3. Overhauling to align with global standards

4. Revised FRS 102 Section 20 vs. IFRS 16: Key comparisons in lease accounting

5. What this means for your organisation

6. Next steps: Getting ready for 2026

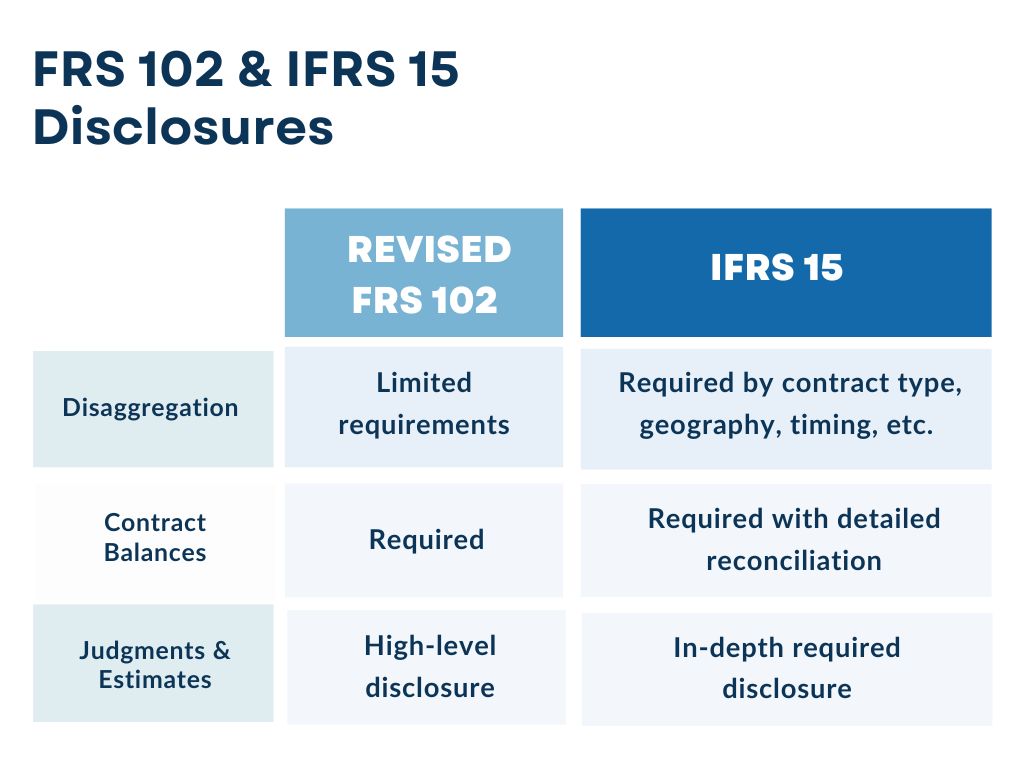

7. Revised FRS 102 Section 23 vs. IFRS 15: Key comparisons in revenue recognition

8. At a glance: What’s changing?

9. Who needs to prepare — and how?

11. Final thoughts for revenue recognition

12. Prepare now for a smooth transition

13. Related articles

Big changes are coming to accounting in the UK and Republic of Ireland. The Financial Reporting Council (FRC) has issued the most extensive revisions to FRS 102 since the standard’s initial launch in 2013. The revisions will bring UK GAAP closer to IFRS and include fundamental changes to how leases are accounted for and revenue is recognised.

What is FRS 102?

FRS 102 is the Financial Reporting Standard applicable in the UK and Republic of Ireland, which provides a comprehensive framework for the financial reporting of entities that are not required or do not choose to apply International Financial Reporting Standards (IFRS). It sets out the recognition, measurement, presentation, and disclosure requirements for a wide range of transactions and events.

Effective date of changes

The revisions to FRS 102 will be effective for accounting periods beginning on or after 1 January 2026.

Overhauling to align with global standards

The primary driver behind these amendments is intended to:

- Enhance clarity and consistency in financial reporting.

- Improve comparability with IFRS, benefiting businesses with international operations or those seeking foreign investment.

- Ensure continued relevance of financial reporting in the face of evolving business practices and regulatory expectations.

