IFRS 16 summary

The IFRS 16 transition date has come and gone. Companies previously following the legacy IAS 17 lease accounting guidance likely transitioned to IFRS 16 during their 2019 fiscal year, in accordance with the standard’s effective date of January 1, 2019, for annual reporting periods beginning on or after that date. As such, IFRS 16 is now effective for all organizations following international accounting standards.

This article will walk through the key changes between the lessee accounting model under IAS 17 and IFRS 16, as well as some of the differences between IFRS 16 and ASC 842, and also provide a comprehensive example of lessee accounting under IFRS 16.

Note: This article has been updated for the benefit of organizations who have already transitioned to IFRS 16. Click here to learn about the different IFRS 16 transition methods.

IFRS 16 lessee lease classification

Under the lessee accounting model under IFRS 16, there is no longer a classification distinction between operating and finance leases. Instead, a single model approach now exists whereby all lessee leases post-adoption are reported as finance leases. These leases are capitalized and presented on the balance sheet as assets, known as the right-of-use (ROU) asset, and liabilities, unless subject to any of the exemptions prescribed by the standard.

Similar to finance lease accounting under IAS 17, the accounting treatment for finance leases under IFRS 16 results in the recognition of both depreciation and interest expense on the income statement.

For those entities with dual reporting requirements under both IFRS 16 and ASC 842, you will notice that the accounting for finance leases under IFRS 16 resembles the accounting for finance leases under ASC 842. However, ASC 842 still retains the operating lease classification.

In conjunction with the change in the lessee’s financial statement presentation, IFRS 16 also requires more robust disclosures.

What is considered a lease under IFRS 16?

Under IFRS 16, a lease is defined as a contract granting an entity the right to utilize a specific asset for a prescribed period of time in exchange for agreed-upon consideration. To determine whether a contract grants control of the asset to the lessee, the agreement must provide the following to the lessee:

- The right to substantially all economic benefits from the use of the asset

- The right to dictate how the asset is used by the entity

At times, an organization may have a contract that seems to meet the definition of a lease but does not fall within the scope of IFRS 16. Situations where this may occur include but are not limited to:

- Leases of biological assets

- Leases for the exploration of non-regenerative resources such as oil, gas, etc.

- Service concession arrangements

- Licenses of intellectual property

Concurrently, lessees reporting under IFRS 16 may choose to take advantage of practical expedients that exclude certain types of leases from capitalization. These include:

- Short-term leases, defined as having a term of 12 months or less at commencement and no option to purchase the leased asset

- Leases of low-value assets, defined as leases for which the underlying asset’s fair value (when the asset is new) is generally less than $5,000

Note: Please refer to our blog on practical expedients for more details on the IFRS 16 expedient options.

IFRS 16 lessor accounting

Under the lessor lease model within IFRS 16, the lessor accounting remains relatively unchanged from IAS 17: there is still a distinction between operating and finance lease classification. Therefore, it will not be further covered in this article.

How to calculate the right-of-use asset under IFRS 16

Under IFRS 16, the ROU asset is calculated based on the following:

The initial amount of the lease liability

+ Payments made at or before the commencement of the lease

– Lease incentives

+ Initial direct costs

+ Estimated costs for restoration or removal/disposal per IAS 37 Provisions, Contingent Liabilities, and Contingent Assets

IFRS 16 right of use asset accounting

One notable distinction between IFRS 16 and ASC 842 lies in the amortization method of the ROU (right-of-use) asset. ASC 842 calculates the expense that diminishes the ROU asset as part of the total operating expense, determined by the accrual of liability expenses. As a result, the amount expensed for the ROU asset varies per period. Conversely, under IFRS 16, the ROU asset undergoes depreciation akin to a finance lease under ASC 842. This approach entails a systematic and logical reduction of the ROU asset, typically on a straight-line basis, throughout the useful life of the underlying asset or the lease term, whichever is briefer. If you are a dual reporter under IFRS 16 and ASC 842, check out this article here for more differences between the two standards.

IFRS 16 finance lease example

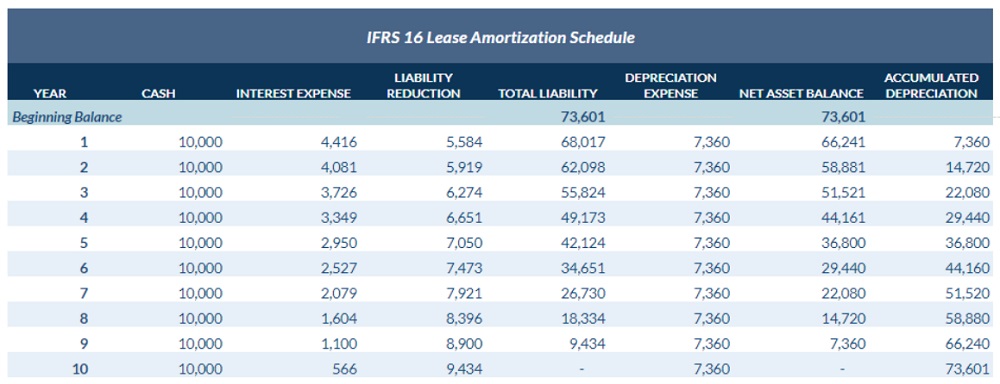

In the example below, we’ll outline the steps to calculate the lessee’s opening lease liability and ROU asset and present the complete amortization schedule, followed by the initial transition journal entry and the journal entry for the first period’s activity.

