2. Depreciation methods in accounting

- Straight-line method of depreciation

- Declining balance method of depreciation

- Sum-of-the-years’-digits depreciation method

- Units of production depreciation method

3. Example: Calculating straight-line depreciation for a fixed asset

- Initial journal entry

- Straight-line depreciation expense calculation

- Annual journal entries

- Updates to depreciation expense

4. Summary

What is depreciation?

Depreciation is a way to account for the reduction of an asset’s value as a result of using the asset over time. Depreciation generally applies to an entity’s owned fixed assets or to its leased right-of-use assets arising from lessee finance leases. This article will focus solely on fixed assets.

Depreciation expense

Depreciation expense allocates the cost of a company’s asset over its expected useful life. The expense is an income statement line item recognized throughout the life of the asset as a “non-cash” expense.

Accumulated depreciation

Accumulated depreciation is the associated balance sheet line item for depreciation expense. Depreciation expense is recorded as a debit to expense and a credit to a contra asset account, accumulated depreciation. The contra asset account is a representation of the reduction of the fixed asset’s value over time.

The accumulated depreciation account has a normal credit balance, as it offsets the fixed asset, and each time depreciation expense is recognized, accumulated depreciation is increased. An asset’s net book value is its cost less its accumulated depreciation.

Accumulated depreciation is carried on the balance sheet until the related asset is disposed of and reflects the total reduction in the value of the asset over time. In other words, the total amount of depreciation expense recorded in previous periods.

Depreciation methods in accounting

Under US GAAP, four methods of calculating depreciation are available for an organization to use:

- Straight-line method of depreciation

- Declining balance depreciation method

- Sum-of-the-years’ digits depreciation method

- Units of production depreciation method

Below we will describe each method and provide the formula used to calculate the periodic depreciation expense.

Straight-line method of depreciation

The straight-line method is the most common method used to calculate depreciation expense. It is the simplest method because it equally distributes the depreciation expense over the life of the asset.

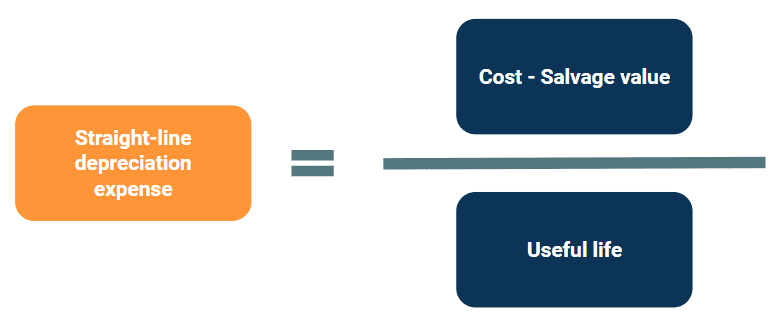

The only inputs required to calculate depreciation expense using the straight-line depreciation method are:

- The cost of the asset: The amount the business paid for the asset.

- The salvage value: Sometimes called scrap value or residual value, this is the estimate of the amount the company expects to receive for the asset if sold at the end of its useful life.

- The useful life of the asset: The estimated amount of time the asset is expected to be used before it needs to be replaced or disposed.

Here is the formula to calculate straight-line depreciation expense:

Because organizations use the straight-line method almost universally, we’ve included a full example of how to account for straight-line depreciation expense for a fixed asset later in this article. Below are three other methods of calculating depreciation expense that are acceptable for organizations to use under US GAAP.

