Under the legacy GASB lease accounting model only capital leases were presented on the statement of net position with an asset and liability balance. As the result of this type of lease transferring the right to use a capital asset, GASB Statement Number 42 Accounting and Financial Reporting for Impairment of Capital Assets and for Insurance Recoveries (GASB 42) was applicable to the asset created by a capital lease.

With the advent of GASB 87, a single model approach now exists for lease classification, with all leases now being considered finance leases. Henceforth, all leased assets falling under the scope of GASB 87 will now also be subject to the guidance of GASB 42.

An impairment under the GASB pronouncements occurs when an asset has a significant unexpected decline in its service utility. Service utility is defined as the usable capacity the asset was expected to provide under normal circumstances when put into service.

However, here it should be noted that a decline in service utility does not always equate to the potential for impairment. Service utility can be reasonably expected to decline in certain situations, such as those stemming from an ordinary decline in performance over an asset’s useful life.

Lease impairment indicators under GASB 42

GASB 87 does not provide guidance on the impairment of leased assets or indicators of impairment. Instead, it directs readers to GASB 42. GASB 42 paragraph 9 provides some examples of internal and external changes in events or circumstances that might drive an evaluation of impairment. Common impairment indicators in addition to the change or expected change of the duration or manner of use include:

- Physical damage requiring restoration to return the leased asset to its service capacity (ex. flood or water damage to a portion of a leased building making it inhospitable)

- Approval or enactment of external laws and regulations impacting the service utility of the leased asset (ex. the EPA instituting new environmental regulations impacting how and to what extent the asset can be used)

- Obsolescence or advancements in technology reducing the need for the leased asset (ex. no longer needing to lease large fax machines with the introduction of small, more efficient scanners)

- Interruption or a shutdown of construction stoppage

It is noteworthy to point out that these are just impairment indicators. Taking the examples listed above at face value for evaluating the potential of impairments can lead governmental reporting entities to pursue an increased number of impairments or miss other scenarios.

For this reason, the GASB chose to add the following two criteria as the test of whether an impairment of a leased asset is warranted:

- Significant decline in its service utility, and

- The decline is unexpected

The presence of both of these criteria requires the leased asset to be analyzed for the amount of impairment.

When assessing if a significant decline in the service utility of an asset has occurred, questions to consider are:

- Has the manner or method in which the asset can be used changed?

- Has the length of time the asset can be used changed?

Recording an impairment loss under GASB 87

After calculating the impairment loss amount, the loss is recognized according to the guidance provided by GASB 87 paragraph 34. The lessee should first adjust its right-to-use asset for any change recognized in the lease liability stemming from the reduction of the underlying asset’s service utility. In theory, because of the asset having reduced utility, the lessor may restructure the lessee’s future payment obligations, which in effect will impact the liability balance. Subsequently, the lessee adjusts the remaining asset balance to its new impaired value by recording a credit to the lease asset with an offsetting debit recorded to impairment loss.

Example: Recording a lease impairment under GASB 87

For example, let’s assume we have a lease in the second year of its ten-year agreement. The remaining lease liability is $250,000, and the corresponding lease asset carrying value is $265,000. During the year, the asset was physically damaged in a natural disaster, significantly reducing its service utility. As a result of this, we assess the remaining utility of the asset to be $125,000. Additionally, the lessor, recognizing the unfortunate situation, agrees to adjust the future payment stream, which results in a reduction to the lease liability by $50,000.

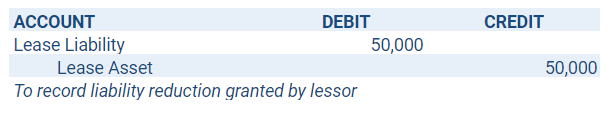

In this scenario, first, we reduce the carrying value of the asset by the same amount as the reduction of the lease liability granted by the lessor $50,000:

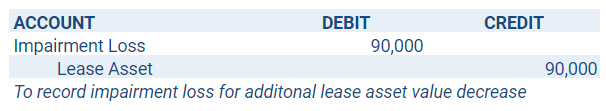

The remaining net asset balance is now $215,000 and requires an additional adjustment of $90,000 to equal the new carrying value of $125,000. The additional right-to-use asset adjustment is recorded to impairment loss:

Note: The liability is not impacted by the impairment loss, only by the concessions offered by the lessor to account for the reduction in service utility of the underlying asset.

Summary

As organizations move to record their leased assets in compliance with the new lease accounting standard, they should be generally aware of how to identify potential indicators of impairment as well as handle the subsequent accounting adjustments. If an impairment is deemed necessary in accordance with the guidance, entities are required to disclose in their financials the amount of any impairment losses recognized in the applicable reporting period as per paragraph 37 of GASB 87.

If your organization is working towards compliance with GASB 87, a software developed by accountants for lease accounting with government accounting in mind, such as LeaseQuery, can help manage these calculations and journal entries in accordance with the financial reporting requirements under both GASB 34 and GASB 87.