The new lease accounting standard for state and local governments enhances the transparency of leasing transactions and improves financial reporting for government entities. These characteristics are promoted through a shift in how leases are classified. Previous guidance follows a two-model approach where leases are deemed either operating or capital based on four tests. Whereas the new guidance, GASB 87, classifies all in-scope leases as finance leases. As a result, lessees record a lease liability and asset at lease commencement based on the present value of lease payments during the term.

After a lessee measures and records the initial lease liability and asset, what about “Day 2” measurement? Statement 87 Paragraph 24 requires the lessee to calculate the amortization of the discount on the liability periodically as interest expense. Any unpaid interest is accumulated on the statement of net position as a liability separate from the lease liability.

What is accrued interest?

Although it is not explicitly defined per GASB 87, accrued interest can be described as a separate liability for the aggregated periodic discount of the lease liability. Furthermore, the standard specifies lease payments are allocated first to this liability before reducing the lease liability or lease receivable.

GASB Implementation Guide No. 2021-1 specifically addresses reporting accrued interest as a separate liability from the lease liability. When lease payments are made consistently each month, the accrued interest liability is not substantial. However, when payments are made less frequently, such as quarterly or annually, lessees will accrue interest until the next payment is made.

Below is an example to help further explain the amortization of the lease liability and the calculation of accrued interest.

Example: Accrued interest for a lease under GASB 87

Let’s consider Bryant County has a fiscal year end of September 30 and adopts the new lease accounting standard October 1, 2021. The county enters into a three-year lease for office space from a third party commencing October 1, 2021. The terms of the lease are:

- Lease start date: October 1, 2021

- Lease end date; September 30, 2024

- Lease payment: $42,000, annually at the beginning of each lease year

- Incremental borrowing rate: 3%

Amortization schedule for the lessee

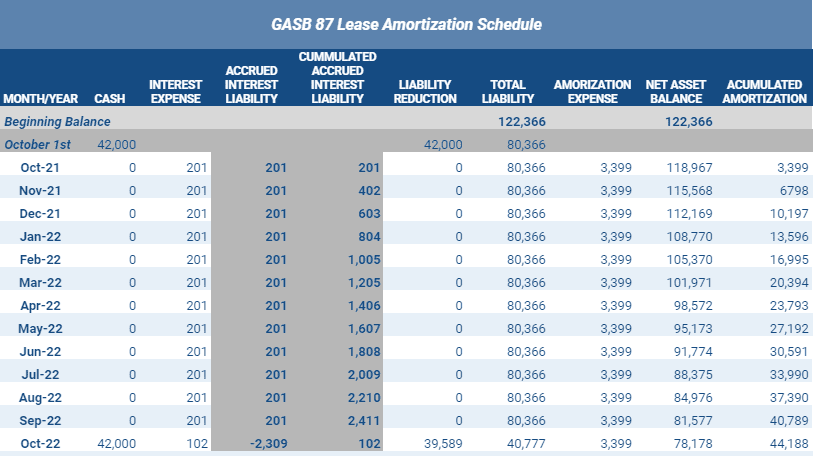

Using the terms above in the present value calculator, Bryant County measures a beginning lease liability and lease asset of $122,366. The lease asset is amortized on a straight-line basis over the lease term. Because the county is required to make annual payments, interest is accrued throughout the year and the annual lease payment must first be allocated to the accrued interest liability.

Below is a snapshot of the county’s amortization schedule over the first 13 months of the lease.

Governmental fund accounting

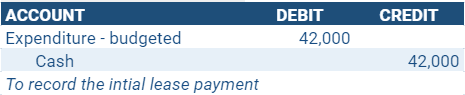

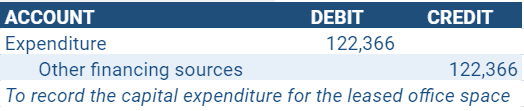

Bryant County accounts for the new lease consistent with governmental fund accounting principles. On October 1, lease commencement, Bryant County makes the first payment of $42,000 and records a debit to a budgeted expenditure account and credit to cash. Additionally, under modified accrual accounting, the county recognizes a debit to expenditure for capital projects and credit to other financing sources of $122,366. We have captured both entries below to record both the capital expenditure and initial lease payment.

Like other counties, Bryant County will make the governmental fund journal entry for leases at the end of the year. However, for the sake of this example, we have provided the entry at inception of the lease for better understanding.

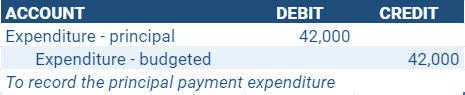

After the initial recognition and payment of a lease, an entity recognizes both the principal and periodic interest expense of the lease asset to the debt service fund. Since Bryant County makes a lease payment at commencement, the total amount of the first payment is recognized as principal. The following entry records the principal payment.

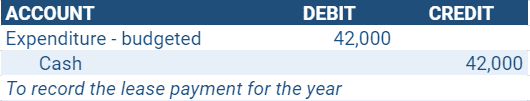

At the beginning of the second year, Bryant County makes its annual payment of $42,000. Like before, the lease payment likely applies to a budgeted expenditure account with the following journal entry.

