There’s no way around it. In order to comply with the new lease accounting standard, you’ll need to gather lease information from multiple departments and consolidate it. This takes some serious legwork, internal communication, and if done inefficiently, can be unnecessarily time consuming. To ensure you collect the right data, you need to take a methodical, thorough approach. But, where do you start?

Scoping your leases

You may assume the first step to transitioning to ASC 842 is to compile all of your possible leases together into an Excel sheet. However, this approach often ends up being an inefficient use of resources, particularly if some of your leases are immaterial, short-term in nature, don’t meet the definition of a lease, or are otherwise exempt.

To save time and resources, consider the following definition of a lease and the scoping exemptions from the new lease accounting standard before finalizing your lease listing.

Leases defined

A lease is defined under ASC 842 as a contract that conveys the right to control an identified asset for a period of time in exchange for consideration. The term “control” is the key in this definition.

In order to have control of an asset, the lessee must be able to obtain “substantially all” of the economic benefit from the asset’s use and direct its use throughout the period of the contract. When compiling your lease portfolio, you will need to consider embedded leases that fit within the definition of a lease under ASC 842. Please refer to our full article on embedded leases for further guidance on how to evaluate your service contracts for hidden embedded leases.

Exemptions

Short-term leases

As an accounting policy election, lessees can opt to not record leases that meet the definition of a short-term lease under ASC 842 on the balance sheet. Per ASC 842, a short-term lease is a lease that, at its commencement date, has a term of 12 months or less and does not include an option to purchase the underlying asset that the lessee is reasonably certain to exercise.

If you have short-term leases and have elected the optional practical expedient, you don’t need to capitalize those on your balance sheet, but will still need to disclose them in your financial statements. Therefore, though you may not be capitalizing your short-term leases, this is important to keep in mind as you will need to track and report them separately. Please refer to our full article on the ASC 842 Disclosure Requirements to evaluate these short-term lease costs and other disclosure requirements.

Materiality

ASC 842 does not have an explicitly defined materiality threshold. However, companies may adopt a reasonable capitalization threshold for ASC 842 application, allowing your company to avoid inventorying and recording low-dollar assets below that amount. Many companies may lease a large amount of various types of low-dollar value equipment, like copiers or computers, that may fall under the materiality threshold.

Your capitalization threshold for lease accounting may be similar to existing capitalization thresholds within your organization, for example those applied for fixed assets. However, it is not appropriate to simply apply your existing capitalization threshold for fixed assets to leases since lease accounting also requires a lease liability to be recorded on the balance sheet, not just an asset. Rather, companies must do the following:

- Assess whether previously existing policies in other areas are appropriate for ASC 842 application

- Document rationale for such a threshold

- Discuss any potential materiality policies with their auditors

When gathering your leases for your transition to ASC 842, consider your materiality threshold before finalizing your lease portfolio to avoid potential unnecessary work. Minimizing the amount of leases to transition will reduce the amount of implementation work and ultimately, the impact the standard has on your organization.

Land easements

The FASB provided an optional practical expedient allowing companies to continue applying ASC 840 accounting treatment for land easements existing as of, or expiring before, the effective date of ASC 842. For leases a company enters into or modifies on or after their adoption of ASC 842, they will need to evaluate whether the easements meet the definition of a lease under ASC 842 or the guidance for intangible assets under ASC 350-30. If you have land easements that are perpetual in nature, they are outside the scope of ASC 842 as a result of not meeting the requirement for a contract to be for a “period of time” within the ASC 842 lease definition and will not need to be included in your lease inventory listing. Additionally land easements with no monetary value do not meet the consideration criteria for a lease under ASC 842 and may also be excluded. For a more in-depth discussion of the practical expedient elections for ASC 842, see our article here.

