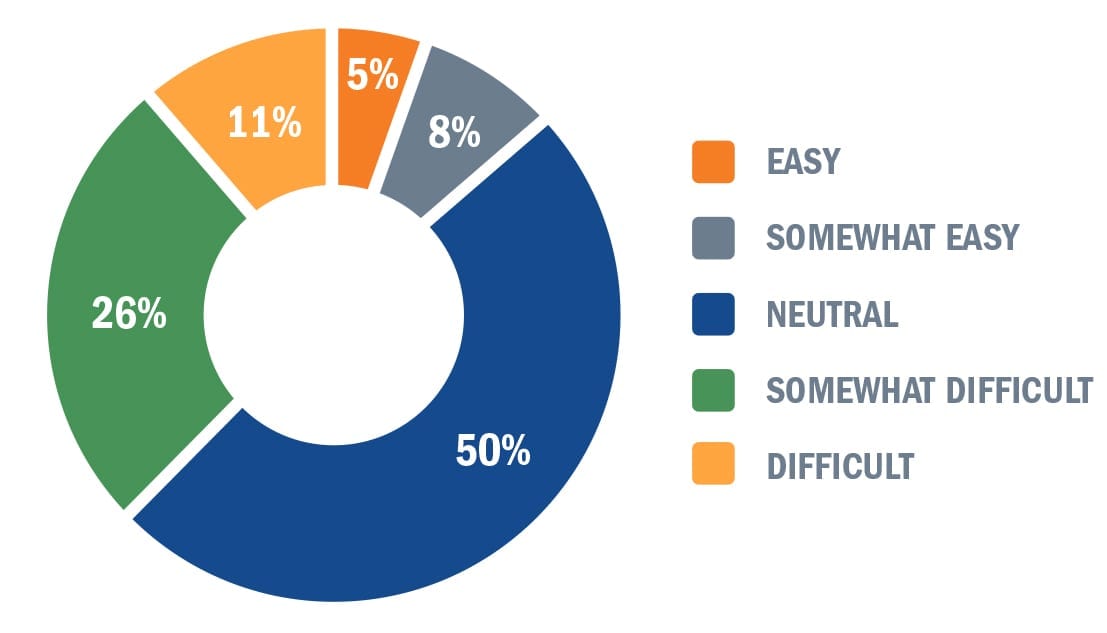

Companies are Underestimating the Difficulty of the Transition

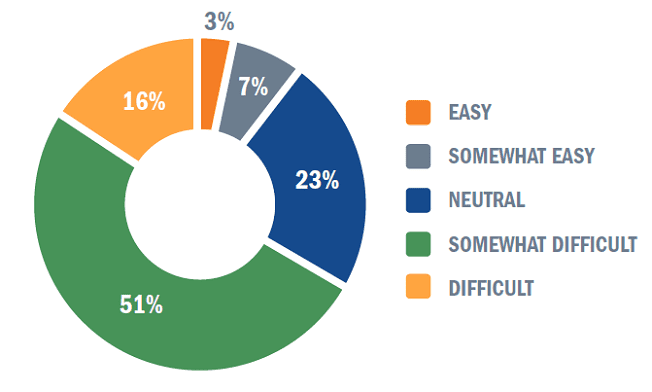

Anticipated Difficulty

We asked all survey respondents in stages one and two of the transition how much difficulty they anticipated. The majority expect the experience to be neutral, while over two-thirds anticipated some level of difficulty.

Actual Difficulty

Accountants in stages three through six report that they faced much more difficulty than those in the early stages are anticipating