Revised FRS 102 Section 20 vs. IFRS 16: Key comparisons in lease accounting

For many organisations, leased assets form a vital part of their operational backbone, offering access to necessary resources like office space, equipment, and vehicles without significant upfront capital expenditure. The latest amendments to FRS 102 are bringing lease accounting closer to IFRS 16 by requiring lessees to recognise most leases directly on their balance sheets.

This “on-balance sheet” model for lessees broadly mirrors IFRS 16. Currently, FRS 102 distinguishes between finance leases (already on the balance sheet) and operating leases (typically expensed in the income statement). The amendments will eliminate this distinction for lessees. Key changes include:

- Right-of-Use (ROU) Asset and Lease Liability Recognition: Lessees will recognise a right-of-use asset and a corresponding lease liability for most leases. This will replace the previous rental expense with depreciation of the ROU asset and interest expense on the lease liability in the income statement. Both finance and operating leases will be treated in this way with the only exceptions being for short term or low value leases. This change may impact profit before tax (likely lower) due to the front-loading of interest expenses.

- Expense Recognition Shift: Instead of recognising lease payments as an operating expense, organisations will now account for depreciation on the ROU asset and interest on the lease liability. This change will significantly impact key financial metrics like EBITDA (likely to increase) and net debt (likely to increase).

While this fundamental shift applies broadly, certain exemptions exist for short-term leases (12 months or less without a purchase option) and low-value assets (such as small office equipment). To understand the scope of these changes, it’s crucial to define what constitutes a lease under FRS 102. Mirroring IFRS 16, a lease is an agreement granting the right to control the use of an identified asset for a specific period in exchange for payment. Control is established when the lessee can obtain substantially all economic benefits from the asset and direct its use.

