Organizations also managing increase in lease liabilities following ASC 842 lease accounting transition

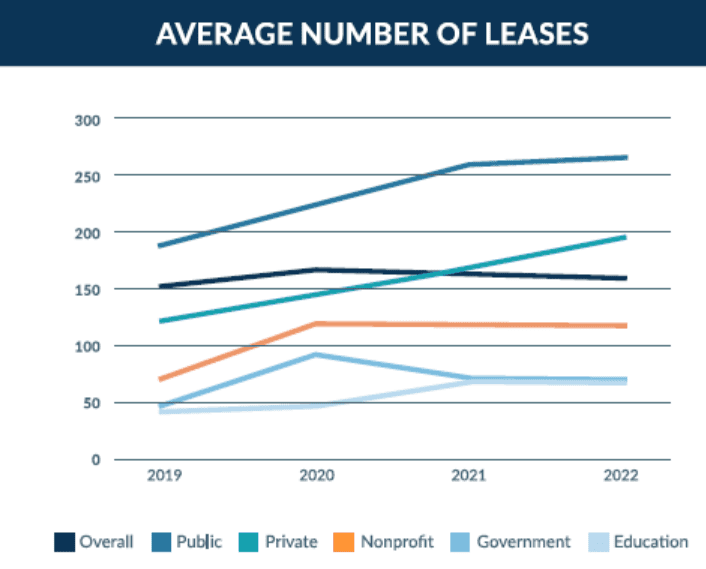

ATLANTA – June 7, 2022 — The average number of leases companies hold has returned to or exceeded pre-pandemic levels, according to the latest 2022 Lease Benchmark Report from accounting technology provider, LeaseQuery. While the resurgence signals impressive resilience, companies are finding that the cost and liabilities of leases are on the rise amid an inflationary environment and lessors looking to recoup losses.

LeaseQuery’s expanded analysis of more than 2,000 public, private and nonprofit organizations found that average lease liabilities are up 38% from 2019. When it comes to lease types, equipment, land and vehicle leases are relatively steady, but building leases have not yet returned to 2019 levels.

“Headlines around the death of the office or storefront have been greatly exaggerated,” says Jennifer Booth, VP of Accounting at LeaseQuery. “But with hundreds of million square feet of office space expiring this year, we are only in the early days of the great reshuffle. As companies consider their footprint for the future, they will do so with new priorities of flexibility and diversification, but most will not disappear from the map altogether.”

Readying Lease Accounting Compliance

Amid major market change, private companies and nonprofits are also working to prepare for landmark accounting changes under ASC 842, which moves all leases onto the balance sheet. The deadline is here, and private companies must now navigate a 21% increase in lease liabilities on their balance sheet post-transition. Meanwhile, nonprofit organizations are experiencing a 4% increase in lease liabilities after their transition.

“While the lease accounting transition is a major hurdle for organizations in this challenging environment, those same challenges make it more important than ever to have visibility over the entire leasing portfolio,” Booth says. “Organizations can now use that insight to optimize operations, renegotiate, right-size and reimagine their leasing needs for the future.”

Industry Leading Specialists

LeaseQuery’s report also analyzes the “Tested 10” industries heavily impacted by lease accounting and market changes. While every industry is impacted differently, the common denominator in lease portfolios and cost trends is change.

Banking, energy, healthcare, higher education, professional services and restaurant leases are expanding over pre-pandemic levels. However, financial services, logistics and transportation, manufacturing and retail leases are flat or lower than pre-pandemic levels.

For individual industry lease trends and more information read the full report: 2022 Lease Benchmark Report.

About the Lease Benchmark Report

LeaseQuery’s Lease Benchmark Report is an annual analysis of more than 2,000 public, private and nonprofit organizations’ financial information as they implement the new lease accounting standards. The report is designed as a benchmarking resource to help companies assess and understand leasing trends across their industry as well as the impact of the landmark lease accounting standard compliance.

About LeaseQuery

LeaseQuery makes accountants’ lives easier by simplifying the complex with technology. More than 28,000 financial professionals globally rely on our cloud-based, CPA-approved solutions and in-house accounting expertise to comply with confidence across various FASB, GASB and IASB accounting standards. Our software helps businesses minimize risk, increase efficiency and reduce costs. Learn more about LeaseQuery’s core lease accounting solution, which focuses on easing the mandatory transition to and ensuring ongoing compliance with ASC 842, IFRS 16, GASB 87 and GASB 96, or explore additional accounting tools. For more information, visit LeaseQuery.com.

Additional Resources

- Learn more about LeaseQuery

- Follow LeaseQuery on LinkedIn and Twitter

- Read LeaseQuery’s blog articles