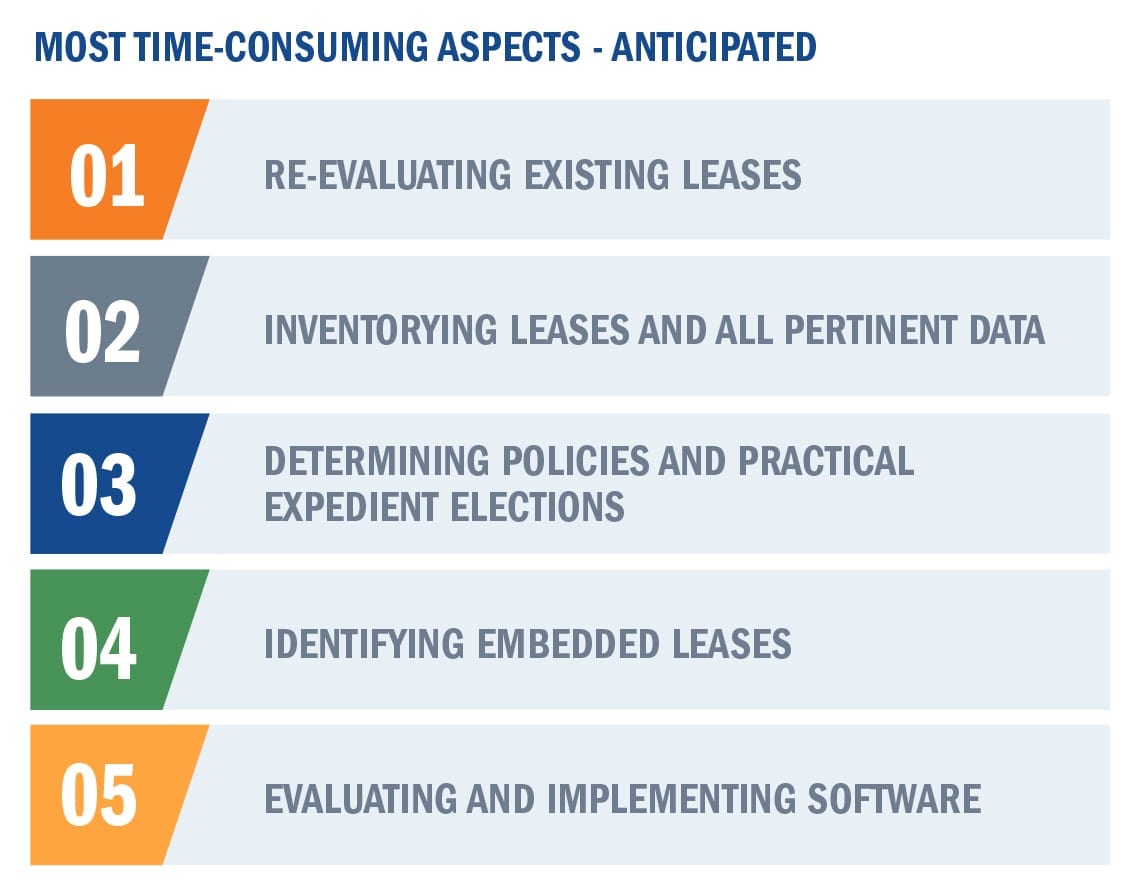

Where should organizations devote their resources?

For the most part, companies in the early stages of their transition have a good handle on which aspects of the transition they expect to wrestle with the most. There is one key exception, and that is in the number of leases that must be transitioned.

Organizations may be underestimating how many leases they have. As the next graphics will show, inventorying leases has proven to be one of the most time-consuming aspects of the transition for companies in later stages.

This perception reflects a troubling trend: in our 2018 survey, number of leases also ranked last for this question.

Quotes from respondents on challenging aspects

Where should organizations devote their time?

In terms of time, organizations are underestimating how much they’ll need to devote to software evaluation and deployment. With many tools in the marketplace, it is critical for companies to not rush the evaluation process.

THE SILVER LINING

All of the time and effort it takes to transition can be worth more than compliance.

The transition enhances data transparency and access, and can enable departments to work better together. The sooner companies transition, the sooner they benefit from these deeper insights.

Better lease management and administration

Efficiences in auditing and general operations

Improved budgeting and forecasting capabilities

Conclusion

The lease transition has been one of the most sweeping changes to accounting in recent memory. Viewed in the context of other recent standard updates, such as revenue recognition, it’s not surprising to see that many companies in the later stages have experienced more difficulty than expected.

With a brief reprieve likely to be granted for private companies, there is a keen opportunity to apply the lessons learned of transitioned companies and act now to avoid a rushed process.

Encoursa provides quality continuing professional education to CPAs. Encoursa hosts NASBA-accredited CPE webinars for growth-oriented professionals looking for high-quality, affordable continuing education.

To do this, Encoursa partners with leading companies who choose to present their solutions to CPAs and finance professionals in a live, educational format. Encoursa also features presenters who speak on topics such as ethics and financial statement preparation.

Visit encoursa.com to learn more.

Like this survey? Check out some of our free tools.

Free Lease Accounting Software

Comply with confidence for free under ASC 842 & IFRS 16.

GASB Lease Accounting RFP

Use our GASB specific RFP to start evaluating software vendors today.

Lease Accounting Software RFP

Use our RFP to start evaluating lease accounting software vendors today.

Lease vs Buy Calculator

Perform a break even analysis with our free Lease vs Buy excel template.

GASB Lease Tracking Template

Use this free tool to create an inventory of your leases.

Embedded Lease Test

Use this free tool to determine if your contract contains a lease.

Lease Asset Tracker

Use this free tool to easily document your leases.

Capital vs. Operating Lease Test

Use this free tool to determine your lease classification.

Present Value Calculator

Use this free tool to calculate the present value of your minimum lease payments.