Mastering accruals is crucial for accurate reporting and sound business decisions.

Accruals represent expenses that have been incurred (the company has received goods or services) but have not yet been paid for as of the end of the accounting period. Even though the cash payment will occur later, these expenses are recorded in the current period to accurately match the period in which the benefit from this good or service was obtained. This creates an accrued liability on the balance sheet, representing the company’s obligation to pay.

“Accrual is the accounting process of recognizing…liabilities and the related changes in …expenses…for amounts expected to be…paid, usually in cash, in the future. Common examples of accruals include purchases and sales of goods or services on account and not-yet-paid interest, rent, wages and salaries, and taxes.” – Conceptual Framework for Financial Reporting, FASB, September 2024

Key characteristics of accruals

- Expense is recognized before the cash outflow.

- Creates a liability.

- Represents an obligation for goods or services already received.

Common types of accruals

- Salaries and wages

- Utilities

- Interest Expense

- Taxes

- Professional Fees (e.g., lawyers, accountants, consultants)

- Repairs and Maintenance

- Other services rendered, billed in arrears

Accruals are often more challenging than prepaids. Prepaid transactions typically originate with an invoice, providing accountants with concrete documentation to guide adjustments. Accruals, however, require accountants to recognize expenses for goods or services before an invoice is received. Determining these unbilled expenses is a complex and demanding task.

Many expenditures, like utilities, bonus payouts, taxes, and professional services, involve variable payments in arrears. Even though payment occurs at the end of the service period, accounting still needs to accrue expense throughout the service period. To do this, an estimated accrual is booked, which is later trued up to the actual payment. Let’s take a look at an example!

True-ups for estimated payments

Setting up an estimated accrual

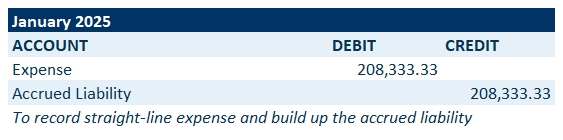

We estimate our property tax liability for the year to be $2,500,000, payable at year-end. To account for this, we’ve created an Excel expense schedule that straight-lines the expense recognition over the period of January 1, 2025, to December 31, 2025, and progressively recognizes a short-term accrued liability.

The January 2025 journal entry is booked as follows.

Changing the estimate

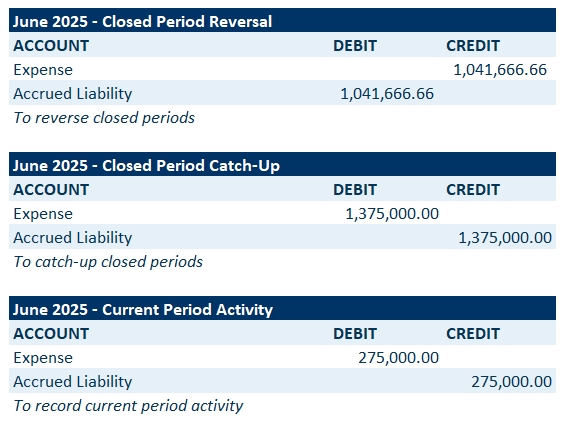

Let’s assume it’s June 2025 and we’ve determined the property tax payment at year-end will be closer to $3,300,000, not the originally estimated $2,500,000. We need to true-up our schedule to reflect this revised estimate.

The following Catch-Up Details Schedule shows you what should have been recorded, had you estimated $3,300,000 from the beginning. Straight-line expense is calculated based on the revised estimate. For the periods that have already been closed (January – May), the schedule indicates the activity from those periods will be caught up in the next open period, June 2025.

This is what the Main Expense Schedule looks like once it’s been trued up. Note that the straight-line monthly expense of $208,333.33 is based on the initial $2,500,000 estimate. These amounts are retained in the schedule, as those periods were closed with these numbers. Once the estimate is revised in June, we need to book catch-up expense in the amount of $608,333.34. From July forward the straight-line monthly expense is $275,000. The catch-up and prospective change in the straight-line calculation results in total expense at the bottom of the schedule equaling the estimated payout.

The June 2025 $608,333.34 catch-up is calculated by summing the following: 1) closed period expense reversal; 2) closed period expense catch-up, and 3) current period expense activity.

The June 2025 journal entries are booked as follows.

The Catch-Up Details Schedule shows a $1,650,000 Accrued Liability balance as of 06/30/2025. This amount matches the Main Expense Schedule. As such, we are fully trued up.

The actual payment is made

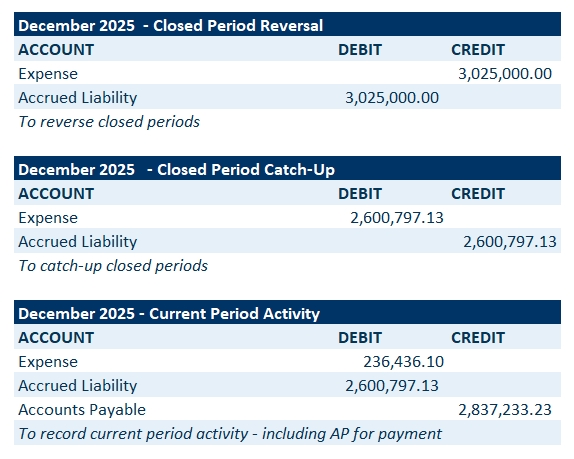

Now, let’s assume it’s the end of the year and the actual payment totaled $2,837,233.23.

The schedules below illustrate that we recorded too much expense throughout the year due to a high estimate. As a result, the December 2025 entry appropriately backs out the excess expense.

The June 2025 $(187,766.77) catch-up is calculated by summing the following: 1) closed period expense reversal; 2) closed period expense catch-up, and 3) current period expense activity.

The Accrued Liability is zeroed out in both schedules. As such, we are fully caught up.

The December 2025 journal entries are booked as follows. Note that these entries all pull from the Catch-Up Details Schedule.

As you can see, the ins and outs of estimated accruals can quickly become quite involved. That is why automating the process with a system like FinQuery can remove the manual steps and lessen the workload. Schedule a demo today!