The accounting treatment of leases has undergone significant changes in recent years, driven by a need for greater transparency and a more accurate representation of a company’s financial position. Both FRS 102, the local standard used by most UK and Irish entities, and IFRS 16, the international accounting standard set by the International Accounting Standards Board (IASB) have introduced new rules on lease accounting. While both aim to achieve similar objectives, there are some key differences between the two standards.

Key similarities

Historically, lease accounting distinguished between finance leases and operating leases. Finance leases were recognised on the balance sheet, while operating leases were kept off-balance sheet, only requiring the recognition of rental/lease expense on the income statement. This approach led to concerns about a lack of transparency due to the potential for companies to understate their lease liabilities and assets.

To address these concerns, the IASB issued IFRS 16, which was effective as of January 1, 2019, and introduced a single accounting model for lessees. This model requires lessees to recognise a right-of-use (ROU) asset and a corresponding lease liability on the balance sheet for all leases except short-term leases and leases of low-value/immaterial assets.

Following the lead of IFRS 16, the Financial Reporting Council (FRC) updated FRS 102 to incorporate the same principle around a single accounting model for lessees. These changes are effective for accounting periods beginning on or after January 1, 2026. Early application is permitted, if the company applies all the amendments to FRS 102 at the same time. The specific section within FRS 102 that relates to leases is Section 20.

Both FRS 102 and IFRS 16 require lessees to recognise a right-of-use (ROU) asset and a lease liability on their balance sheet for most leases, unless exempt. Additionally, both standards require lease liabilities to be measured at the present value of future lease payments.

Despite the overarching similarities, however, several key differences exist between FRS 102 and IFRS 16.

