Prepaid insurance is a standard and recurring item on the balance sheet for the vast majority of businesses, making it one of the most common types of prepaid asset. Examples include business owners insurance, worker’s compensation insurance, and cyber liability insurance. Whatever is being insured, it is defined as prepaid insurance if an agreement for insurance is executed and the payment in exchange for the insurance is made up front and in full. This type of payment structure, where the amount is paid up front for a service that spans a period of time, must be recognized over the service period under accrual accounting, which is a requirement of both US GAAP and IFRS. In this blog we will dive into how we account for prepaid insurance with an example.

What is prepaid insurance?

Prepaid insurance is recorded on the balance sheet as a short term (current) asset if the service period is less than one year. If spanning longer than a year of coverage, both a short term and long term (non-current) asset will be recorded. As mentioned above, this occurs when coverage is purchased for an extended period of time and is paid at the beginning of the coverage period for the whole term. As we will see in our example below, in order to recognize this prepayment of insurance, we must make a journal entry to debit prepaid insurance and credit cash for the full amount. Subsequent entries are made to record expense by debiting insurance expense and crediting prepaid insurance to record the monthly expense and amortization for the corresponding period. Let’s take a look at this below.

Prepaid insurance example journal entry

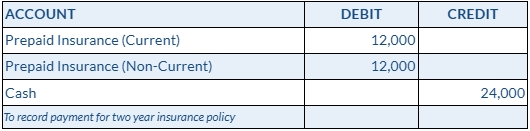

In our example, we have purchased a business owner’s insurance policy in the amount of $24,000 for a period of two years. Payment was made in full for $24,000 on the start date of the policy. Let’s see how we initially book the prepaid insurance and subsequently record our expense and amortize the prepaid account.

Journal entry 1

We first recognize our purchase of the insurance with the following entry. This entry will also allocate the current portion related to the next 12-month period and the non-current portion for the period outside of the next 12 months:

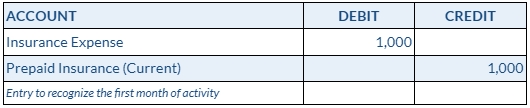

Journal entry 2

Now that we have recorded the payment of the insurance and booked the corresponding prepaid asset account(s), we can amortize the asset over the term of the policy. This entry will be made each month for the entire policy term.

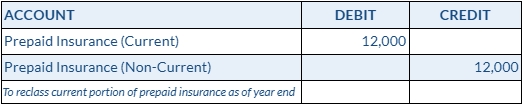

Journal entry 3

We will also need to make an entry at the end of our first year to properly reclassify the non-current portion of the prepaid asset to the current asset account. This entry can be seen below:

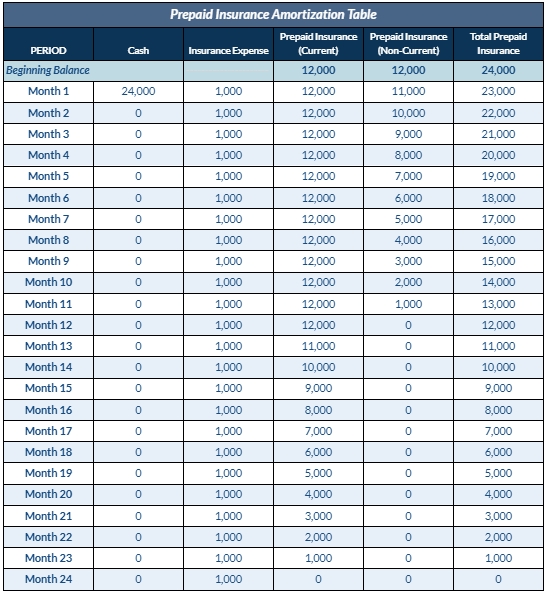

Amortization schedule

For a complete view of how these entries come together, an amortization schedule is shown below outlining how the prepaid asset balance is reduced, or amortized, throughout the term of the policy.

Summary

Now that you’ve seen the full lifecycle of accounting for prepaid insurance, from booking the asset to fully expensing it, you can apply these principles to other prepaid items your business might have, such as rent or software subscriptions. Understanding this core concept is key to accurate financial reporting. By following these steps, you can be confident that your balance sheet and income statement properly reflect your business operations.

Another common example of accrual basis accounting coming into play are accrued expenses. If you are interested in learning how to account for your accrued expenses, see our helpful blog, “Accrued Expenses and Liabilities: Definition, Journal Entries, Examples, and More Explained.”