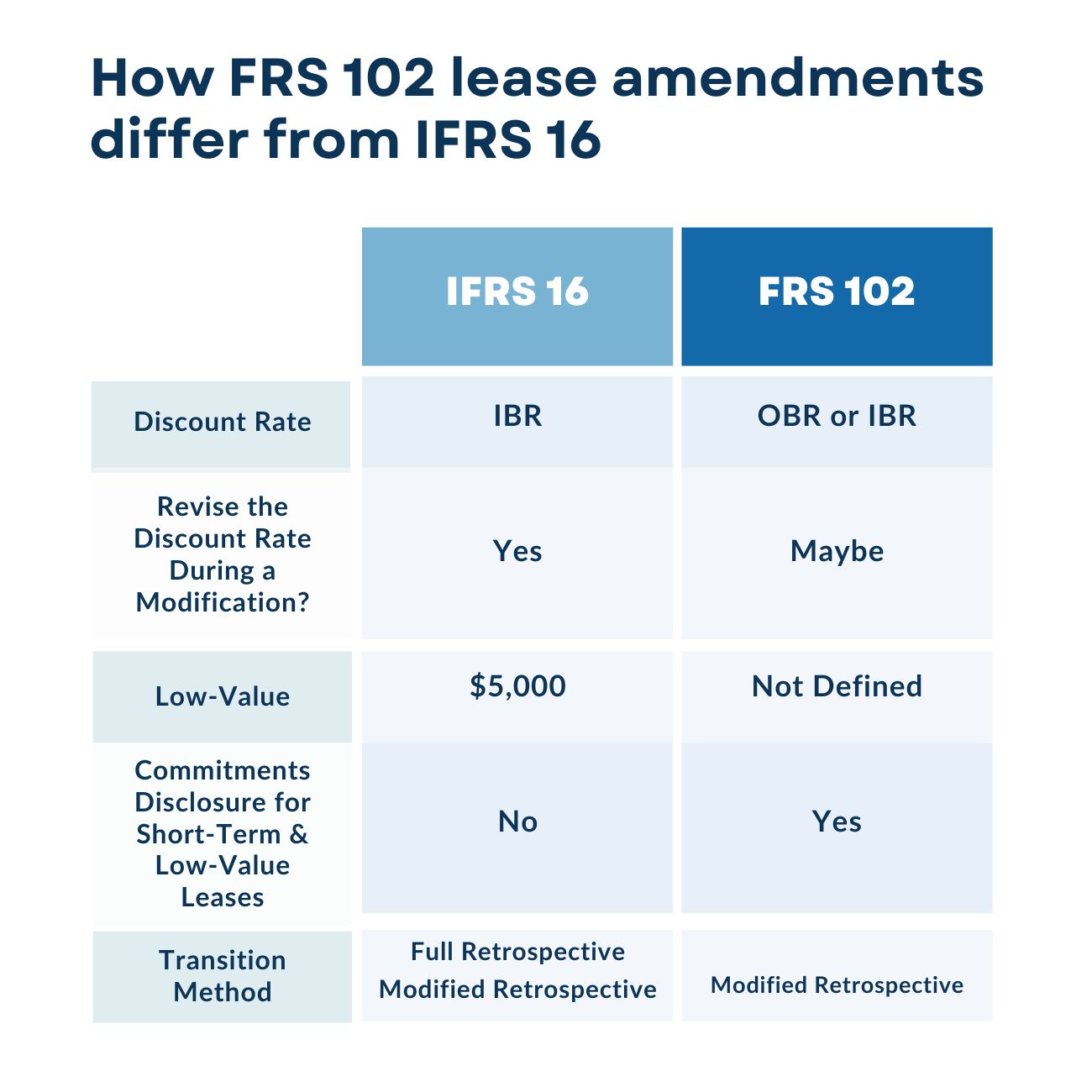

Other than the effective date, one of the biggest differences that will still exist between the updated FRS 102 lease treatment and IFRS 16 is the discount rate application. IFRS 16 requires the use of the lessee’s incremental borrowing rate, when the implicit rate is not readily determinable. The FRS 102 amendments also require the use of the implicit rate if it is readily determinable, but introduces a new rate option called the “obtainable borrowing rate” (OBR), which is defined per FRS 102 as “the rate of interest that a lessee would have to pay to borrow, over a similar term, an amount similar to the total undiscounted value of lease payments to be included in the measurement of the lease liability.”

To learn more about the specific differences between the lease updates in FRS 102 to IFRS 16, click here. Below is a summary of the differences discussed in that article:

What this means for your organisation

Impact and considerations

These changes will have a wide-ranging impact on organisations reporting under UK GAAP, including:

- Financial Metrics: Impacts to key performance indicators like EBITDA, profit, and net debt may necessitate reviewing debt covenants and performance-related remuneration schemes.

- Systems and Processes: Accounting systems and processes will need updates to accommodate the new requirements for lease and revenue accounting.

- Distributable Reserves: The revised income statement profile, particularly with the recognition of depreciation and interest from leases, could impact the ability to pay dividends.

To learn more about the implementation considerations for the lease changes to FRS 102, click here.

Next steps: Getting ready for 2026

Changes of this scale require preparation. Here are some key steps to take:

- Impact Assessment: Conduct a thorough review of existing accounting policies, lease agreements, and customer contracts to identify the potential impact of the amendments.

- System Review: Assess whether current accounting software and systems can handle the new requirements. Upgrades or new solutions including lease accounting software, like LeaseQuery, may be necessary. Start reviewing new solutions early to ensure sufficient time for selection and implementation.

- Data Gathering: Start collecting the necessary data for lease accounting, including lease terms, payment schedules, and discount rates. Review customer contracts to understand performance obligations and transaction prices.

- Training: Ensure accounting and finance teams are well-trained on the new accounting standards and their implications.

- Early Engagement: Engage with auditors and business advisors early to discuss the potential impact and ensure a smooth transition.

Revised FRS 102 Section 23 vs. IFRS 15: Key comparisons in revenue recognition

Revenue recognition is entering a new era for UK and Irish GAAP reporters. With the 2024 amendments to FRS 102, the Financial Reporting Council (FRC) has taken a significant step toward international alignment by revising Section 23: Revenue to broadly follow the IFRS 15 five-step model.

This update means that the gap between FRS 102 and IFRS 15 has narrowed significantly. However, there are still important differences in application, disclosure, and complexity.

At a glance: What’s changing?