Key differences

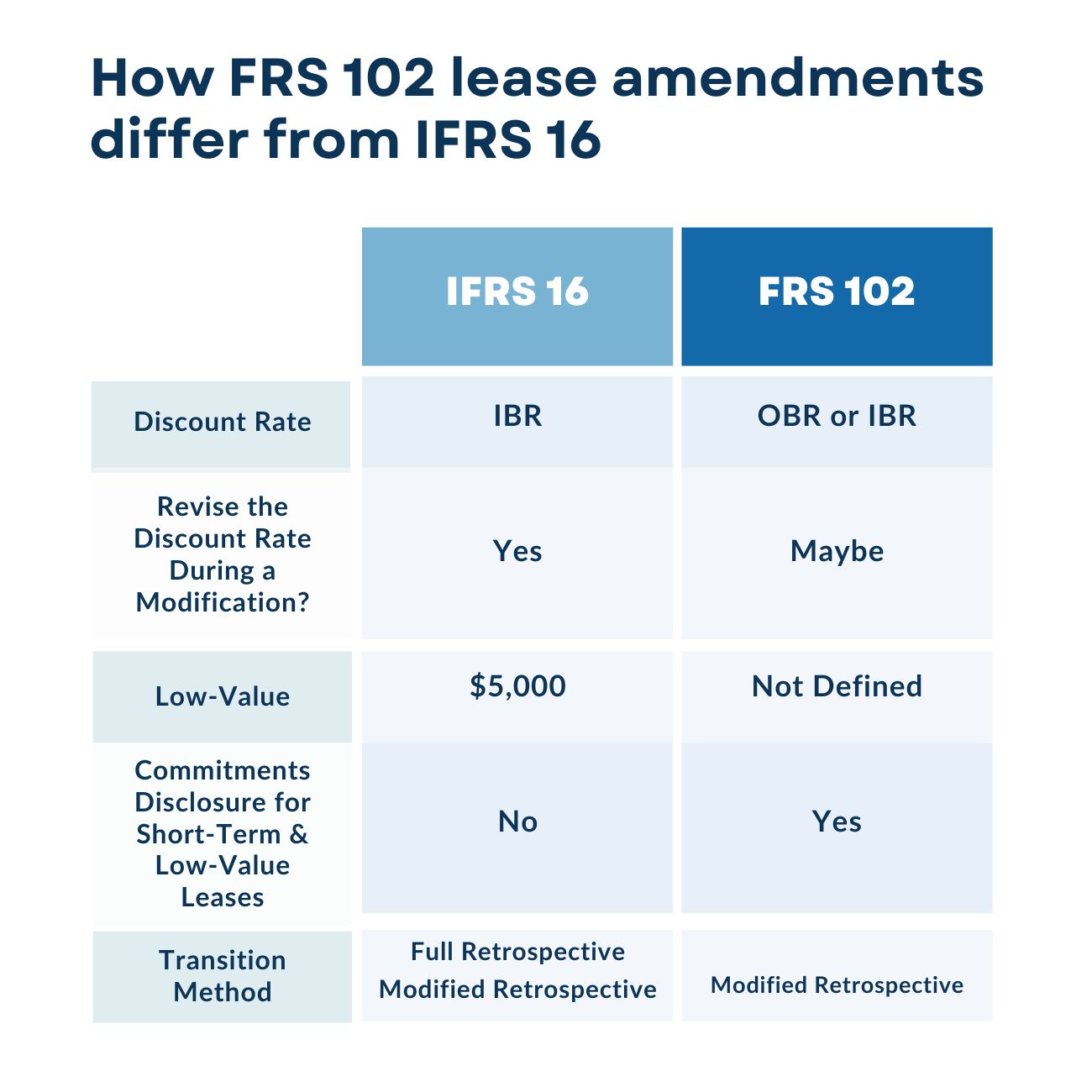

Discount rate application

When calculating the lease liability, IFRS 16 requires the use of the lessor’s implicit interest rate if that rate can be readily determined. Given that the rate is rarely readily determinable, IFRS 16 permits the use of a lessee’s incremental borrowing rate (IBR). This is the rate of interest that the lessee would have to pay to borrow over a similar term, and with similar security, the funds necessary to obtain an asset of a similar value to the ROU asset in a similar economic environment.

FRS 102 also requires the use of the lessor’s implicit interest rate if that rate can be readily determined. However, it introduces an additional option for when that rate is not readily determinable. This rate is called the “obtainable borrowing rate” (OBR), which is defined per FRS 102 as “the rate of interest that a lessee would have to pay to borrow, over a similar term, an amount similar to the total undiscounted value of lease payments to be included in the measurement of the lease liability.” This makes it significantly easier to obtain since that rate is solely dependent on the value of the lease payments and lease terms, which are readily available inputs.

Additionally, there are differences in discount rate applications when lease modifications arise.

Under IFRS 16, the lessee must use a revised discount rate for all lease modifications that aren’t considered separate/new leases. Generally, the same concept applies to lease modifications under FRS 102, however, Section 20 introduces scenarios that allow a lessee to not update the discount rate.

The three modification scenarios that permit a lessee to use an unchanged discount rate are:

1) the additional consideration from the lease modification is insignificant relative to the total consideration of the original lease,

2) the lease modification decreases the scope of the lease by removing the right to use one or more underlying assets, and the consideration for the lease decreases by an amount commensurate with the stand-alone price for the decrease in scope, or

3) the lease modification decreases the consideration payable for the remaining term of the lease but does not decrease the scope of the lease by removing the right to use one or more underlying assets.

If an unchanged discount rate is used for a lease modification, this should be included in a company’s FRS 102 lease disclosures along with the carrying value of the remeasured lease liabilities.

Low-value leases

Lessees reporting under IFRS 16 may choose to take advantage of an optional exemption for leases of low-value assets, which The Basis for Conclusions cited as leases for which the underlying asset’s fair value (when the asset is new) is generally less than $5,000.

FRS 102 does not provide guidance around a specific dollar value threshold under which leases are exempt. However, it does provide flexibility for organisations to determine whether or not other assets are of low value for their own organisation.

However, unlike IFRS 16, FRS 102 requires lessees to disclose a maturity analysis of its lease commitments for exempted short-term leases and leases of low-value assets.

Transition methods

Overall, the transition to FRS 102 is similar to that of IFRS 16, however, IFRS 16 provided a choice between two transition methods: the full retrospective approach, and the modified retrospective approach. In contrast, FRS 102 only allows for the modified retrospective approach, simplifying the transition for companies. Additionally, if an organisation already has IFRS 16 balances for group/consolidated reporting purposes, they are permitted to use the existing carrying values as its opening balances of right-of-use assets and lease liabilities at the date of initial application to FRS 102.

Conclusion

While FRS 102 is meant to mirror the accounting framework provided by IFRS 16, there are nuanced differences between the standards, particularly in areas such as discount rate application, low-value asset thresholds, and transition methods. As such, companies that report under FRS 102 need to carefully consider the implications of the new lease accounting rules and make the necessary adjustments to their accounting policies, systems, and processes to ensure a smooth transition to the new lease accounting standards.