Declining balance method

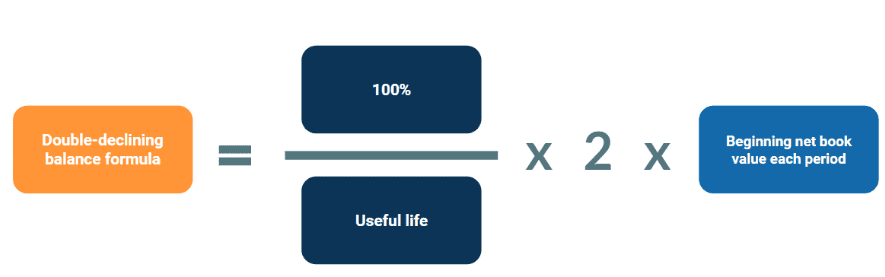

The declining balance method of depreciation does not recognize depreciation expense evenly over the life of the asset. Rather, it takes into account that assets are generally more productive the newer they are and become less productive in their later years. Because of this, the declining balance depreciation method records higher depreciation expense in the beginning years and less depreciation in later years. This method is commonly used by companies with assets that lose their value or become obsolete more quickly.

To calculate depreciation using this method, a rate of depreciation is calculated and multiplied by the book value each year. The formula to calculate depreciation expense using this method is as follows:

The term “double-declining balance” is due to this method depreciating an asset twice as fast as the straight-line method of depreciation. The “2” in the formula represents the acceleration of deprecation to twice the straight-line depreciation amount. However, when using the declining balance method of depreciation, an entity is not required to only accelerate depreciation by two. They are able to choose an acceleration factor appropriate for their specific situation.

Sum-of-the-years’-digits depreciation method

Similar to the declining balance method, the sum-of-the -years’-digits method accelerates depreciation, resulting in higher depreciation expense in the earlier years of an asset’s life and less in later years.

This method is calculated by adding up the years in the useful life and using that sum to calculate a percentage of the remaining life of the asset. The percentage is then applied to the cost less salvage value, or depreciable base, to calculate depreciation expense for the period.

For example, if an asset has a useful life of 5 years, summing the digits of the five years of the asset’s useful life looks like this: 1 + 2 + 3 + 4 + 5 = 15. Each year, the depreciable base is multiplied by the percentage of the remaining useful life to determine the annual depreciation expense. The annual expense is then allocated evenly over the year in each financial period.

For further clarity, for an asset with a 5-year useful life, the annual depreciation expense for the first year would be one third (⅓ = 5 /15) of the asset’s value. In year two, the annual depreciation expense percentage would be approximately 27% or 4/15. Then, in year three the percentage would be one fifth (⅕ = 3/15), and so on.

Units of production depreciation method

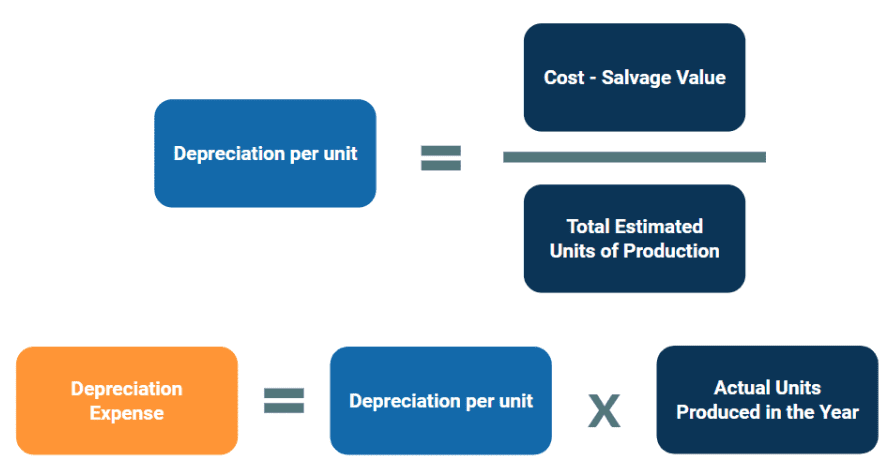

Unlike the other methods, the units of production depreciation method does not depreciate the asset based on time passed, but on the units the asset produced throughout the period. This method is most commonly used for assets in which actual usage, not the passage of time, leads to the depreciation of the asset.

This method first requires the business to estimate the total units of production the asset will provide over its useful life. Then a depreciation amount per unit is calculated by dividing the cost of the asset minus its salvage value over the total expected units the asset will produce. Each period the depreciation per unit rate is multiplied by the actual units produced to calculate the depreciation expense.

