GASB Statement No. 87, Leases (GASB 87), is a comprehensive change by the governmental accounting standards board for lease arrangements. Previous GASB lease guidance, including GASB 13 and GASB 62, did not require all leases to be recognized on the statement of financial position. Instead, only those classified as capital leases were recognized and disclosed as assets and liabilities in the financial statements.

To improve the consistency and transparency of accounting and financial reporting for leases by governments, GASB 87 requires lessees to recognize an intangible right-to-use asset and liability for leases that were previously classified as operating leases and establishes a single classification model for leases going forward. Because of this, additional quantitative and qualitative disclosures are required for lessees.

Qualitative disclosures

In addition to the quantitative disclosures we will outline below, GASB 87 requires the lessee to include a qualitative explanation of its leases, with specific transactions or lease aspects required to be disclosed. Among these are:

- General description of the nature of leasing arrangements, including the basis, terms, and conditions related to any additional variable payments, such as those based on the future performance of the lessee or usage of the underlying asset, not included in the lease liability.

- Any residual value guarantees not included in the lease liability, along with the terms and conditions of the guarantees.

- The nature and extent of leases with related parties.

Quantitative disclosures

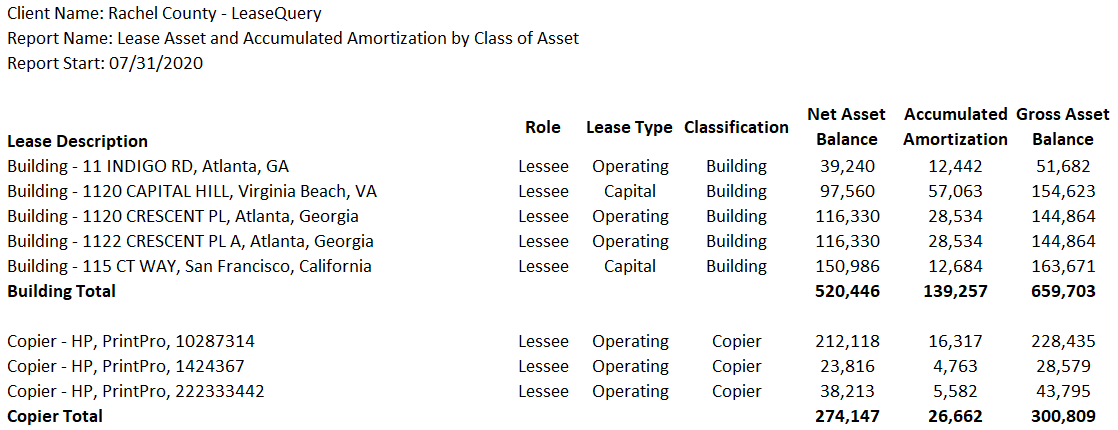

Lease asset disclosure

GASB 87 requires lessees to recognize a lease asset associated with their lease agreements. Therefore, one of the newly required quantitative disclosures is to disclose the total amount of lease assets and the related accumulated amortization, summarized by the major classifications of the underlying assets (buildings, copiers, vehicles, etc). This disclosure must be separate from the lessee’s other capital assets.

See below for an example of the lessee’s lease asset quantitative disclosure:

Lessee’s outflow of resources

Together with the lease asset, GASB 87 requires lessees to recognize a lease liability associated with their lease agreements, measured as the present value of the remaining lease payments. According to GASB 87, paragraph 21, the following are included as payments when calculating the lease liability:

- Fixed payments

- Variable payments depending on an index or a rate (such as the Consumer Price Index or a market interest rate) and ones fixed in substance

- Residual value guarantees the lessee is reasonably certain of being required to pay

- The price of a purchase option the lessee is reasonably certain they will exercise

- Payments for penalties for terminating the lease the lessee reasonably certain they will be required to pay

- Lease incentives receivable from the lessor

- Any other payments the lessee is reasonably certain of being required to disburse based on an assessment of all relevant factors.

Lessees often make other variable and additional payments not included in the lease liability. GASB 87 requires disclosure of the amount of outflows of resources recognized in the reporting period for variable and other payments not included in the measurement of the lease liability, such as residual value guarantees or termination penalties the lessee was previously uncertain of owing.

