Several years ago, my business partners and I sold our business to a large, publicly traded company. The due diligence process was a bear. Fielding incoming requests seemingly every hour while simultaneously running our business as normal was taxing and stressful. Fortunately, we were prepared. We saw M&A activity in our industry increasing, and realized it was only a matter of time before potential acquirers started contacting us.

We collated and organized every contract for both vendors and clients, every recurring transaction, prepared for deep dives into the durability of our revenue, while predicting what questions or concerns they may have. Of all the tasks involved in that preparation, by far the most valuable was contract and recurring expense identification, categorization, and even remediation. Those were the good ol’ days.

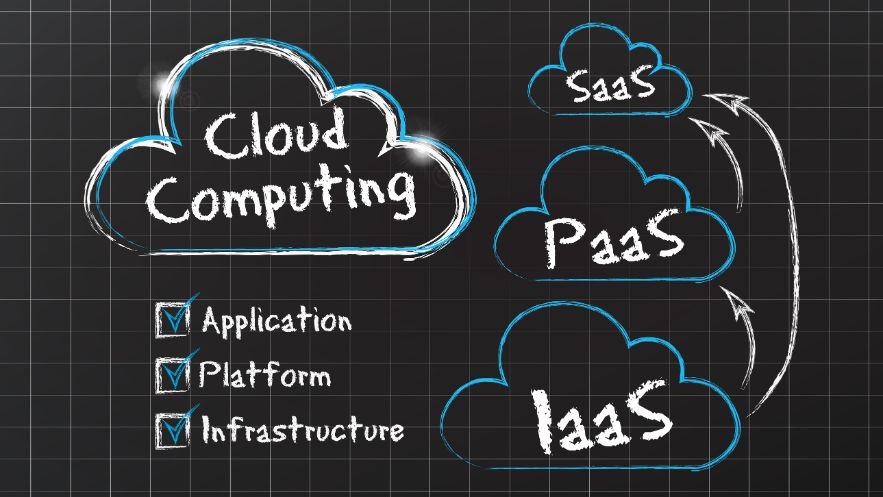

Today, the volume of recurring transactions such as software purchases and subscriptions, and the contracts that govern those agreements, have exponentially increased. What we accomplished with a spreadsheet is no longer possible. Companies now use hundreds of SaaS services and subscriptions and will spend between $5,000 and $15,000 per employee on these applications. A lot of that spend will be redundant services, underutilized or not utilized at all, or even worse, purchased without leaders knowing about it – a trend called Shadow IT.

Thankfully, there’s a solution that easily pays for itself in the way of reduced costs, improved productivity, and even improved enterprise value and sale price multiples. Here’s how:

M&A: The tech audit

In M&A deals, a comprehensive technology audit is necessary to inventory software assets, identify redundancies, and optimize the software suite. By analyzing each software component, enterprises can avoid overlaps and reduce unnecessary software expenditure.

Minimizing unexpected liabilities is key. A thorough assessment of your software assets and planned expenditures can identify redundant tools, outlying costs, and shadow IT that could potentially devalue your company. Understanding your software estate ensures you’re not blindsided by under-utilized licenses or legal fines for non-compliance.

IPO: Balance sheets and beyond

For companies eyeing an IPO, transparency and compliance in software management become even more crucial. The scrutiny from auditors, potential investors, and regulatory bodies is intense, focusing not just on the balance sheets but also on the operational efficiencies and governance structures within the organization.

Proper software expense management optimizes your technology stack, ensures license compliance, and portrays strong governance to stakeholders. Effective software asset management can also reveal cost savings and efficiency improvements, further enhancing market appeal.

Disclosure is non-negotiable for an IPO, and software can be particularly tricky. Listing software assets and associated costs while also demonstrating a strategic approach to software as an operational asset – not just a cost center – can profoundly alter investor perceptions.

Sale to a PE firm: The profit potential in software

When selling to a financial buyer, like a private equity (PE) firm, the emphasis shifts towards demonstrating the profitability and scalability of your business. How you manage software spend is key to showcasing operational efficiency and future growth potential.

PE firms consider operational maturity when evaluating potential investments. Showing a strategic software spending approach—optimizing assets, cutting waste, and leveraging tech for a competitive edge—can greatly boost your company’s appeal. Efficient software management signals to PE firms that your company has strong processes for scaling operations while controlling costs, a crucial aspect in their investment decisions.

A well-documented plan for software asset and cost management is a strong indicator of operational excellence and financial prudence. It showcases the company’s ability to drive cost efficiencies and strategically invest in technology for growth, innovation, and competitive edge. This attractiveness to PE firms seeking value-creation opportunities can lead to high returns.

For private equity buyers, each recurring expense dollar affects company valuation. Demonstrating an optimized software ecosystem proves the efficiency of your operational model, potentially increasing your company’s value.

Proactive strategies for sound software spending

Effective cost management isn’t about cutting corners; it’s about strategically allocating resources to maximize value. Before you’re even entertaining the thought of an acquisition or sale, consider these strategies:

Define clear ROI metrics for your software investments

Invest in software where the returns are quantifiable. Whether it’s a CRM system improving sales engagement or an analytics platform enhancing customer insights, each tool should have a clear, measurable return on investment.

Centralize software procurement

A fragmented approach to software purchasing can lead to overspending and under-utilization. Centralizing procurement can better regulate software acquisition and ensure every purchase aligns with your company’s strategic goals.

Conduct regular audits

Conducting regular audits of your software licenses, usage data, and vendor contracts can help identify redundant or underutilized tools. This information can inform future purchasing decisions, reduce unnecessary spend, and ensure compliance with licensing agreements.

Leverage technology for visibility and control

Invest in a comprehensive software asset management solution that offers real-time visibility into your entire software ecosystem. This can provide valuable insights into usage, compliance, and cost optimization opportunities.

Conclusion

For businesses on the cusp of an acquisition, sale, or IPO, mastering software spend and contract management is a crucial step toward maximizing valuation and showcasing operational maturity. By conducting regular audits, centralizing procurement processes, and investing in technology for visibility and control, enterprises can strategically manage their software expenses and drive efficiencies, ultimately boosting their bottom line.

Our acquisition by a strategic acquirer was successful and our business was valued at the top end of the industry valuation spectrum because we demonstrated we had our arms around the business. So don’t let the ‘software loophole’ undermine your business goals – take charge of your software spend today in order to realize successful exits tomorrow.