Other ASC 842 exemptions

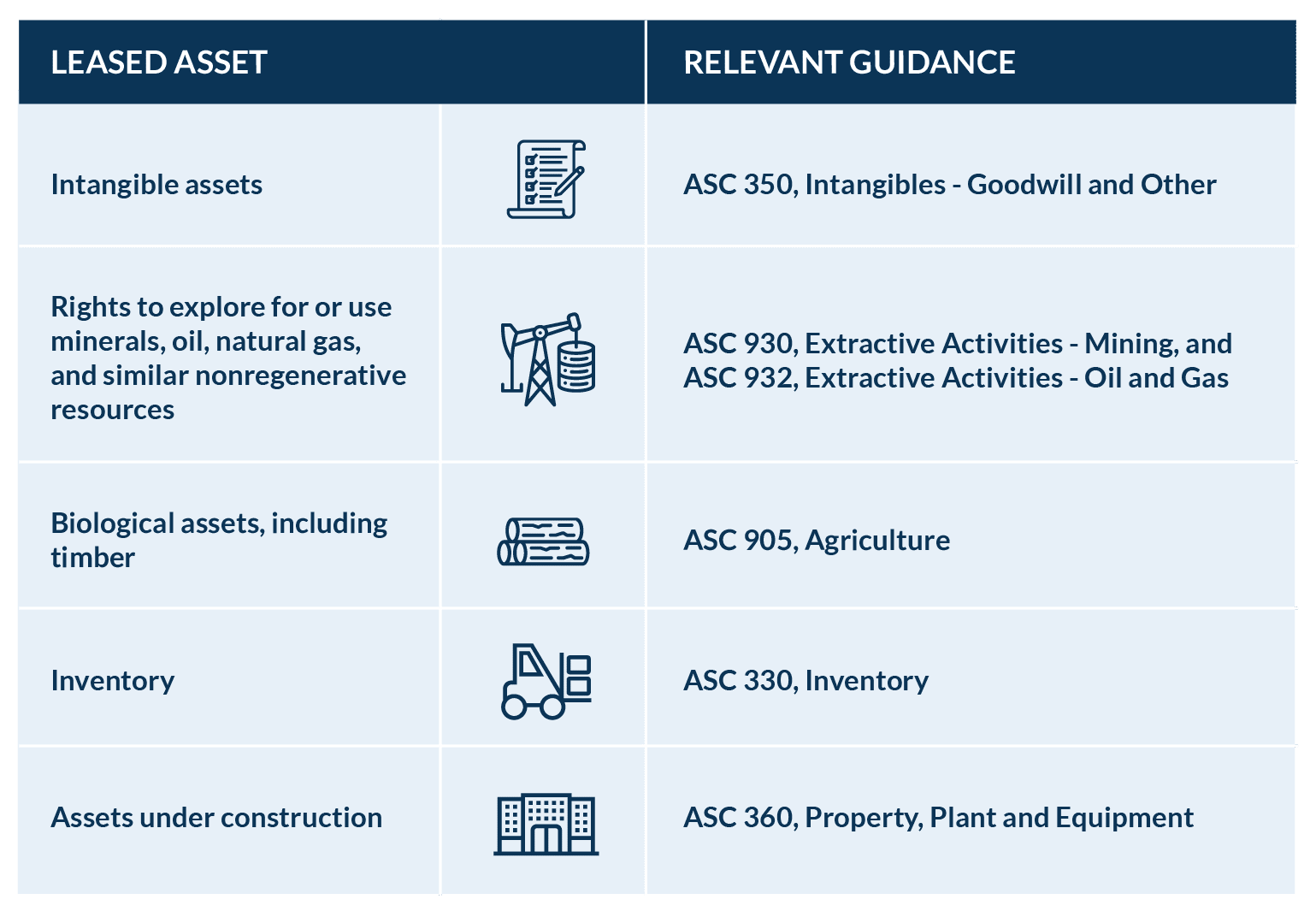

The scope of ASC 842 is specifically limited to leases of property, plant, and equipment. When compiling your lease listing, you’ll want to exclude the items in the chart below (in addition to the exemptions listed above that can be excluded as policy elections). ASC 842 explicitly states it is not applicable to the following types of agreements:

Finding your leases

Look at your requisition process

When developing your lease inventory, the first step is to understand your organization’s requisition process and which departments are involved. You may have supply chain or purchasing departments that initiate requisitions, or procurement may fall on individual controllers in certain regions. Before you can build your lease inventory, you will need to understand your organization’s current processes so you can identify the departments to engage.

Your internal auditors may already have walk-throughs of your organization’s requisition process as part of their normal auditing procedures. If so, reach out to your company’s internal audit team to obtain their auditing walk-throughs to avoid duplicating work.