Below are the two formulas used in the units of production depreciation method:

Regardless of the depreciation method used, the total depreciation expense (and accumulated depreciation) recognized over the life of any asset will be equal. However, the rate at which the depreciation is recognized over the life of the asset is dictated by the depreciation method applied.

Example: Calculating straight-line depreciation for a fixed asset

Now, consider an example to illustrate the straight-line method depreciation for a fixed asset.

A company purchases equipment for $100,000. This is machinery purchased to manufacture products for the business to sell. Since the equipment is a tangible item the company now owns and plans to use long-term to generate income, it’s considered a fixed asset.

The company determines it will use the straight-line method to depreciate this asset. These additional factors are also evaluated to account for the asset:

- Purchase Price: $100,000

- Salvage value: $30,000

- Useful life of equipment: 10 years

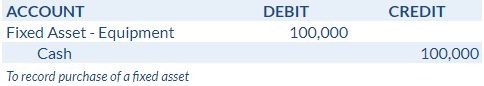

Initial journal entry

To recognize the initial purchase of the fixed asset, the company makes the following entry:

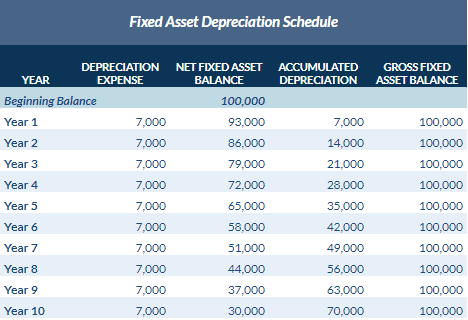

Straight-line depreciation expense calculation

In the explanation of how to calculate straight-line depreciation expense above, the formula was (cost – salvage value) / useful life.

To calculate the straight-line depreciation expense of this fixed asset, the company takes the purchase price of $100,000 minus the $30,000 salvage value to calculate a depreciable base of $70,000. This results in an annual depreciation expense over the next 10 years of $7,000.

So, the company will record depreciation expense of $7,000 annually over the useful life of the equipment.

Below is the annual depreciation schedule for the asset:

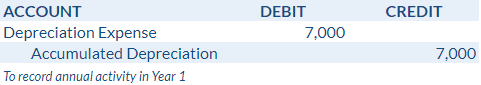

Annual journal entries

Throughout the year, the company recognizes straight-line depreciation expense evenly each month as a reduction in the asset value. The journal entry recorded is a debit to depreciation expense and a credit to accumulated depreciation. In addition to the journal entry made when the equipment was purchased discussed above, the company records an aggregate entry in Year 1 to recognize the annual depreciation of $7,000:

In subsequent years, the aggregated depreciation journal entry will be the same as recorded in Year 1. The company will continue to make journal entries to recognize the depreciation expense related to the asset until the end of Year 10, at which point the net fixed asset balance will equal its estimated salvage value of $30,000. Further, the full depreciable base of the asset resides in the accumulated depreciation account as a credit.

Updates to depreciation expense

In some scenarios, subsequent journal entries may change due to adjustments to the fixed asset’s useful life or value to the company as a result of improvements or impairments of the asset. For example, during year 5 the company may realize the asset will only be useful for 8 years instead of the originally estimated 10 years. The prior depreciation expense cannot be changed as it was already reported.

In this instance, the company recalculates the straight-line depreciation expense using the current net book value of the asset minus the $30,000 salvage value divided by the updated number of years of life remaining. From the amortization table above, we will deduct $30,000 from the current net asset value of $65,000 at the end of year 5 resulting in a $35,000 depreciable cost. Then divide the depreciable cost of $35,000 by the 3 years of useful life remaining. The fixed asset will now have an updated annual depreciation expense of $11,667 for each year of its remaining useful life.

Summary

Depreciation expense represents the reduction in value of an asset over its useful life. Multiple methods of accounting for depreciation exist, but the straight-line method is the most commonly used. This article covered the different methods used to calculate depreciation expense, including a detailed example of how to account for a fixed asset with straight-line depreciation expense.