The rise of software subscriptions

In today’s tech-enabled environment, software applications are one of the main tools for operational efficiency within organizations. Whether you are a publicly traded company, non-profit organization, or government agency, software solutions have been implemented to streamline processes and automate manual tasks across all entities. In doing so, subscriptions to software tools have become one of the largest areas of spend within organizations.

This article examines the nuances of accounting for software subscriptions and important considerations such as popular pricing models and their financial statement impact.

Understanding popular pricing models in SaaS

At its most basic level, pricing for software has generally been divided into two camps:

- Perpetual licenses in which you purchase the license upfront and use the software indefinitely; and

- Subscription-based where licenses generate recurring expenses.

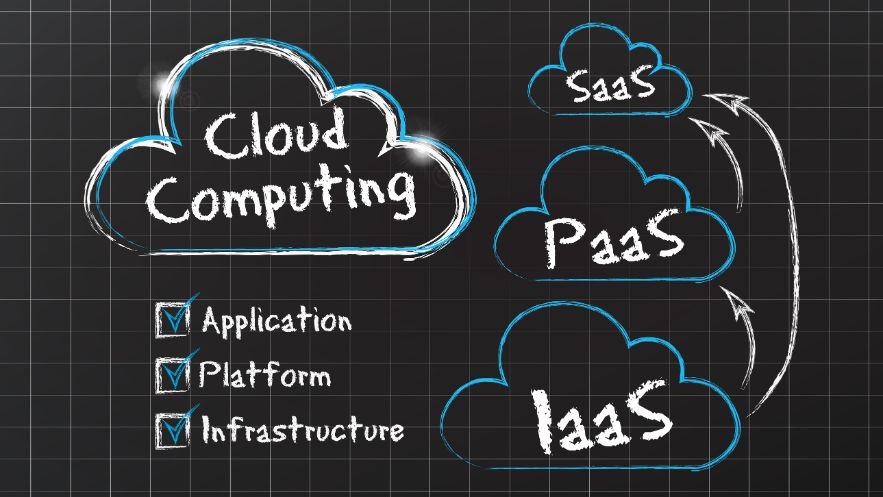

Over the past decade, the widespread adoption of cloud computing prompted organizations to shift from on-premise software solutions to cloud-based SaaS. Barriers to entry for new software vendors have also reduced significantly, which in turn has led to an explosion of available options on the market and a marked increase in subscription-based pricing over perpetual licensing.

Each of these models comes with pros and cons, summarized below.

Traditional perpetual licensing:

| Pros | Cons |

| Forecastability of spend | Costly to upgrade and maintain |

| Indefinite use of the purchased product | On-premise and hosted on customer servers |

| More cost-effective in the long run, especially for large investments such as an ERP | Generally lacks integration or interoperability with other business applications |

| Ongoing payments to vendors are limited to support services which can be terminated or reinstated as needed |

Subscription-based model:

| Pros | Cons |

| Cloud-based | Dependency on vendor |

| Infrastructure, maintenance, and security are largely handled by the vendor | Ease of procurement invites shadow IT and large unforeseen SaaS spend |

| Easily scalable whether based on usage or user count | Ongoing subscription costs and unpredictability of price escalations upon renewals |

If pricing were the only determining factor, it would be logical to conclude the perpetual pricing model for software is the more sound investment for an organization. However, when taking interoperability, accessibility, security, and maintenance all into consideration, SaaS is generally deemed the better investment between the two. It’s also increasingly the only option offered by vendors, in part because capturing recurring revenues is more enticing than taking a one-time payment.

How to account for software subscriptions

Just as we know that different software products from various vendors have many functions, we can also assume each comes with different pricing structures and tiers. Generally, the two pricing structures observed in most SaaS agreements are usage-based pricing and user-based pricing.

While user-based pricing generally equates to the number of licenses or “seats” provided to an organization, usage-based pricing comes in many forms. Examples of usage pricing include:

- A contract management software charging by the number of contracts

- A document management system charging by storage space

- A CRM charging for the number of contacts

Organizations that procure software for internal use have to grapple with whether the software should be capitalized or expensed in the period incurred; an area for which the guidance had been vague until the update to ASC 350-40: Internal-Use Software Accounting & Capitalization.

What does the guidance say?

Two pronouncements deal with software capitalization. ASC 350-40, Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That Is a Service Contact (ASC 350-40), as noted above, addresses internal-use software from a customer’s perspective. On the other hand, ASC 985-20, Software—Costs of Software to Be Sold, Leased, or Marketed (ASC 985-20) deals with software intended to be “sold, leased, or marketed’ from the perspective of a vendor. This article specifically addresses internal-use software from the perspective of a customer – software not intended to be sold, leased, or marketed, and as such, it falls under the guidance provided in ASC 350-40.

SaaS throws an additional layer of confusion into the assessment. In layman’s terms, if an organization is signing a subscription agreement to use software internally owned by a third-party vendor, they’re neither purchasing a license nor funding development; instead, they are subscribing to a service. In essence, the organization has signed a service contract otherwise known as a cloud computing agreement. Generally, the subscription fees for such types of software arrangements are expensed over the term of the contract and are not capitalized.

To put it more succinctly, under GAAP an organization evaluating the accounting treatment of software they’ve procured for internal use should assess:

- Whether they can take possession of the software during the hosting or subscription period without a significant penalty.

- Whether they can either operate the software by itself or contract with an unrelated third party to host the software.

If the answer is no to one or both questions, then they would account for it as they would a service contract under ASC 350-40.

Financial statement impact of software subscriptions

Accounting for prepaid subscriptions

From the standpoint of an organization subscribing to a SaaS solution, the prevailing industry expectation is that upfront payments will be required – commonly known as a prepaid subscription. While payments can be required at various intervals such as quarterly, monthly, or annually, ultimately what’s observed is that the financial obligations precede the service being provided, i.e., use of the software. As a result, the organization would record a prepaid asset on its balance sheet reflecting the advanced payment for the forthcoming usage of the software solution to be expensed over the term of the contract.

Please refer to our article on accounting for prepaid expenses for more information, which includes detailed accounting examples.

When the services provided by the SaaS solution are utilized over time, the organization should systematically amortize the recorded prepaid asset over the utilization period. The offsetting debit to the amortization of the prepaid asset is software expense, an operating expense.

Summary

As organizations rely more heavily on software subscriptions and SaaS applications in their daily operations, it’s imperative they are managed, tracked, and accounted for correctly. This will require coordination between cross-functional teams such as accounting and IT to put processes in place to oversee SaaS spend. Understanding the pricing models, services being provided, and payment terms all play a factor in determining the financial statement impact of procuring a SaaS application. As a rule of thumb, cloud-hosted SaaS should be accounted for as a service contract under ASC 350-40 with a prepaid asset recognized if payments are made in advance.