Engage the right departments

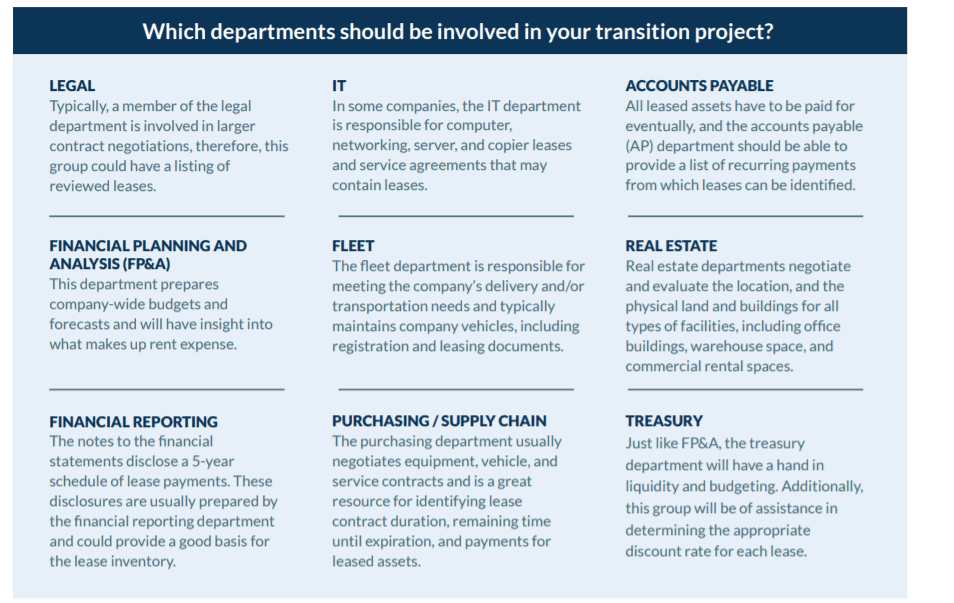

Do not limit your search to the real estate department alone. While real estate leases are often material and are certainly a piece of the puzzle, other lease types must be considered in addition to real estate leases. ASC 842 is applicable to leases of property, plant, and equipment – which includes IT equipment, office equipment, vehicles, manufacturing equipment, etc.

To maximize success during the implementation of the new lease accounting standard, pull together an interdepartmental team to gather all of your organization’s contracts.

Because the legal department likely needs to approve large contracts, they should be involved. Supply chain, purchasing, or procurement will be able to provide a list of vendors. IT tends to manage most of entities’ technology vendors and accounts payable handles vendor payments, so they’ll have a list of vendors as well.

Below are some of the departments you should consider including in your lease evaluation and implementation process:

As part of the lease evaluation process, it is important to educate all those involved on the new lease accounting standards. Consider our ASC 842 Survival Kit for assistance with this.

Consolidate your leases in one place

We can’t stress how important it is to work methodically to ensure accuracy and promote efficiency. To keep everyone marching to the beat of the same drum, create a lease inventory template for each department and location to complete. We have an example you can use here.

As you work to compile one master listing of all of your organization’s contracts, now is a good time to evaluate the contracts from the appropriate departments to determine if they contain embedded leases, which can be hidden in service contracts.

Cross-check your template for accuracy and completeness

Once each department has provided its information, compile one master listing which you can cross-check for duplicates and accuracy. There are a few ways you should cross-check your lease listing to ensure you didn’t overlook any key agreements.

First, reach out to each physical location for a listing of their leased assets. For larger or decentralized organizations with many locations or even a global presence, contact the finance managers or controllers at each location to obtain their list of leased assets. For smaller organizations, you may need to speak to a few office or manufacturing plant managers. Compile the list of leased assets for all of your physical locations independently from the listing of leased assets from the company’s departments. Compare this listing to the master lease listing compiled from the departments and add any new leases.

Next, obtain a listing of recurring payments from your accounts payable department. It is likely some of the recurring payments represent payments associated with lease agreements. Determine what types of agreements the recurring payments are for and compare that information to your consolidated lease listing. Identify any payments representing lease obligations not on your lease listing and add them.

Also reconcile your lease listing with your disclosures reported under ASC 840. Specifically, compare your lease listing with your five-year lease commitment schedule to ensure you’ve included all of those lease obligations.

Summary

Efficiency and accuracy in your lease evaluation process are key to a successful implementation. Make sure to involve the right departments and communicate the seriousness of compliance to your interdepartmental team. While this will be a time-consuming process, if you set the right foundation, you’ll be in a great position to comply with the new lease accounting standard well beyond your transition date.