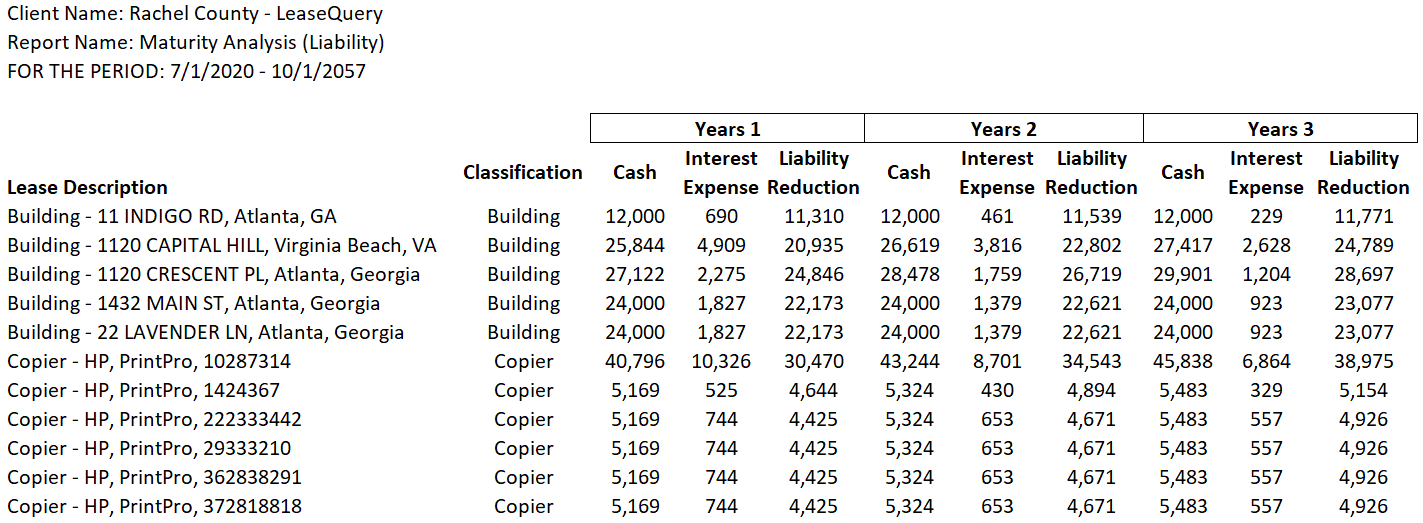

Lease liability disclosure and maturity analysis

The lessee must present a maturity analysis of their lease liability balance as part of the required quantitative disclosures. This report projects the undiscounted cash flows to be made in the future. Per GASB 87, this disclosure shows the maturity of the lease liability, by both principal and interest, separately presented, for five individual subsequent years and in five-year increments thereafter.

Below is an example of a maturity analysis of the lessee’s lease liability:

Future lease commitments

The lessee must also disclose commitments under leases not yet commenced in conjunction with the materiality analysis. This quantitative report discloses future cash commitments for leases not started as of the reporting period, excluding short-term leases.

Short-term leases: exempt

GASB 87 allows an exemption of short-term leases, defined as a lease with a maximum possible noncancellable term of 12 months or less, including all renewal options. While the Board originally considered a disclosure requirement for the amount of outflows associated with short-term leases, they determined that requiring entities to identify and disclose the short-term lease outflows would reduce the relief given by the short-term lease exemption in the first place. Therefore, the Board ultimately decided not to require a disclosure for short-term lease outflows.

Additional disclosures (if applicable)

While the above disclosures represent those required for all lessees with leases in scope for GASB 87, additional disclosures may exist based on individual organizations’ lease portfolios and transactions occurring during the reporting period. These include:

- Sublease transactions

- Sale-leaseback or lease-leaseback transactions

- Impairment losses on lease assets

Sublease disclosure

If the lessee has any subleases, these must be included in the qualitative description of its leasing arrangements. The lessee (now the sublessor) accounts for the sublease as two separate transactions and discloses the lessor portion of the sublease separately from the original lessee transactions.

Sale-leaseback and lease-leaseback disclosures

A sale-leaseback involves the sale of an asset, combined with a lease of the same asset back to the seller. The lessee benefits from this transaction through the access to working capital that selling and subsequently leasing back the property provides. The lease and subsequent sale are accounted for and disclosed as two separate transactions. If a lessee has any sale-leaseback transactions, the terms and conditions of those transactions must be disclosed.

Conversely, a lease-leaseback transaction involves an asset leased by one party to another party, then back to the first party. Per GASB 87, lease-leasebacks are not accounted for separately, but as a net transaction. However, both parties must disclose the gross amount of the lease and leaseback separately in their financial statements.

Impairment loss disclosure

Over a lease term, circumstances may lead to a change in the lessee’s manner or duration of use of the underlying asset, and the asset may be impaired. If the lessee impairs a lease asset during the reporting period, the components of the impairment loss and any change in the lease liability must be disclosed.

Summary

GASB 87 requires additional quantitative and qualitative disclosures compared to the previous lease standards for lessee financial reporting. These disclosures require more detailed information and can be cumbersome to prepare, especially for government entities with a large number of leased assets. Using a software solution can facilitate the preparation of the necessary quantitative disclosures and mitigate the risk of material misstatement from the manual manipulation required if using Excel. A system like LeaseQuery can assist with these quantitative disclosures through their software solution.