2. What are accrued liabilities?

3. Accrued expenses vs. accounts payable

4. Common examples of accrued expenses

5. Prepaid vs. accrued expenses

6. Accrual vs. cash accounting

7. Financial statement presentation

8. Accrued expense accounting treatment and journal entries

9. Accrued expenses accounting example

10. Finding missing accrued expenses

11. Summary

12. Related articles

What are accrued expenses?

Accrued expenses, also known as accruals, are costs for goods or services an entity has used or received that they will pay at a later date, and for which they haven’t received a bill or invoice. For example, a business might incur an expense for a utility that accrues over the period when they’re using it, but they don’t receive an invoice or pay for it until after the usage period has ended.

When a business incurs an accrued expense, they record an accrued expense journal entry, which includes a debit to the expense and a credit to an accrued liability.

What are accrued liabilities?

An accrued liability is an entity’s financial obligation to pay the costs of goods or services they have received, but haven’t paid and for which they haven’t been billed or invoiced. In other words, accrued liabilities are simply the financial obligations to pay the costs associated with accrued expenses.

On the balance sheet, accruals are recorded as liabilities because they represent future payment commitments. This is crucial for compliance with US GAAP reporting standards, which require entities to use the accrual basis of accounting when recording accrued expenses. Under the accrual basis, expenses should be recognized during the period or periods when they are incurred, regardless of when they are paid.

Accrued expenses vs. accounts payable

Under US GAAP, accrued expenses (and the associated accrued liabilities) and accounts payable are similar in that they both represent liabilities for goods or services that have already been received by an entity. The primary difference between them, however, lies in whether or not the entity has received a bill or invoice for the goods or services. Accounts payable are financial obligations for goods and services that an entity has received and for which they have received a bill or invoice, whereas with accrued expenses, the entity has not yet been invoiced.

Common examples of accrued expenses

Entities can accrue expenses for a number of reasons. As long as there is a benefit being received, an expense should be recorded. Below are some common examples of transactions that can result in accrued expenses:

- Utilities

- Various services, such as consulting or other project-based services

- Accrued salaries, wages, and bonuses

- Usage-based cloud computing services

- Accrued interest arising from a loan

- Payroll taxes

- Other taxes

- Any other purchases or services received without an invoice

Prepaid vs. accrued expenses

Prepaid expenses are, essentially, the opposite of accrued expenses. While accruals are paid after an entity has received goods or services, prepaid expenses are paid in advance. These advance payments create a type of asset, so, unlike accruals, prepaid expenses are recorded as an asset on the balance sheet.

Accrued and prepaid expenses are, however, similar in that they are often expensed over multiple periods using the accrual basis of accounting. For example, in the case of an accrual, the usage period may cover several months before an invoice is received. Likewise, for a prepaid expense, the company may make a prepayment in full for a service that is actually incurred over a period of several months. In both cases, the expenses would be recognized over the full usage period and not necessarily when they are actually paid.

Accrual vs. cash accounting

Entities reporting under US GAAP are required to use the accrual basis of accounting. There is a fundamental concept in accrual accounting called, “the matching principle.” The matching principle states that revenue and expense should be recognized in the period when they occur and not necessarily when they are paid. In other words, businesses using the accrual basis should recognize expenses for goods and services they have received when they use them even if they have not paid for them.

The accrual basis is significantly different from the cash basis of accounting, which requires entities to recognize their expenses in the same period in which they make payments for them. It does not require them to match the costs of their expenses with the periods in which they used the associated goods or services. A business using the cash basis of accounting will simply expense their purchases in full when the associated payments are made.

For example, imagine that a company receives consulting services for a period of three months, during which they are not yet billed for the services. Under the accrual basis, the company would begin recording an accrued liability and recognizing an expense for these services during the month when they began. They would continue to do so each month until the services were no longer in use. When the company receives an invoice for services after the three-month period is over, they would then make a payment and reverse out their accrued liability balance.

Using the same example under the cash basis of accounting, the company would simply wait until they received the invoice for services, then pay it and expense the costs in full during that period.

When compared to the cash basis, the accrual basis of accounting is generally better for providing an accurate assessment of organizations’ financial health, which is why it’s required under US GAAP.

Financial statement presentation

Accrued expenses on the balance sheet

Businesses should consider the utilization period for their accrued expenses and liabilities when classifying them on the balance sheet. If the service period and payment occur within a span of 12 months, then the accrued liability is classified as short-term. Accrued expenses and liabilities are generally classified as current liabilities because their payments are due within a year.

Conversely, if the service period is more than a year, the liability is classified as non-current, or long-term.

Accrued expenses on the income statement

Under US GAAP, accrued expenses should be recorded throughout the period in which the associated good or service is in use, and recognized on the income statement in conjunction with the associated accrued liability on the balance sheet.