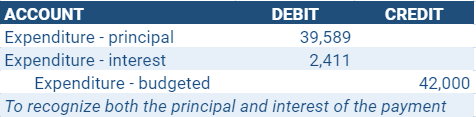

However, unlike before, the $42,000 payment is allocated to both principal and interest within the debt service fund. As of October 1, 2022, the unpaid interest expense is $2,411. Therefore, the remainder of the cash payment that is applied against the lease liability is $39,589 ($42,0000 – $2,411). Bryant County records the following entry to the debt service fund:

*Note, once again, most entities may record the above entry at year end, but we’ve provided it at the beginning of the year for the sake of this example.

Conversion entries

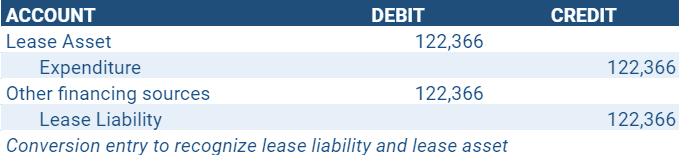

To convert the capital projects fund for the office space to full accrual accounting, Bryant County clears both the expenditure for capital projects and other financing sources balances and records the corresponding lease asset and lease liability. The amount for each line item is the present value of the lease payments over the lease term. As such, the county records the following conversion journal entry to recognize the lease on its government-wide financial statements:

In addition to the entry above, Bryant County must consider the impact to both the lease liability and lease asset during the year.

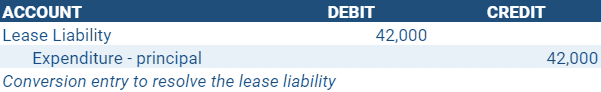

Again, because a payment is made at the beginning of the lease term, the full $42,000 is recognized as principal. This reduces the beginning lease liability balance to $80,366 ($122,366 – $42,000). The county records the following conversion entry:

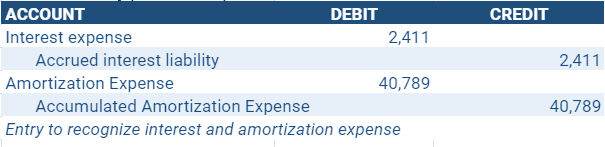

Additionally, at the government-wide level, Bryant County calculates interest expense by multiplying the outstanding liability ($80,366) by the monthly discount rate (3% / 12 months). At the end of the first year, the county recognizes $2,411 to interest expense and the accrued interest liability.

The lease asset is amortized by the straight-line method over the lease term ($3,399 = $122,366 / 36 months). Bryant County accounts for the full year of amortization of the lease asset at $40,789 ($3,399 * 12 months). The entry below represents the conversion entry under GASB 34 to establish both the interest expense on the lease liability and the amortization expense of the asset for Bryant County’s lease of office space.

Note, Bryant County will perform the conversion entry at the end of the second year similar to as described above.

Proprietary fund accounting

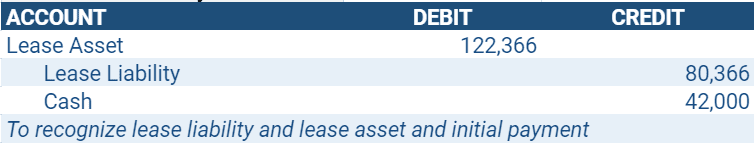

The entries listed above reflect the governmental fund and conversion entries for the first 13 months of the lease. If Bryant County records the lease at the proprietary fund level, the following entry is recorded to recognize the lease liability, lease asset and initial lease payment using the full accrual method of accounting.

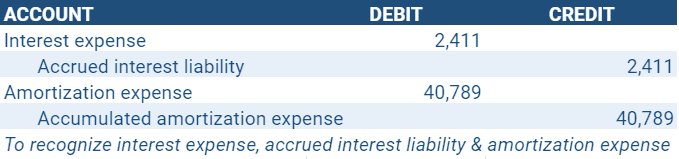

At the end of the year, the county records the following entry to recognize both interest and amortization expense.

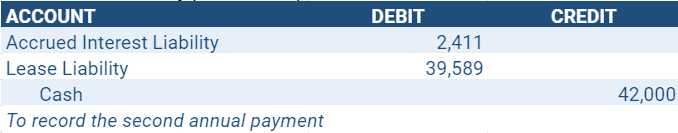

Then at the beginning of the second year, the county records the second annual payment and its impact to the lease liability. The $42,000 is first allocated to the accrued interest liability. So the principal portion of the lease payment that reduces the liability is $39,589 ($42,000 – $2,411).

Summary

This article explains accounting for the accrued interest liability under GASB 87. Leases in scope of GASB 87 are treated as finance leases and require establishing a lease liability and lease asset upon commencement based on the present value of all remaining lease payments. Subsequently, the lessee calculates the amortization of the discount on the lease liability as interest expense. Unpaid interest is accrued in a separate liability account from the lease liability and any lease payments are allocated to accrued interest first.

If your organization is not currently separating accrued interest from the lease liability, a software solution purpose built for lease accounting, such as LeaseQuery, can help manage these calculations in accordance with the financial reporting requirements under GASB 87.