Commencement Date: January 1, 2024

Lease Term: 10 years

Lease Payment (paid in arrears): $10,000 annually

Lessee’s Incremental Borrowing Rate: 6%

Useful Life of Underlying Asset: 25 years

If you’re a small business and looking to report under IFRS 16, you can do all of this in our new lease accounting software, LeaseGuru powered by FinQuery.

Amortization schedule

Based on the facts above, we’ll take the following steps to generate the IFRS 16 amortization schedule:

- Calculate the initial lease liability as the present value of the total remaining lease payments as of the commencement date.

- Calculate the initial right-of-use asset as the lease liability at commencement plus or minus any necessary adjustments.

- Amortize the lease liability over the lease term to reflect both lease payments and interest on the liability using the effective interest method.

- Depreciate the ROU asset in a systematic and rational manner over the useful life of the underlying asset or the lease term, whichever is shorter.

Using the values noted above, the amortization schedule at the commencement date of the lease is as follows:

To calculate the present value of the future lease payments, apply the lessee’s incremental borrowing rate of 6%. Per IFRS 16, lessees are encouraged to use the rate implicit in their lease. However, if that is not readily determinable, then a lessee is provided further leeway to use their own incremental borrowing rate as we have done in this example.

As we can see in the above schedule, because no adjustments were necessary to calculate the opening ROU asset at commencement, the ROU asset is equal to the lease liability. The ROU asset is then depreciated in a systematic and rational manner (e.g. straight-line in our case) over the shorter of the lease term or useful life of the underlying asset. In our example, the ROU asset is depreciated over the 10-year lease term, which is shorter than the leased asset’s useful life of 25 years.

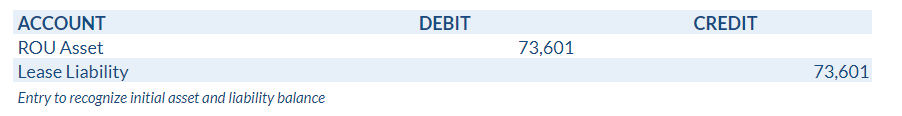

Journal entries

The initial journal entry* under IFRS 16 records the asset and liability on the balance sheet as of the lease commencement date. Below we present the entry recorded as of 1/1/2024 for our example:

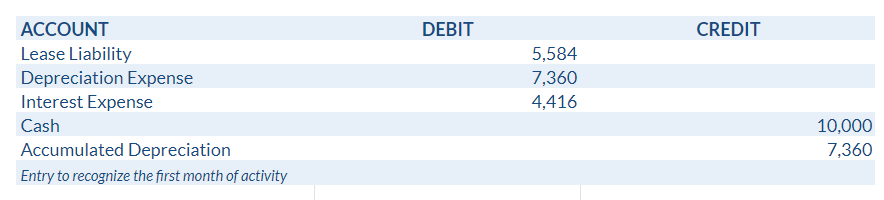

Utilizing the amortization table, the journal entry for the end of the first period is as follows:

*Please note that if you are using FinQuery’s journal entries, the system combines these entries together.

IFRS 16 disclosures

Now let’s cover the disclosure requirements for lessees under IFRS 16. Within the notes to the financial statements, an entity is expected to present both qualitative and quantitative disclosures regarding their leasing activities for the respective reporting period(s). The quantitative disclosures required by IFRS 16 for lessees include but are not limited to:

- The carrying amount of all ROU assets summarized by asset class as of the end of the reporting period

- ROU asset depreciation expense, summarized by asset class for the reporting period

- Total interest expense on lease liabilities for the reporting period

- Expenses from short-term leases not included on the balance sheet as of the end of the reporting period

- Expenses from low-value asset leases not included on the balance sheet as of the end of the reporting period or in the expense summary of short-term leases for the reporting period

- Expenses from variable lease payments excluded from the lease liability calculation

- Sublease income for the reporting period

- Any gains or losses recognized from sale-leaseback transactions

- Total cash outflows for leases

- Any ROU asset additions

- A maturity analysis of all lease liabilities as of the end of the period

Furthermore, the lessee is required to disclose certain qualitative information to help financial statement users understand the entity’s leases and leasing activities, including the following:

- Summary of leasing activities

- Commitments for leases not yet commenced (i.e. a liability is not yet recorded on the balance sheet)

Try LeaseGuru IFRS 16 accounting software for free:

LeaseGuru powered by FinQuery is our new IFRS 16 lease accounting software for small businesses. With this software, you can view journal entries, amortization schedules, disclosures and more. Create your free account to try it out today!

Summary

In this high-level overview of IFRS 16, we introduced the key differences for lessee accounting under IAS 17 and IFRS 16, provided an example of a lessee amortization schedule and the related journal entries, and discussed the required disclosures.