Old FRS 102 (pre-2026)

- Focused on transfer of risks and rewards

- Based on older international standards

- Simplified and principles-based

Revised FRS 102 (2026 onward)

- Introduces a five-step revenue recognition model, closely based on IFRS 15

- Emphasizes contractual performance obligations and transfer of control

- Targets greater comparability and consistency, especially for companies with complex revenue streams

Comparing the standards

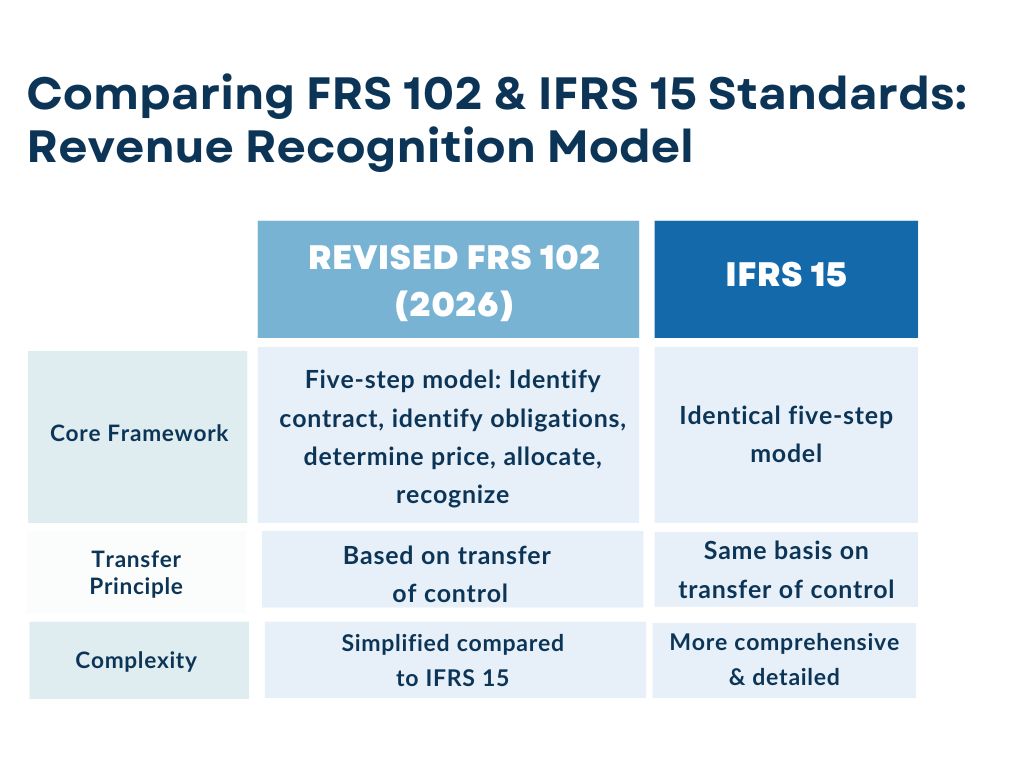

1. Revenue recognition model

Revenue recognition: A five-step approach

This update shifts the focus from the transfer of risks and rewards to the transfer of control of goods or services. To do this, FRS 102 will adopt a five-step model that aligns with IFRS 15:

- Identify the contract(s) with a customer.

- Identify the performance obligations in the contract.

- Determine the transaction price.

- Allocate the transaction price to the performance obligations.

- Recognise revenue when (or as) performance obligations are satisfied.

This more detailed framework requires businesses to more rigorously assess their contracts, particularly those with bundled goods or services, variable consideration, warranties, or significant financing components. For contracts with payment terms extending beyond six months, organisations must also consider the time value of money. This could lead to changes in the timing of revenue recognition, especially for long-term contracts.

The core model under both standards is now effectively the same. However, IFRS 15 still includes additional guidance for specific industries and arrangements that the revised FRS 102 simplifies or omits for practicality.

2. Performance obligations

Both standards now require entities to break contracts into distinct performance obligations and allocate the transaction price accordingly. The key difference is depth—IFRS 15 contains more detailed application examples and industry-specific guidance.