In simpler terms, think of the income statement as a record of a company’s financial performance over a specific period. When we talk about accrued expenses, we’re discussing costs that a business has incurred and benefited from, even if they haven’t yet paid for them or received a bill, over a specific period of time.

Accrued expense accounting treatment and journal entries

Under US GAAP, the accounting treatment for accrued expenses is typically composed of two main parts:

- The initial recognition of the accrued expense and corresponding accrued liability

- The reversal of the accrued liability balance after the payment is made

Before a business is invoiced, they often estimate the dollar amounts for their accrued expenses because, in many cases, the accountants do not know exactly how much they will be billed for services. However, estimating these costs is necessary in order to adhere to the accrual basis of accounting. Without these estimations, you would not be able to perform the monthly expense reporting in some cases. Because of this, there are two main types of journal entries used in accounting for accrued expenses: the accrual adjusting entry and the accrual reversal entry.

Accrual adjusting entry

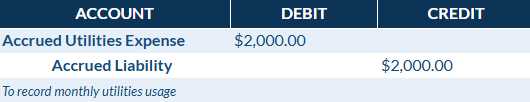

The accrual adjusting entry is made after the end of the period in which the accrued expense is incurred. This journal entry includes a debit to the accrued expense and a credit to the accrued liability. Below is an example of the adjusting entry:

If the cost of the accrued expense was estimated, then this adjusting entry will be an estimate.

Accrual reversal entry

After the accrued expense is paid, the accrual reversal entry is made at the beginning of the following period to record payment of the accrued expense and reverse out the accrued liability balance. It includes a debit to the accrued liability and a credit to cash paid. Below is an example of the reversing entry:

Accrued expenses accounting example

The following is a full example of how to account for accrued expenses using the accrual method of accounting:

Salvan Manufacturing, LLC, pays for their usage of electricity utilities on a quarterly basis. They have agreed to pay using the averaging method, so their daily utilities cost is a fixed rate based on their yearly average. As a result, they typically pay $2,000 per month for electricity.

After the end of each month, the Salvan Manufacturing accountants make an accrual adjusting entry to recognize the accrued utilities expense for their electricity usage. Below is the necessary journal entry:

The liability increases by $2,000 every month when the company repeats the adjusting entry. A few days after the end of each three-month period, Salvan Manufacturing receives a bill for their electrical utilities totaling $6,000. Their accountants then record the accrual reversal entry to record payment for utilities and to reverse out the accrued liability balance. Below is the necessary journal entry:

For more full examples of accounting for prepaids and accruals with journal entries, be sure to download our Ultimate Guide to Prepaid and Accrual Accounting:

Finding missing accrued expenses

Because accrued expenses are not triggered by an invoice but rather by consumption of goods/services, sometimes it can be difficult to estimate, or even find, accruals. For routine and predictable accruals, calculation is often straightforward. However, for more complex expenses, a structured approach to identify and calculate accruals is necessary.

Examples of ways to estimate accruals

Historical data analysis

The most common method involves analyzing past trends. For recurring expenses like utilities, a company can average the costs from prior periods to estimate the current period’s expense. This method is simple but may not be accurate if there are significant changes in usage or pricing.

Analysis of open purchase orders

A systematic review of open purchase orders (POs) at the end of the accounting period should be completed to review POs for which goods or services have been marked as received but for which no vendor invoice has yet been processed. This gap is an indicator that an expense has been incurred and an accrual is necessary.

Vendor confirmations

For significant, non-recurring expenses, such as professional services or project-based costs, direct communication with vendors is crucial. Requesting a summary of unbilled work performed as of the period-end can provide a highly accurate basis for an accrual.

Contractual analysis

For expenses governed by contracts, such as software or maintenance agreements, the terms of the contract will dictate the amount to be accrued.

Project-based accruals

For large-scale projects, accruals can be estimated based on the percentage of project completion. This often involves collaboration between the accounting and project management teams to determine a reasonable estimate of the work performed.

Conservative estimation

In situations of high uncertainty where a precise figure is difficult to ascertain, a company may adopt a conservative approach by slightly overestimating the expense. This helps to ensure that liabilities are not understated, though it may slightly depress current period earnings. A subsequent true-up is required when the actual invoice is received.

Despite the implementation of robust estimation processes, the risk of missing accruals remains a significant concern, as the failure to identify and record these liabilities can lead to overstated profits and understated liabilities, potentially misleading stakeholders and impacting financial ratio analysis.

Summary

Correctly identifying and accounting for accrued expenses is crucial for compliance under US GAAP, so it is important for accountants to know how and when to apply the accrual basis of accounting. If your organization has a lot of financial contracts that require using the accrual basis, your accounting for prepaids and accruals could be costing your accounting team time and money. Schedule a demo of FinQuery Prepaid and Accrual Accounting to see how we can help your team save time and streamline its accounting processes by tracking every contract in one system and automating your accounting for prepaid and accrued expenses.