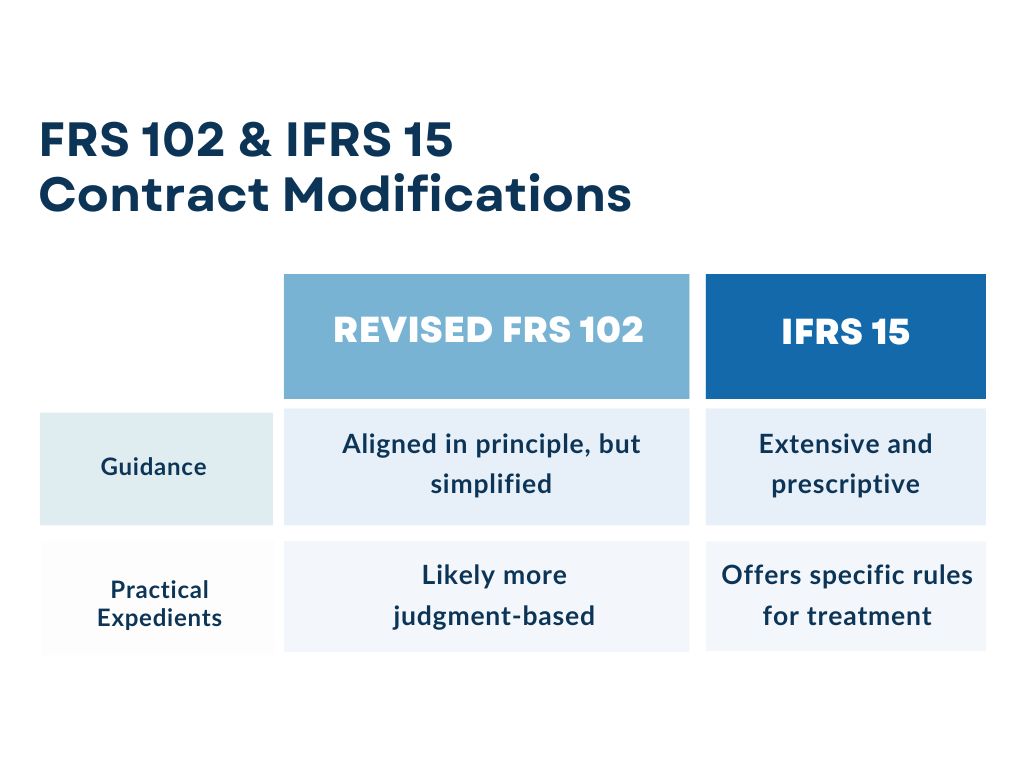

3. Contract modifications

For growing companies with evolving contract terms (e.g. SaaS or licensing), both frameworks provide a contract modification framework, but IFRS 15 supports more specific scenarios.

4. Disclosures

Although the recognition model aligns, disclosure requirements remain simpler under revised FRS 102. This is intentional to ease the burden on smaller preparers.

Who needs to prepare — and how?

The revised FRS 102 is a major shift for companies used to the historical “risks and rewards” model of revenue recognition. For those already reporting under IFRS or preparing for future transition, this alignment offers a smoother pathway. However, entities still need to reassess their contracts, billing practices, and internal systems to ensure they comply with the new five-step model.

Key steps to prepare

- Inventory existing contracts and assess how revenue is currently recognized.

- Identify performance obligations and determine when control transfers.

- Evaluate pricing structures, particularly if you offer discounts, variable consideration, or bundling.

- Update policies and disclosures to align with new requirements.

- Consider systems and automation, especially if you rely heavily on spreadsheets or basic ERP tools.

Final thoughts for revenue recognition

The revised FRS 102 represents a modernisation of UK and Irish GAAP. By adopting the principles of IFRS 15, it increases comparability and relevance in today’s complex, service-driven economy.

Still, IFRS 15 remains more detailed and demanding, particularly for public companies, multinationals, and industries with complex revenue models. The revised FRS 102 aims to strike a balance: providing conceptual alignment without overwhelming smaller preparers with compliance burdens.

Prepare now for a smooth transition

The FRS 102 Periodic Review 2024 introduces the most far-reaching changes to the United Kingdom and Republic of Ireland GAAP since its initial implementation. In particular, the alignment of lease accounting with IFRS 16 and revenue recognition with IFRS 15 represents a significant shift in accounting practices. By understanding the reasons behind these changes, being aware of the key amendments to lease accounting and revenue recognition, and by taking proactive steps now, businesses can ensure a smoother transition. Don’t wait until 2026 – the time to prepare is now.

Register for our upcoming partner webinar to get a detailed guide on transitioning to FRS 102 and how it impacts lease accounting and revenue recognition: FRS 102: Guide to Transitioning to the New Lease Accounting and Revenue Recognition Requirements